Japanese Yen and Dollar are experiencing broad declines today, as rebound in Chinese and Hong Kong stocks that buoyed overall market sentiment. The mood lifted on news that Country Garden, a troubled Chinese property giant, has secured an extension for a critical debt payment deadline, effectively avoiding default. Reports suggest that the company’s Chinese creditors have agreed to a repayment plan stretched over the next three years.

While Yen and Dollar falter, Sterling has emerged as today’s top performer in the currency market, outperforming Australian Dollar and Euro. The strong showing by Sterling could indicate that individual currency dynamics are also impacting forex market movements, in addition to the broader uplift in sentiment around China’s economic conditions.

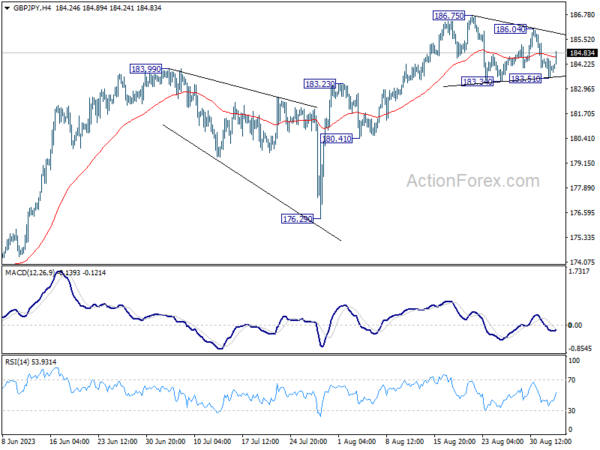

Technically, GBP/JPY’s rebound today keeps recent price actions from 186.75 short term top as a sideway corrective pattern, probably in form of triangle. In other words, larger up trend is expected to resume after this consolidation completes. Break of 186.04 resistance will be the first sign that GBP/JPY is ready to rise through 186.75 high.

In Asia, Nikkei closed up 0.70%. Hong Kong HSI is up 2.39%. China Shanghai SSE is up 1.40%. Singapore Strait Times is up 0.28%. Japan 10-year JGB yield rose 0.0141 to 0.646.

Swiss Q2 GDP stagnates as manufacturing slumps

Switzerland’s GDP growth for Q2 came in flat at 0.0% qoq, missing the modest expectation of a 0.1% qoq growth. While this paints a grim picture, particularly for manufacturing and construction sectors, certain segments like trade and accommodation services displayed resilience, leaving a mixed bag of results for economists and investors to sift through.

The manufacturing sector contracted sharply by -2.9% qoq, weighed down significantly by a decline in the chemical and pharmaceutical industry, which shrank by -2.3%. Mechanical engineering and metal construction also faced headwinds, reflecting the sector’s sensitivity to challenging international conditions. Furthermore, the construction sector didn’t fare well either, contracting by -0.7% qoq.

On a brighter note, both private and government consumption showed marginal growth at 0.4% and 0.1% qoq, respectively. These figures indicate that domestic demand remains somewhat steady, offering a counterbalance to the weaknesses observed in production sectors.

Equipment and software investment plunged by -3.7% qoq, while exports of goods fell by -1.2% qoq. However, export of services saw a rise of 2.6% qoq, and imports of goods and services contracted by -3.7%, making a net positive contribution to GDP.

New Zealand goods terms of trade rose 0.4% in Q2

In Q2 2023, New Zealand’s goods terms of trade rose by a 0.4%, much better than expectation of -1.3% decline. Both export and import prices for goods witnessed a dip, falling -0.6% and -1.0% respectively. Export volumes surged 6.8%, while import volumes declined by -2.8%, suggesting robust external demand and potentially cautious domestic consumption.

The services sector terms of trade rose significantly by 4.4%, a robust figure indeed. Export prices for services edged up 0.3%, whereas import prices saw a more considerable decline of -3.9%.

Alasdair Allen, international trade manager, highlighted that New Zealand typically enjoys a trade surplus with China, increasingly driven by trade in goods. The trade surplus for Q2 stood at a NZD 2.0B, with total goods and services exports to China valued at NZD 5.8B, and imports at NZD 3.8B. Notably, there have been only three quarterly goods deficits with China over the past five years.

RBA and BoC to hold, US ISM services and China data featured

This week, much attention will be on RBA and BoC, both of which are expected to leave their key interest rates unchanged.

Consumer inflation in Australia eased to 4.9% in July, prompting economists to largely anticipate that RBA will maintain its official cash rate at 4.10% in its Tuesday meeting. However, there is no consensus on the road ahead. Major local banks present a divided front: ANZ, CBA, and Westpac expect the rate to remain static until at least the end of 2023. In contrast, NAB projects another 25 bps hike to 4.35% come November. A recent Reuters poll further substantiates this division, with 21 of 35 respondents anticipating another hike by the year’s end, while the remaining expect rates to hold steady.

