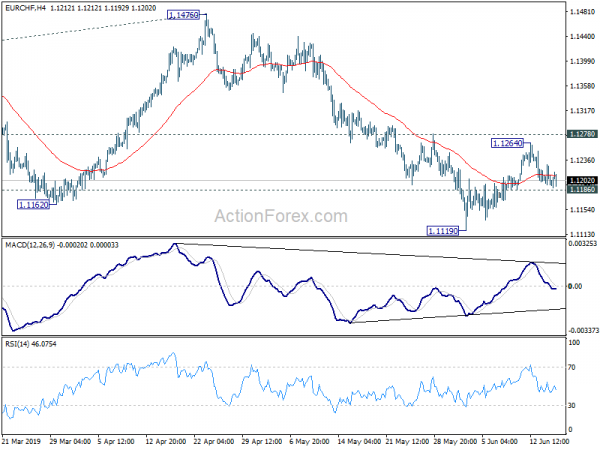

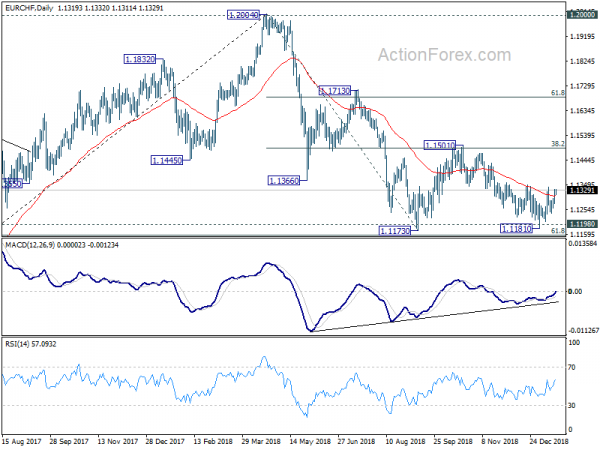

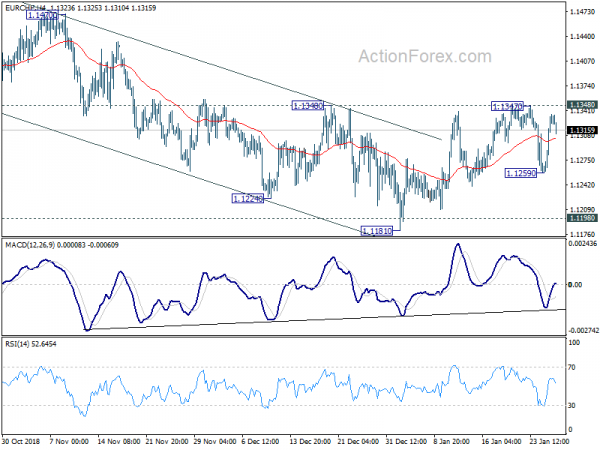

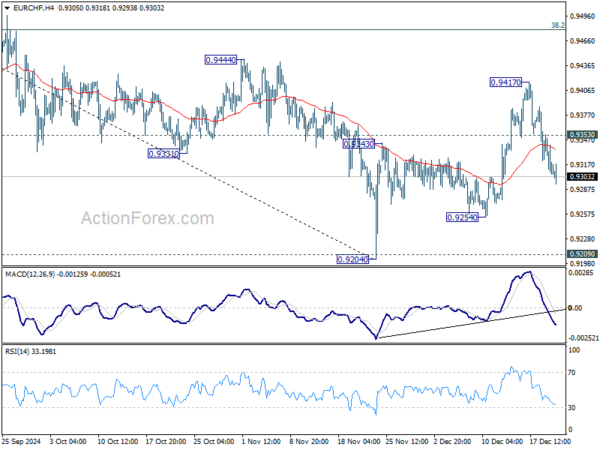

Daily Pivots: (S1) 1.1183; (P) 1.1205; (R1) 1.1219; More….

