Sterling was the star winner last week as boosted by renewed hope of a Brexit deal between the government and opposition. Poor results for both Conservatives and Labours are piling pressure on both parties to end the Brexit standoff and drama as soon as possible. In short, Conservatives lost more than 1300 seats. But despite the results, Labour didn’t gain anything, but instead lost around 80 seats. That’s seen as a wake up call to the two major parties on how deeply the public is dissatisfied by them.

Prime Minister Theresa May stepped up calls on Labour leader Jeremy Corbyn to agree on a cross-party deal to leave the EU. May said in a Sunday newspaper party: “To the Leader of the Opposition I say this: Let’s listen to what the voters said in the local elections and put our differences aside for a moment. Let’s do a deal”. May is expected to offer new concessions to Labour as talks with restart on coming Tuesday. It’s perceived that both sides are getting closer and closer and a deal could be done within days.

New economic projections as presented in the quarterly Inflation Report was somewhat Sterling neutral. BoE voted unanimously to leave the Bank rate unchanged at 0.75% and the asset purchase program at GBP 435B . Besides see the economy to expand +0.5% in 1Q19, up from +0.2% in 4Q18, the staff has upgraded GDP growth in 2019 through 2020. The unemployment rate is expected to fall further from the current multi-decade low level. Meanwhile, inflation forecasts were revised lower.

Economic data from UK were generally positive but could be due to pre-Brexit stockpiling mainly. Q1 GDP rose 0.5% qoq versus expectation of 0.2% qoq. PMI manufacturing dropped to 53.1, down from 55.1 in April. But construction PMI rose to 50.5, up from 49.7. Services PMI also rose to 50.4, up from 48.9.

Euro lifted as better than expected Q1 and resurgence of inflation

Euro followed as second strongest as economic data showed that Q1’s slowdown was not as bad as originally expected. Meanwhile, there were signs of pickup in inflation in Eurozone. Most importantly, Eurozone GDP grew 0.4% qoq in Q1, up from Q4’s 0.2% and beat expectation of 0.3% qoq. France GDP growth was steady at 0.3% qoq. Italy GDP turned back to 0.2% qoq growth. Spain GDP grew 0.7% qoq, up from 0.6% qoq.

On inflation, Eurozone CPI accelerated to 1.7% yoy in April. up from 1.4% yoy and beat expectation of 1.6% yoy. CPI core accelerated to 1.2% yoy, up from 0.8% yoy and beat expectation of 1.0% yoy. Germany CPI accelerated to 2.0% yoy, up from 1.3% yoy and beat expectation of 1.5% yoy. France CPI also accelerated slightly to 1.2% yoy from 1.1% yoy.

It’s too early to confirm that the worst is over for Eurozone. But at least, things are getting better. The next batch of May PMIs will be crucial in solidifying a positive outlook.

