Australian Dollar is taking a surprising dip today despite RBA’s anticipated decision to raise the cash rate target by 25bps. Investors have taken this opportunity to lock in profits, influenced by the central bank’s softened rhetoric on the immediate need for further rate hikes. It appears RBA is likely to pause again to evaluate the impact of its policy measures, likely awaiting Q4 data in February before considering additional moves.

The mood in Asia also influenced commodity currencies, with a dour risk sentiment catalyzed by China’s unexpectedly steep drop in trade surplus. Although nominal wages in Japan edged higher, the overall weakness in Yen suggests that such positive data is insufficient to counterbalance the ongoing slide in real wages growth and household expenditure.

On the flip side, Dollar emerged as one of the strongest performers of the day so far, closely followed by Swiss Franc. Euro and British Pound are also making headway, with Sterling exhibiting a minor advantage over the common currency.

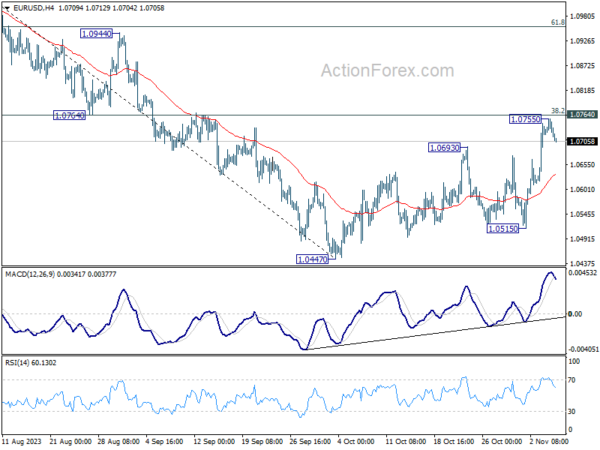

From a technical standpoint, Dollar’s recent downward momentum appears to be waning. A recovery could be imminent, yet it’s premature to declare a bullish reversal. A critical point of interest for Forex traders will be 55 4H EMA (now at 1.0643) in EUR/USD. Should Euro sustain above this level, it could signal that choppy rise from 1.0447 is set to continue through 1.0755 resistance later on. Conversely, sustained break below the 55 4H EMA might suggest the rebound is over, and send EUR/USD through 1.0515 support to retest 1.0447 low.

In Asia, at the time of writing, Nikkei is down -1.26%. Hong Kong HSI is down -1.50%. China Shanghai SSE is down -0.35%. Singapore Strait Times is down -0.33%. Japan 10-year JGB yield is up 0.0074 at 0.881. Overnight, DOW rose 0.10%. S&P 500 rose 0.18%. NASDAQ rose 0.30%. 10-year yield rose 0.104 to 4.662.

RBA hikes to 4.35%, future path hinges on evolving data

RBA announced an increase in cash rate target by 25 bps to 4.35%, aligning with market anticipations. Accompanying this move, RBA signaled a shift to a neutral policy stance, indicating that “whether further tightening of monetary policy is required… will depend upon the data and the evolving assessment of risks .”

In the statement, RBA said inflation is “still too high” and is proving “more persistent than expected a few months ago”. A rate hike was was warranted today to be “more assured” that inflation would return to target in a “reasonable timeframe”.

The central bank’s outlook is tempered by “significant uncertainties,” particularly regarding the persistence of services inflation which has been notably resilient internationally and could mirror in the Australian market.

The effectiveness of monetary policy changes and the response of wage settings and pricing decisions amid a slowdown in economic growth are areas of unpredictability, especially given the current tightness of the labor market. Household consumption prospects are also veiled with uncertainty, too. T

Looking abroad, RBA’s statement brought to light the ongoing global uncertainties, notably the economic trajectory of China and the far-reaching consequences of international conflicts, adding further dimensions to the central bank’s considerations.

China’s export decline deepens while imports rebound

China’s export figures have taken a sharper downturn than anticipated in October, contracting by -6.4% yoy to USD 274.8B, exceeding market predictions of -3.1% yoy. This downturn marks the sixth consecutive month where China’s exports have receded.

