Looking through all the financial market news last week, the message was rather unified. That is, 2019 will be a year of slowdown, globally. Economic data, central banks, governments and independent organizations are all reinforcing this message. While ECB’s “pre-emptive” dovish turn triggered wild market reactions, it was just the nail for the case. The question now is whether the markets are pessimistic enough on the outlook.

Judging from the technical developments, we see that there are conditions in place for bearish reversals in stocks in US, Germany and Japan. But none of these indices confirmed reversal. Instead, late buying on Friday showed much underlying resilience. We believed the panic buttons weren’t hit yet. A lot will depend on upcoming developments in US-China trade negotiations and Brexit.

In the currency markets, Yen emerged as the biggest winner on risk aversion, and more so from reversal in global treasury yields. US 10-year yield hit as high as 2.759 on March 1 but closed just 2.625 last week, lowest since early January. German 10-year hit hit as high as 0.21, also on March 1, but closed the week at 0.071. New Zealand Dollar was the second strongest, US Dollar the third. On the other hand, Sterling was the weakest ones as crucial Brexit votes approach. Euro followed as second weakest on ECB.

A quick recap on OECD, China, ECB, BoC, RBA and NFP

Let’s have quick recap on some important happenings last week. OECD lowered global growth forecast by -0.2% to 3.3% in 2019 and by -0.1% to 3.4% in 2020. In the Interim Economic Outlook, it’s noted that Chinese and European slowdown, and weakening global trade growth are the principal factors weighing on the world economy. For China, while policy stimulus should offset weak trade development, “risks remains of a sharper slowdown” that would hit global growth and trade.

China lowered 2019 GDP growth target to 6-6.5%. The lower bound at 6% would be the slowest pace of growth in nearly three decades. China plans to cut around CNY 2T in taxes and fees for companies, in particular manufacturers. Budget deficit is expected to climb 0.2% to 2.8% of GDP. Shockingly poor February trade data reinforced that China is facing “tough struggle” and serious impact from trade war. February alone, exports contracted -20.7% yoy, decline since February 2016. Imports also dropped -5.2% yoy.

The picture was better if we take out the distortion by Chinese New Year. January and February combined, exports dropped -4.6% yoy while imports dropped -3.1% yoy. These figures were not disastrous but still weak. Zooming into trade with US, the deterioration was rather drastic. Total trade with US dropped -19.9% yoy, exports dropped -14.1% yoy but imports dropped -35.1% yoy. Trade with EU wasn’t too bad, still recorded 3.7% yoy growth in total trade, 2.4% yoy rise in exports and 5.7% rise in imports.

European slowdown is another drag to global economy as noted by OECD. ECB’s statement, press conference and policy actions showed policy makers are in deep worry. Firstly, ECB changed the forward guidance and now expects to keep interest rates at present levels “at least through the end of 2019”, prolonged from “summer of 2019”. TLTRO-III is announced, quarterly from September 2019 through March 2021. It’s aiming at preserving favourable bank lending conditions, and smooth transition of monetary policy.

In the post meeting press conference, ECB President Mario Draghi said weakening in data points to a “sizeable moderation” in growth extends into 2019. Impact from slowdown in external demand and country/sector specific factors is “turning out to be somewhat longer-lasting”. GDP growth was “revised down substantially in 2019 and slightly in 2020”. GDP is projected to grow by 1.1% in 2019, 1.6% in 2020 and 1.5% in 2021. They compare to December’s projection of 1.7% in 2019, 1.7% in 2020 and 1.5% in 2021. Risks surrounding outlook are “still tilted to the downside”, due to “geopolitical factors, the threat of protectionism and vulnerabilities in emerging markets.”

Talking about central banks, after leaving interest rate unchanged at 1.75%, BoC acknowledged that, as “recent data” suggested, global economic slowdown has been “more pronounced and widespread” than previously anticipated. The most surprisingly change comes from the monetary policy stance. BOC judged that the current economic developments “warrant a policy interest rate that is below its neutral range”. Moreover, “given the mixed picture that the data present, it will take time to gauge the persistence of below-potential growth and the implications for the inflation outlook”. In short, BoC has take a rate hike off the table, at least for now.