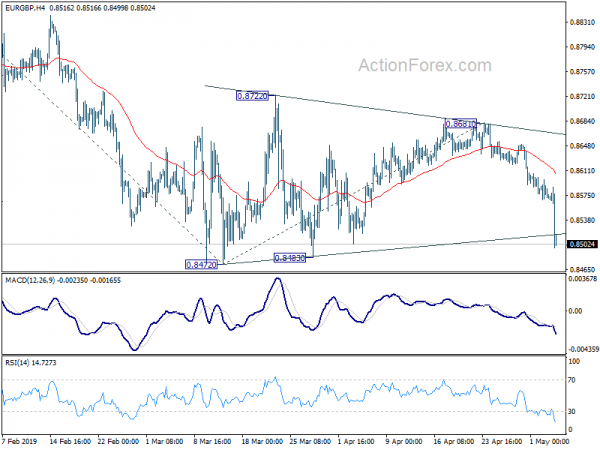

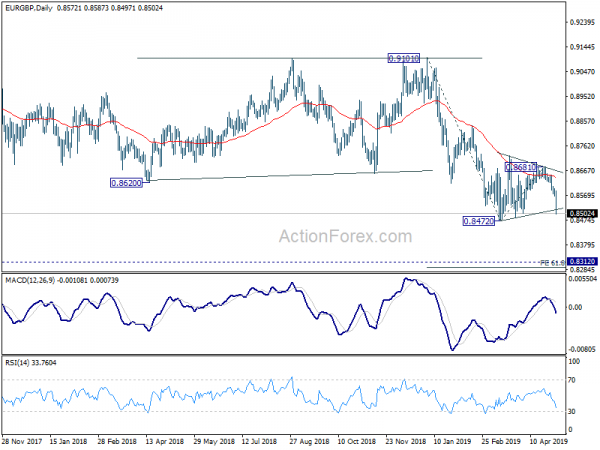

EUR/GBP could finally have downside breakout

EUR/GBP will be an interesting pair to watch after last week’s steep decline. Current development argues that consolidation from 0.8472 has completed with three waves up to 0.8681 already, after failing to sustain above 55 day EMA. Immediate focus is on 0.8472 support this week. Firm break there will resume the fall from 0.9101 to 61.8% projection of 0.9101 to 0.8472 from 0.8681 at 0.8292, which is close to 0.8312 key medium term support.

Dollar failed to ride on Powell’s comments, sluggish inflation dragged

Dollar ended the week as the third weakest ones even though Fed Chair Jerome Powell talked down the chance of rate cut in the post FOMC meeting press conference. Weak inflation and, more important, wage growth, dragged down the greenback.

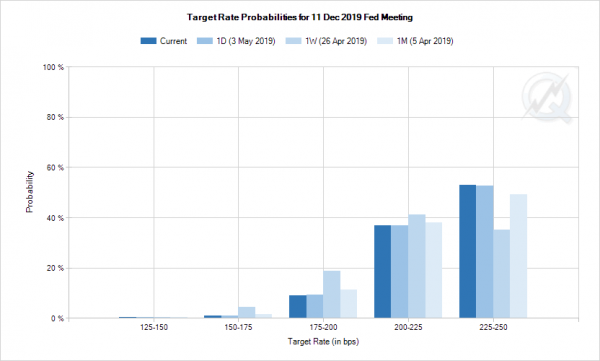

The FOMC rate decision itself was rather listless. Policymakers decided unanimously to keep the target range for the fed funds rate unchanged at 2.25-2.50%. Meanwhile, the IOER was lowered to 2.35% from 2.4%. The slight change in the accompanying statement showed a more upbeat assessment on the economic developments, despite softening inflation.

Powell elaborated at the press conference, the members “suspect that some transitory factors may be at work” regarding the recent slowdown in inflation. As such, the baseline view remains that, “with a strong job market and continued growth, inflation will return to 2% over time and then be roughly symmetric around our longer-term objective”. Meanwhile, Powell suggested that risks to global economic outlook “have moderated somewhat”. Most importantly, Powell noted that “our policy stance is appropriate at the moment” and emphasized “we don’t see a strong case for moving it in either direction.”

Markets’ bet on rate cut receded after the comments. As of end of Friday, fed funds futures are pricing in on 47% chance of a cut by December meeting, comparing with 75% chance a week ago.

Employment data were also strong too. Non-farm payroll employment grew strongly by 263k in April, well above expectation of 185k. Unemployment dropped to 3.6%, lowest level since December 1969. But that was more due to drop in participation rate by -0.2% to 62.8%. Wage growth however, disappointed as average hourly earnings rose 0.2% mom, below expectation of 0.3% mom.

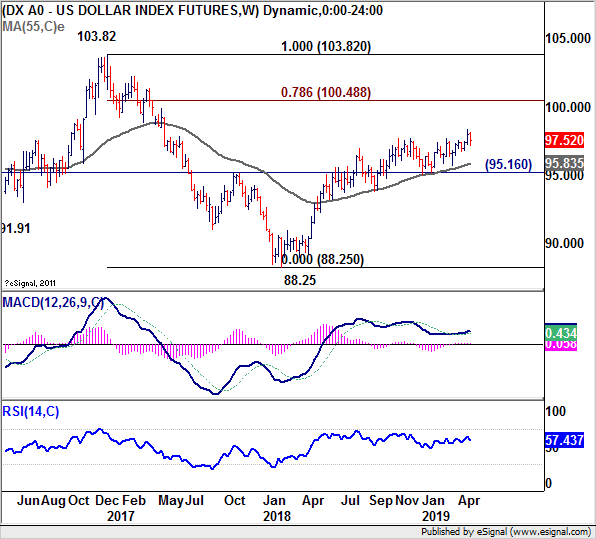

Further rise remains in favor in Dollar index in medium term as long as 95.16 support holds. But based on current weak momentum, strong resistance could be seen at around 100 handle, which is close to 78.6% retracement of 103.82 to 88.25 at 100.39 to limit upside. And break of 95.16 will be a strong sign of bearish reversal.

