As the Fed and the ECB signal they may be done with policy easing for now, the Reserve Bank of Australia may follow suit, but the Bank of England could be a late joiner to the easing club. Apart from the next wave of central bank meetings, monthly trade statistics will come to the fore with China’s figures likely to attract the most attention, while employment numbers out of Canada and New Zealand will also be eyed. Meanwhile, over in the United Kingdom and the United States, services PMIs will be the main highlights.

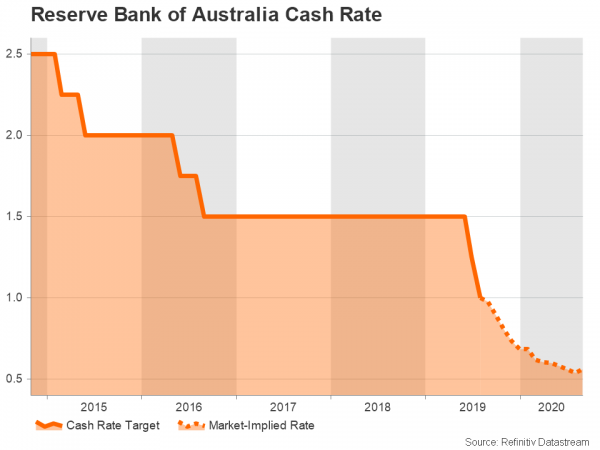

RBA meets, may signal no more cuts this year

The RBA is expected to keep its cash rate unchanged on Tuesday but with a November move never really being in play, traders will be on the look out for clues about a possible December cut. Market expectations for an end-of-year rate reduction are fast diminishing and the minutes of the October meeting minutes as well as recent remarks by Governor Philip Lowe suggest the Bank is in no hurry to lower rates again. Quarterly inflation data released this week did little to add pressure on the RBA to ease again and so the Australian dollar stands to extend its recent gains if the Bank seemingly rules out another near-term cut.

But the biggest clue is likely to be found from the RBA’s Monetary Policy Statement – a quarterly outlook report – due to be released on Friday. A big downward revision to economic forecasts would probably be perceived as leaving the door open for more cuts in the future.

In terms of data, September retail sales and trade numbers will be watched on Monday and Thursday, respectively.

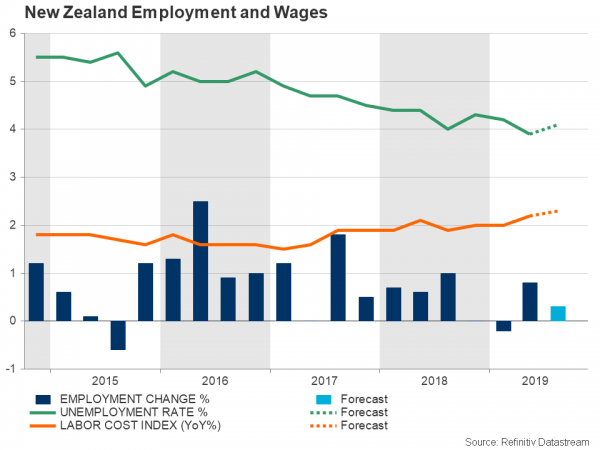

New Zealand jobs report could make or break RBNZ rate cut

While the RBA is becoming reluctant to ease policy further, it’s a different picture across the Tasman Sea, where the Reserve Bank of New Zealand is still more likely to lower rates later this month, although those odds have also been falling. One crucial piece of the jigsaw for the RBNZ will be Wednesday’s quarterly employment numbers. The unemployment rate is projected to have ticked higher to 4.1% in the third quarter and for jobs growth to have moderated to 0.3% from 0.8% over the quarter. If the data does point to increased slack in the labour market, expectations of a November cut would receive a boost and potentially trigger a pullback in the New Zealand dollar, which is enjoying a rebound against the US dollar.

