The financial markets are relatively steady in a light day today. The imminent risk of war between US and Iran is eased, as Trump opts for more economic sanctions. Meanwhile, it appears that US and China are both preparing for the Trump-Xi summit at G20 in Japan later in the week. While practical no one expects a deal there, hopes are high for at least an agreement to resume trade negotiations. In the currency markets, Yen and Swiss Franc are trading a touch softer while Dollar remains pressured. On the other hand, commodity currencies are generally firmer, as led by Australian Dollar. Euro and Sterling are mixed for now.

Technically, overall outlook in the markets are unchanged. While Dollar is expected to weaken further in the near term, there are some levels that might give the greenback support, at least for a rebound attempt. Those levels include 1.1142 projection resistance in EUR/USD, 1.2840 fibonacci resistance in GBP/USD, 1.3068 support in USD/CAD and 0.7022 resistance in AUD/USD. Gold would also face 1452.80 projection resistance with next rise.

In other markets, Nikkei closed up 0.13%. Hong Kong HSI is p 0.39%. China Shanghai SSE is up 0.01%. Singapore Strait Times is down -0.45%. Japan 10-year JGB yield is down -0.16.

China urges US to compromise and make concessions in trade talks

At a news briefing regarding G20 summit, Chinese Vice Commerce Minister Wang Shouwen said talks are underway between China and US teams regarding trade negotiations. He gave no details on the highly anticipated meeting between Xi and Trump ahead. Though, he reiterated China’s stance on mutual respect and urged US to make concessions for compromises.

Wang said, “mutual respect means each side must respect the other’s sovereignty”, apparently referring US demand for China to implement the trade agreement with domestic laws. Wang also said “equality and mutual benefit means the consultations have to happen on an equal basis, the agreement to be reached has to be beneficial for both sides… Meeting each other half way means both sides have to compromise and make concessions, not just one side.”

Wang also noted Xi has asked Trump to treat Chinese companies fairly during last week’s telephone conversation. He added “we hope that the U.S. can remove certain unilateral measures inappropriately taken against Chinese companies, in the spirit of free trade and the World Trade Organization.”

RBA Lowe: It legitimate to ask how effective further monetary easing would be

Australian Dollar is said to be lifted by RBA Governor Philip Lowe’s question on effectiveness of further rate cuts. Lowe said in a panel discussion in Canberra today that “it’s a legitimate question to ask how effective further monetary easing would be”.

Lowe explained that exchange rate is an “important channel” through which easing stimulates growth. And other transmission mechanisms “are weaker at the moment.” However, he added “we trade with one another, we don’t trade with Mars, so if everyone’s easing, the effect that we get from exchange-rate depreciation via the transmission mechanism isn’t there.”

Meanwhile, it’s possible to ease more than other major central banks. But Lowe warned this was “quite a dangerous path to go down.” Instead, he urged the country to switch focus to fiscal policy and structural reforms. Also, “governments here and around the world should have their top drawers full with ideas.”

Lowe also said he didn’t understand why investors were pushing stocks higher while expecting central banks to cut interest rates. He said “there are investors who think the outlook is sufficiently weak that they expect central banks right around the world to cut interest rates but they are not worried about corporate profits or credit risk.”

Currently, markets are expecting RBA to cut interest rates by -50bps from 1.25% by year end. The next move could come as early as in August. To us, we also don’t understand why Lowe’s comments could shoot up the Aussie. He didn’t indicate less need to loosen up monetary policies. Rather, he’s simply suggesting that cutting interests are not enough to lift inflation back to target.

RBNZ to stand pat this week, door open for further rate cut

RBNZ rate decision is a major focus of the week. After lowering the policy rate by -25 bps to 1.50% in May, the central bank would likely remain on hold this month. Domestic economic developments came in largely consistent with policymakers’ projections. Q1 GDP growth beat RBNZ’s expectations, but breakdowns were mixed. Forward-looking indicators signaled that risks to growth are skewed to the downside.

Global economic outlook remains uncertain and major central banks have recently shifted their stance on the dovish side. It is unlikely that G20 summit this week would resolve US-China trade war. At best, both sides would agree to resume negotiations. All these should lead the RBNZ to adopt a cautious tone this month, while opening the door for reducing interest rates again later this year.

Here are some previews:

- RBNZ Preview – Maintaining Cautious Tone to Pave Way for Further Cuts

- RBNZ Keen to Stay Ahead of Global Slowdown

Trump-Xi summit at G20 most crucial for market sentiments

While expectations for policy easing from major central banks intensified since last wee, some events ahead might cool such expectations. Trump-Xi meeting at G20 towards the end of the week will be crucial for global investor sentiments. Fed Chair Jerome Powell will speak again this week and he’s got another chance to clarify how imminent a rate cut is. US consumer confidence and durable goods orders will be featured. But the most important one is probably PCE inflation on Friday.

