Australian Dollar is trading broadly lower today, reflecting uncertainties that emerged after release of minutes from RBA meeting earlier this month. The minutes revealed that a hold was considered at the meeting. Arguments were finely balanced even though it eventually decided to hike 25bps. These revelations have stirred market doubts about the continuity of monetary tightening in July, suggesting that the RBA might opt for a pause. Weighing down Aussie further is a slight pullback in Asian stocks, despite China’s expected rate cut.

Elsewhere in the currency markets, New Zealand Dollar is trailing Aussie as the second weakest so far for the day, with Swiss Franc and Canadian Dollar following. Japanese Yen and Dollar are making mild gains as their corrective recoveries proceed. However, momentum of both currencies remains relatively weak. Euro and Sterling are showing mixed dynamics at the moment.

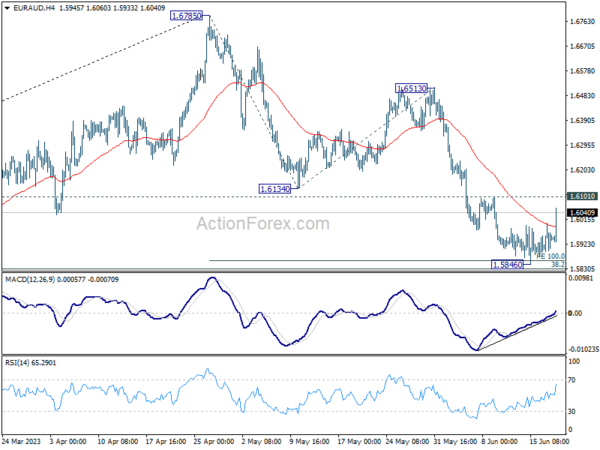

Technically, with the rebound in Asian session, EUR/AUD is now targeting 1.6101 resistance. Decisive break there should add to the case that whole corrective fall from 1.6785 has completed with three waves down to 1.5846, after hitting 100% projection of 1.6785 to 1.6134 from 1.6513 at 1.5862, slightly above 38.2% retracement of 1.4281 to 1.6785 at 1.5828. Stronger rally would be seen back to 1.6513 resistance next. If realized, the development would likely be accompanied by deeper pull back in AUD/USD and stronger rally in EUR/USD.

In Asia, at the time of writing, Nikkei is down -0.31%. Hong Kong HSI is down -1.53%. China Shanghai SSE is down -0.18%. Singapore Strait Times is down -0.46%. Japan 10-year JGB yield is down -0.0038 at 0.391.

RBA minutes: Finely balanced arguments for hold and hike

Minutes from RBA’s June 6 monetary policy meeting reveal an active debate over whether to hold or raise the cash rate by 25bps.

As stated in the minutes, “Members recognised the strength of both sets of arguments, concluding that the arguments were finely balanced.” However, they ultimately determined that a rate increase was the stronger course of action at this meeting.

Recent data indicating that inflation risks had begun tilting to the upside were a key influence on the board’s decision. As they noted, “Given this shift and the already drawn-out return of inflation to target, the Board judged that a further increase in interest rates was warranted.”

Such a move would bolster confidence that inflation would indeed return to the target range “over the period ahead”, they reasoned.

At the meeting, RBA raised cash rate target by 25bps to 4.10%.

RBA Bullock: Economy needs to grow at a below trend pace for a while

In a speech, RBA Deputy Governor Michele Bullock noted the economy needs to “grow at a below trend pace for a while” to bring demand and supply into better balance. Only that will give “the greatest chance of securing sustainable full employment into the future.”

Bullock explained, “For monetary policy… We think of full employment as the point at which there is a balance between demand and supply in the labour market (and in the markets for goods and services) with inflation at the inflation target.”

“In recent months, the balance between labour demand and supply has improved somewhat,” she noted. “Nevertheless, the labour market remains tight.”

Also, “for the first time in decades, firms’ demand for labour exceeds the amount of labour that people are willing and able to

“At the same time, with demand for goods and services high relative to the economy’s capacity to supply those things, inflation is well above the 2–3 per cent target range.”

PBoC cuts two key lending rates

China’s PBoC executed cuts to two of its pivotal lending rates today, marking the first time such adjustments have been made in 10 months since last August.

