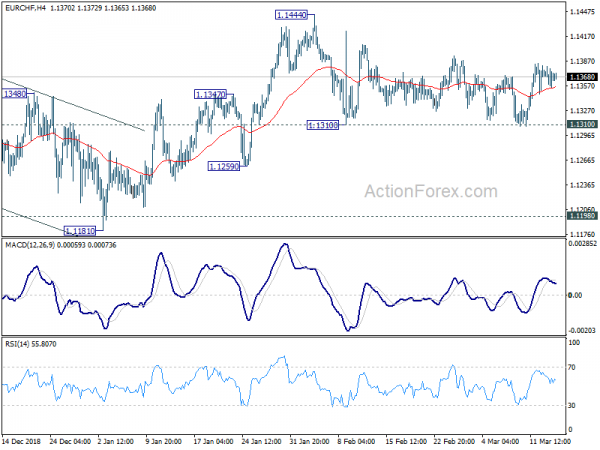

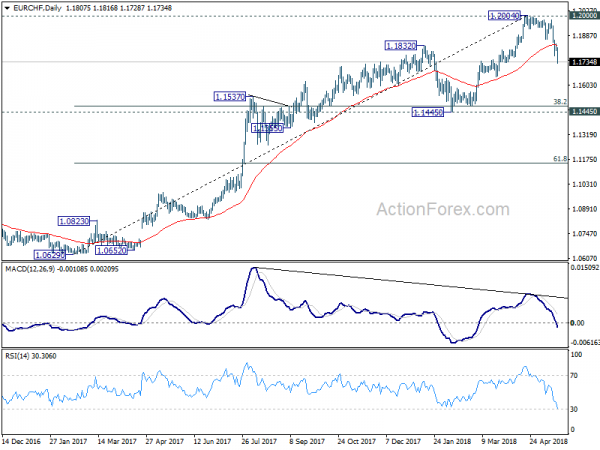

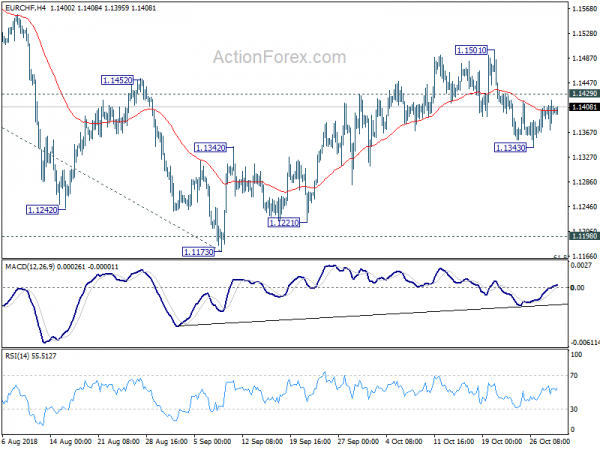

Daily Pivots: (S1) 1.1656; (P) 1.1679; (R1) 1.1699; More…

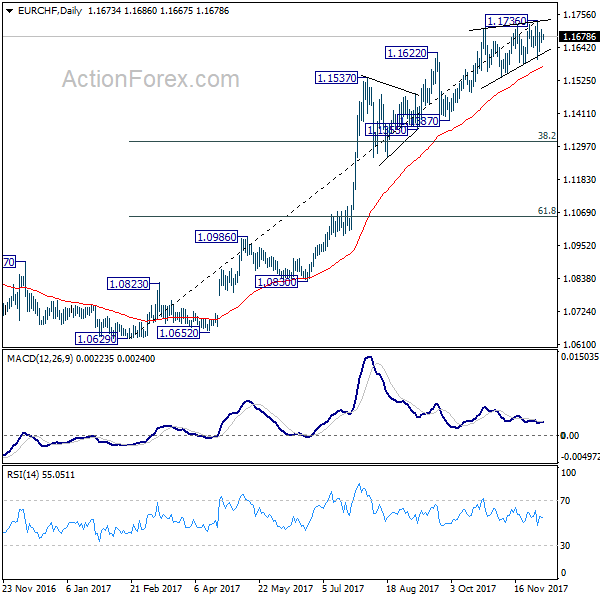

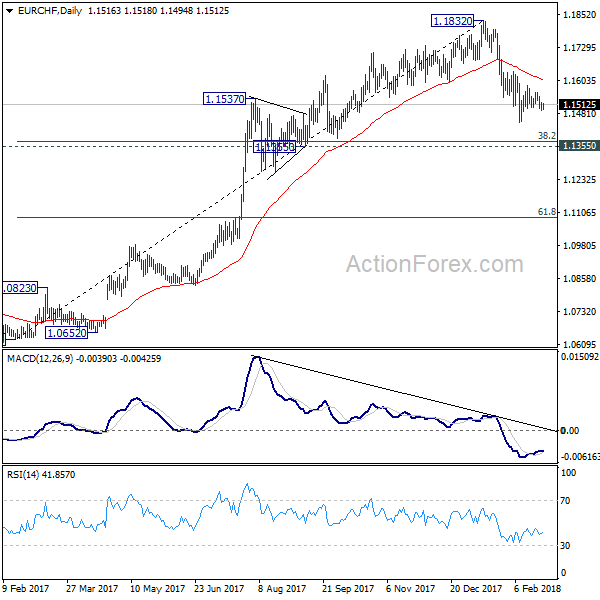

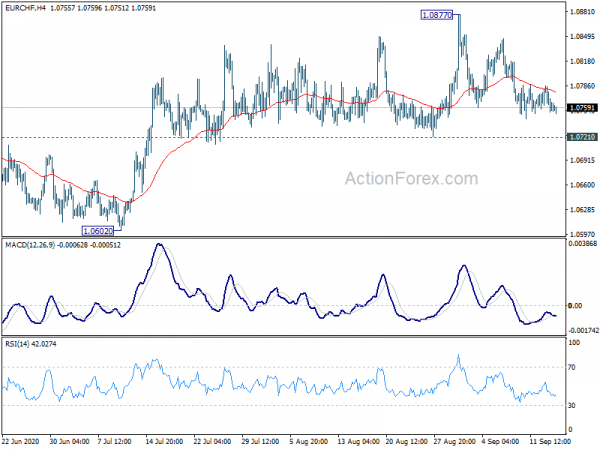

