Multiple themes are unfolding in the markets today without any one taking center stage. Dollar is gaining strength, particularly against Yen, supported by an extended rebound in Treasury yields. Euro, on the other hand, is losing ground to the Pound after failing to break through a key near-term resistance level, which also weighs on the common currency against the greenback. Meanwhile, Aussie continues to rally against Kiwi, but no significant movement is observed elsewhere.

From a technical standpoint, it is premature to confirm a reversal of Dollar’s near-term downtrend despite today’s recovery. Crucial levels to monitor include 1.0830 support in EUR/USD, 1.2343 support in GBP/USD, and 0.9070 resistance in USD/CHF. As long as these levels hold, Dollar’s weakness could resume at any moment.

In Europe, at the time of writing, FTSE is up 0.13%. DAX is down -0.19%. CAC is down -0.17%. Germany 10-year yield is up 0.0329 at 2.473. Earlier in Asia, Nikkei rose 0.07%. Hong Kong HSI rose 1.68%. China Shanghai SSE rose 1.42%. Singapore Strait Times rose 0.50%. Japan 10-year JGB yield rose 0.0206 to 0.482.

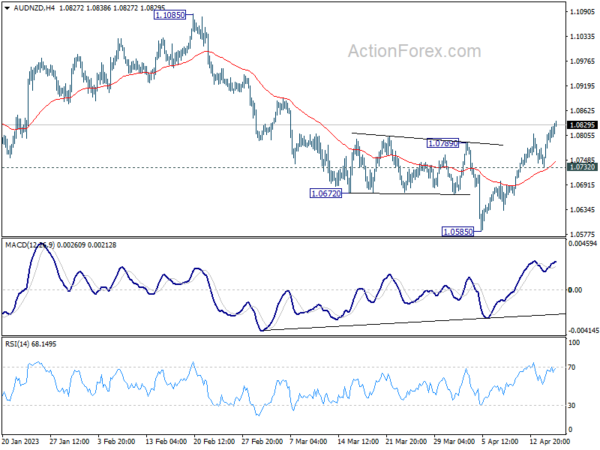

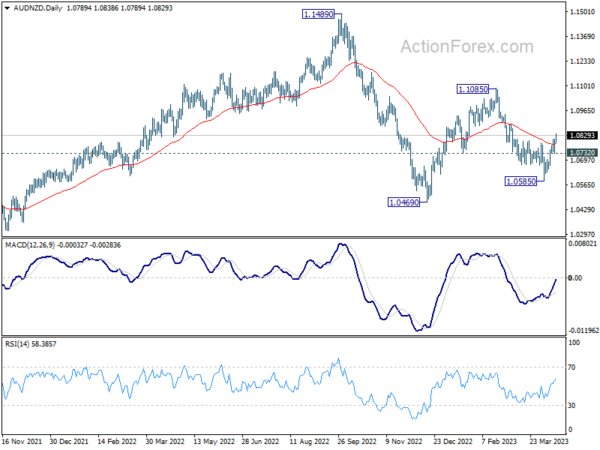

AUD/NZD rebound gains traction ahead of RBA minutes

AUD/NZD continues to extend its rebound from 1.0585 short-term bottom, prompting traders to further close their short positions as the previous selloff failed to push the cross through 1.0469 low. Market participants are awaiting the release of RBA minutes in the upcoming Asian session, along with Australian PMIs and New Zealand CPI data this week.

Expectations on New Zealand’s CPI remain divided, with some anticipating a slowdown from 7.2% yoy level. If realized, this would fall below RBNZ’s forecast of 7.3%, potentially sparking speculation of a less aggressive rate hike path. Conversely, improvements in Australia’s PMI could bolster RBA’s confidence in resuming tightening with another rate hike in May.

Technically, break of 1.0789 resistance now argues that fall from 1.1085 has completed at 1.0585. Rise from there could be seen as the third leg of the pattern from 1.0469. Further rally could be seen back to 1.1085 resistance next. However, on the downside, break of 1.0732 support will bring retest of 1.0585 low instead.

