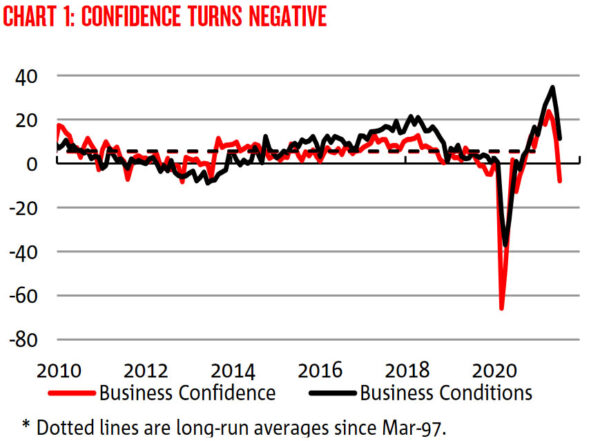

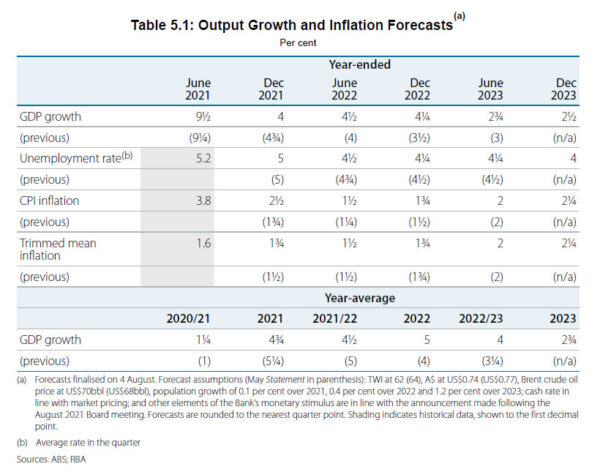

Australia NAB business confidence dropped sharply from 11 to -8 in July. Business conditions dropped form 25 to 11. Looking at some details, trading conditions dropped form 32 to 12. Profitability conditions dropped from 25 to 6. Employment conditions dropped from 18 to 10.

NAB said: “The continuing lockdown in NSW and the briefer periods of disruption across a number of other states saw a further deterioration in activity in the business sector in July… Confidence took a big hit in the month with optimism collapsing on the back of ongoing restrictions.”

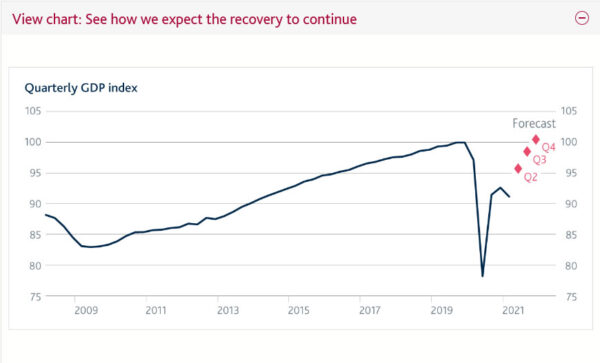

“It is now widely expected that we will see a negative print for GDP in Q3. However, we know that once restrictions are removed that the economy has tended to rebound relatively quickly. We will continue to track the survey very closely for an indication of just how quickly that happens – particularly forward orders and capacity utilisation as we assess how the disruption has fed into expansion plans as conditions bounce back”

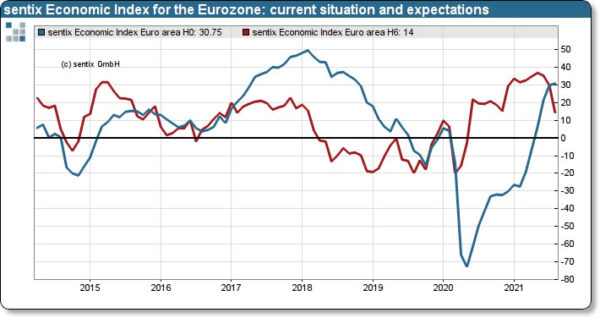

German ZEW dropped sharply to 40.4, increasing risks for the economy

Germany ZEW Economic Sentiment dropped sharply from 63.3 to 40.4 in August, well below expectation of 57.0. Germany Current Situation rose from 21.9 to 29.3, below expectation of 30.0. Eurozone ZEW Economic Sentiment dropped sharply from 61.2 to 42.7, well below expectation of 72.0. Eurozone Current Situation rose 8.6 pts to 14.6.

“Expectations have declined for the third time in a row. This points to increasing risks for the German economy, such as from a possible fourth COVID-19 wave starting in autumn or a slowdown in growth in China. The clear improvement in the assessment of the economic situation, which has been ongoing for months, shows that expectations are also weakening due to the higher growth already achieved,” comments ZEW President Professor Achim Wambach on current expectations.

Full release here.