Another central bank RBA sounded confident. After leaving interest rate unchanged at 1.50%, RBA maintained the central scenarios of growth, inflation, employment outlook. And continued to expect the “gradual” progress of reducing unemployment and inflation returning to target. Governor Philip Lowe later said that wage growth is expected to offset negative impact from fall in house prices. However, Q4 GDP released, at just 0.2% qoq, was way worse than expected. After the release, more economists are forecasting two RBA cuts this year, including , Westpac, Macquarie, JP Morgan, UBS, Nomura, AMP, Capital Economics, Market Economics…

Talking about rate cuts, traders are not back betting on a cut by Fed by the end of the year. Fed futures now imply around 20% chance of that happening. It was practically at 0% chance a week ago and more than 20% chance a month ago. But judging on the fact that the chance just rose little on Friday, non-farm payrolls report didn’t have too much impact yet. After all, the 20k job growth in February was undoubtedly poor. But a month of data could distorted by many factors like weather. We may have some upward revision in the data next month. Also, unemployment rate dropped back to 3.8% while average hourly earnings accelerated to 0.4% mom. It’s overall not too bad a set of data.

US-China trade talks could drag on to April while tariff damages continue

No additional progress is reported regarding US-China trade talks. Instead, there are rumors that the March 27 Trump-Xi summit in Mar-a-Lago is called off. There are some speculations. Some noted the agreement is better signed in a third country. Some said Xi is concerned Trump will walk away from a deal in Florida, just like what he did to Kim in Vietnam. But most likely reason is the two sides are still far away on some core issues. The ne got at ions could drag on to April.

Meanwhile, we’d like to point out that the phrase “trade truce” is an incorrect description of the current state (admittedly, we used it too). According to Cambridge Dictionary, truce means “a short interruption in a war or argument, or an agreement to stop fighting or arguing for a period of time”. If US and China are engaged in a trade war, the cannons are the tariffs. Such tariffs are still “flying”, every single day. They just stopped escalating, but the war is still on.

If the punitive and retaliatory tariffs since last year damaged global trade growth and economy, they’re still doing it. Hence, the longer the talks, the longer the impacts would be. IP theft, forced technology transfer and unfair trade practices are also happening everyday in China before a deal is made and enforced. Besides, it should be reminded that the steel and aluminum tariffs are still on, and there is no end in sight. It will remain a drag in EU’s economy, as well as others.

EU’s offer rejected by UK, Brexit votes loom

The crucial votes on Brexit from March 12 to 14 are approaching but there is no clear breakthrough. As a somewhat last ditch effort, EU chief negotiator Michel Barnier reveal, through his tweets, new package of “concessions” to the UK. Firstly, the arbitration panel can give UK the risk to a “proportionate suspension of its obligation under the backstop, as a last resort, if EU breaches its best endeavours/good faith obligations to negotiate alternative solutions.”

More controversially, Barnier said “EU commits to give UK the option to exit the Single Customs Territory unilaterally, while the other elements of the backstop must be maintained to avoid a hard border. UK will not be forced into customs union against its will.” That means, the UK can choose to apply the backstop just to Northern Ireland, rather than the whole of UK. This idea was rejected by the UK long ago.

The idea drew heavy criticism from the UK government. Cabinet Minister Andrea Leadsom rejected the idea and said she was “absolutely astonished”. She also warned that “if the EU doesn’t enable us to resolve this issue issue about the permanent nature of the backstop, then in effect what the EU is pushing us towards is leaving the EU without a withdrawal agreement at all”. Chairman of the ruling Conservative Party Brandon Lewis also said “we are not going to have an agreement that compromises the unity of the United Kingdom.”

Without any fundamental change regarding Irish backstop, there is practically no chance for May to get her Brexit deal through the Parliament on March 12, next Tuesday. A vote on no-deal Brexit will then be held on March 13 to see if there is explicit consent on this path. If not, there will be another vote on Article 50 extension on March 14.

As for Sterling’s reactions, it should be noted that its recent rally was built on fading chance of no-deal Brexit. There was no positive development on the deal to push the Pound higher. Last week’s decline just put Sterling back to where it was.

Risk sentiments turned sour, but no panic yet

S&P 500’s decline last week confirmed short term topping at 2816.88, after hitting 78.6% retracement of 2940.91 to 2346.58 at 2813.72. The index then hit as low as 2722.27. We’re viewing rise from 2346.58 as a leg inside the medium term consolidation pattern from 2940.91. Thus, we’re expecting such rise to complete between 2813.72 and 2940.91 and reverse.

