Euro is trading steadily today despite inflation data coming in weaker than expected. The muted market reaction suggests investors are comfortable looking through near-term softness, focusing instead on the broader policy and inflation backdrop. Indeed, recent data point to inflation likely undershooting the ECB’s own forecasts in the near term. That said, medium-term inflation expectations remain well anchored, limiting pressure on policymakers to respond preemptively.

For now, the ECB can afford patience. With inflation expectations stable, a single downside surprise is unlikely to shift the policy stance, particularly given the Bank’s emphasis on medium-term dynamics rather than month-to-month volatility. Still, the price outlook is not without risk. Sustained renewal of Euro’s uptrend—especially if EUR/USD were to break and hold above the 1.20 level—could prompt reassessment, as currency strength would add a disinflationary impulse through import prices.

At the same time, services inflation remains sticky, as highlighted in today’s PMI reports. Rising energy prices, coupled with a marked pickup in service-sector input costs and selling prices, could quickly reawaken inflation concerns if they persist.

Taken together, these cross-currents keep the bar for an ECB rate move high. Any rate move would require clearer evidence that inflation risks are either becoming entrenched or decisively fading, neither of which is yet the case. Looking further ahead, medium-term risks tilt mildly to the upside. Fiscal expansion in Germany later this year could provide additional demand support.

In the US, Dollar is also holding within tight ranges. The latest ADP report reinforced the “low hiring, low firing” narrative that has dominated recent labor market data. While hiring momentum is cooling, the adjustment is not yet feeding through to wage dynamics. Pay growth remains elevated, strengthening the argument for more hawkish members of the FOMC to remain patient for now.

Uncertainty lingers over the timing of the more comprehensive non-farm payrolls report, delayed by the brief government shutdown. With a funding deal already in place, markets hope the data will be released soon to provide clearer direction.

For the week so far, Aussie leads FX performance, followed by Sterling and Kiwi. Yen sits firmly at the bottom, trailed by Swiss Franc and Euro. Dollar and Loonie remain in the middle.

In Europe, at the time of writing, FTSE is up 1.22%. DAX is down -0.33%. CAC is up 0.87%. UK 10-year yield is down -0.001 at 4.526. Germany 10-year yield is down -0.019 at 2.875. Earlier in Asia, Nikkei fell -0.78%. Hong Kong HSI rose 0.05%. China Shanghai SSE rose 0.85%. Singapore Strait Times rose 0.43%. Japan 10-year JGB yield fell -0.009 to 2.251.

US ADP jobs grow only 22k, but wage pressures steady

US private employment rose by just 22k in January, according to the ADP report, well below expectations of 48k increase.

Job gains were concentrated in service-providing industries, which added 21k positions, while goods-producing sectors contributed just 1k. By firm size, medium-sized businesses drove employment growth with 41k new jobs, while large employers shed -18k positions and small establishments saw no net change, pointing to uneven demand for labor.

Wage growth, however, remained resilient. Pay for job-stayers rose 4.5% yoy, little changed from prior months. Job-changer wage growth slowed modestly from 6.6% yoy to 6.4%.

As Nela Richardson, chief economist at ADP, noted, job creation has slowed sharply over the past three years, but wage growth has remained stable—highlighting a labor market that is cooling through hiring rather than pay compression.

Eurozone CPI cools to 1.7% in January, core ticks down to 2.2%

Eurozone flash CPI slowed from 1.9% yoy to 1.7% in January, in line with expectations. Underlying pressures also moderated slightly. Core CPI, which strips out energy, food, alcohol, and tobacco, edged down from 2.3% to 2.2% yoy.

By component, services inflation remained the largest contributor but slowed to 3.2% from 3.4%. Food, alcohol, and tobacco inflation picked up from 2.5% to 2.7%. Non-energy industrial goods inched higher from 0.3% to 0.4%. Energy prices was a major drag, with annual inflation falling sharply from -1.9% to -4.1%.

Eurozone PMI services finalized at 51.6, cost pressures stay on ECB radar

Eurozone PMI Services was finalized at 51.6 in January, easing from December’s 52.4. PMI Composite edged lower to 51.3 from 51.5. The data still point to ongoing expansion, but momentum softened slightly at the start of the year.

At the country level, the picture was mixed but broadly supportive. Spain was the strongest performer with PMI Composite at 52.9, despite slipping to a seven-month low. Germany (52.1) and Italy (51.4) both posted modest improvements. France (49.1) stood out as the laggard, with activity remaining in contraction territory.

