Sample Category Title

Markets in Mild Risk Averse Mode, Dollar Stays Weak

The financial markets are trading in mild risk averse mode today. European indices started the week lower, following -1.29% loss in Japanese Nikkei. And FTSE, DAX and CAC are all staying in red at the time of writing, despite paring some losses. US futures also point to mildly lower open. Meanwhile, Dollar remains pressured as recent selloff resumes. Sentiments seemed to be weighed down by US president Donald Trump's protectionist tone in his inauguration speech. In addition, Trump has signaled renegotiation of the North American Free Trade Agreement and withdrawal from the Trans-Pacific Partnership trade pact. Meanwhile, he treated in US morning that it's going to be a "busy week with a heavy focus on jobs and national security". Markets will stay focused on what Trump would deliver.

On the data front, Canada wholesale sales rose 0.2% mom in November. Japan all industry index rose 0.3% mom in November. Looking ahead, Q4 GDP report from UK and US will be the main focus of the week ahead. Dollar and Sterling are so far the weakest major currencies this month, for different reasons. Dollar is weighed down by uncertainties on Trump's policies while Sterling is pressured by concern of hard Brexit. Traders will likely look pass the GDP data from both countries and stay cautious. Eurozone PMIs and German Ifo will also catch some attentions. Meanwhile, Australian CPI will also be closely watched. Aussie is so far the strongest major currency this month and would look into inflation reading for additional strength.

Here are some highlights for the week ahead:

- Monday: Japan all industry index; Canada wholesale sales; Eurozone consumer confidence

- Tuesday: Eurozone PMIs; UK public sector net borrowing; US existing home sales

- Wednesday: Japan trade balance; Australia CPI; Swiss UBS consumption; German Ifo; US house price index

- Thursday: New Zealand CPI; Swiss trade balance; German Gfk consumer sentiment; UK GDP; US jobless claims, trade balance, wholesale inventories, new home sales, leading indicators

- Friday: Japan CPI; Australia PPI, import prices; Eurozone M3 money supply; US GDP, durable goods

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.0646; (P) 1.0677 (R1) 1.0731; More.....

Intraday bias in EUR/USD remains on the upside as choppy rise from 1.0339 continues. At this point, rise from 1.0339 is seen as a corrective move and should be limited by 1.0872 resistance. On the downside, below 1.0588 minor support will argue that it's completed and turn bias back to the downside for 1.0339 support.

In the bigger picture, whole down trend from 1.6039 (2008 high) is in progress. Such down trend is expected to extend to 61.8% projection of 1.3993 to 1.0461 from 1.1298 at 0.9115. On the upside, break of 1.1298 resistance is needed to confirm medium term bottoming. Otherwise, outlook will stay bearish in case of rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Consensus | Previous | Revised |

|---|---|---|---|---|---|---|

| 04:30 | JPY | All Industry Activity Index M/M Nov | 0.30% | 0.40% | 0.20% | 0.00% |

| 13:30 | CAD | Wholesale Sales M/M Nov | 0.20% | 0.60% | 1.10% | 1.30% |

| 15:00 | EUR | Eurozone Consumer Confidence Jan A | -4.8 | -5.1 |

Subscribe to our daily and mid-day newsletter to get this report delivered to your mail box

GBP/JPY Daily Outlook

Daily Pivots: (S1) 141.23; (P) 141.65; (R1) 142.13; More...

Intraday bias in GBP/JPY remains neutral for the moment. On the upside, firm break of 142.16 will indicate completion of the fall from 148.42. More importantly, this will suggest that such decline is merely a three wave correction and the rise from 122.36 isn't completed. In such case, intraday bias will be turned to the upside for 148.42 and then 150.42 fibonacci level. Meanwhile, below 136.44 will target 61.8% retracement of 122.36 to 148.42 at 132.31 and below.

In the bigger picture, price actions from 122.36 medium term bottom are seen as developing into a corrective pattern. Upside is so far limited below 38.2% retracement of 195.86 to 122.36 at 150.42 for setting the medium term range. At this point, we don't expect a break of 122.36 in near term and the corrective pattern would extend for a while. Though, sustained break of 150.42 will target 61.8% retracement at 167.78.

