Risk aversion remains the dominant theme in the global financial markets on trade war threats. In particular, German 10-year yield turns negative again on safe haven flows. Based on currently available information, the trigger for Trump’s escalation was China’s pull back on its commitments in the negotiation progress. And it’s a general consensus in the the trade team that tariffs is the only way to go if no deal could be sealed this week. Hence, even though Chinese Vice Premier Liu travel to the US on May 9-10, it’s unsure what he could do to bring negotiations back on track and avert the new tariffs on Friday.

In the currency markets, Yen is currently the strongest one, picking up steam on falling stocks and yields. Australian Dollar is lucky as the second strongest, thanks to RBA standing pat. But it’s post RBA rally has been limited since the central bank was actually laying the ground work for rate cuts down the road, subject to developments in the job markets. Dollar is the third strongest. Sterling and Swiss Franc are the weakest ones.

Technically, GBP/JPY’s break of 144.80 minor support now puts focus back to 143.72 key support. Decisive break there will indicate near term bearish reversal. EUR/GBP’s break of 0.8568 now suggests that at least another recovery would be seen before larger down trend resumes through 0.8472 key support. EUR/USD, USD/CHF, USD/CAD and AUD/USD are staying in familiar range. But Dollar seems to be heading for a test on resistance levels in these pairs soon.

In Europe, currently, FTSE is down -1.08%. DAX is down -0.61%. CAC is down -0.80%. German 10-year yield is down -0.040 at -0.030, turns negative again. Earlier in Asia, Hong Kong HSI rose 0.52%. China Shanghai SSE rose 0.69%. Singapore Strait Times rose 0.67%. Japan remains on holiday.

China VP Liu to visit US on May 9-10 despite new tariff threats

Chinese Vice Premier Liu He will still travel to the US on May 9-10 to resume trade negotiations despite re-escalated tariff threats. That’s a slight delay comparing to the original plan of traveling to the US on Wednesday. According to the MOFCOM’s statement, the visit was by invitation of US Trade Representative Robert Lighthizer and Treasury Secretary Steven Mnuchin.

Chinese Foreign Ministry spokesman Geng Shuang said in a regular press briefing that “adding tariffs can’t resolve any problem” of trade conflicts. “Talks are by their nature a process of discussion. It’s normal for both sides to have differences. China won’t shun problems and is sincere about continuing talks,” he added. Shuang also said “We hope the U.S. side can work hard with China, to meet each other halfway, and on the basis of mutual respect and equality, resolve each other’s reasonable concerns, and strive for a mutually beneficial, win win agreement.”

It’s widely reported that China reneged on the commitments it made, explicitly with the new draft agreement sent to the US over the weekend. Both Lighthizer and Steven Mnuchin confirmed that. And it’s seen as the trigger for Trump to declare trade war escalation to full blown level this Friday. Mnuchin also confirmed that “the entire economic team … are completely unified and recommended to the president to move forward with tariffs if we are not able to conclude a deal by the end of the week.”

Eurozone growth projected to bottom lower in 2019, but rebound still expected in 2020

In the latest Spring Economic Forecasts, European Commission downgrade 2019 Eurozone GDP growth projections slightly by -0.1%. Though, it would be the seventh year of growth in a row. And despite continuing global uncertainties, domestic dynamics are expected to support the European economy. More importantly, the Commission expects growth to bottom in 2019 and pick up again in 2020.

Eurozone projections (Winter forecasts):

- 2019 GDP at 1.2% (downgraded from Winter forecast at 1.3%)

- 2020 GDP at 1.5% (downgraded from 1.6%)

- 2019 HICP at 1.4% (unchanged)

- 2020 HICP at 1.4% (downgraded from 1.5%)

Germany projections:

- 2019 GDP at 0.5% (downgrade from 1.1%)

- 2020 GDP at 1.5% (downgraded from 1.7%)

France projections:

- 2019 GDP at 1.3% (unchanged)

- 2020 GDP at 1.5% (unchanged)

European Commission Vice President Valdis Dombrovskis said: “The European economy is showing resilience in the face of a less favourable external environment, including trade tensions. Growth is set to continue in all EU Member States and pick up next year, supported by robust domestic demand, steady employment gains and low financing costs. Yet risks to the outlook remain pronounced. On the external side, these include further escalation of trade conflicts and weakness in emerging markets, in particular China. In Europe, we should stay alert to a possible ‘no-deal Brexit’, political uncertainty and a possible return of the sovereign-bank loop.”

Commissioner Pierre Moscovicisaid: “The European economy will continue to grow in 2019 and 2020. Growth remains positive in all our Member States and we continue to see good news on the jobs front, including rising wages. This means that the European economy is holding up in the face of less favourable global circumstances and persistent uncertainty. Nonetheless, we should stand ready to provide more support to the economy if needed, together with further growth-enhancing reforms. Above all, we must avoid a lapse into protectionism, which would only exacerbate the existing social and economic tensions in our societies.”

There could be a cross-party Brexit deal in UK, but not this week

According to a BBC’s political editor Laura Kuenssberg, there is a way for the UK government and opposition to compromise on a Brexit deal. however, it’s unlikely to be reached this week. Kuenssberg tweeted that “Senior govt source says it IS possible though to see a way to a deal, but unlikely to be resolved this week.” But the aim is “to set out a path to get the Withdrawal Bill to Commons with a fair wind.”

Foreign Secretary Jeremy Hunt indicated to BBC radio that he’s “not a believer in a customs union” as a “sustainable long-term solution” of Brexit. It’s clear that customs union is the way Labour would like to go forward with. Hunt urged that “this is a time when we have to be willing to make compromises on all sides because the message of last week was that voters for both main parties are very, very angry about the fact Brexit hasn’t been delivered.”

