The theme of the markets have switched from risk aversion to selloff in European majors today. In particular, Euro leads other down after weak PMIs point to further slow down in the economy. Even worse, Markit expects that the PMI readings are now consistent with ECB easing bias. And of course, in the background, the standoff between Italy and EU on budget continues as Italian government doesn’t appear to back down on the 2019 deficit target. Sterling is the second weakest on Brexit impasse while Swiss Franc is the third weakest.

On the other hand, Canadian Dollar is firm, together with Dollar and Australian. BoC rate hike and the accompanying statement is the main focus ahead. The question is how BoC views the sharp slow down in CPI from 2.8% to 2.2% in September, and the impact on policy path. Yen is mixed, partly because risk aversion recedes, and partly due to sharp fall in 10 year JGB yield by -0.0151 to 0.135.

Technically, both EUR/USD and GBP/USD have taken out 1.1431 and 1.2921 support to recent recent decline. EUR/USD should be heading back to 1.1300 low. GBP/USD targeting 1.2661/2784 support zone. USD/CHF also breaks 0.9980 resistance and should be target 1.0067 key level. EUR/CHF’s break of 1.1392 minor support indicates completion of recent rebound from 1.1173. The focus today is whether USD/CAD would finally taken out near term falling channel resistance decisively to extend rally, or be rejected further from it.

In other markets, FTSE is up 1.28% at the time of writing, DAX is up 0.91%, CAC is up 1.44%. German 10 year yield is currently down -0.0026 at 0.409. It’s crucial to defend 0.4 psychological level. Italian 10 year yield is down -0.044 at 3.537. Spread remains above 300 alarming level. Earlier today, Nikkei gained 0.37%, Singapore Strait Times rose 0.02%, China Shanghai SSE rose 0.33% to 2603.30, back above 2600 handle. But Hong Kong HSI dropped -0.38%.

Eurozone PMI dropped to 25-month low, GDP growth waning to 0.3% in Q4

Eurozone PMI manufacturing dropped to 52.1 in October, down from 53.2 and missed expectation of 53.1. That’s a 26-month low. PMI services dropped to 53.3, down from 54.7 and missed expectation of 54.5. That’s a 24- month low. PMI composite dropped to 52.7, down from 54.1, hit a 25-month low.

Markit Chief Business Economist Chris Williamson said in the release that “pace of Eurozone economic growth slipped markedly lower in October” “setting the scene for a disappointing end to the year”. The survey is indicative of GDP growth “waning to 0.3%” in Q3. And, “further momentum could be lost in coming months”. The slowdown is “led by a drop in exports” linked to trade wars and tariffs. Regarding ECB policy, Williamson noted “PMI has fallen to a level that would historically be consistent with a bias towards loosening monetary policy in order to prevent any further deterioration of economic growth.”

Also released, Germany PMI manufacturing dropped to 52.3 in October, down from 53.7 and missed expectation of 53.5. That’s a 29-month low. PMI services dropped to 53.6, down from 55.9 and missed expectation of 55.5. That’s a 5-month low. PMI composite dropped to 52.7, down from 55.0, hit a 41-month low. France PMI manufacturing dropped to 51.2 in October, down from 52.2 and missed expectation of 52.4. That’s also a 25-month low. PMI services rose to 55.6, up from 54.8 and beat expectation of 54.7, and hit a 4-month high. PMI composite rose 0.3 to 54.0.

Italy Salvini: No longer be servant of silly EU rules

In Italy, Deputy Prime Minister, leader or eurosceptic League, Matteo Salvini pledged that the country won’t change the 2019 budget despite rejection by the European Commission. He emphasized that “Italians come first” and “Italy no longer wants to be a servant to silly rules.” And he also explained that Italy has to “do the opposite” of previous government to boost growth and lower debt.

European Economic Commissioner Pierre Moscovici said the EU and Italy are “still in a constructive dialogue even if it is within a clear framework… My door is always open and I hope that the Italian government will listen to this message.”

EU Tusk: November Brexit summit still on the card if decisive progress is made

European Council President Donald Tusk said EU is ready to extend the transition period after Brexit in March, if UK requests for it. For now, “it was made clear by the UK that more time is needed to find a precise solution”. Hence, “there is no other way but to continue the talks” with UK.

Nonetheless Tusk also said “I stand ready to convene a European Council, if and when the Union negotiator reports that decisive progress has been made”, referring to the possibility of an extra summit on November 17-18.

Japan PMI manufacturing rose to 53.1, upbeat start to Q4

Japan PMI manufacturing rose to 53.1 in October, up from 52.5 and beat expectation of 52.6. Markit noted that “growth of key macroeconomic variables (output, new orders and employment) all accelerate”, and “rates of input cost and output price inflation both quicken to multi-year highs.”

Joe Hayes, Economist at IHS Markit said in the release that the ” manufacturing sector looks set to start Q4 on a more upbeat note”. And, “the latest survey indicated stronger expansions in all the key barometers of macroeconomic health”. Also, ” export sales rose for the first time since May” despite global trade tensions.