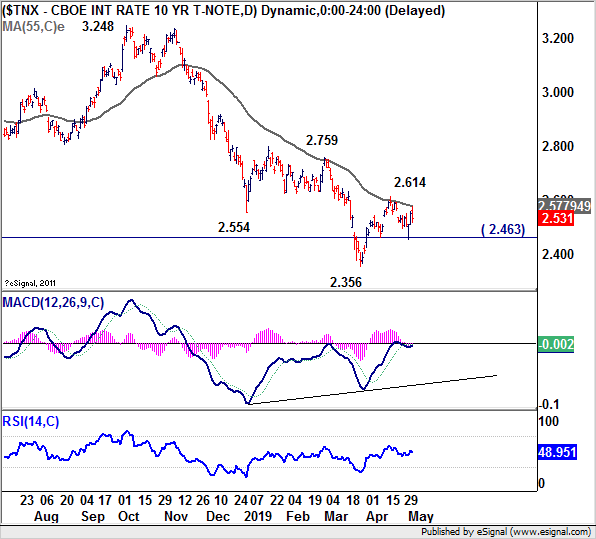

10-year yield was also rather in decisive. TNX drew support from 2.463 last week and rebounded. But then, it failed to break through falling 55 day EMA again on another attempt. Near term outlook is mixed for now. On the downside, firm break of 2.463 should add much credence to case that fall from 3.248 is resuming through 2.356 low. However, considering, bullish convergence condition in daily MACD, firm break of 2.614 resistance will be a strong indication of bullish trend reversal. It may takes a while for the picture to clear itself.

RBNZ to cut this week, would RBA do too?

Australian and New Zealand Dollar were the two weakest currencies last week. Both were pressured by expectations of rate cut by respective central banks. RBNZ has turned dovish for some time, and Q1 inflation and employment data added further support for a cut in May. Must weaker than expected Australian CPI also added to the case of an RBA cut. Additionally, weaker than expected China PMIs also raised doubt that the seasonal recovery in March was just false dawn.

Both central banks will meet this week. RBNZ is almost sure to cut. RBA will come first opinions are divided on whether it will act now, or wait till August meeting. We believe it all depends on the new economic projections to be previewed on Tuesday with the statement, with details on Friday. If RBA does forecast sharp deterioration in inflation, there should be enough reason for a pre-emptive cut. Otherwise, it could just turn a bit dovish to pave the way for a move later in the year.

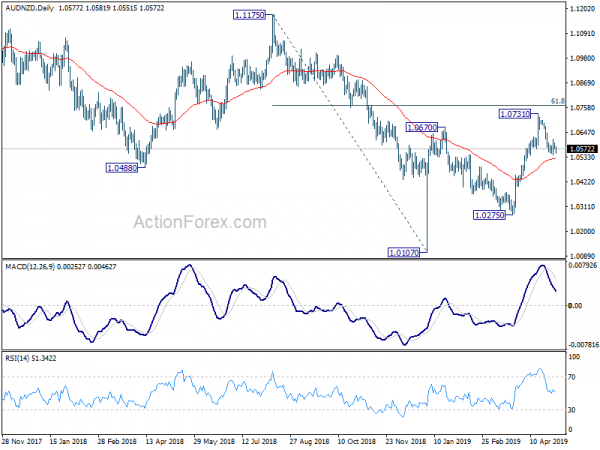

The outcome for AUD/NZD is rather uncertain, very much depending and what RBA would do. For now, AUD/USD’s pull back from 1.0731 is seen as a corrective move only. And rise rise from 1.0107 flash crash low is in favor to extend through 61.8% retracement of 1.1175 to 1.0107 at 1.0767. However, sustained break of 55 day EMA (now at 1.0530) will argue that the rise from 1.0275 has completed. Deeper decline will be seen back to retest 1.0275. That would also open the case that rebound from 1.0107 has totally completed ahead of 1.0767 fibonacci resistance.