RBA stands pat at 1.50%, revised down growth and inflation forecasts

Australian Dollar rebounds after RBA left cash rate unchanged at 1.50%, rather than delivered a rate cut as some expected. While, keeping interest rate on hold, the central bank did lay down the criteria in labor market development as condition for policy action in response to subdued inflation.

RBA acknowledged that Q1 inflation data were “noticeably lower than expected”. And, “further improvement in the labour market was likely to be needed for inflation to be consistent with the target”. Thus, the central bank said it will be “paying close attention to developments in the labour market at its upcoming meetings.

With the new economic projections, RBA is expecting around 2.75% growth in 2019 and 2020. That’s a slightly downward revision from February’s around 3% in 2019 and by a little less in 2020.

Underlying inflation is expected to be at 1.75% this year and 2% in 2020. Headline inflation is expected to be at around 2% in 2019. There were also slight downward revision from February’s projection of 2% in 2019 and 2.25% in 2020.

Australia retail sales rose 0.3%, trade surplus narrowed to AUD 4.95B

Australia retail sales rose 0.3% mom in March, above expectation of 0.2% mom. February’s growth was revised up from 0.8% mom to 0.9% mom. In seasonally adjusted terms, there were rises in Victoria (0.7%), Queensland (0.6%), New South Wales (0.2%), Tasmania (0.4%), South Australia (0.1%), and the Northern Territory (0.7%). The Australian Capital Territory was relatively unchanged (0.0%) and Western Australia (-0.7%) fell in seasonally adjusted terms in March 2019.

Trade surplus narrowed to AUD 4.95B in March, down from AUD 5.14B but beat expectation of AUD 4.49B. Goods and services exports dropped -2% to AUD 39.34B. Good and services imports dropped -1% to AUD 34.39B.

Other data released today include Germany factory orders which rose 0.6% mom in March, lower than expectation of 1.5% mom. Swiss foreign currency reserves rose to CHF 772B in April versus expectation of CHF 756B. Japan PMI manufacturing was finalized at 50.2 in April.

USD/CHF Mid-Day Outlook

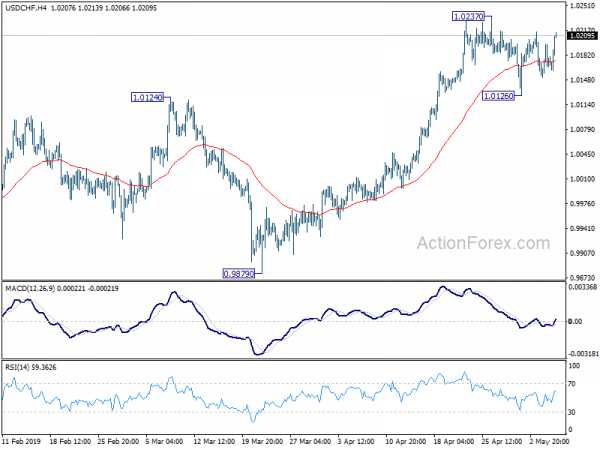

Daily Pivots: (S1) 1.0154; (P) 1.0175; (R1) 1.0200; More…..

USD/CHF rebounds notably today but stays in range of 1.0126/0237. Intraday bias remains neutral first and more sideway trading could be seen. On the upside, break of 1.0237 will resume larger rise from 0.9186 to 1.0342 key resistance. However, break of 1.0126 will turn bias to the downside for deeper decline to 55 day EMA (now at 1.0066).

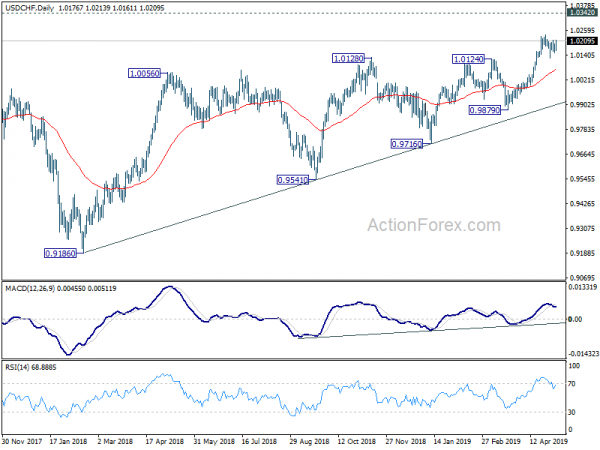

In the bigger picture, medium term up trend from 0.9186 is extending. Current rise should target 1.0342 resistance next. For now, we’d be cautious on strong resistance from there to limit upside, until we see medium term upside acceleration. On the downside, break of 0.9879 support is needed to indicate reversal. Otherwise, outlook will stay bullish in case of deep pull back.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Consensus | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:30 | JPY | PMI Manufacturing Apr F | 50.2 | 49.5 | 49.5 | |

| 01:30 | AUD | Trade Balance (AUD) Mar | 4.95B | 4.49B | 4.80B | 5.14B |

| 01:30 | AUD | Retail Sales M/M Mar | 0.30% | 0.20% | 0.80% | 0.90% |

| 03:00 | NZD | RBNZ 2-Year Inflation Expectation Q2 | 2.00% | 2.00% | ||

| 04:30 | AUD | RBA Rate Decision | 1.50% | 1.25% | 1.50% | |

| 06:00 | EUR | German Factory Orders M/M Mar | 0.60% | 1.50% | -4.20% | -4.00% |

| 07:00 | CHF | Foreign Currency Reserves (CHF) Apr | 772B | 756B | 756B | |

| 14:00 | CAD | Ivey PMI Apr | 51.5 | 54.3 |