However, the late buying on Friday argues that SPX could be trying to form a bottom around 55 day EMA (now at 2712.82). Thus, there is no confirmation of near term reversal yet. There could still be another rise through 2816.88 before reversal. Though, sustained break of 55 day EMA will add to the case of reversal and target 38.2% retracement of 2346.58 to 2816.88 at 2637.22 and below.

DAX’s decline last week indicates short term topping at 11676.86. It is totally possibly for the rebound from 10279.20 to complete around 11726.62 key support turned resistance. This level is close to 55 week EMA at 11752.90 too. But so far, despite the pull back, DAX is held well inside near term rising channel as well as 55 day EMA. Thus, there is no clear indication of reversal yet. The rebound from 10279.20 could still extend to trend line resistance (now at 12350).

Comparing to the SPX and DAX, the outlook in Nikkei looks more dangerous as it closed below 55 day EMA. It’s also reasonable for rebound form 18948.58 to complete around 50% retracement of 24448.07 to 18948.58 at 21698.32, which is close to 55 week EMA at 21564.12. But then, Nikkei is staying inside near term rising channel. Thus, there is still prospect of extending the rebound from 18948.58 to 61.8% retracement at 22347.26. Though, firm break of the channel support should bring deeper fall to retest 18948.58 low.

The decline in China Shanghai SSE on Friday, after poor trade data, might look steep. But it should be noted that it came after the index surged to 3219.93 on government tax and fees cut. The index just closed the week down -0.81%. And it’s natural to have a set back ahead of 61.8% retracement of 3587.03 to 2440.90 at 3149.20. It’s also close to 55 month EMA at 3144.61. There is prospect for the index to gyrate lower in near term. But we’d expect strong support from 38.2% retracement of 2440.90 to 3129.93 at 2866.72 to contain downside. 2440.09 is seen as a long term bottom that completes the long term correction from 2015 high at 5178.19. Thus, further rally is expected to 3587.03 resistance in medium term.

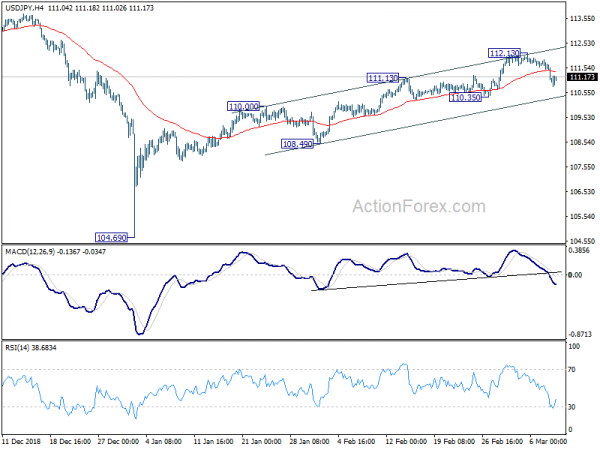

In the currency markets, USD/JPY, despite the sharp fall from 112.13, is holding well above 110.35 support, as well as near term channel support.

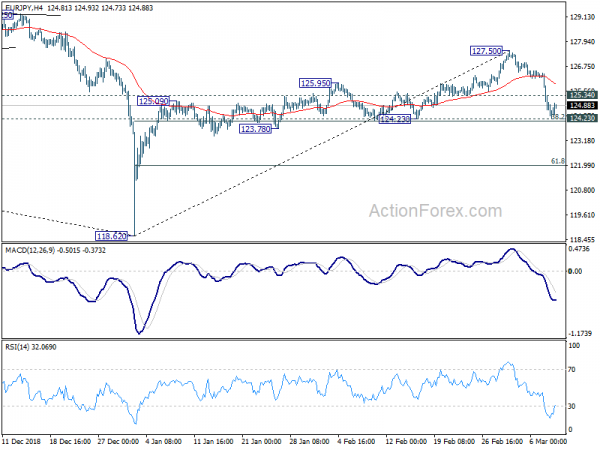

EUR/JPY also recovered just ahead of 124.23 cluster support (38.2% retracement of 118.62 to 127.50 at 124.10).