Subscribe to our daily and mid-day newsletter to get this report delivered to your mail box

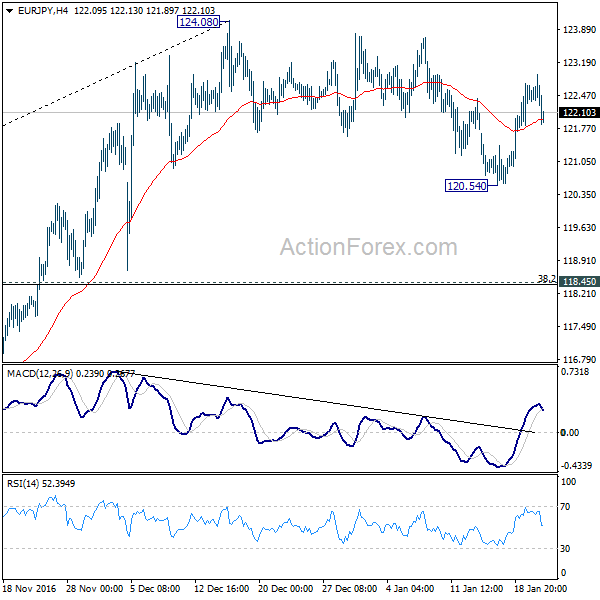

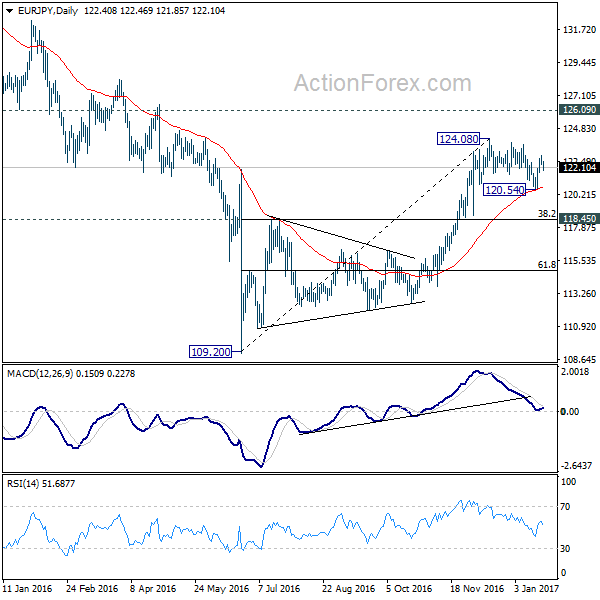

EUR/JPY Daily Outlook

Daily Pivots: (S1) 122.27; (P) 122.60; (R1) 122.94; More...

Intraday bias in EUR/JPY remains neutral for the moment. Price actions from 124.08 are corrective in nature and rebound from 109.20 is not completed. Break of 124.08 will target 126.09 key resistance next. Meanwhile, below 120.54 will target 118.45 cluster support (38.2% retracement of 109.20 to 124.08 at 118.39). We'd expect strong support from there to contain downside.

In the bigger picture, price actions from 109.20 medium term bottom are seen as part of a medium term corrective pattern from 149.76. There is prospect of another rise towards 126.09 key resistance level before completion. But even in that case, we'd expect strong resistance between 126.09 and 141.04 to limit upside, at least on first attempt. Sustained trading below 55 day EMA will pave the way to retest 109.20.

Subscribe to our daily and mid-day newsletter to get this report delivered to your mail box