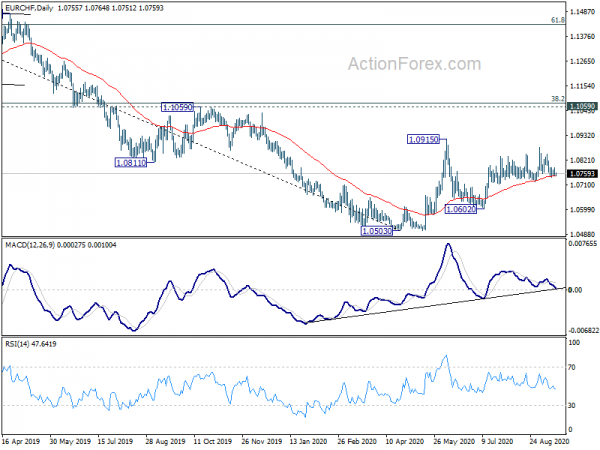

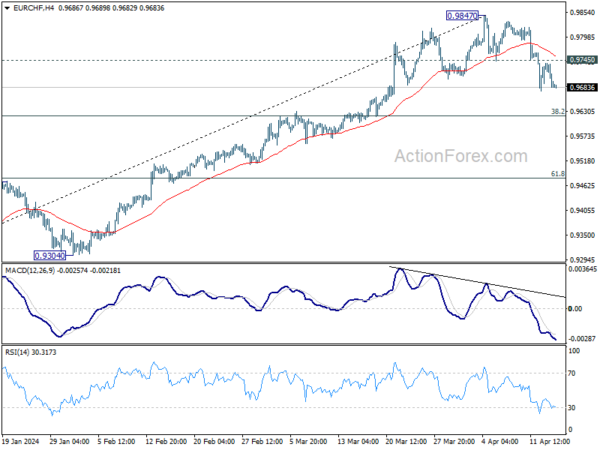

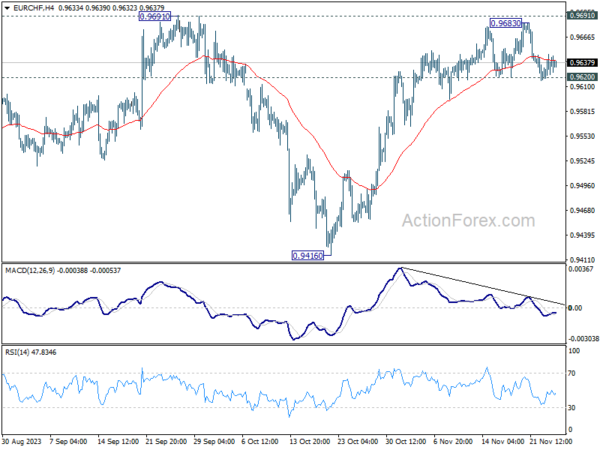

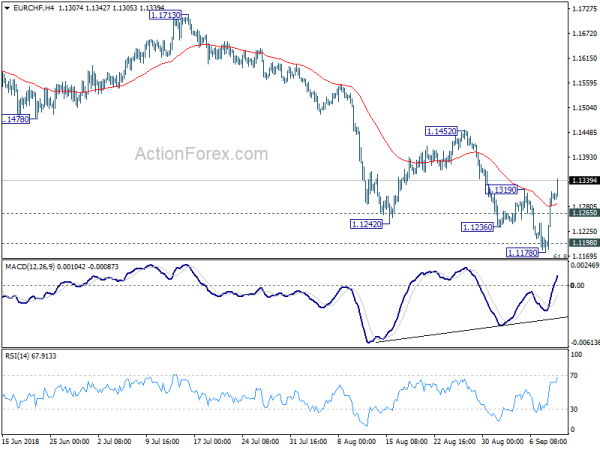

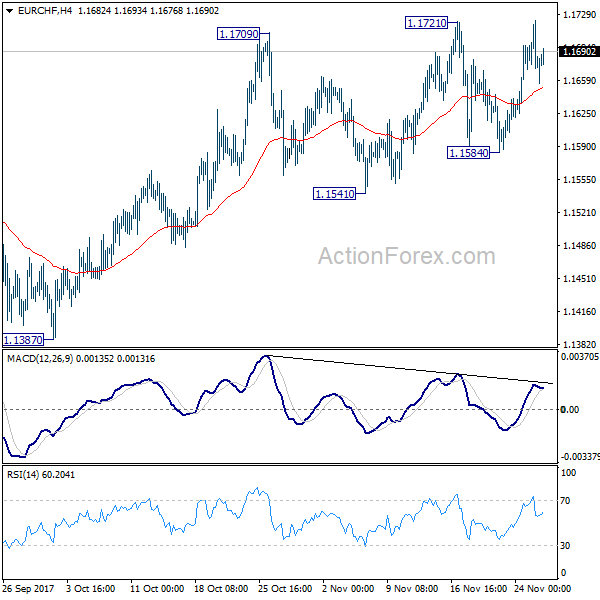

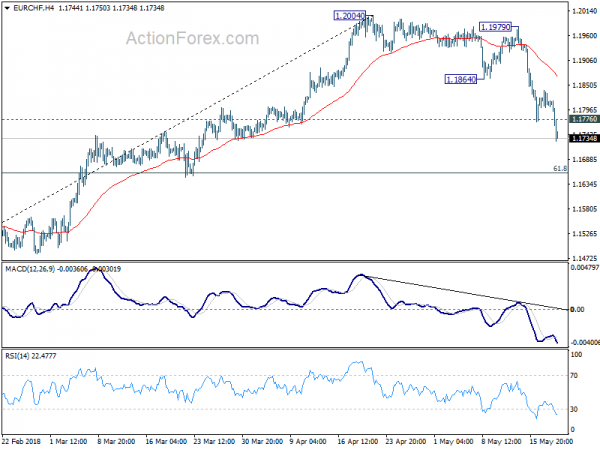

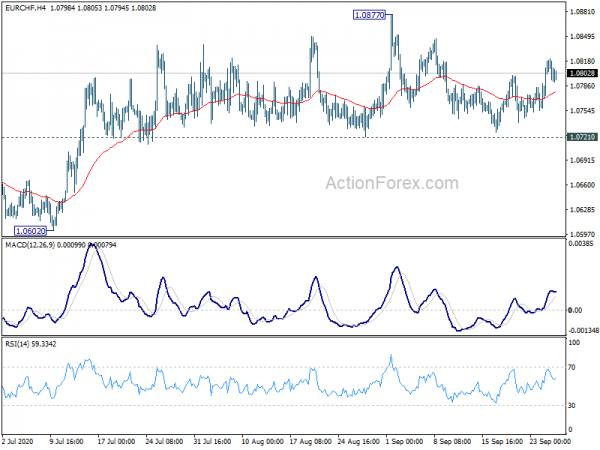

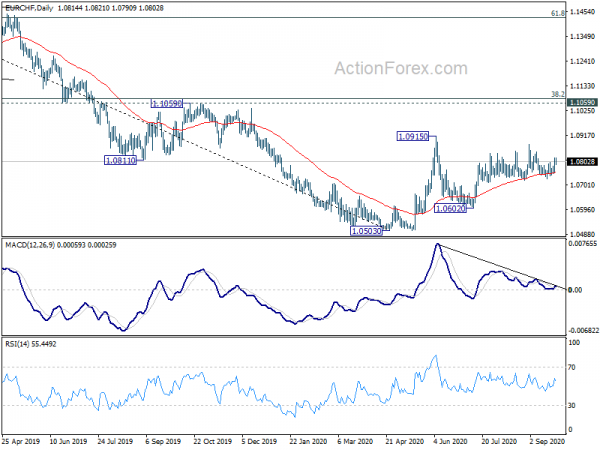