In contrast, imports defied expectations with a 3.0% yoy increase, a significant departure from the forecasted -5.4% yoy decline, and putting an end to an 11-month streak of contraction.

The culmination of these trade activities resulted in a considerable narrowing of the trade surplus, which shrunk from USD 77.7B to USD 56.5B. This is a stark contraction compared to the anticipated figure of USD 84.2B.

Japan’s labor cash earnings up 1.2% yoy, but real wages down for 18th month

Japan reported a modest increase in nominal labor cash earnings in September, with 1.2% yoy rise that slightly exceeded market expectations of 1.0% yoy gain. This uptick, an improvement from the previous month’s 0.8%, may seem like a positive indicator at first glance, with base salary growth also marking an increase to 1.4% yoy from August’s 1.2% yoy.

However, not all components of earnings showed strength. Special payments, often a volatile category, continued to decline by -6.0% yoy , albeit a less severe contraction than -6.3% yoy reported in August. Meanwhile, overtime pay exhibited a marginal increase, rising 0.7% yoy, suggesting a modest uptick in extra working hours.

The nuanced picture of Japan’s wage situation becomes more concerning when adjusted for inflation. Real wages, which reflect the purchasing power of income, fell sharply by -2.4% yoy compared to the same month last year, marking the 18th consecutive month of decline. This persistent slide in real wages points to the squeeze on household income as inflation outpaces nominal wage growth.

In line with the strain on incomes, household spending dipped by -2.8% yoy , although the figure is marginally better than the anticipated -3.0% yoy fall. This marks the seventh straight month of decline, underscoring the ongoing reticence of Japanese consumers to open their wallets amid economic uncertainties.

On a more positive note, on a seasonally adjusted basis, household spending saw an unexpected increase of 0.3% mom, defying expectations of a -0.4% mom decline.

BoE’s Pill suggests rate cuts by mid-2024 “not totally unreasonable”

In an online event overnight, BoE Chief Economist Huw Pill acknowledged the slower pace of reduction compared to global counterparts. The UK has also seen inflation climbed higher. Despite this lag, he expressed confidence that “We’re going to see the UK get down to levels more comparable to what we’re seeing in the rest of the world.”

Pill’s remarks came amid the backdrop of market expectations that have priced in a potential rate cut as early as August 2024. He finds this timing “not totally unreasonable,” highlighting it’s a period when the Bank might reassess its stance, albeit with the usual caveat that economic conditions are fluid and subject to change.

Moreover, Pill tempered expectations of a return to the ultra-low interest rate environment seen pre-pandemic, indicating that future rates are more likely to find a middle ground. This perspective reinforces the notion that the era of zero interest rates was an anomaly rather than a standard monetary condition.

Fed’s Kashkari signals preference for stronger policy action to tame inflation target

Minneapolis Federal Reserve President Neel Kashkari expressed concern over the consequences of insufficient tightening in a WSJ interview, saying, “Under-tightening will not get us back to 2% in a reasonable time.” He favored a stance that leans toward an aggressive policy rather than a cautious one.

In a subsequent conversation with Fox News, Kashkari drew attention to the economy’s endurance despite Fed’s recent rounds of rate increases. “The economy has proved to be really resilient even though we’ve raised interest rates a lot over the past couple of years. That’s good news,” he said. This resilience suggests that the economy might be better positioned to handle further rate hikes, should they be deemed necessary.

However, Kashkari was clear that the Fed’s job is far from over, as inflation remains a critical challenge. “We need to let the data keep coming to us to see if we really have got the inflation genie back in the bottle so to speak,” he conveyed, emphasizing the need for ongoing vigilance. He added, “We haven’t completely solved the inflation problem. We still have more work ahead of us to get it done.”

Looking ahead

Germany industrial production, Swiss foreign currency reserves, Eurozone PPI will be released in European session. Later in the day, trade balance from Canada and US will be featured.