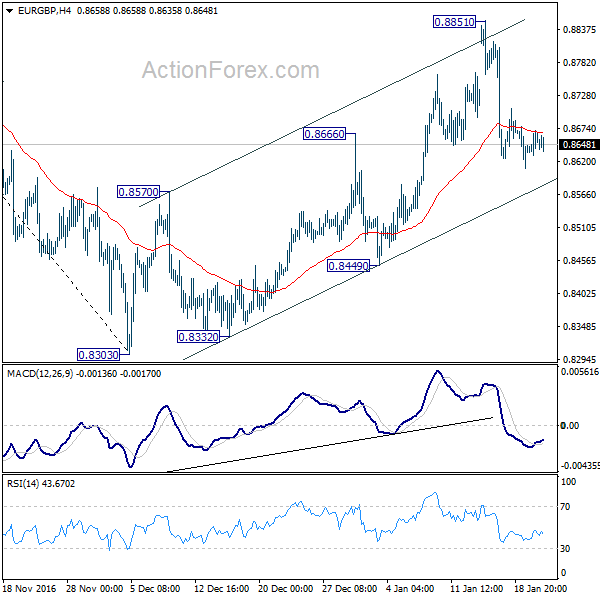

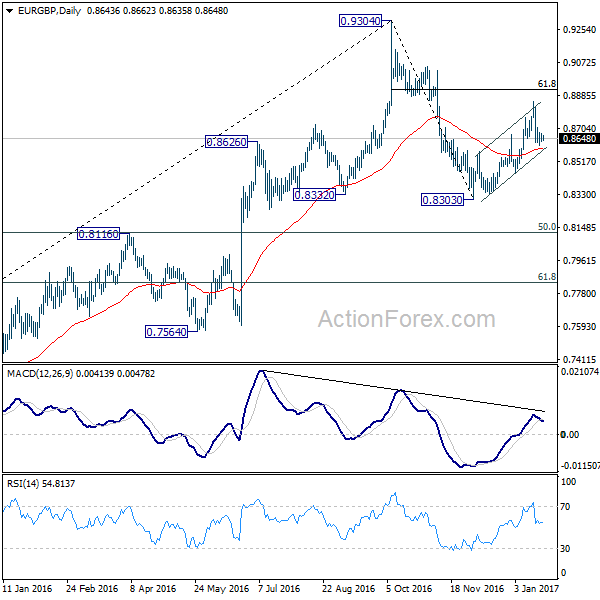

EUR/GBP Daily Outlook

Daily Pivots: (S1) 0.8625; (P) 0.8648; (R1) 0.8667; More...

Intraday bias in EUR/GBP remains neutral for the moment. Rise from 0.8303 is seen as a corrective move, as the second leg of the corrective pattern from 0.9304. Break of 0.8449 support will indicate that such rise is completed and the third leg has started for 0.8303 and below. Above 0.8851 will extend the rise from 0.8303. But in that case, strong resistance should be seen above 61.8% retracement of 0.9304 to 0.8303 at 0.8922 to limit upside and bring near term reversal.

In the bigger picture, price actions from 0.9304 are viewed as a medium term corrective pattern. Deeper fall cannot be ruled out yet. But we'd expect strong support from 0.8116 cluster support (50% retracement of 0.6935 to 0.9304 at 0.8120) to contain downside. Overall, the corrective pattern would take some time to complete before long term up trend resumes at a later stage. Break of 0.9304 will pave the way to 0.9799 (2008 high).

Subscribe to our daily and mid-day newsletter to get this report delivered to your mail box

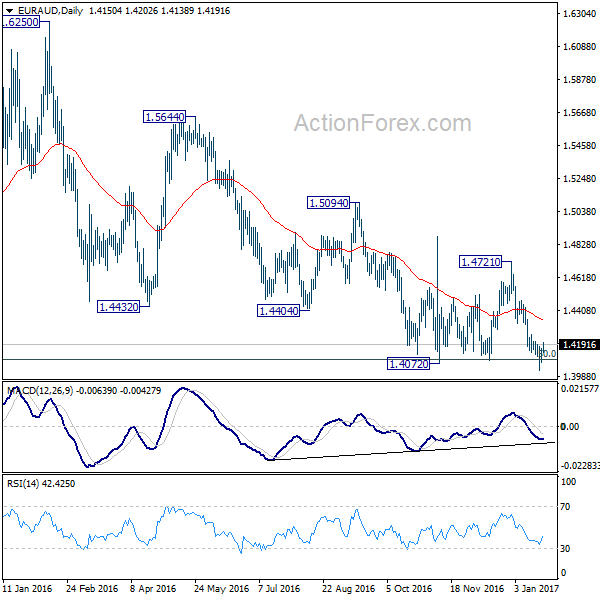

EUR/AUD Daily Outlook

Daily Pivots: (S1) 1.4093; (P) 1.4131; (R1) 1.4187; More...

Intraday bias in EUR/AUD remains neutral for the moment. Near term outlook stays bearish as the corrective decline from 1.6587 is still in progress. Below 1.4025 will target 1.3671 key support level. We'd expect downside to be contained there to bring reversal. Meanwhile, above 1.4251 minor resistance will turn focus back to 1.4271 resistance.

In the bigger picture, price actions from 1.6587 medium term top are viewed as a consolidative pattern. 50% retracement of 1.1602 to 1.6587 at 1.4095 was already met. While further fall cannot be ruled out, we'd expect strong support above 1.3671 to contain downside and bring rebound. Up trend from 1.1602 should not be finished and will resume later. Break of 1.4721 resistance will be the first sign of resumption of up trend from 1.1602 and target retesting of 1.6587 high first.