Similarly, BoC is predicted to keep its key interest rate at 5.00% when it meets on Wednesday, after two consecutive 25 bps hikes in its previous meetings. A Reuters poll saw 31 out of 34 economists forecasting a rate hold this month. Going forward, only a minority of respondents—8 out of 34—foresee one more hike to 5.25% by year-end. In addition to the rate decision, Canadian job data will also be under the microscope.

Markets will also be closely tracking other major economic indicators, including Fed’s Beige Book report and US ISM services data. From China, Caixin PMI services and trade balance reports are on the watchlist.

Here are some highlights for the week:

- Monday: New Zealand terms of trade; Japan monetary base; Germany trade balance; Swiss GDP; Eurozone Sentix investor confidence.

- Tuesday: Japan household spending; Australia current account, RBA rate decision; China Caixin PMI services; Eurozone PMI services final, PPI; UK PMI services final; US factory orders.

- Wednesday: Australia GDP; Germany factory orders; UK PMI construction; Eurozone retail sales; Canada labor productivity, BoC rate decision, trade balance; US trade balance, ISM services, Fed’s Beige Book.

- Thursday: New Zealand manufacturing sales; Japan leading indicators; Swiss unemployment rate; Germany industrial production, foreign currency reserves; France trade balance; Eurozone GDP revision; Canada building permits, Ivey PMI; US jobless claims.

- Friday: Japan average cash earnings, GDP final; Germany GDP final; France industrial production; Canada employment.

AUD/USD Daily Report

Daily Pivots: (S1) 0.6420; (P) 0.6471; (R1) 0.6503; More…

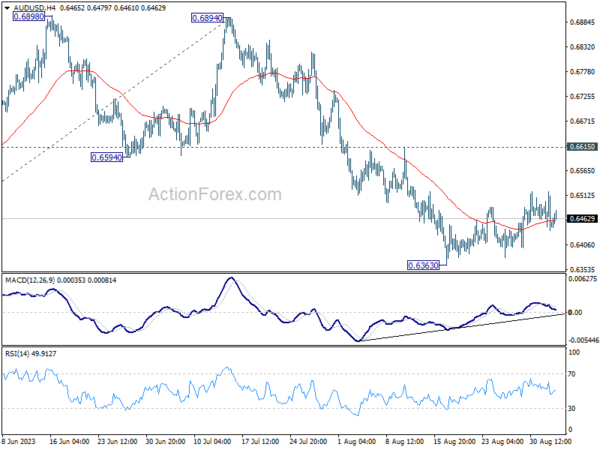

AUD/USD recovers mildly today but stays in the consolidation pattern from 0.6363. Outlook is unchanged and intraday bias stays neutral. In case of another recovery, upside should be limited by 0.6615 resistance. Break of 0.6363 will resume larger fall from 0.7156 to 100% projection of 0.7156 to 0.6457 from 0.6894 at 0.6195.

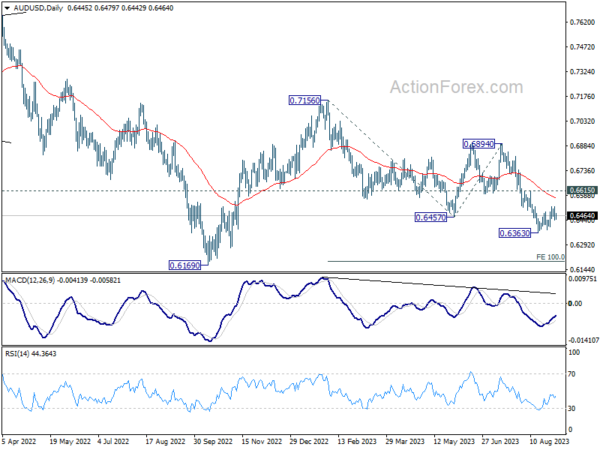

In the bigger picture, current development argues that the down trend from 0.8006 (2021 high) is still in progress. Decisive break of 0.6169 will target 61.8% projection of 0.8006 to 0.6169 to 0.7156 at 0.6021. This will now remain the favored case as long as 0.6894, in case of strong rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Terms of Trade Index Q2 | 0.40% | -1.30% | -1.50% | |

| 23:50 | JPY | Monetary Base Y/Y Aug | 1.20% | -0.70% | -1.30% | |

| 01:00 | AUD | TD Securities Inflation M/M Aug | 0.20% | 0.80% | ||

| 06:00 | EUR | Germany Trade Balance (EUR) Jul | 15.9B | 17.6B | 18.7B | |

| 07:00 | CHF | GDP Q/Q Q2 | 0.00% | 0.10% | 0.30% | |

| 08:30 | EUR | Eurozone Sentix Investor Confidence Sep | -19.6 | -18.9 |