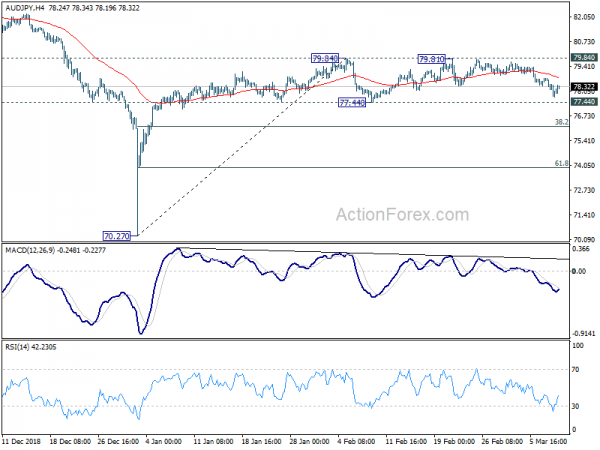

AUD/JPY was held well comfortably above 77.44 support.

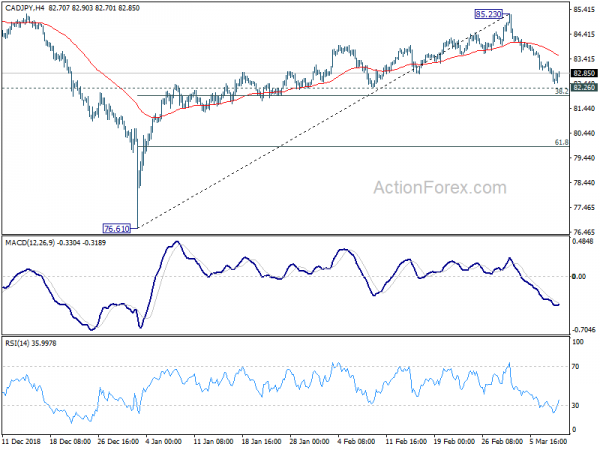

CAD/JPY is still holding above 82.26 support.

There is so far no confirmation on bullish reversal in the Japanese Yen. More evidence might come this week as the above levels are broken. But for now, the declines in Yen crosses are generally viewed as corrective first.