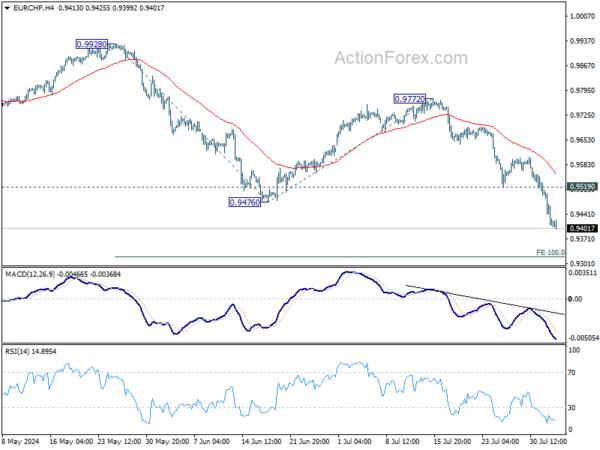

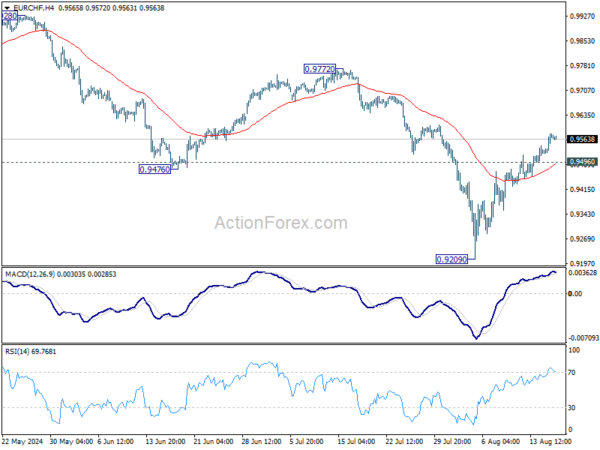

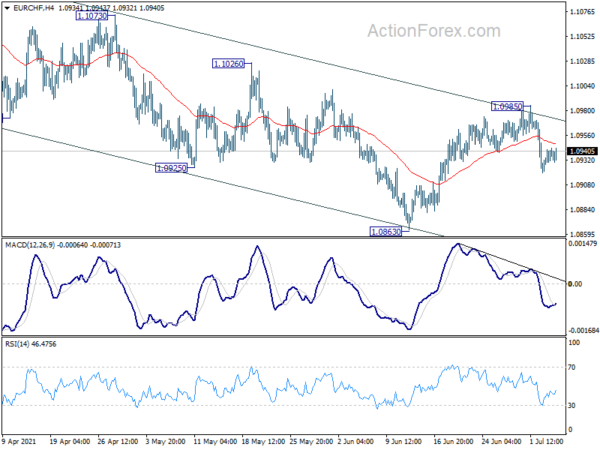

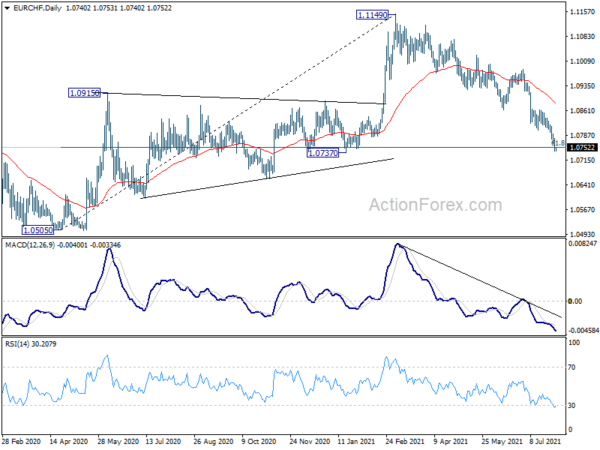

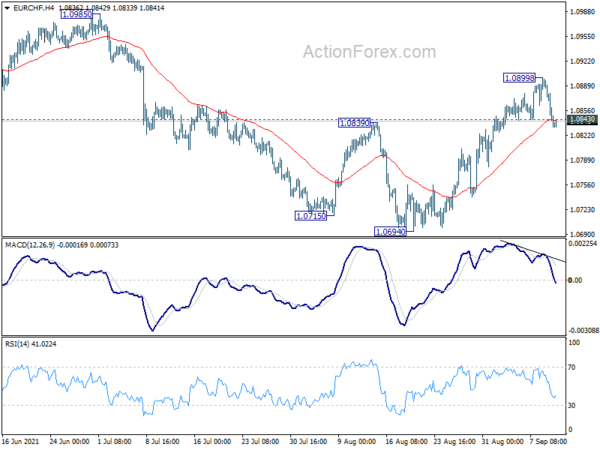

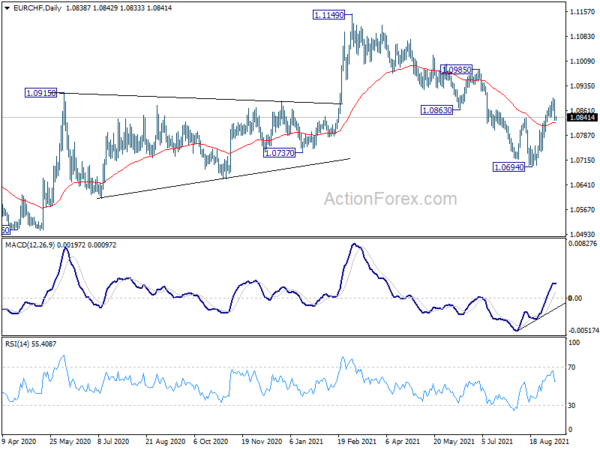

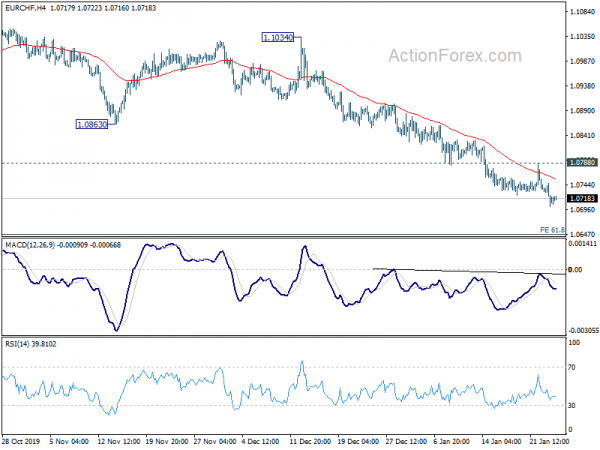

