Dollar initially surged after Fed decided to double tapering pace and indicated there could be as many as three rate hikes next year. Nevertheless, the rally attempted was choked off by strong risk-on rally in stocks. Investors seemed to be relieved that firstly, Fed is still cautious on the developments with Omicron. Secondly, the uncertainty regarding pace of rate hike was removed. The greenback is still the strongest was for the week so far, but is kept inside last week’s range except versus Yen and Canadian. Focus will turn to BoE and ECB policy decisions today. SNB will be featured too be it’s more likely a non-event.

Suggested readings on Fed, ECB and BoE:

- Hawkish Fed Anticipates Three or More Rate Hikes Next Year

- FOMC Increases Tapering, Sees 3 Rate Hikes In 2022 AND 2023

- Fed Research Review: Catching Up to Reality – First Rate Hike Likely in May

- ECB Preview – Phase-Out of PEPP by March as Scheduled

- ECB Meeting: Shadow Tapering

- ECB Meeting: High Inflation Still Transitory Or Time To Talk Tapering?

- BOE Preview – Delaying Rate Hike to February 2022

- BoE Preview: Will The BoE Push Back To February?

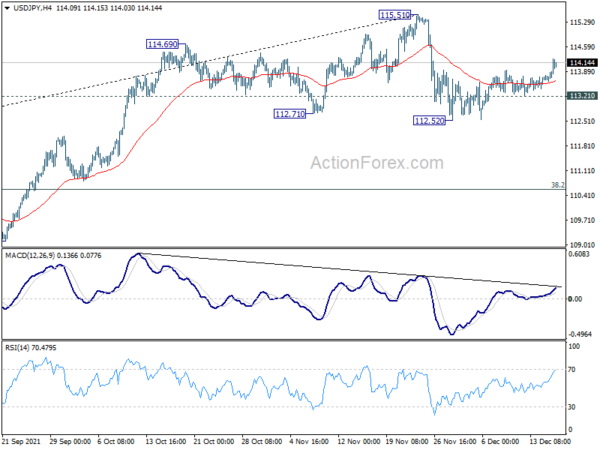

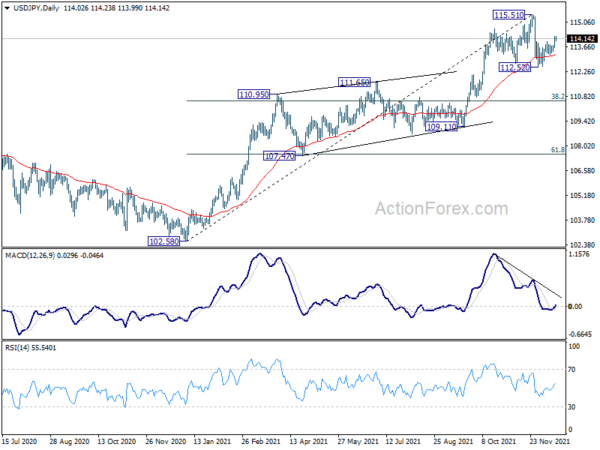

Technically, USD/JPY’s break of 133.94 minor resistance is sign a progress, as rebound from 112.52 is resuming towards 115.51 high. Yet, we’d maintain that the greenback will need to move out from near term ranges to confirm it’s direction. To be specific, the ranges to breakout from are 1.1185/1.3820 in EUR/USD, 1.3158/1.3351 in GBP/USD, 0.9156/0.9372 in USD/CHF and 112.52/115.51 in USD/JPY.

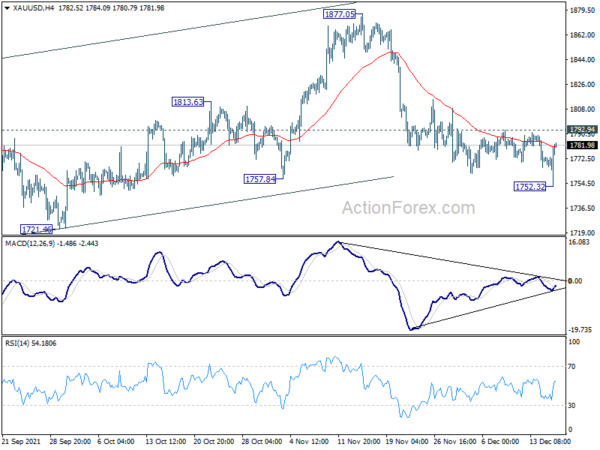

Gold spiked lower after Fed, but quickly recovered

Gold spiked lower to 1752.32 after Fed decided to double tapering pace while the new projections indicated three rate hikes next year. Yet, Gold quickly recovered and there was no follow through buying in Dollar.

For now, further fall will remain in favor in Gold as long as 1792.94 resistance holds. Break of 1752.32 will resume the decline from 1877.05 to 1721.46 first. Break there will target key long term support zone at 1676.55/1682.60.

However, strong break of 1792.94 will now bring sustained trading above 55 day EMA. Considering bullish convergence condition in 4 hour MACD too, that would signal complete of fall from 1877.05 and bring stronger rise back towards this resistance.

Japan exports rose 20.5% yoy in Nov, imports surged 43.8% yoy to record

Japan’s exports rose 20.5% yoy to JPY 7367B in November. That’s the ninth straight months of increase, helped by 4.1% rise in auto shipments. Exports to China rose 155.0% yoy. Imports rose 43.8% yoy to JPY 8322B. That’s the largest amount on record since 1979, jacked up by 144.1% yoy rise in fuels. Trade surplus came in at JPY 955B.

In seasonally adjusted terms, exports rose 5.3% mom to JPY 7385B. Imports rose 5.9% mom to 7872B. Trade balance reported a deficit of JPY -487B.