The Chinese central bank opted to reduce one-year loan prime rate by -10 bps, taking it down from 3.65% to 3.55%. Concurrently, it also implemented a -10 bps cut to five-year loan prime rate, adjusting it from 4.3% to 4.2%.

These measures follow other recent actions aimed at easing monetary policy. Only last Thursday, PBOC made its first cut to one-year medium-term loan facility in 10 months. Furthermore, the bank reduced its seven-day reverse repurchase rate on the preceding Monday.

Looking ahead

Swiss trade balance, Germany PPI and Eurozone current account will be released in European session. Later in the day, US will release housing starts and building permits.

AUD/USD Daily Report

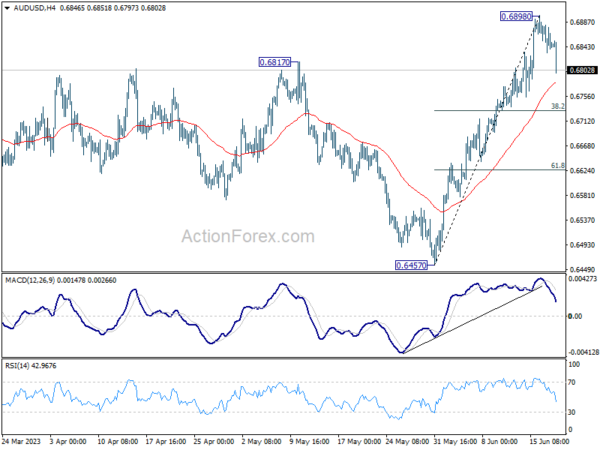

Daily Pivots: (S1) 0.6827; (P) 0.6857; (R1) 0.6880; More…

Intraday bias in AUD/USD remains neutral as consolidation from 0.6898 continues. Downside of retreat should be contained by 38.2% retracement of 0.6457 to 0.6898 at 0.6730 to bring another rally. As noted before, whole corrective decline from 0.7156 could have completed with three waves down to 0.6457 already. Above 0.6898 will resume the rise from 0.6457 to retest 0.7156 high next.

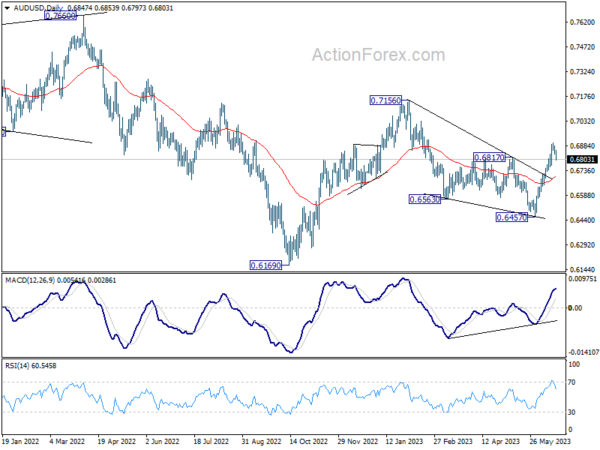

In the bigger picture, fall from 0.7156 could have completed in a three wave corrective structure at 0.6457. The development argues that rise from 0.6169 (2022 low) is still in progress. Firm break of 0.7156 will also add to the case that whole down trend from 0.8006 (2021 high) has finished and turn medium term outlook bullish. For now this will be the favored case as long as 55 D EMA (now at 0.6694) holds, even in case of deep pull back.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 01:30 | AUD | RBA Minutes | ||||

| 04:30 | JPY | Industrial Production M/M Apr F | 0.70% | -0.40% | -0.40% | |

| 06:00 | CHF | Trade Balance (CHF) May | 3.45B | 2.60B | ||

| 06:00 | EUR | Germany PPI M/M May | -0.70% | 0.30% | ||

| 06:00 | EUR | Germany PPI Y/Y May | 1.70% | 4.10% | ||

| 08:00 | EUR | Eurozone Current Account (EUR) Apr | 27.3B | 31.2B | ||

| 12:30 | USD | Housing Starts May | 1.40M | 1.40M | ||

| 12:30 | USD | Building Permits May | 1.43M | 1.42M |