Dollar and Euro are so far the worst performer in quiet trading today. The greenback is clearly weighed down again by stocks’ rise and yield’s decline. There are news that China’s Shanghai is back in tougher restrictions, but investors are not too bothered. Canadian Dollar is also soft after data showed retail sales contraction. Meanwhile, New Zealand Dollar is the strongest one, looking ahead to tomorrow’s historical 75bps rate hike by RBNZ. Swiss Franc is also strengthening slightly together with Sterling.

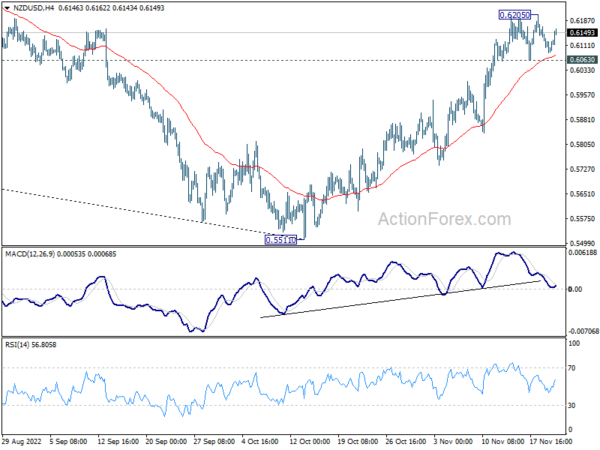

Technically, while NZD/USD recovered today, it’s held well inside range of 0.6063 and 0.6205. Further rally is in favor as long as 0.6063 minor support holds. But NZD/USD would then be facing long term fibonacci level of 38.2% retracement of 0.7463 to 0.5511 at 0.6257. Loss of upside momentum could limit upside there, and break of 0.6063 minor support would indicate the start of a near term pull back, at least.

Suggested readings on RBNZ:

- The Consensus Calls for the RBNZ to Hike by 75bp Tomorrow

- RBNZ Might Need to Slam the Brakes in November as Economy Heats Up

In Europe, at the time of writing, FTSE is up 0.70%. DAX is up 0.14%. CAC is up 0.08%. Germany 10-year yield is up 0.018 at 2.011. Earlier in Asia, Nikkei rose 0.61%. Hong Kong HSI dropped -1.31%. China Shanghai SSE rose 0.13%. Singapore Strait Times rose 0.28%. Japan 10-year JGB yield dropped -0.0012 to 0.245.

Canada retail sales dropped -0.5% mom in Sep, down -1.0% qoq in Q3

Canada retail sales dropped -0.5% mom to CAD 61.1B in September. Sales declined in 7 of 11 subsectors, led by sales at gasoline stations (-2.4%) and food and beverage stores (-1.3%). Excluding gasoline and auto, sales contracted -0.4%mom. IN volume terms retail sales also declined -0.1% mom.

For Q3, sales were down -1.0% qoq, the first quarterly decline since Q2 of 2020. In volume terms, sales were down -1.4% qoq in Q3.

According to advance estimate, sales rose 1.5% mom in October.

ECB Holzmann backs another 75bps hike to give a strong signal about determination

ECB Governing Council member Robert Holzmann told FT in an interview, that he could “see no signs that core inflation is reducing”. He added that another big rate hike “would give a strong signal about our determination,” as “it would tell businesses and trade unions we are serious so don’t underestimate us, be careful.”

He backs another 75bps rate hike in December but he was still “open to changing my mind” based on the ECB’s new quarterly economic forecasts. He added that interest rates could need to rise to a level where they “caused pain”. Hence, it’s important to hike “early” because “afterwards the pain is much, much larger.”

RBA Lowe not ruling out return to 50bps hike, nor pausing

RBA Governor Philip Lowe reiterated in a speech that the Board expects to “interest rates further over the period ahead”, and interest rate is “not on a pre-set path”.

“We have not ruled out returning to 50 basis point increases if that is necessary,” he said. “Nor have we ruled out keeping rates unchanged for a time as we assess the state of the economy and the outlook for inflation.”

“As we take our decisions over coming meetings, we will be paying close attention to developments in the global economy, the evolution of household spending and wage and price setting behaviour.”

