Forex traders are probably starting to put up guards ahead of the key events in FOMC rate tomorrow, ECB on Thursday, and NFP on Friday. Australian Dollar remains the top performer today, bolstered by RBA’s unexpected rate hike. However, there is no follow through buying after the initial spike. Meanwhile, Yen is attempting a recovery, though momentum appears weak. Sellers have shifted their attention to Canadian Dollar today, while European majors also show some weakness. Notably, Euro has shown no reaction to the released CPI data.

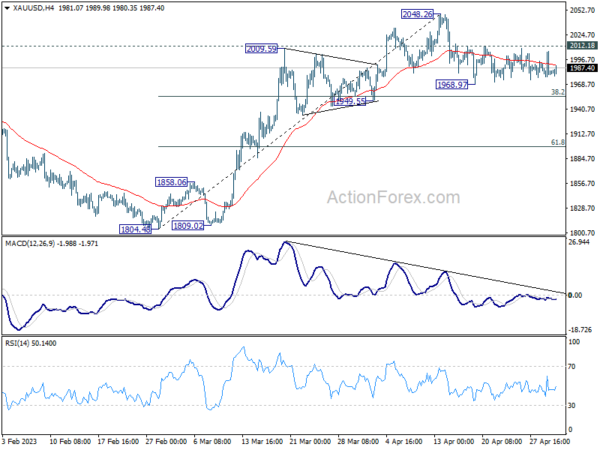

From a technical perspective, Gold will be in spotlight for the remainder of the week. The corrective pattern from 1968.97 implies that the pullback from 2048.26 is not yet complete. Downside breakout is mildly favored towards 1949.55 support zone (38.2% retracement of 1804.48 to 2048.26 at 1955.13). For now, robust support is expected in this area, which could lead to rebound. However, firm break of this support zone may trigger accelerated decline towards 61.8% retracement at 1897.60. If this scenario unfolds, it could coincide with a deeper correction in EUR/USD, pushing through 1.0908 support level .

In Europe, at the time of writing, FTSE is down -0.09%. DAX is down -0.33%. CAC is down -0.56%. Germany 10-year yield is up 0.0472 at 2.360. Earlier in Asia, Nikkei rose 0.12%. Hong Kong HSI rose 0.20%. China Shanghai SSE rose 1.14%. Singapore Strait Times rose 0.35%. Japan 10-year JGB yield rose 0.0201 to 0.423.

Eurozone CPI rose to 7.0% yoy in Apr, core CPI down to 5.6% yoy

Eurozone CPI accelerated from 6.9% yoy to 7.0% yoy in April, above expectation of 6.9% yoy. CPI core (all item excluding energy, food, alcohol & tobacco) slowed from 5.6% yoy to 5.7% yoy, below expectation of 5.7% yoy.

Looking at the main components, food, alcohol & tobacco is expected to have the highest annual rate in April (13.6%, compared with 15.5% in March), followed by non-energy industrial goods (6.2%, compared with 6.6% in March), services (5.2%, compared with 5.1% in March) and energy (2.5%, compared with -0.9% in March).

Eurozone PMI manufacturing finalized at 45.8, 35-month low

Eurozone PMI Manufacturing was finalized at 45.8 in April, a 35-month low. The index was also below the 50 no-change mark for a tenth straight month. PMI Manufacturing Output was finalized at 48.5, a 4-month low.

PMI Manufacturing of all major states declined in the month, and recorded contractionary reading except Greece (52.4). Ireland (48.6), France (45.6), the Netherlands (44.9), Germany (44.5) and Austria (42.0) were all at 35-month low. Spain was at 3-month low of 49.0 while Italy was at 6-month low at 46.8.

UK PMI manufacturing finalized at 47.8, remained in the doldrums

UK PMI Manufacturing was finalized at 47.8 in April, slightly down from March’s 47.9. Output, new orders, employment and stocks of purchases all contracted and vendor lead times improved (a sign of weaker demand for inputs hurting suppliers).

Rob Dobson, Director at S&P Global Market Intelligence, said: “The UK manufacturing sector remained in the doldrums at the start of the second quarter. Output and new orders contracted, as manufacturers felt the impacts of client uncertainty, destocking and tightening cost controls. There was no escape from the subdued mood of the market, with both domestic and export customers remaining reticent to commit to new contracts.”

RBA Lowe: The board is not on pre-set course

RBA Governor Philip Lowe reiterated in a speech that after today’s 25bps rate hike, “some further tightening of monetary policy may be required”. But he added the decision will “depend upon how the economy and inflation evolve”, and the central bank is “not on a pre-set course”. The Board will pay close attention to developments in the global economy, household spending, inflation and labor market outlook.

Lowe also explained today’s decision, and noted that while there was “confirmation” that inflation has peaked, ” it will be some time yet before inflation is back in the target range.” Labor market is “still very tight” and service inflation is “uncomfortably persistent abroad”.

He warned, “if people think inflation is going to remain high then, understandably, they will adjust their behaviour.” Firms will be more willing to put up their prices and workers will seek larger pay rises. If this adjustment in expectations were to happen, high inflation would become entrenched and the end result would be even higher interest rates and a poorer outlook for jobs.

RBA defies expectations with rate hike, may still require further tightening

In a surprising move, RBA raises cash rate target by 25bps to 3.85%, contrary to market expectations of a hold. Nevertheless, RBA softened its tightening bias, stating, “some further tightening of monetary policy may be required,” depending on “how the economy and inflation evolve.”

Despite acknowledging that Australian inflation “has passed its peak” and “recent data showed a welcome decline,” the central bank still expects inflation to be at 4.25%, slowing to 3% in mid-2025. That is, “it takes a couple of years before inflation returns to the top of the target range”. RBA added that services price inflation remains “still very high and broadly based” with upside risks, while goods inflation is decelerating.