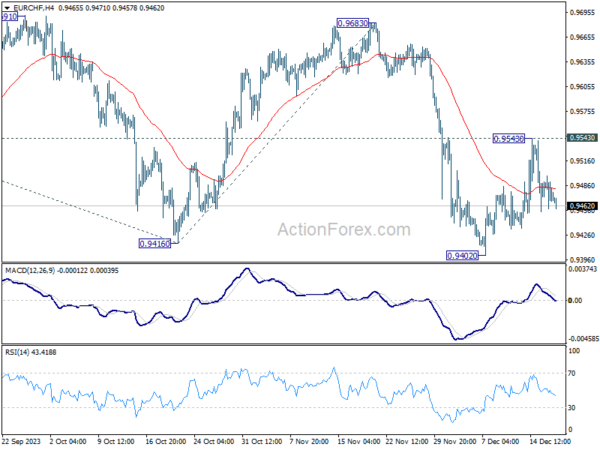

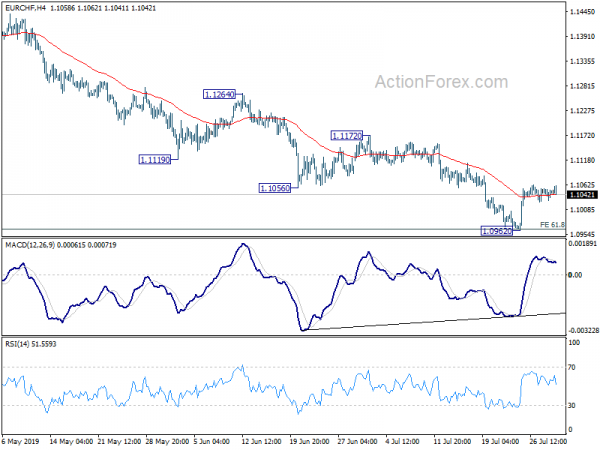

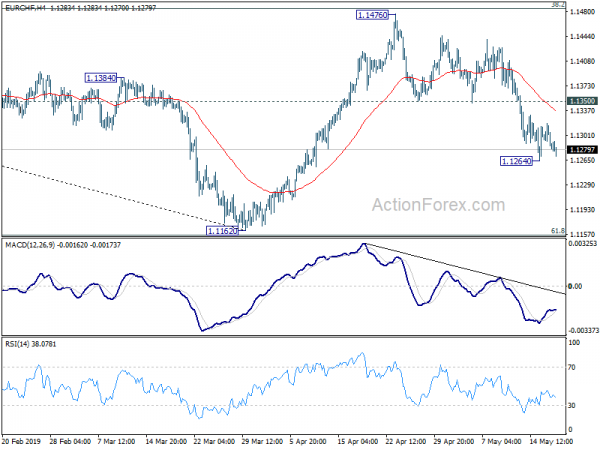

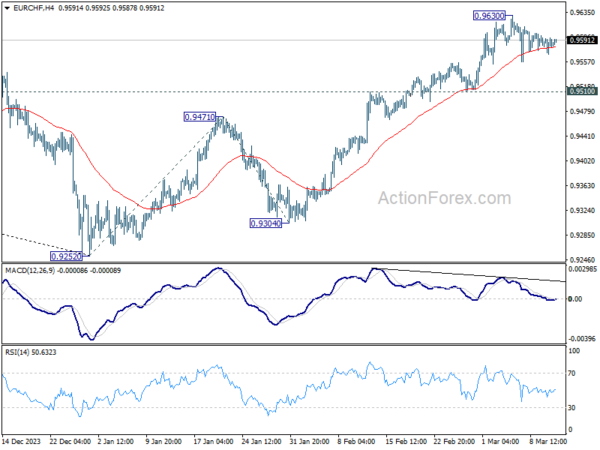

Intraday bias in EUR/CHF remains neutral at this point. Near term outlook is unchanged. As noted before, persistent bearish divergence condition in 4 hour MACD and rising wedge like structure suggests that the cross is near to forming a top, if not formed. Hence, even in case of another rise, we’d expect limited upside potential. On the downside, sustained break of 1.1584 support will be a strong sign of trend reversal and should turn outlook bearish for 38.2% retracement of 1.0629 to 1.1736 at 1.1313.

