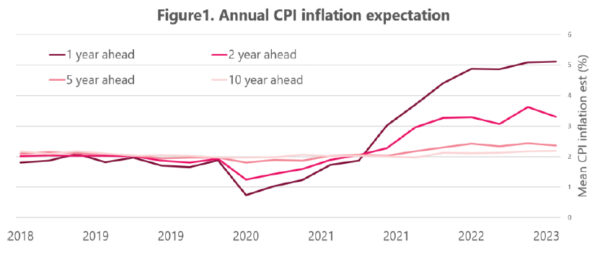

According to RBNZ Survey of Expectations (Business), one-year inflation expectations rose slightly from 5.08% to 5.11% in February quarter. The reading was similar to value from the 1990 survey when actual CPI was 7.60%.

On the other hand, two-year inflation expected dropped further from 3.62% to 3.30%. The spread also narrowed, with no respondent answering below 2.00% or above 6.00%.

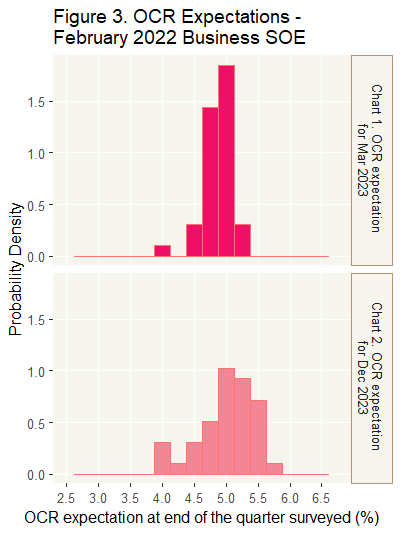

Official Cash Rate (OCR) expectations increased notably by 74 basis points from 4.25% to 4.89% by the end of this quarter. OCR is expected rise further to 5.00% by the end of the year, up from 4.67%.

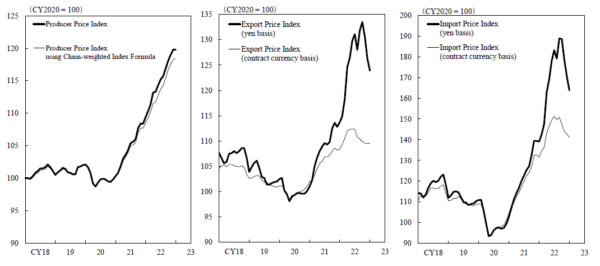

Japan GDP grew 0.2% in Q4 only, missed expectations

Japan GDP grew 0.2% qoq in Q4, below expectation of 0.5% qoq. In annualized term, GDP rose 0.6%, below expectation of 2.0%. GDP deflator rose 1.1% yoy, matched expectations. For the full year of 2022, GDP expanded 1.1%, slowed from 2021’s 2.1%.

Economy Minister Shigeyuki Goto said after the release, “Rising inflation and the global slowdown are risks… But corporate spending appetite hasn’t cooled … we’re not too pessimistic about the outlook.”

Finance Minister Shunichi Suzuki said, “With global monetary tightening continuing, the slowdown in overseas economies could still drag on Japan’s economy as well. We also need to pay attention to the impact from inflation, supply constraints, volatility in financial markets and the spread of Covid cases in China.”

Separately, it’s confirmed that the government nominated Kazuo Ueda as the next BoJ Governor, when Haruhiko Kuroda’s term ends on April 8. Ueda is a 71-year-old former BoJ board member and an academic at Kyoritsu Women’s University.