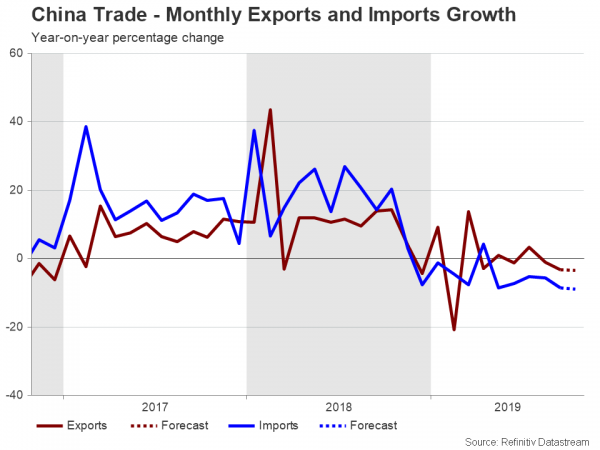

China to report October trade and inflation figures

Central bank policy and domestic indicators will not be the only risks for the aussie and the kiwi as trade data out of Australia’s and New Zealand’s biggest export market on Friday will show whether the trade war is continuing to hurt China’s ability to do commerce with the rest of the world. Exports from China are forecast to have declined by 3.5% year-on-year in October, worsening slightly from the 3.2% drop of September, while imports are anticipated to have tumbled by 8.9% y/y.

Moreover, the latest producer and consumer prices, due on Saturday, will be important too.

Japanese household spending in pre-sales tax hike surge

Staying in Asia, household spending and wage growth data out of Japan are unlikely to stir much of a response in the yen but will be watched to determine how long the Bank of Japan will be able to stay on the sidelines. Solid private consumption has been supporting the Japanese economy as exporters have come under the firing line of Trump’s trade fight with China. But, yet more disappointing earnings growth could jeopardize that as wages have been falling for most of the year and the sales tax hike that came into effect on October 1 could also dampen spending. However, in September, household spending is forecast to have jumped by 3.8% over the month as consumers boosted their purchases before the sales tax increase kicked in. Both sets of figures for September are due on Friday.

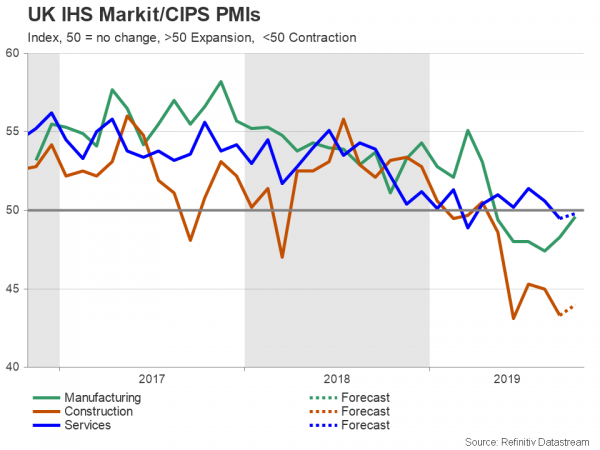

Is Bank of England about to perform a dovish pivot?

Moving to Europe, the Bank of England’s policy decision on Thursday will be the main event and could prove to be the Bank’s most important meeting for some time. There is speculation the BoE is close to switching to an easing bias as several policymakers have been hinting that the Bank may be forced to cut interest rates even if lawmakers were to approve a Brexit deal as the ongoing political uncertainty, not to mention the long drawn-out trade war and the resultant global slowdown, weigh heavily on the British economy.

UK GDP contracted in the second quarter and the latest PMIs indicate growth didn’t fare much better in the third quarter. The PMIs for October are out on Monday (construction) and Tuesday (services). The services PMI is forecast to remain in contractionary territory for the second straight month after unexpectedly dipping below 50 in September. A poor start to the fourth quarter would heighten fears of a prolonged slowdown, or even a recession, and could spur policymakers to drop their long-held tightening bias and even flag a rate cut.

The BoE will also be publishing its quarterly economic projections on Thursday, so an overall downbeat tone could take some of the shine off the pound, which rallied by 5.3% versus the dollar in October – its best month in a decade.

Little to hold back the euro in quiet week

It will be somewhat of a muted week on the continent, however, as there’s not much on the Eurozone calendar that could upset the euro’s current upswing. With the European Central Bank set to leave its monetary policy framework untapped for the next few months, and the Federal Reserve also hitting the pause button, the euro’s near-term prospects are suddenly looking much perkier.