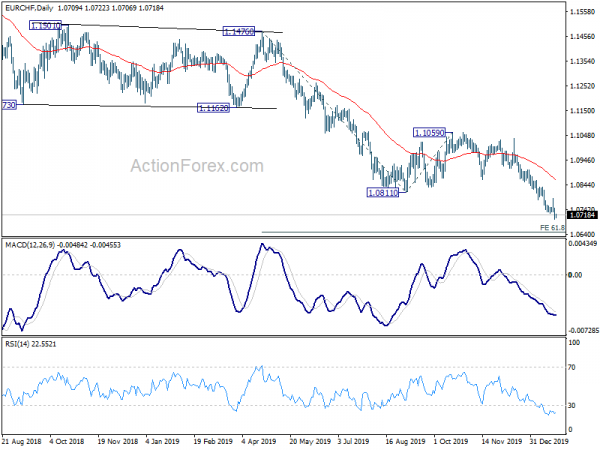

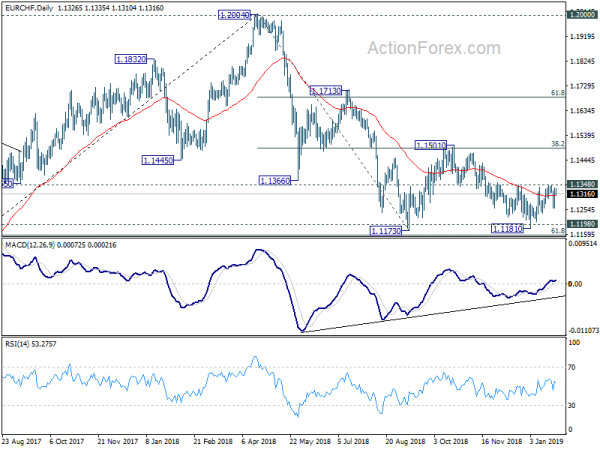

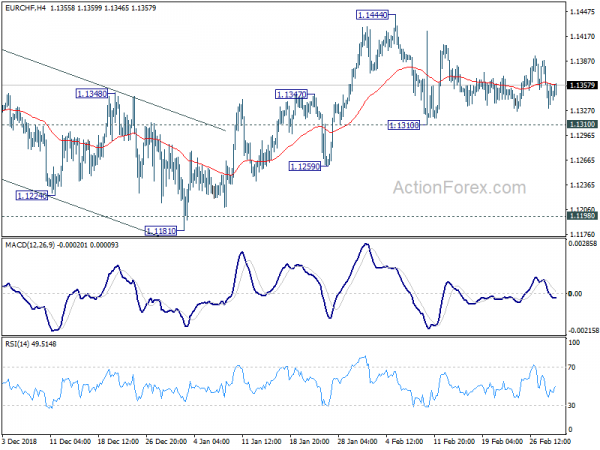

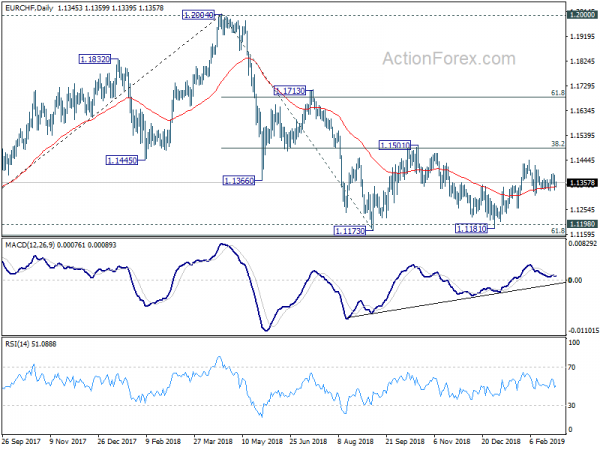

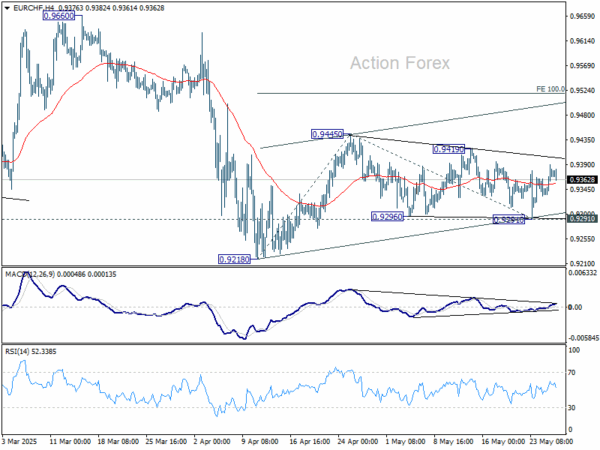

Intraday bias in EUR/CHF remains neutral at this point. Recovery from 1.1119 is seen as a correction and upside should be limited by 1.1278 resistance to bring fall resumption. On the downside, break of 1.1186 minor support will turn intraday bias back to the downside for 1.1119 first. Break there will extend recent down trend to 61.8% projection of 1.2004 to 1.1173 from 1.1476 at 1.0962 next.