According to Cyrus de la Rubia of Hamburg Commercial Bank, service sector growth has been “decent” but far from comfortable, with weak new business growth and limited hiring highlighting the recovery’s vulnerability.

While headline inflation is close to the ECB’s 2% target, services inflation remains sticky. Rising energy prices linked to cold weather, alongside a marked pickup in service sector input costs and selling prices flagged by the PMI, could reawaken concerns.

UK PMI services finalized at 54.0, encouraging start to the year

UK PMI Services was finalized at 54.0 in January, surging from December’s 51.4 and marking the strongest reading since August 2025. PMI Composite also rose sharply to 53.7 from 51.4, the highest level since August 2024,.

According to Tim Moore of S&P Global Market Intelligence, the survey points to an “encouraging start” to the year after a sluggish end to 2025. Service sector output expanded at the fastest pace in five months, supported by improved investment sentiment and stronger inflows of new work. That said, Moore noted that consumer demand remains constrained by squeezed household incomes, while geopolitical risks continue to weigh on business spending decisions.

The recovery is therefore uneven. While business confidence improved to its highest level since October 2024, firms continued to cut staff at an accelerated pace as they sought to offset rising payroll costs. At the same time, a sharp increase in input prices fed through to the fastest rise in output charges in five months.

New Zealand jobs grow 0.5% in Q4, unemployment ticks to decade-high

New Zealand’s labor market delivered mixed signals in Q4. Employment rose 0.5% qoq, beating expectations for a 0.3% gain, pointing to continued job creation. Employment rate edged up to 66.7% from 66.6%, reinforcing the view that labor demand remains resilient.

At the same time, unemployment rate climbed to 5.4% from 5.3%, above expectations and the highest since the September 2015 quarter. The rise was accompanied by an increase in the labor force participation rate to 70.5% from 70.3%, suggesting that more people are entering or re-entering the job market, which is adding to slack even as hiring continues.

Wage pressures remained contained. The labor cost index rose 2.0% yoy, with private sector wages up 2.0% and public sector wages up 2.2%. The combination of steady employment growth, rising participation, and moderate wage inflation points to a labor market that is still cooling gradually.

Japan PMI composite finalized at 53.1, broadening growth at start of 2026

Japan’s PMI Services was finalized at 53.7 in January, up from December’s 51.6. PMI Composite rose to 53.1 from 51.1. The data point to a clear acceleration in private-sector activity at the start of 2026, with growth firmly back above expansionary levels.

According to Annabel Fiddes of S&P Global Market Intelligence, business activity rebounded at the fastest pace since May 2023. Services remained the primary growth engine, posting the strongest rise in activity in nearly a year, while manufacturing output also returned to growth for the first time since last June.

The surveys suggest the recovery is becoming more broad-based. Demand improved across both manufacturing and services simultaneously for the first time in more than two-and-a-half years, a notable shift after a prolonged period of uneven momentum. Employment was another bright spot, with firms adding staff across both sectors to expand capacity in response to stronger demand.

Cost pressures eased at the start of the year, with input prices rising at their slowest pace in almost two years. However, companies raised selling prices more aggressively, indicating efforts to rebuild margins.

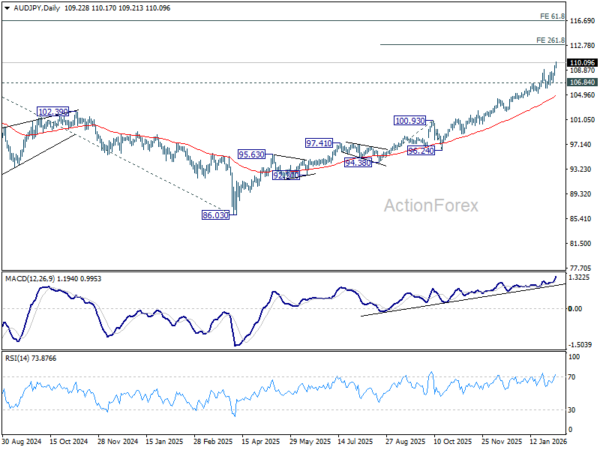

AUD/JPY re-accelerates to new record high, 113 and then 116 next targets

AUD/JPY surged to a fresh record high this week. The move reflects renewed strength in Aussie following a hawkish turn from the RBA, alongside renewed weakness in the Yen as intervention risks fade and election looms.

On the Australian side, the catalyst has been clear. The RBA became the first major central bank to reverse course from easing, responding to a resurgence in inflation that has been building since late last year. Policymakers highlighted stronger-than-expected consumption and a labor market that remains slightly tight, reinforcing that more policy restraint is needed.