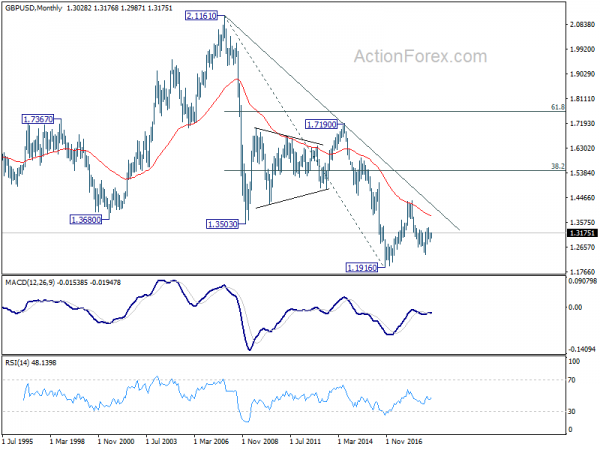

GBP/USD Weekly Outlook

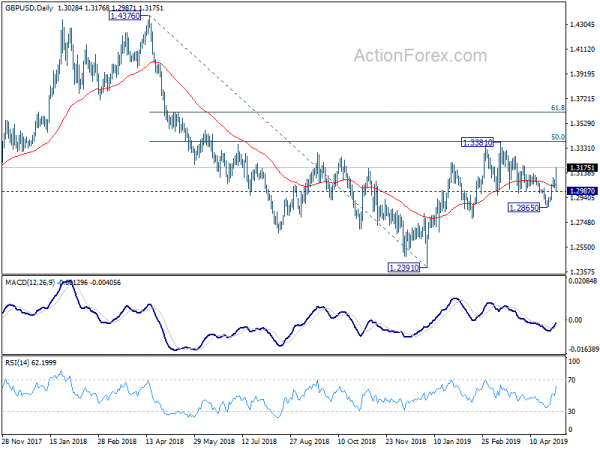

GBP/USD’s strong rally last week suggests that corrective decline from 1.3381 has completed at 1.2865 already. Also, 1.2774 key support level was defended. Rise from 1.2391 is likely in progress. Intraday bias is now on the upside this week for retesting 1.3381 high. On the downside, below 1.2987 minor support will turn bias back to the downside for 1.2865 support instead.

In the bigger picture, medium term decline from 1.4376 (2018 high) halted and made a medium term bottom after hitting 1.2391. Rebound from 1.2391 is seen as a corrective move for now. In case of another rise, strong resistance could be seen around 61.8% retracement of 1.4376 to 1.2391 at 1.3618 to limit upside. On the downside, break of 1.2773 support will suggests that such corrective rise is completed and bring retest of 1.2391 low first.

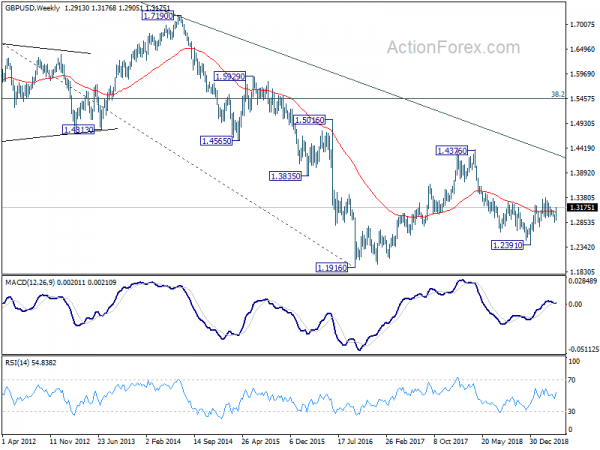

In the longer term picture, consolidative pattern from 1.1946 (2016 low) is still in progress. For now, we’d expect any downside attempt to be contained by 1.1946 low first. But decisive break of 38.2% retracement of 2.1161 (2007 high) to 1.1946 at 1.5466 is needed to indicate long term reversal. Otherwise, an eventual downside breakout will remain in favor.