“Developments in each of these three areas will affect the pace at which inflation returns to target and whether the economy can remain on an even keel over the next couple of years.”

NZ goods exports rose 14% yoy in Oct, imports surged 24% yoy

New Zealand goods exports rose 14% yoy to NZD 6.1B in October. Goods imports rose 24% yoy to NZD 8.3B. Trade deficit widened from NZD -1.7B to NZD -2.1B, much larger than expectation of NZD -1.7B.

Annual goods expects, comparing with the year ended October 2021, rose 14% to NZD 71.1B. Annual goods imports rose 25% to NZD 84.0B. Annual trade deficit swelled to fresh record of NZD -12.9B, comparing to NZD -4.9B a year ago.

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 140.77; (P) 141.51; (R1) 142.86; More…

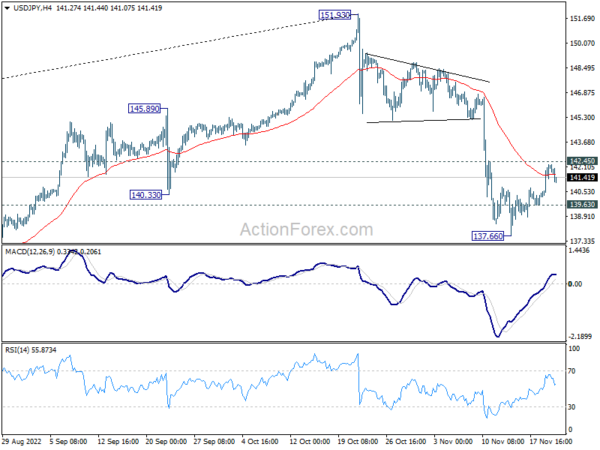

USD/JPY retreated ahead of 142.45 minor resistance and intraday bias remains neutral first. On the upside, firm break of 142.45 will turn bias back to the upside for stronger rebound to 55 day EMA (now at 143.34) and above. However, break of 139.63 minor support will turn bias back to the downside for 137.66. Break there will resume the decline from 151.93, to 133.07 fibonacci level, as a correction to the larger up trend.

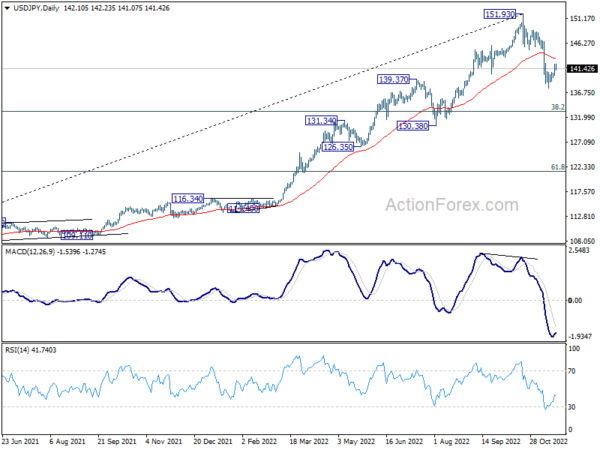

In the bigger picture, a medium term top should be formed at 151.93. Fall from there is correcting larger up trend from 102.58. It’s too early to call for bearish trend reversal. But even as a corrective move, such decline should target 38.2% retracement of 102.58 to 151.93 at 133.07, or further to 55 week EMA (now at 130.28).

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Trade Balance (NZD) Oct | -2129M | -1715M | -1615M | -1696M |

| 07:00 | GBP | Public Sector Net Borrowing (GBP) Oct | 12.7B | 19.1B | 19.2B | 16.9B |

| 09:00 | EUR | Eurozone Current Account (EUR) Sep | -8.1B | -20.3B | -26.3B | |

| 13:30 | CAD | New Housing Price Index M/M Oct | -0.20% | 0.20% | -0.10% | |

| 13:30 | CAD | Retail Sales M/M Sep | -0.50% | -0.50% | 0.70% | 0.40% |

| 13:30 | CAD | Retail Sales ex Autos M/M Sep | -0.70% | -0.60% | 0.70% | 0.50% |

| 15:00 | EUR | Eurozone Consumer Confidence Nov P | -26 | -28 |