Subscribe to our daily and mid-day newsletter to get this report delivered to your mail box

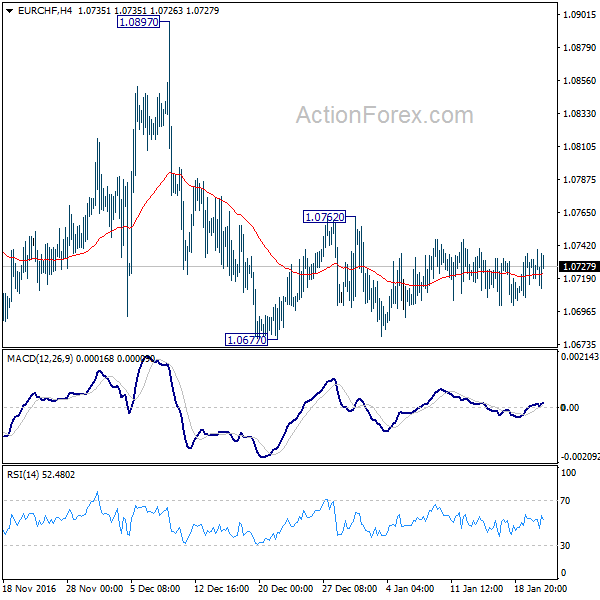

EUR/CHF Daily Outlook

Daily Pivots: (S1) 1.0707; (P) 1.0723; (R1) 1.0732; More...

Intraday bias in EUR/CHF remains neutral for the moment. The corrective price actions and its stay below falling 55 days EMA affirmed near term bearishness. Break of 1.0677 will extend recent decline to 1.0620 key support level. On the upside, above 1.0762 will turn focus back to 1.0897 resistance. But decisive break there is needed to confirm trend reversal. Otherwise, outlook will stay bearish for another fall later.

In the bigger picture, the decline from 1.1198 is seen as a corrective move. Such correction is still in progress and retest of 38.2% retracement of 0.9771 to 1.1198 at 1.0653 could be seen. Sustained trading below 1.0653 will target 50% retracement at 1.0485. Meanwhile, break of 1.0897 resistance will argue that the larger up trend is finally resuming for above 1.1198.

Subscribe to our daily and mid-day newsletter to get this report delivered to your mail box

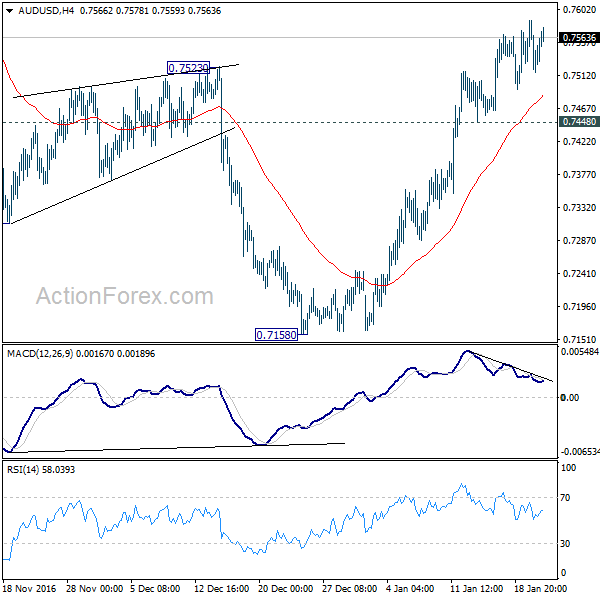

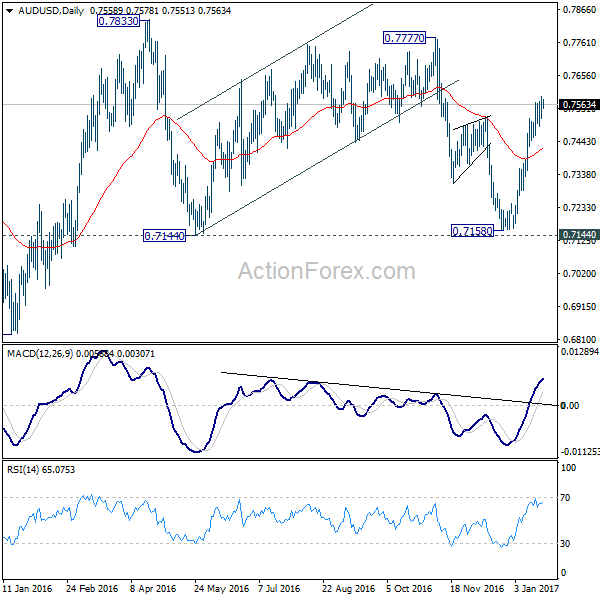

AUD/USD Daily Outlook

Daily Pivots: (S1) 0.7517; (P) 0.7552; (R1) 0.7588; More...

