Asian markets began the trading week on a high note, largely driven by a rise in Japan’s Nikkei index, which was buoyed by encouraging results from BoJ Tankan Survey. Meanwhile, market participants seemed to overlook weak data from China’s manufacturing sector. Australian and New Zealand dollars led the other currencies, experiencing broad gains, closely trailed by Canadian Dollar. Japanese Yen and the Swiss Franc, however, traded with a weak undertone. Euro, Dollar, and British Pound exhibited mixed trading for the time being.

Although US traders may adopt a more relaxed stance due to the long July 4th weekend, trading may not be entirely subdued. RBA’s interest rate decision, scheduled for tomorrow, could indeed stir up some market volatility. Besides, the week is packed with significant economic data releases, including ISM indexes and the much-anticipated non-farm payroll report.

From a technical analysis perspective, the AUD/JPY pair will be of particular interest in the next 24 hours. For now, deeper decline is in favor as long as 96.48 minor resistance holds. In case of another fall, the focus is on whether it could depend 38.2% retracement of 90.24 to 97.66 at 94.82. Nevertheless, break of 96.48 would likely prompt stronger rally back to retest 97.66 high.

In Asia, Nikkei closed up 1.70%. Hong Kong HSI is up 1.91%. China Shanghai SSE is up 1.29%. Singapore Strait Times is up 0.26%. Japan 10-year JGB yield is up 0.0023 at 0.402.

In Asia, Nikkei closed up 1.70%. Hong Kong HSI is up 1.91%. China Shanghai SSE is up 1.29%. Singapore Strait Times is up 0.26%. Japan 10-year JGB yield is up 0.0023 at 0.402.

BoJ’s Tankan survey indicates renewed confidence amongst Japanese businesses

BoJ’s quarterly Tankan survey for Q2 has pointed to an uptick in confidence among Japanese businesses, surpassing market expectations.

Large manufacturing index, a key barometer of Japan’s industrial sector, saw an impressive rise from a two-year low of 1 to 5, outperforming the market expectation of 3. This level marks the highest index value since Q4 of 2022, signifying a considerable rebound in sentiment within the manufacturing sector.

Similarly, large non-manufacturing index advanced from 20 to 23, again exceeding market forecasts of 22. This development signals the highest reading since Q2 2019, reflecting a resurgence in confidence within the broader service sector.

Looking forward, outlook for large manufacturers also leaped from 3 to 9, beating market predictions of 5. However, the outlook for large non-manufacturing firms was slightly below expectations at 20, compared to an anticipated figure of 21.

On the capital expenditure front, large firms plan to ramp up their outlays by a notable 13.4% in the current fiscal year ending March 2024, dwarfing the 3.2% increase projected in the Q1 survey.

Interestingly, the Tankan survey also revealed that companies foresee inflation hitting 2.6% a year from now, a slight pullback from the 2.8% projection made in March. Looking further ahead, inflation expectations stand at 2.2% for three years’ time, a slight reduction from March figure of 2.3%, while projection for inflation five years from now remains stable at 2.1%.

Japan PMI manufacturing finalized at 49.8, fractional deterioration in the sector

Japan’s Manufacturing PMI was finalized at 49.8 in June, a downturn from May’s 50.6, according to au Jibun Bank. The reading fell just short of the neutral 50.0 threshold that separates expansion from contraction, indicating a slight decline in the health of the nation’s manufacturing sector.

The report also highlighted that both output and new orders regressed, while supplier performance showed the most significant improvement since March 2016. Input prices increased at the slowest pace observed in the past 28 months.

Usamah Bhatti of S&P Global Market Intelligence noted, “The latest data pointed to a fractional deterioration in the Japanese manufacturing sector at the midpoint of 2023.”

However, the slackening in demand and output conditions had a double-edged effect. On one hand, pressure on supply chains eased in June, with average lead times shortening for the second successive month. Simultaneously, easing pressure on supply chains also alleviated inflationary pressures, driving the Input Prices Index to a 28-month low.