Elsewhere, Eurozone CPI flash will also be an important factor on whether ECB could at least wait until September for policy actions. BoC will look into GDP and business outlook survey to solidify their neutral stance. BoJ summary of opinions might also reveal how close is the central bank on loosening policy further.

Here are some highlights for the week::

- Monday: Germany Ifo business climate.

- Tuesday: New Zealand trade balance; BoJ minutes, corporate service price index; UK CBI realized sales; Canada wholesale sales; US house price indices, consumer confidence, new home sales.

- Wednesday: RBNZ rate decision; Germany Gfk consumer sentiment; UK BoE inflation report hearings, BBA mortgage approvals; US durable goods orders, goods trade balance, wholesale inventories.

- Thursday: Japan retail sales; New Zealand ANZ business confidence; Germany CPI; US Q1 GDP final, jobless claims, pending home sales.

- Friday: UK Gfk consumer confidence; Japan Tokyo CPI, unemployment rate industrial production, BoJ summary of opinions; Germany import price, Eurozone CPI flash; Swiss KOF economic barometer; UK Q1 GDP final, current account; Canada GDP; US Personal income and spending, Chicago PMI; Canada BoC business outlook survey.

AUD/USD Daily Outlook

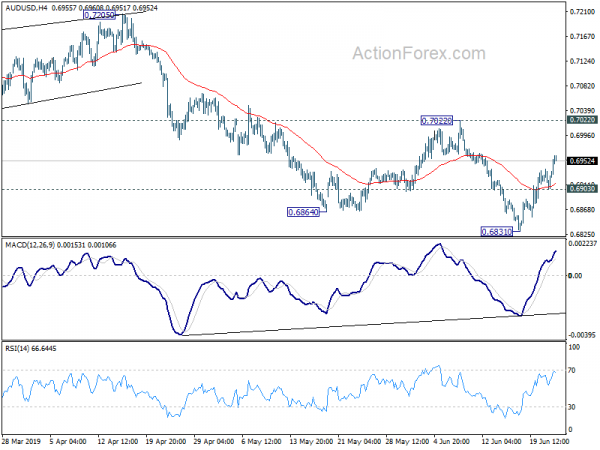

Daily Pivots: (S1) 0.6907; (P) 0.6922; (R1) 0.6942; More…

AUD/USD’s correctively recovery from 0.6831 might extend higher. But upside should be limited by 0.7022 resistance to bring fall resumption. On the downside, below 0.6903 minor support will turn bias to the downside for retesting 0.6831 low first. Break there will resume the decline from 0.7295 to 0.6722 low next. However, firm break of 0.7022 will indicate near term reversal and turn outlook bullish for 0.7205 resistance instead.

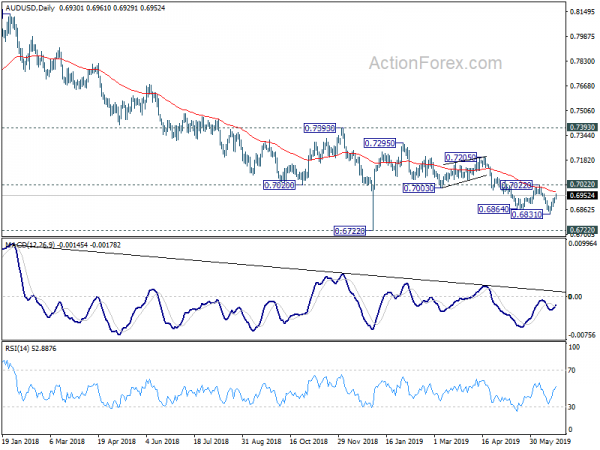

In the bigger picture, with 0.7393 key resistance intact, medium term outlook remains bearish. The decline from 0.8135 (2018 high) is seen as resuming long term down trend from 1.1079 (2011 high). Decisive break of 0.6826 (2016 low) will confirm this bearish view and resume the down trend to 0.6008 (2008 low). However, firm break of 0.7393 will argue that fall from 0.8135 has completed. And corrective pattern from 0.6826 has started the third leg, targeting 0.8135 again.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 08:00 | EUR | German IFO Business Climate Jun | 97.5 | 97.9 | ||

| 08:00 | EUR | German IFO Expectations Jun | 94.6 | 95.3 | ||

| 08:00 | EUR | German IFO Current Assessment Jun | 100.3 | 100.6 |