BoC to raise interest rate, focus on forward guidance

BoC rate decision is a major focus today. The market has fully priced in that BoC would raise its policy rate by 25 bps to 1.75%. Despite a mixed employment market and moderating inflation in September, clarity of the trade relationship with the US still warrants a rate hike. Indeed, if macroeconomic developments continue to evolve according to BOC’ projections, two more rate hike a probably justified in 1H19. But for now, BoC would at most be cautiously optimistic, retaining the stance of gradual and data-dependent tightening.

More in BOC Preview – Rate Hike Fully Priced but Future Decision Still Data- Dependent

EUR/USD Mid-Day Outlook

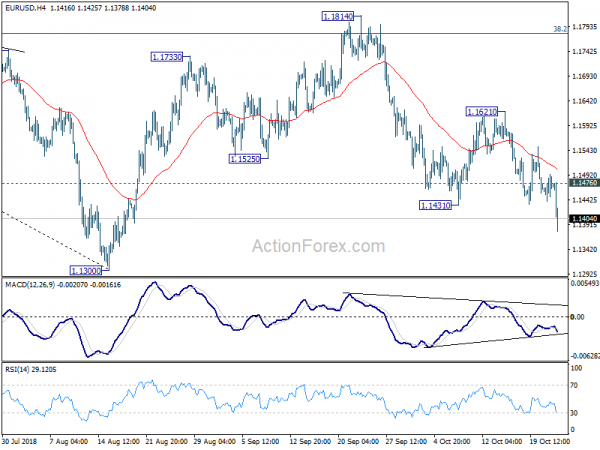

Daily Pivots: (S1) 1.1442; (P) 1.1468; (R1) 1.1496; More….

EUR/USD drops to as low as 1.1378 so far today. Break of 1.1431 support indicates resumption of fall from 1.1814. Intraday bias is turned back to the downside for retesting 1.1300 low. Decisive break there will resume whole down trend from 1.2555. On the upside, above 1.1476 minor resistance will turn intraday bias neutral first. But outlook will remain cautiously bearish as long as 1.1621 resistance holds.

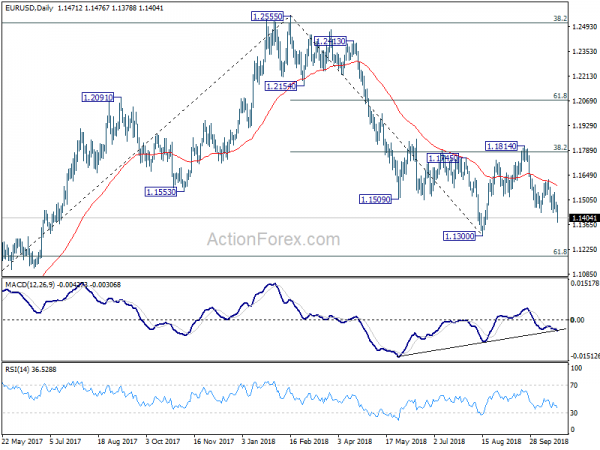

In the bigger picture, corrective pattern from 1.1300 could have completed at 1.1814 after hitting 38.2% retracement of 1.2555 to 1.1300 at 1.1779. Decisive break of 1.1300 will resume the down trend from 1.2555 to 61.8% retracement of 1.0339 (2017 low) to 1.2555 at 1.1186 next. Sustained break there will pave the way to retest 1.0339. On the upside, break of 1.1814 will delay the bearish case and extend the correction from 1.1300 with another rise before completion.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | PMI Manufacturing Oct P | 53.1 | 52.6 | 52.5 | |

| 7:15 | EUR | France Manufacturing PMI Oct P | 51.2 | 52.4 | 52.5 | |

| 7:15 | EUR | France Services PMI Oct P | 55.6 | 54.7 | 54.8 | |

| 7:30 | EUR | Germany Manufacturing PMI Oct P | 52.3 | 53.5 | 53.7 | |

| 7:30 | EUR | Germany Services PMI Oct P | 53.6 | 55.5 | 55.9 | |

| 8:00 | EUR | Eurozone Manufacturing PMI Oct P | 52.1 | 53.1 | 53.2 | |

| 8:00 | EUR | Eurozone Services PMI Oct P | 53.3 | 54.5 | 54.7 | |

| 8:00 | EUR | Eurozone M3 Money Supply Y/Y Sep | 3.50% | 3.50% | 3.50% | 3.40% |

| 8:30 | GBP | BBA Mortgage Approvals Sep | 38.5K | 39.0K | 39.4K | 39.2K |

| 13:00 | USD | House Price Index M/M Aug | 0.30% | 0.20% | ||

| 13:45 | USD | US Manufacturing PMI Oct P | 55.5 | 55.6 | ||

| 13:45 | USD | US Services PMI Oct P | 54.1 | 53.5 | ||

| 14:00 | CAD | BoC Rate Decision | 1.75% | 1.50% | ||

| 14:00 | USD | New Home Sales Sep | 630K | 629K | ||

| 14:30 | USD | Crude Oil Inventories | 6.5M | |||

| 15:15 | CAD | BoC Press Conference | ||||

| 18:00 | USD | Federal Reserve Beige Book |