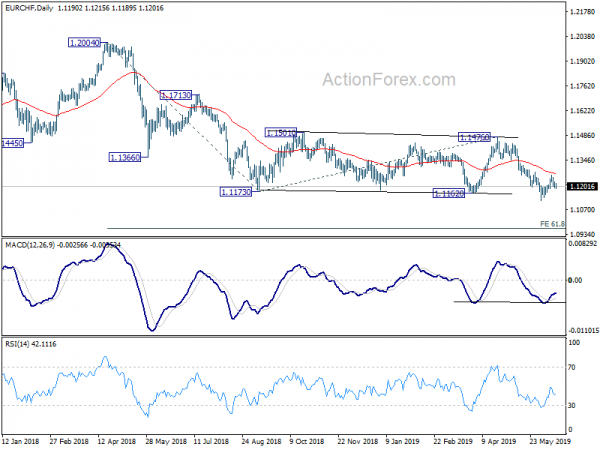

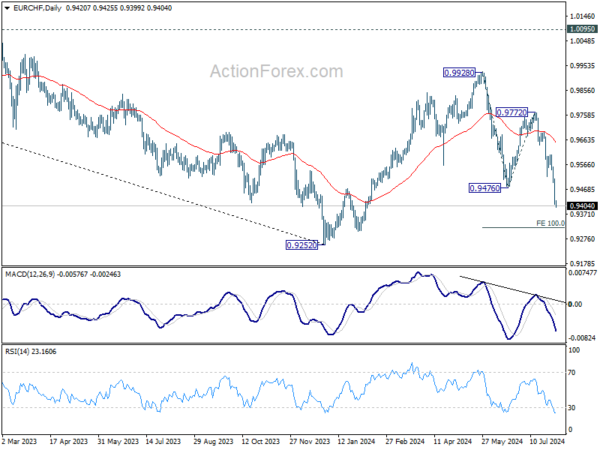

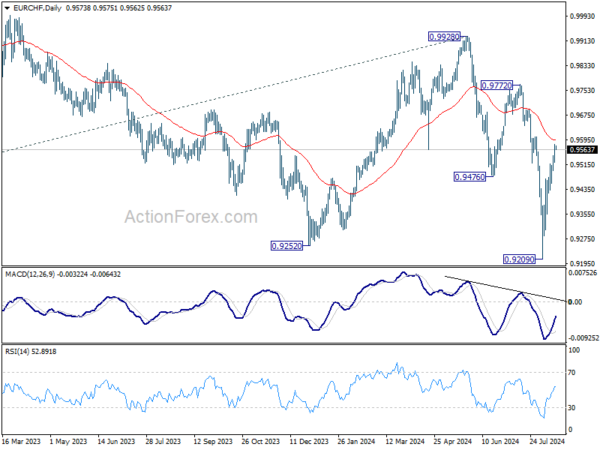

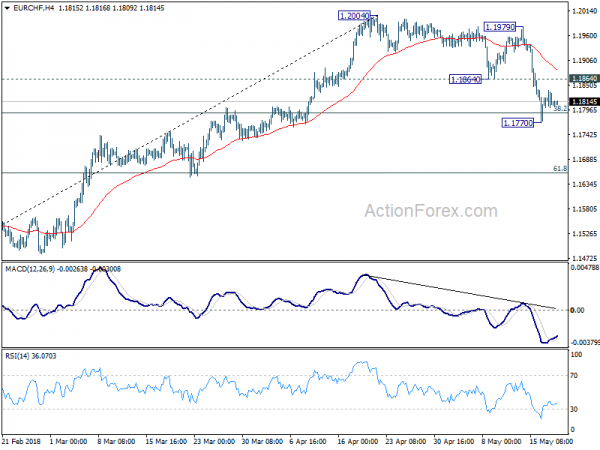

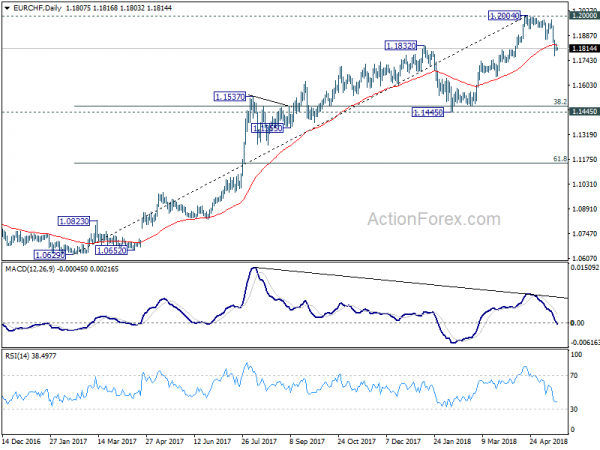

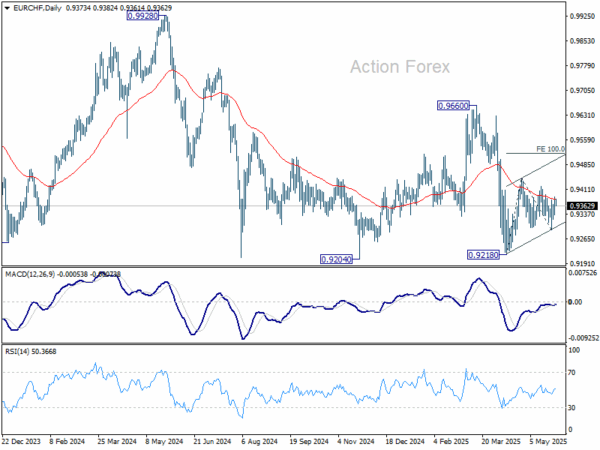

In the bigger picture, current development firstly suggests that down trend from 1.2004 is still in progress. More importantly, it’s likely a long term down trend itself, rather than a correction. Outlook will remain bearish as long as 1.1476 resistance holds. EUR/CHF could target 1.0629 support and below.