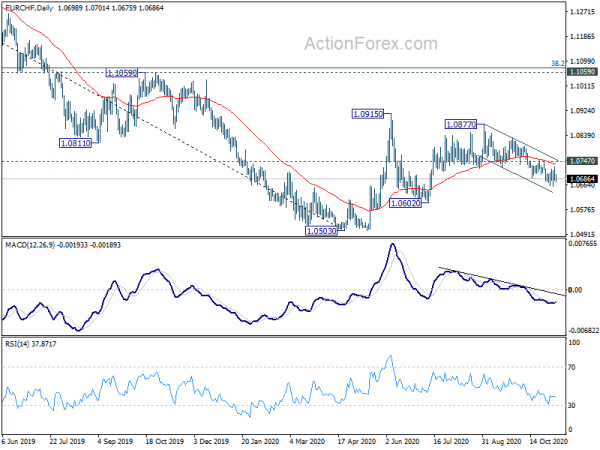

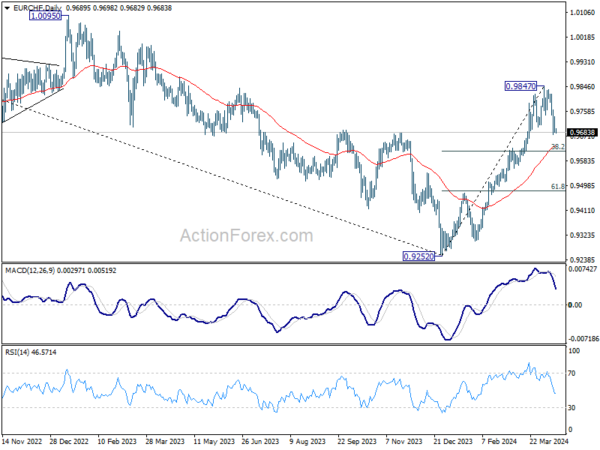

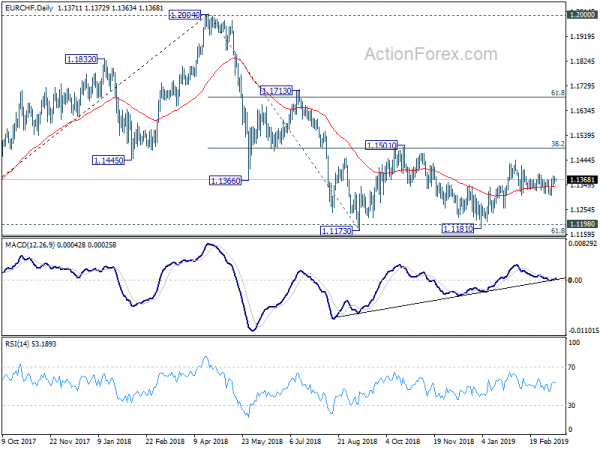

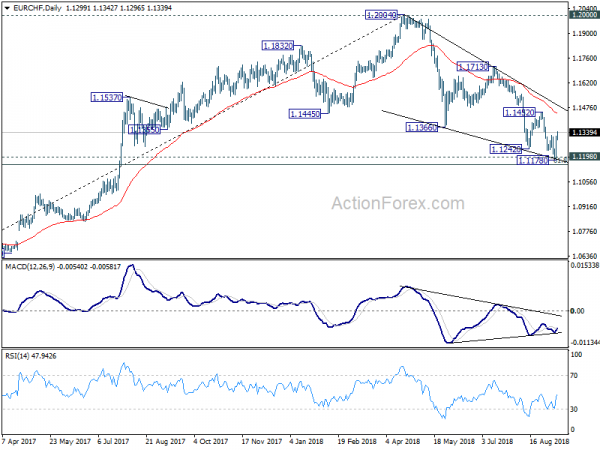

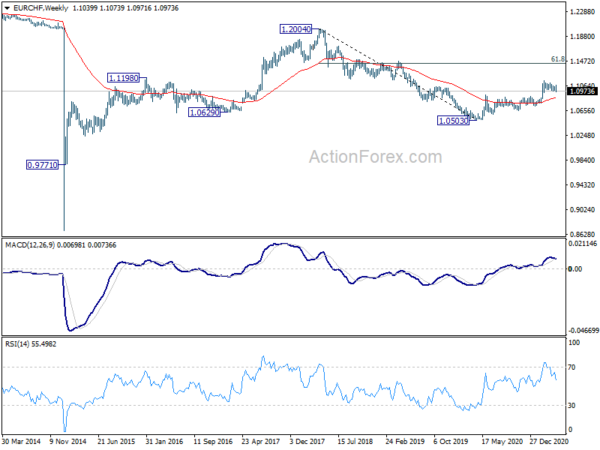

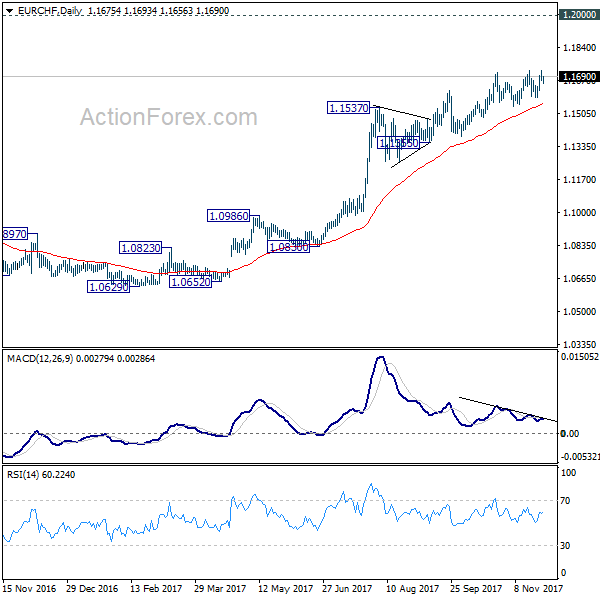

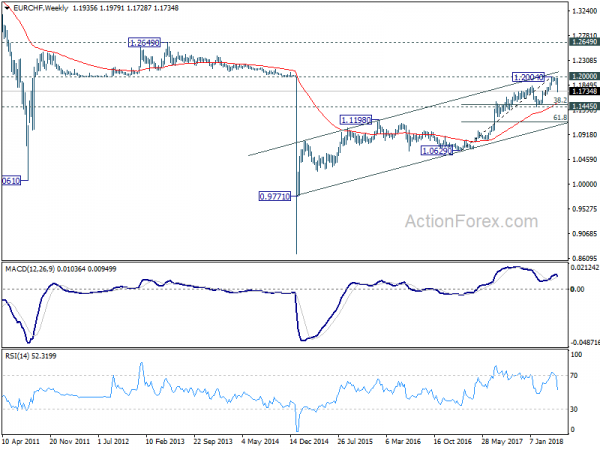