Further rise is in favor in AUD/USD with 0.7448 minor support intact. But upside should be limited by 0.7777/7833 resistance zone to bring near term reversal. On the downside, below 0.7448 minor support will turn bias back to the downside for 0.7144 key support level.

In the bigger picture, AUD/USD is staying inside long term falling channel and it's likely that the down trend from 1.1079 is still in progress. Break of 0.6826 low will confirm this bearish case. We'll be looking for bottoming sign again as it approaches 0.6008 key support level. Meanwhile, sustained break of 0.7833 resistance will be a strong sign of medium term reversal.

Subscribe to our daily and mid-day newsletter to get this report delivered to your mail box

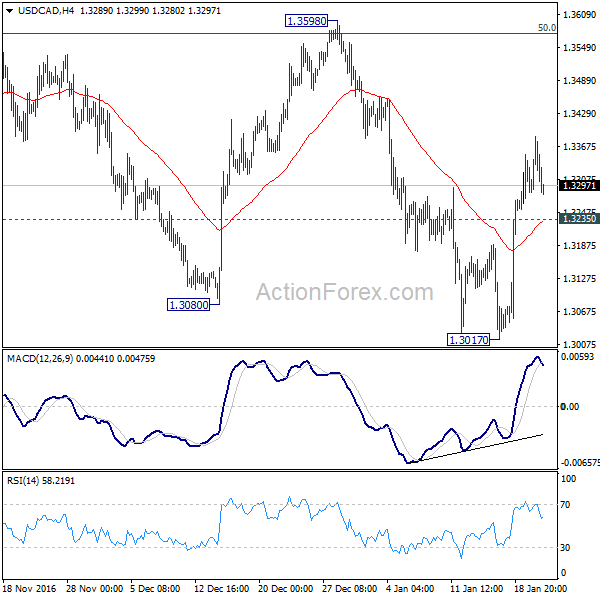

USD/CAD Daily Outlook

Daily Pivots: (S1) 1.3262; (P) 1.3307; (R1) 1.3363; More...

With 1.3235 minor support intact, further rise is in favor in USD/CAD for 1.3598 resistance. Consolidation pattern from 1.3588 should have completed with three waves to 1.3017. Break of 1.3598 will extend the whole choppy rise from 1.2460 to next fibonacci level at 1.3838. On the downside, below 1.3235 minor support will turn focus back to 1.3017 instead.

In the bigger picture, price actions from 1.4689 medium term top are seen as a correction pattern. The first leg has completed at 1.2460. The second leg is still in progress and could target 61.8% retracement of 1.4689 to 1.2460 at 1.3838. As rise from 1.2460 is seen as a corrective move, we'd look for reversal signal above 1.3838. Meanwhile, break of 1.3017 will likely start the third leg to 1.2460 and below.

Subscribe to our daily and mid-day newsletter to get this report delivered to your mail box