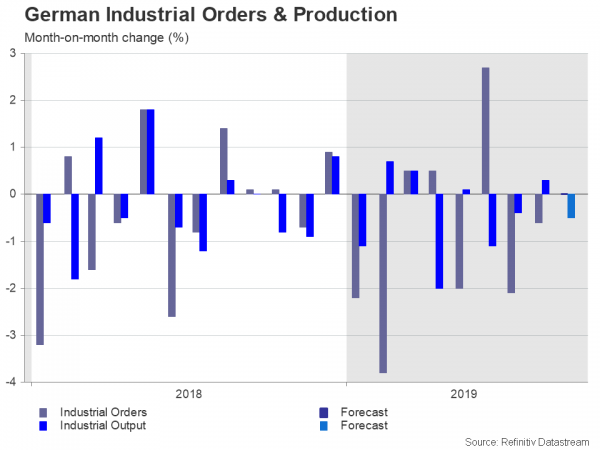

While next week’s releases have the capacity to trigger some knee-jerk reactions, the biggest risk for the euro in the coming days is likely to be negative trade headlines. Looking at the data, business surveys will start the week, with the final October print of the manufacturing PMI out on Monday along with the November sentix index, followed by the final services PMI on Wednesday. Eurozone retail sales are also due on Wednesday, but German numbers may attract more interest given the growing worries of a recession in the country. German industrial orders, industrial output and trade figures (all for September) are out on Wednesday, Thursday and Friday, respectively.

ISM non-manufacturing PMI to be US focal point

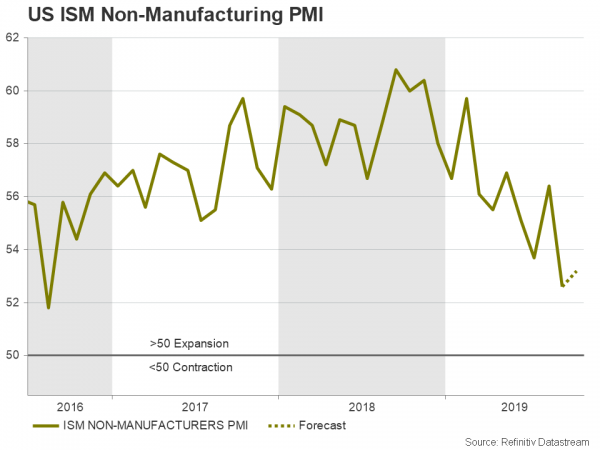

The US will also have a relatively slow week with the only major release being the ISM non-manufacturing PMI. The ISM’s non-manufacturing composite is forecast to edge up to 53.2 in October from 52.6 in September when it plunged to a three-year low. If the PMI does recover in October, it would go some way in easing recession fears and reinforce the Fed’s decision to put its easing cycle on hold.

The dollar fell sharply after the October FOMC meeting despite going on pause as Chairman Jerome Powell indicated that although the Fed may be done with cutting rates for now, a hike is not in the picture either without a “significant move up in inflation”. A reassuring ISM figure could see the dollar restoring some of those losses but at the same time, the greenback remains vulnerable to downbeat data and possible setbacks in the US-China trade talks. Political headaches for President Trump could also weigh on the dollar after the House of Representatives voted to formally begin the impeachment inquiry against him.

The other releases to keep an eye on in the coming week are factory orders on Monday, the trade balance and the JOLTS job openings on Tuesday, and finally, the preliminary reading of the University of Michigan’s consumer sentiment index on Friday.

Canadian jobs report could cause more pain for the loonie

The Bank of Canada surprised everyone by flagging a possible rate cut at its policy meeting this past week. Highlighting the growing risks to the economy from the trade conflict, the BoC was unexpectedly gloomy about the outlook, elbowing the Canadian dollar away from three-month peaks versus its US counterpart.

The sudden shift has effectively ended the loonie’s month-long rally and raised the bar for pushing the currency higher. This means the loonie is more likely to react to negative data than positive ones in the coming weeks, including the October employment report due on Friday.