Importantly, the RBA’s own forecasts assume interest rates rise further later this year. While officials have avoided pre-committing to a sequence of hikes, the projection alone has been enough to lift Aussie, particularly against low-yielding peers.

In contrast, Yen has come back under broad-based pressure. The perceived risk of intervention—especially coordinated action between Japan and the US—has receded markedly. Conflicting messages from Japanese officials on Yen weakness suggest authorities are not yet prepared to step in directly, at least not before USD/JPY approaches the 160 area again.

Political positioning has added another pressure to Yen. Some traders are positioning ahead of Sunday’s snap election, where the ruling Liberal Democratic Party could secure an outright majority on the back of strong approval for Prime Minister Sanae Takaichi. While her policy agenda raises longer-term fiscal concerns, a decisive win would also buoy domestic equities, reinforcing risk-on sentiment and keeping the Yen under pressure.

That combination of stronger Australian fundamentals and weaker Japanese currency support has proven potent. Even without a sharp change in global risk sentiment, domestic factors alone are sufficient to sustain AUD/JPY upside.

Technically, momentum has re-accelerated, with D MACD turning higher again. Near-term bias stays firmly bullish as long as 106.84 support holds. The next target sits at the 261.8% projection of 94.38 to 100.93 from 96.24 at 113.38.

Looking further out, the next major hurdle comes in at 61.8% projection of 59.85 (2020 low) to 109.36 (2024 high) from 86.03 (2025 low) at 116.62. Price action around that zone will be key in defining whether the current rally extends into a sustained long-term breakout or pauses after an extended run.

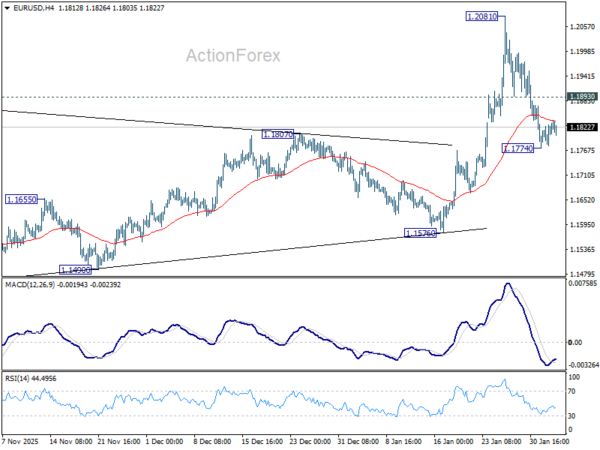

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.1790; (P) 1.1809; (R1) 1.1839; More….

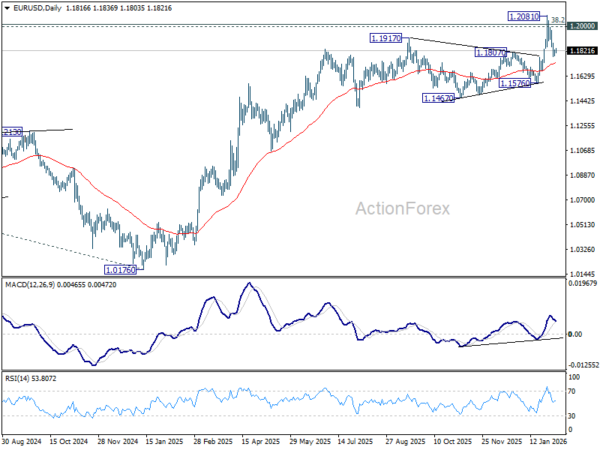

Intraday bias in EUR/USD remains neutral as it’s bounded in right range above 1.1774. On the downside, below 1.1774 will extend the fall from 1.2081 short term top to 55 D EMA (now at 1.1724). Firm break there will raise the chance of reversal on rejection by 1.2 psychological level, and target 1.1576 support. On the upside, above 1.1893 minor resistance will bring stronger rebound to retest 1.2081. Decisive break above 1.2 will carry larger bullish implications.

In the bigger picture, as long as 55 W EMA (now at 1.1458) holds, up trend from 0.9534 (2022 low) is still in favor to continue. Decisive break of 1.2 key psychological level will add to the case of long term bullish trend reversal. Next medium term target will be 138.2% projection of 0.9534 to 1.1274 from 1.0176 at 1.2581. However, sustained trading below 55 W EMA will argue that rise from 0.9534 has completed as a three wave corrective bounce, and keep long term outlook bearish.