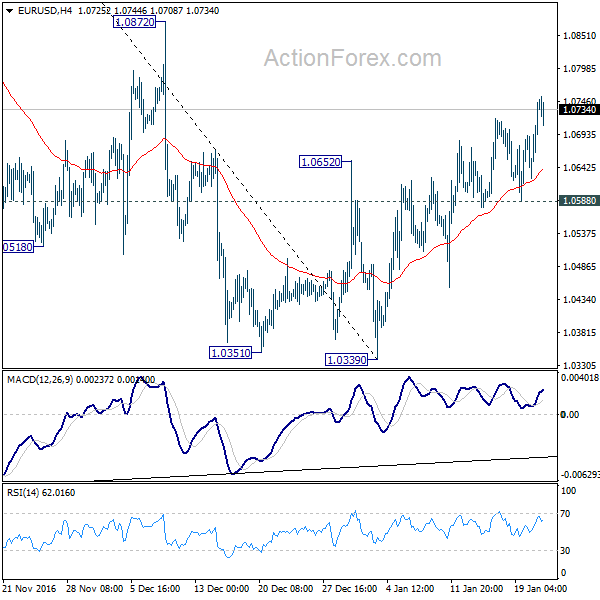

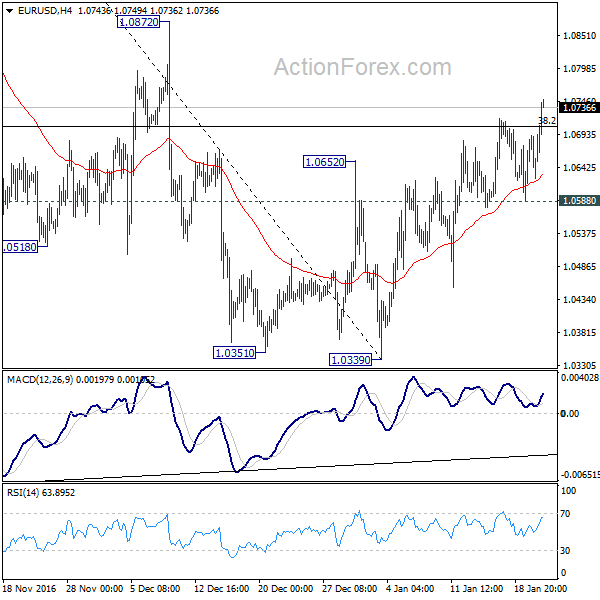

EUR/USD Daily Outlook

Daily Pivots: (S1) 1.0646; (P) 1.0677 (R1) 1.0731; More.....

EUR/USD's rebound from 1.0339 resumed today and reaches as high as 1.0749 so far. Intraday bias is back on the upside for further rise. At this point, rise from 1.0339 is seen as a corrective move and should be limited by 1.0872 resistance. On the downside, below 1.0588 minor support will argue that it's completed and turn bias back to the downside for 1.0339 support.

In the bigger picture, whole down trend from 1.6039 (2008 high) is in progress. Such down trend is expected to extend to 61.8% projection of 1.3993 to 1.0461 from 1.1298 at 0.9115. On the upside, break of 1.1298 resistance is needed to confirm medium term bottoming. Otherwise, outlook will stay bearish in case of rebound.

Subscribe to our daily and mid-day newsletter to get this report delivered to your mail box

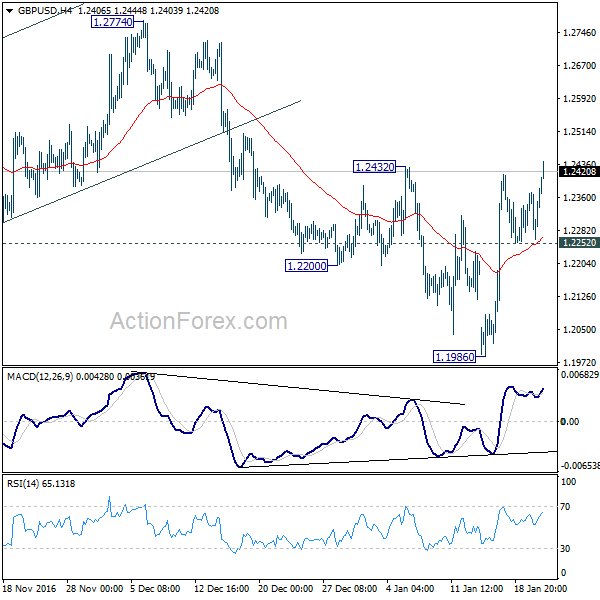

GBP/USD Daily Outlook

Daily Pivots: (S1) 1.2295; (P) 1.2337; (R1) 1.2415; More...

GBP/USD's rebound from 1.1986 resumes today and breaches 1.2432 resistance. Intraday bias is mildly on the upside for further rise. But still, such rise is seen as the third leg of the consolidation pattern from 1.1946. Thus, we'd expect strong resistance at 1.2774 to limit upside and bring down trend resumption eventually. On the downside, below 1.2188 minor support will turn bias to the downside for retesting 1.1946 low.

In the bigger picture, fall from 1.7190 is seen as part of the down trend from 2.1161. There is no sign of medium term bottoming yet. Sustained trading below 61.8% projection of 2.1161 to 1.3503 from 1.7190 at 1.2457 will target 100% projection at 0.9532. Overall, break of 1.3444 resistance is needed to confirm medium term bottoming. Otherwise, outlook will remain bearish.

Subscribe to our daily and mid-day newsletter to get this report delivered to your mail box