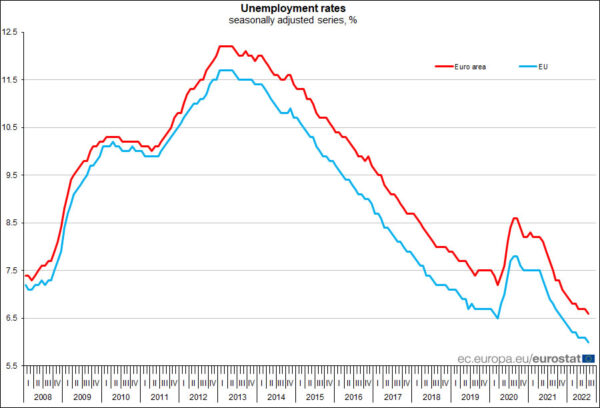

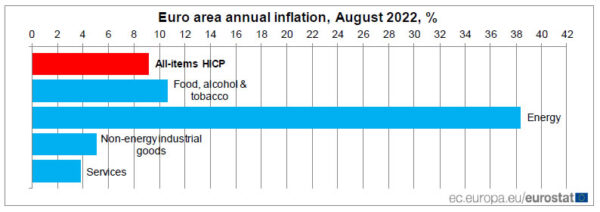

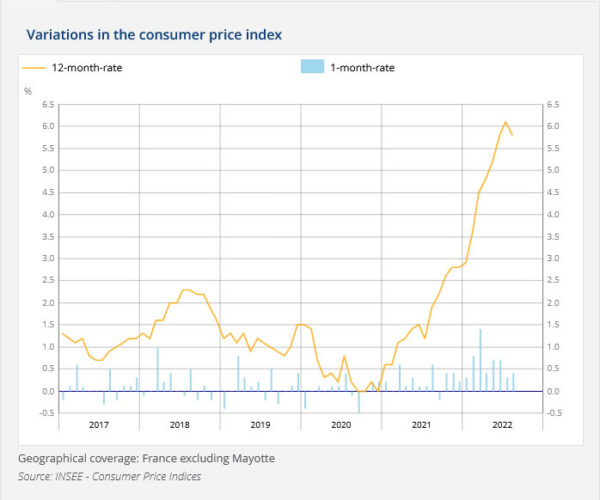

Bundesbank chief Joachim Nagel said yesterday that, “monetary policy must react decisively in order to preserve the credibility of the inflation target. Data from a number of countries shows that frontloading or bringing interest rate increases forward, reduces the risk of a painful economic downturn.”

“In my view, a larger interest rate hike reduces the risk of inflation expectations becoming de-anchored,” Nagel said. “We should not delay further rate hikes for fear of a possible recession. Inflation rates will not return to the central bank’s inflation target on their own.”

However, Governing Council member Yannis Stournaras said yesterday that there is “no need to take very large steps” on rate hike. “Gradual normalization will be appropriate.”

“In my view, this year, we will see the peak of inflation and a steady deceleration thereafter, inflation will gradually decline in 2023 and converge towards the target in 2024,” he added.

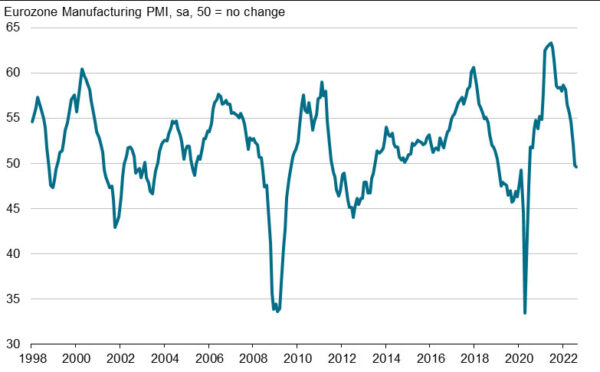

US ISM manufacturing unchanged at 52.8, prices dropped to 52.5, employment jumped to 54.2

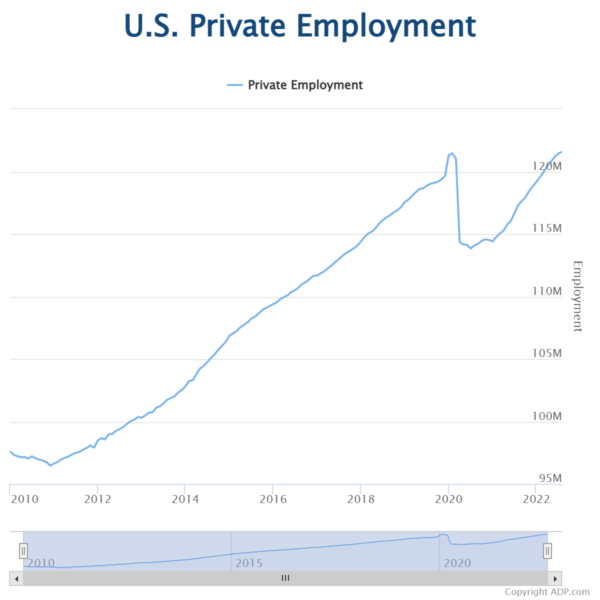

US ISM Manufacturing PMI was unchanged at 52.8 in August, slightly above expectation of 52.6. Looking at some details, new orders rose from 48.0 to 51.3. Production dropped from 53.5 to 50.4. Employment jumped from 49.9 to 54.2. Prices dropped sharply from 60.0 to 52.5.

ISM said: “Manufacturing performed well for the 27th straight month. With (1) supplier delivery performance recording its fourth straight month of improvement, (2) price increase growth slowing significantly for the second consecutive month, (3) hiring and total employment both positive and expanding and (4) lead times easing across all three categories of purchasing activity, the sector is at or approaching supply/demand equilibrium.”

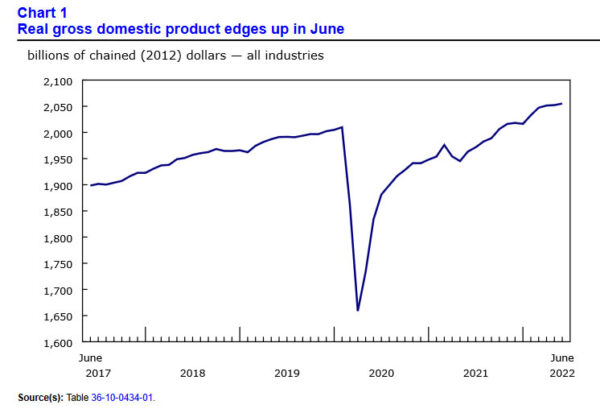

Also, “the past relationship between the Manufacturing PMI and the overall economy indicates that the Manufacturing PMI for August (52.8 percent) corresponds to a 1.4-percent increase in real gross domestic product (GDP) on an annualized basis.”

Full release here.