Japan PMI manufacturing dropped to 53.3, recovery sustained with softening momentum

Japan PMI Manufacturing dropped from 54.0 to 53.3 in December. PMI Services dropped from 53.0 to 51.1. PMI Composite dropped from 53.3 to 51.8.

Annabel Fiddes, Economics Associate Director at IHS Markit, said: “The latest Flash PMI data showed that the Japanese private sector recovery was sustained in December, rounding off the best quarterly performance since Q4 2018. However, both manufacturers and services companies signalled softer rates of output and new order growth compared to November, to suggest a softening of momentum.”

Australia employment rose 366.1k in Nov, unemployment dropped sharply to 4.6%

Australia employment rose 366.1k in November, above expectation of 200k. Full-time employment rose 128.3k. Part-time employment rose 237.8k. Unemployment rate dropped sharply from 5.2% to 4.6%, better than expectation of 5.0%. Participation rate also jumped 1.4% to 66.1%. Monthly hours worked in all job rose 4.5% mom.

Also released, PMI manufacturing dropped from 59.2 to 57.4 in December. PMI Services dropped from 55.7 to 55.1. PMI Composite dropped from 55.7 to 54.9.

New Zealand GDP contracted -3.7% qoq in Q3, better than expectation

New Zealand GDP dropped -3.7% qoq in Q3, better than expectation of -4.3% qoq. For the year, GDP contracted -0.3% yoy, versus expectation of -1.6% yoy. Services industries dropped -2.7% qoq. Goods-producing industries dropped -7.3% qoq. Primary industries dropped -3.1% qoq.

USD/JPY Daily Outlook

Daily Pivots: (S1) 113.70; (P) 113.98; (R1) 114.33; More…

USD/JPY’s rebound from 112.52 resumed by breaking 113.94 minor resistance and intraday bias is back on the upside for retesting 115.51 high. Firm break there will resume whole up trend from 102.58 and target 118.65 key long term resistance. On the downside, below 113.21 minor support will now likely resume the correction from 115.51 through 112.52 support.

In the bigger picture, no change in the view that rise from 102.58 is the third leg of the up trend from 101.18 (2020 low). Such rally should target a test on 118.65 (2016 high) on resumption. However, firm break of 109.11 structural support will argue that the trend might have reversed and bring deeper fall to 107.47 support and possibly below.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | GDP Q/Q Q3 | -3.70% | -4.30% | 2.80% | 2.40% |

| 21:45 | NZD | GDP Y/Y Q3 | -0.30% | -1.60% | 17.40% | 17.90% |

| 22:00 | AUD | Manufacturing PMI Dec P | 57.4 | 59.2 | ||

| 22:00 | AUD | Services PMI Dec P | 55.1 | 55.7 | ||

| 23:50 | JPY | Trade Balance (JPY) Nov | -0.49T | -0.32T | -0.44T | -0.42T |

| 0:30 | AUD | Employment Change Nov | 366.1K | 200.0K | -46.3K | -56.0K |

| 0:30 | AUD | Unemployment Rate Nov | 4.60% | 5.00% | 5.20% | |

| 8:15 | EUR | France Manufacturing PMI Dec P | 55.3 | 55.9 | ||

| 8:15 | EUR | France Services PMI Dec P | 55.6 | 57.4 | ||

| 8:30 | EUR | Germany Manufacturing PMI Dec P | 57 | 57.4 | ||

| 8:30 | EUR | Germany Services PMI Dec P | 51 | 52.7 | ||

| 8:30 | CHF | SNB Interest Rate Decision | -0.75% | -0.75% | ||

| 9:00 | EUR | Eurozone Manufacturing PMI Dec P | 57.7 | 58.4 | ||

| 9:00 | EUR | Eurozone Services PMI Dec P | 54.2 | 55.9 | ||

| 9:30 | GBP | Manufacturing PMI Dec P | 57.6 | 58.1 | ||

| 9:30 | GBP | Services PMI Dec P | 57.5 | 58.5 | ||

| 10:00 | EUR | Eurozone Trade Balance (EUR) Oct | 5.7B | 6.1B | ||

| 12:00 | GBP | BoE Interest Rate Decision | 0.10% | 0.10% | ||

| 12:00 | GBP | BoE Asset Purchase Facility | 875B | 875B | ||

| 12:00 | GBP | MPC Official Bank Rate Votes | 2–0–7 | 2–0–7 | ||

| 12:00 | GBP | MPC Asset Purchase Facility Votes | 0–3–6 | 0–3–6 | ||

| 12:45 | EUR | Eurozone ECB Interest Rate Decision | 0.00% | 0.00% | ||

| 13:30 | EUR | ECB Press Conference | ||||

| 13:30 | CAD | ADP Employment Change Nov | 65.8K | |||

| 13:30 | CAD | Wholesale Sales M/M Oct | 1% | |||

| 13:30 | USD | Housing Starts Nov | 1.57M | 1.52M | ||

| 13:30 | USD | Building Permits Nov | 1.67M | 1.65M | ||

| 13:30 | USD | Initial Jobless Claims (Dec 10) | 192K | 184K | ||

| 13:30 | USD | Philadelphia Fed Manufacturing Dec | 30 | 39 | ||

| 14:15 | USD | Industrial Production M/M Dec | 0.70% | 1.60% | ||

| 14:15 | USD | Capacity Utilization Dec | 76.70% | 76.40% | ||

| 14:45 | USD | Manufacturing PMI Dec P | 58.3 | |||

| 14:45 | USD | Services PMI Dec P | 58 | |||

| 15:30 | USD | Natural Gas Storage | -59B |