ECB Kazaks hints at potential smaller rate hike in May

ECB Governing Council member Martins Kazaks has suggested that a smaller rate hike of 25 basis points in May is possible, although a 50 basis point increase should not be dismissed entirely.

In an interview with Latvian news service Leta, Kazaks stated, “At some points, it’s only natural that the step size is reduced. For example, the increase could be not 50 basis points, but 25 basis points.”

Regarding the upcoming ECB Council meeting in May, Kazaks commented, “Should we move to a lower step already at the ECB Council meeting in May? I think there is every possibility for that, but a 50 basis point increase is not an option that can be ignored.”

Kazaks remains optimistic about the Eurozone’s economic outlook, pointing out that “the economy is still resilient, there will probably not be a recession in the Eurozone this year, the labor market remains strong, the pressure on wages is still very high and in some cases even increasing. Therefore, in my opinion, a rate increase is necessary.”

NZ BNZ Services dropped to 54.4, but keeps its head above water

New Zealand’s service sector growth slowed down in March, with the BusinessNZ Performance of Services Index (PSI) declining to 54.4 from 55.8 in February. However, the index stayed above the long-term average of 53.6.

BusinessNZ Chief Executive Kirk Hope highlighted the uptick in negative sentiment, with the proportion of negative comments surging from 51.9% in February to 58.6% in March. The main concerns expressed were a cooling economy, the impact of price increases, and overall uncertainty.

Despite these challenges, BNZ Senior Economist Craig Ebert remains cautiously optimistic. He noted that while the PSI held relatively steady in March, the Performance of Manufacturing Index (PMI) slipped into slightly negative territory. Nonetheless, Ebert believes that there is enough positive momentum to suggest an underlying tendency for growth in activity.

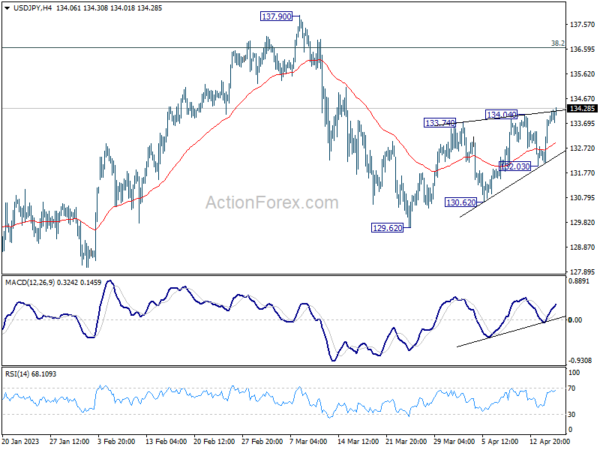

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 132.68; (P) 133.26; (R1) 134.35; More…

Intraday bias in USD/JPY remains mildly on the upside as rebound from 129.62 is in progress. Further rally could be seen back towards 137.90 resistance. For now, further rise will remain in favor as long as 132.03 support holds, in case of retreat.

In the bigger picture, corrective pattern from 127.20 might be extending. But after all, down trend from 151.93 is expected to resume at a later stage. Break of 127.20 will resume this down trend and target 61.8% projection of 151.93 to 127.20 from 137.90 at 122.61. This will now be the favored case as long as 137.90 resistance holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | NZD | Business NZ PSI Mar | 54.4 | 55.8 | ||

| 12:30 | CAD | Wholesale Sales M/M Feb | -1.70% | -1.60% | 2.40% | |

| 12:30 | CAD | Foreign Securities Purchases (CAD) Feb | 4.62B | 6.28B | 4.21B | |

| 12:30 | USD | Empire State Manufacturing Index Apr | 10.8 | -18.2 | -24.6 | |

| 14:00 | USD | NAHB Housing Market Index Apr | 44 | 44 |