China Caixin PMI manufacturing dipped to 50.5, dire job market, deflationary pressure, waning optimism

China’s Caixin PMI Manufacturing for June recorded a slight decline from 50.9 in May to 50.5. slightly above expectation of 50.2. Caixin indicated that while output marginally increased, demand growth remained modest. Meanwhile, input prices experienced their sharpest decline since January 2016, and business confidence sank to an eight-month low.

Wang Zhe, Senior Economist at Caixin Insight Group, summed up the situation: “Manufacturing activity growth suffered a marginal slowdown.”

“A slew of recent economic data suggests that China’s recovery has yet to find a stable footing, as prominent issues including a lack of internal growth drivers, weak demand and dimming prospects remain,” Wang added.

“Problems reflected in June’s Caixin China manufacturing PMI, ranging from an increasingly dire job market to rising deflationary pressure and waning optimism, also point to the same conclusion.”

RBA rate decision in the balance: Market braces for aussie volatility

The much-anticipated RBA rate decision this week presents a fifty-fifty split on whether the central bank will opt for a hike or a pause. This follows a Reuters poll indicating that of the 31 economists surveyed, 16 predict a hike, while 15 expect a pause. Additionally, 16 out of 30 economists forecast that the cash rate will peak at or above 4.60% by the end of September. Thus, should the RBA decide to hold this week, it is more likely to be a pause in the tightening cycle than a definitive end.

This level of uncertainty surrounding RBA’s imminent decision, coupled with the accompanying statement, indicates that Australian Dollar may face significant volatility. Contributing additionally to this turbulence are key releases from China – specifically Caixin PMI manufacturing data due on Monday and Caixin PMI services data set for Wednesday. These releases could influence Chinese stocks and Yuan, subsequently impacting Aussie. As such, traders should brace for a potentially tumultuous week.

The release of FOMC minutes is another significant event to watch. However, the minutes are unlikely to diverge significantly from the overarching message that the tightening cycle is not yet complete. In the words of FOMC Chair Jerome Powell, a “strong majority” of FOMC participants expect at least two more hikes by year’s end. Hence, the overall impact of the minutes could be overshadowed by high-impact economic data such as ISM indexes and non-farm payroll figures, especially wage growth data.

Additional key economic data releases to watch this week include Swiss CPI, Eurozone PPI and retail sales, Japan’s cash earnings and household spending, and Canadian employment data.

Here are some highlights for the week:

- Monday: Japan Tankan survey, PMI manufacturing final; Australia MI inflation gauge, building approvals; China Caixin PMI manufacturing; Swiss CPI; Eurozone PMI manufacturing final; US ISM manufacturing, construction spending.

- Tuesday: New Zealand NIZER business confidence; RBA rate decisions; Germany trade balance; Canada manufacturing PMI.

- Wednesday: China Caixin PMI services; France industrial production; Eurozone PMI services final, PPI; UK PMI services final; US factory orders, FOMC minutes.

- Thursday: Australia trade balance; Germany factory orders; UK PMI construction; Eurozone retail sales; Canada trade balance; US ADP employment, jobless claims, trade balance, ISM services.

- Friday: Japan labor cash earnings, household spending; Swiss unemployment rate; Germany industrial production; US non-farm payrolls; Canada employment, Ivey PMI.