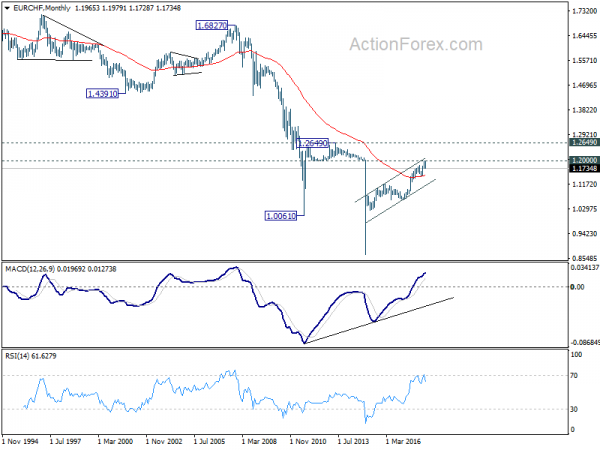

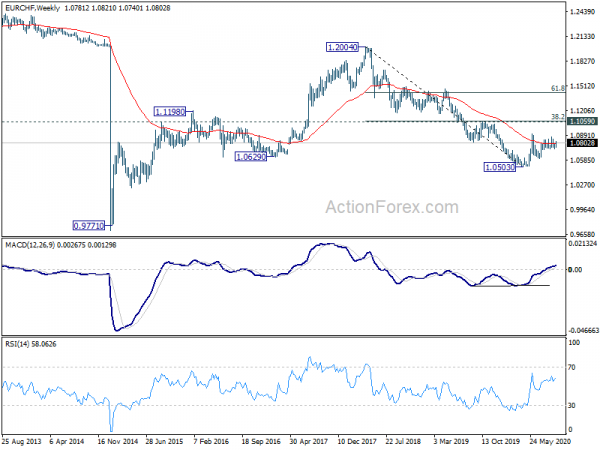

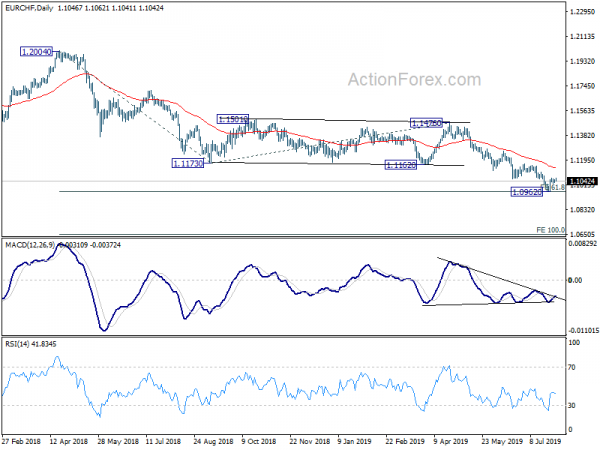

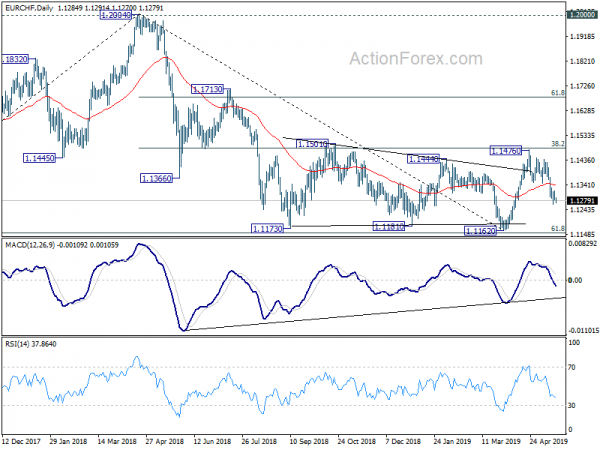

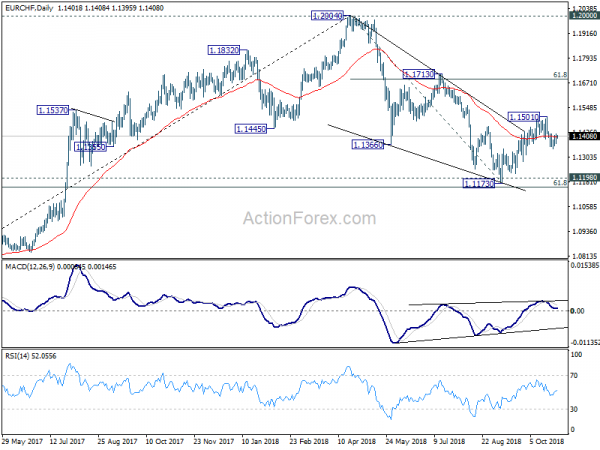

In the bigger picture, while a medium term top could be around the corner, there is no change in the larger outlook. That is, long term rise from SNB spike low back in 2015 is still in progress and would extend. As long as 1.1195 resistance turned support holds, we’ll hold on to this bullish view and expect another to prior SNB imposed floor at 1.2000. Though, we’ll reassess the outlook if 1.1195 is firmly taken out.