RBA projects the economy to grow by 1.25% in 2023 and around 2% over the year to mid-2025. With anticipated below-trend economic growth, unemployment rate is forecast to gradually increase to around 4.5% in mid-2025.

RBNZ Hawkesby: Not currently seeing widespread financial distress amongst households or businesses

According to RBNZ Financial Stability Report, debt servicing costs for households with mortgages are expected to more than double by the end of the year. Despite this, household balance sheets remain resilient, with most having substantial equity buffers. Early-stage arrears have increased but remain low compared to post-Global Financial Crisis levels. Banks’ strong capital positions allow them to support customers, and borrowers facing stress are encouraged to seek assistance from their banks.

“We are not currently seeing widespread financial distress amongst households or businesses, which reflects the strength in the economy and labour market to date. However, more borrowers may fall behind on their payments this year, given the ongoing repricing of mortgages and expected weakening in the labour market,”Deputy Governor Christian Hawkesby says.

“Recent profitability and strong capital positions puts banks in a good position to take a long-term view and support their customers. We encourage borrowers encountering stress to talk to their banks, as hardship programmes may be available, and some customers may be able to temporarily switch to interest-only payments or increase the remaining term of their loan.”

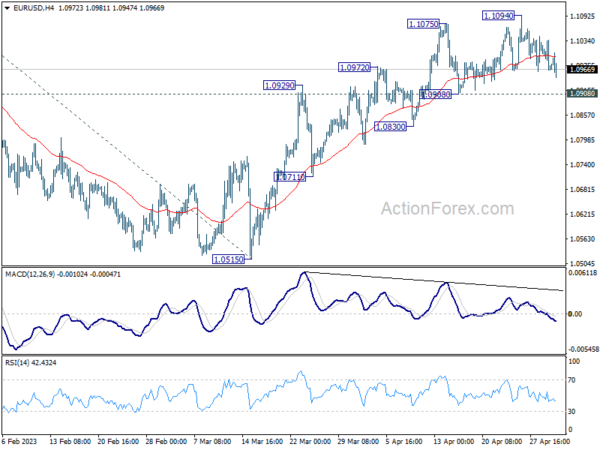

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.0949; (P) 1.0992; (R1) 1.1021; More…

EUR/USD is staying in sideway consolidation below 1.1094 and intraday bias remains neutral. Further rally is expected as long as 1.0908 support holds. Break of 1.1094 will resume larger up trend to 1.1273 fibonacci level. Break there will target 61.8% projection of 0.9534 to 1.1032 from 1.0515 at 1.1441 However, considering bearish divergence condition in 4H MACD, break of 1.0908 support will indicate short term topping and turn bias back to the downside.

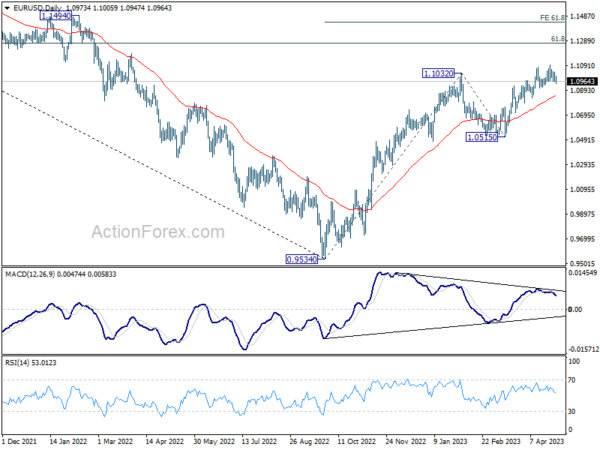

In the bigger picture, rise from 0.9534 (2022 low) is in progress for 61.8% retracement of 1.2348 (2021 high) to 0.9534 at 1.1273. Sustained break there will solidify the case of bullish trend reversal and target 1.2348 resistance next (2021 high). This will now remain the favored case as long as 1.0515 support holds, even in case of deeper pull back.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Monetary Base Y/Y Apr | -1.70% | -1.50% | -1.00% | |

| 04:30 | AUD | RBA Interest Rate Decision | 3.85% | 3.60% | 3.60% | |

| 06:00 | EUR | Germany Retail Sales M/M Mar | -2.40% | 0.40% | -1.30% | |

| 07:00 | CHF | SECO Consumer Climate Q2 | -30 | -22 | -30 | |

| 07:30 | CHF | Manufacturing PMI Apr | 45.3 | 50 | 47 | |

| 07:45 | EUR | Italy Manufacturing PMI Apr | 46.8 | 49 | 51.1 | |

| 07:50 | EUR | France Manufacturing PMI Apr F | 45.6 | 45.5 | 45.5 | |

| 07:55 | EUR | Germany Manufacturing PMI Apr F | 44.5 | 44 | 44 | |

| 08:00 | EUR | Eurozone Manufacturing PMI Apr F | 45.8 | 45.5 | 45.5 | |

| 08:00 | EUR | Eurozone M3 Money Supply Y/Y Mar | 2.50% | 3.10% | 2.90% | |

| 08:30 | GBP | Manufacturing PMI Apr F | 47.8 | 46.6 | 46.6 | |

| 09:00 | EUR | Eurozone CPI Y/Y Apr P | 7.00% | 6.90% | 6.90% | |

| 09:00 | EUR | Eurozone CPI Core Y/Y Apr P | 5.60% | 5.70% | 5.70% | |

| 14:00 | USD | Factory Orders M/M Mar | 0.80% | -0.70% |