USD/JPY Daily Outlook

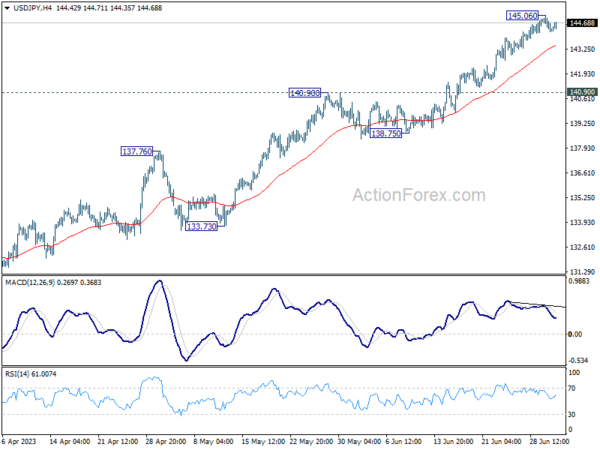

Daily Pivots: (S1) 144.00; (P) 144.53; (R1) 144.86; More…

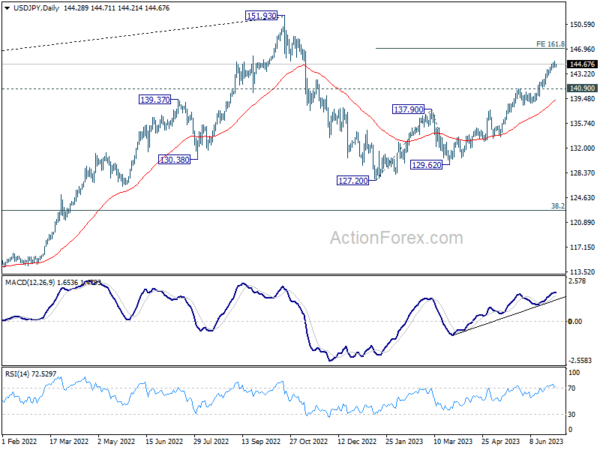

Intraday bias in USD/JPY remains neutral for consolidations below 145.06. Break of 55 4H EMA (now at 143.40) could trigger deeper correction. But further rally will remain in favor as long as 140.90 resistance turned support holds. On the upside, break of 145.06 will resume larger rise to 161.8% projection of 127.20 to 137.90 from 129.62 at 146.93.

In the bigger picture, rise from 127.20 is currently seen as the second leg of the corrective pattern from 151.93 high. Further rally is expected as long as 138.75 support holds, to retest 151.93. But strong resistance could be seen there to limit upside. Break of 138.75 will indicate the the third leg has started back towards 127.20.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Building Permits M/M May | -2.20% | -2.60% | ||

| 23:50 | JPY | Tankan Large Manufacturing Index Q2 | 5 | 3 | 1 | |

| 23:50 | JPY | Tankan Non – Manufacturing Index Q2 | 23 | 22 | 20 | |

| 23:50 | JPY | Tankan Large Manufacturing Outlook Q2 | 9 | 5 | 3 | |

| 23:50 | JPY | Tankan Non – Manufacturing Outlook Q2 | 20 | 21 | 15 | |

| 23:50 | JPY | Tankan Large All Industry Capex Q2 | 13.40% | 3.20% | ||

| 00:30 | JPY | Manufacturing PMI Jun F | 49.8 | 49.8 | 49.8 | |

| 01:00 | AUD | TD Securities Inflation M/M Jun | 0.10% | 0.90% | ||

| 01:30 | AUD | Building Permits M/M May | 20.60% | 4.90% | -8.10% | -6.80% |

| 01:45 | CNY | Caixin Manufacturing PMI Jun | 50.5 | 50.2 | 50.9 | |

| 06:30 | CHF | CPI M/M Jun | 0.20% | 0.30% | ||

| 06:30 | CHF | CPI Y/Y Jun | 1.80% | 2.20% | ||

| 07:30 | CHF | Manufacturing PMI Jun | 42.8 | 43.2 | ||

| 07:45 | EUR | Italy Manufacturing PMI Jun | 45.4 | 45.9 | ||

| 07:50 | EUR | France Manufacturing PMI Jun F | 45.5 | 45.5 | ||

| 07:55 | EUR | Germany Manufacturing PMI Jun F | 41 | 41 | ||

| 08:00 | EUR | Eurozone Manufacturing PMI Jun F | 43.6 | 43.6 | ||

| 08:30 | GBP | Manufacturing PMI Jun F | 46.2 | 46.2 | ||

| 13:45 | USD | Manufacturing PMI Jun F | 46.3 | 46.3 | ||

| 14:00 | USD | ISM Manufacturing PMI Jun | 47.2 | 46.9 | ||

| 14:00 | USD | ISM Manufacturing Prices Paid Jun | 44.2 | |||

| 14:00 | USD | ISM Manufacturing Employment Index Jun | 51.4 | |||

| 14:00 | USD | Construction Spending M/M May | 0.50% | 1.20% |