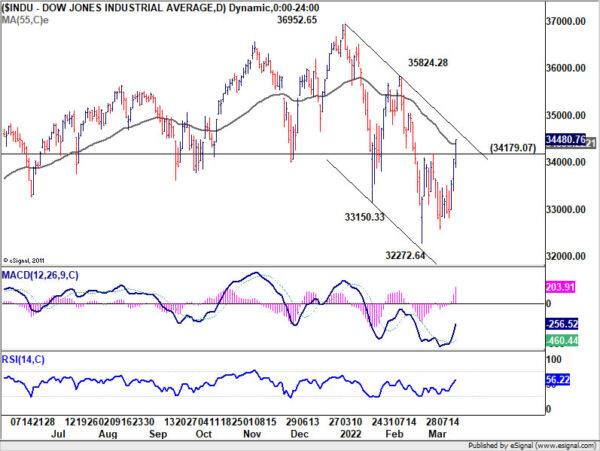

US benchmark treasury yield jumped sharply overnight after Fed Chair Jerome Powell gave green light to more aggressive tightening pace. He said, “there is an obvious need to move expeditiously to return the stance of monetary policy to a more neutral level, and then to move to more restrictive levels if that is what is required to restore price stability.”

In particular, he added, “if we conclude that it is appropriate to move more aggressively by raising the federal funds rate by more than 25 basis points at a meeting or meetings, we will do so.”

Fed fund futures are now indicating 61.6% chance of a 50bps hike at May 4 meeting to 0.75-100%, up from 43.9% a day ago.

10-year yield rose 0.167 to close at 2.315. Near term outlook in TNX will stay bullish as long as 2.065 resistance turned support holds. Next target is 100% projection of 0.398 to 1.765 from 1.343 at 2.710.

BoJ Kuroda: We need to patiently maintain our powerful monetary easing

BoJ Governor Haruhiko Kuroda reiterated to the parliament today that it’s still premature to discuss details on stimulus exit. “Given recent price developments, we need to patiently maintain our powerful monetary easing,” he said.

Kuroda said consumer prices are likely to rise. However, he warned that “instead of leading to higher wages and corporate profits, such cost-push inflation will weigh on the economy in the long run by hurting corporate profits and households’ real income.”