AUD/USD Daily Report

Daily Pivots: (S1) 0.6449; (P) 0.6484; (R1) 0.6547; More…

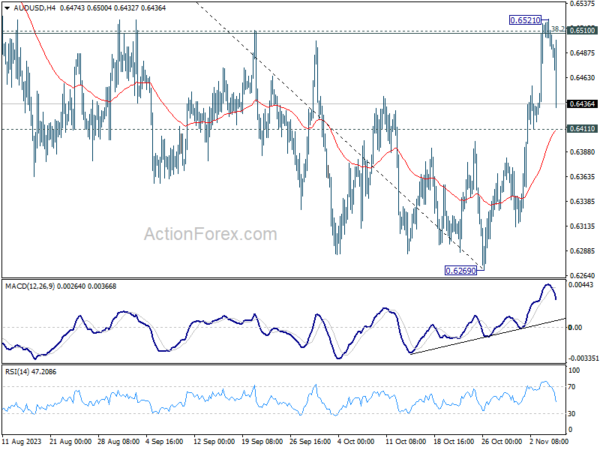

Intraday bias in AUD/USD is turned neutral first with today’s steep retreat. For now, another rise will remain mildly in favor as long as 0.6411 minor support holds. Sustained break of 0.6510 cluster resistance (38.2% retracement of 0.6894 to 0.6269 at 0.6508) will argue that whole decline from 0.7156 might be completed with three waves down to 0.6269. Stronger rally should then be seen to medium term trend line resistance (now at 0.6700). However, firm break of 0.6411 will indicate rejection by 0.6510, and turn bias back to the downside for retesting 0.6269 low.

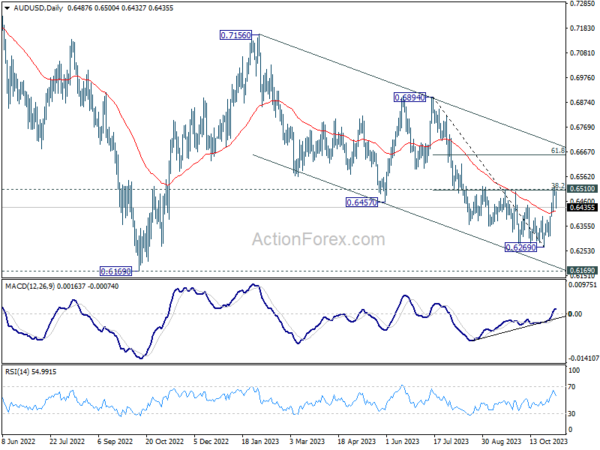

In the bigger picture, there is no confirmation that down trend from 0.8006 (2021 high) has completed. While current rebound from 0.6269 might extend higher, it could be the third leg of a corrective pattern from 0.6169 (2022 low) only. For now, medium term bearishness will remain as long as 0.6894 resistance holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Labor Cash Earnings Y/Y Sep | 1.20% | 1.00% | 1.10% | 0.80% |

| 23:30 | JPY | Overall Household Spending Y/Y Sep | -2.80% | -3.00% | -2.50% | |

| 00:01 | GBP | BRC Like-For-Like Retail Sales Y/Y Oct | 2.60% | 2.80% | ||

| 03:00 | CNY | Trade Balance (USD) Oct | 56.5B | 84.2B | 77.7B | |

| 03:30 | AUD | RBA Interest Rate Decision | 4.35% | 4.35% | 4.10% | |

| 07:00 | EUR | Germany Industrial Production M/M Sep | -0.30% | -0.20% | ||

| 08:00 | CHF | Foreign Currency Reserves (CHF) Oct | 678B | |||

| 10:00 | EUR | Eurozone PPI M/M Sep | 0.30% | 0.60% | ||

| 10:00 | EUR | Eurozone PPI Y/Y Sep | -12.50% | -11.50% | ||

| 12:30 | CAD | Trade Balance (CAD) Sep | 1.0B | 0.7B | ||

| 13:30 | USD | Trade Balance (USD) Sep | -60.5B | -58.3B |