Position trading

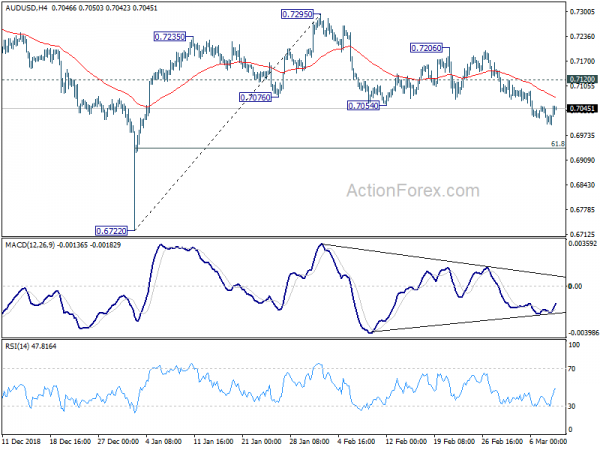

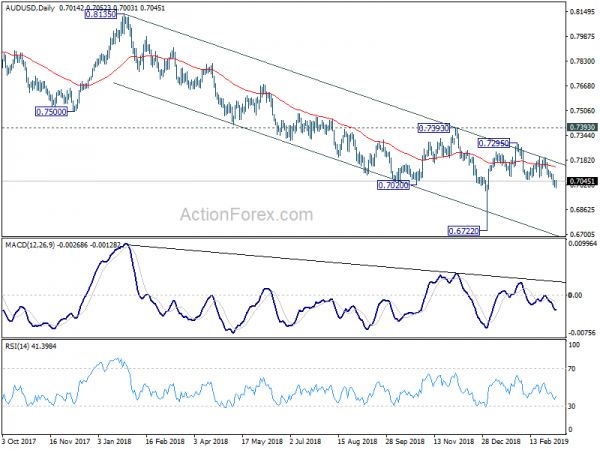

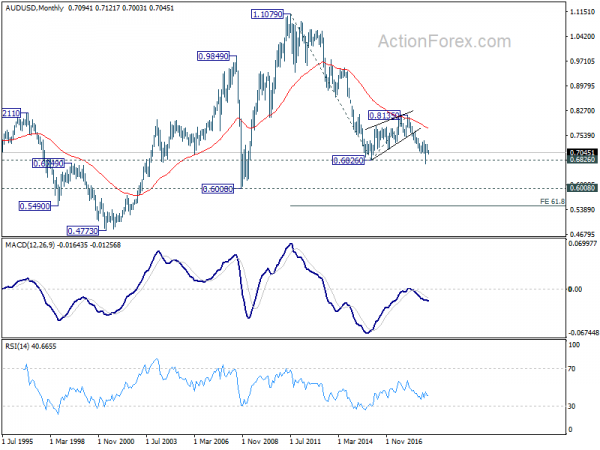

We’ve switch from AUD/JPY short to AUD/USD short last week, then there it went the turn in market sentiments and sharp decline in global treasury yield. We’re admittedly trapped by prior week’s rally in yields as we’ve given up the expectation for Yen to rebound. Though, the bearish view on Aussie still holds. So, we’d stay short in AUD/USD, entered at 0.7050. Stop will be held at 0.7120. 0.6722 low is the first target. But we’re actually looking at long term down trend resumption to 0.6008 and below.

EUR/USD Weekly Outlook

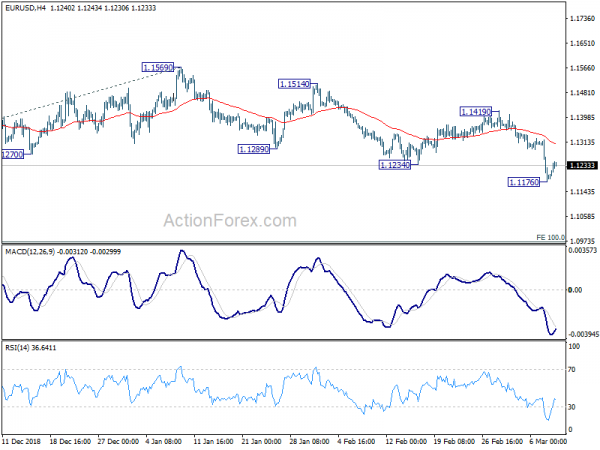

EUR/USD dropped sharply to 1.1176 last week and breach of 1.1215 low indicates resumption of down trend from 1.2555. As a temporary low is formed, initial bias is neutral this week for some consolidations first. Upside of recovery should be limited below 1.1419 resistance to bring down trend resumption. On the downside, break of 1.1176 will target 100% projection of 1.1814 to 1.1215 from 1.1569 at 1.0970 next.

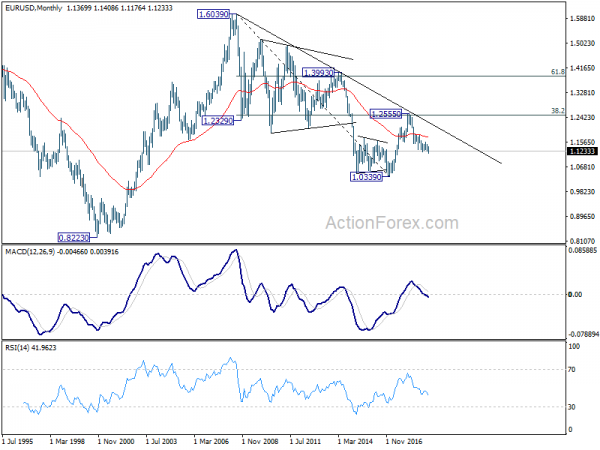

In the bigger picture, down trend from 1.2555 medium term top is still in progress. Bearishness is affirmed by sustained trading below falling 55 week EMA. 61.8% retracement of 1.0339 (2017 low) to 1.2555 at 1.1186 is met. Sustained break there will pave the way to retest 1.0339. On the upside, break of 1.1569 resistance will now indicate completion of such down trend and turn medium term outlook bullish.

In the long term picture, the rejection from 38.2% retracement of 1.6039 to 1.0339 at 1.2516 argues that long term down trend from 1.6039 (2008 high) might not be over yet. EUR/USD is also held below decade long trend line resistance. Firm break of 61.8% retracement of 1.0339 to 1.2555 at 1.1186 should at least bring a retest on 1.0339 low. This will remain the favored case as long as 1.1569 resistance holds.