China’s GDP grew 6.5% yoy in Q4, accelerated from prior quarter’s 4.9% yoy, beat expectation of 6.1% yoy. Overall, GDP grew 2.3% in 2020, making it the only major economy that avoided a contraction, due to the coronavirus pandemic that started with outbreak in Wuhan.

December data were mixed. Industrial production grew 7.3% yoy, accelerated from 7.0% yoy, beat expectation of 6.9% yoy. Fixed asset investment grew 2.9% ytd yoy, below expectation of 3.2% ytd yoy. Retail sales grew only 4.6% yoy, slowed from 5.0% yoy, missed expectation of 5.50% yoy.

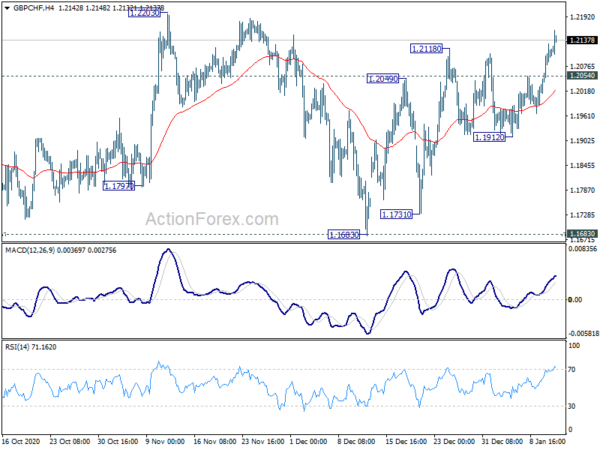

Hong Kong HSI trades mildly higher today in response to the releases. HSI is now pressing an important resistance level, with 100% projection of 21139.26 to 26782.61 from 23124.25 at 28767.60, as well as medium term channel. Decisive break of the level will confirm upside acceleration. More importantly, rise from 21139.26 should finally b e seen as developing into a long term up trend.

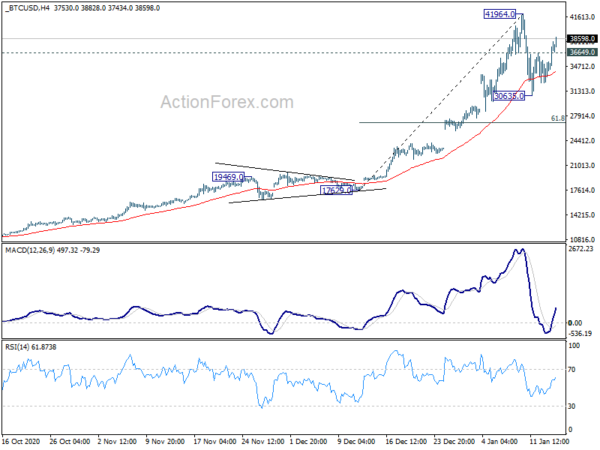

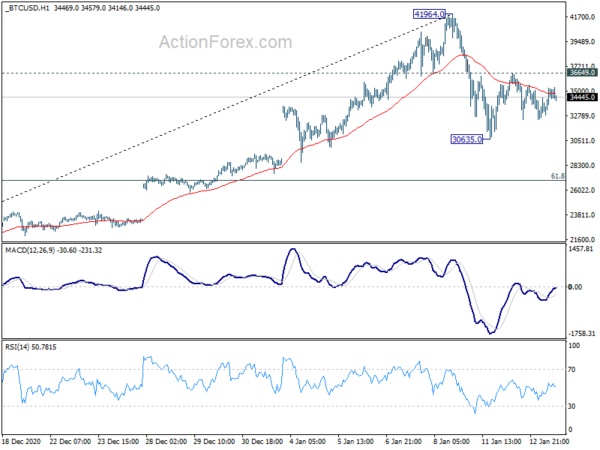

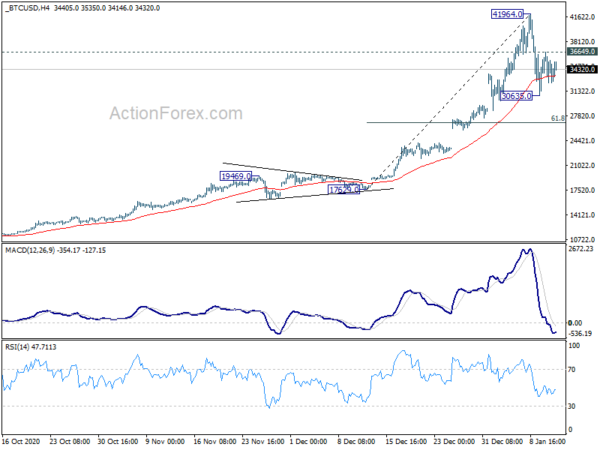

Bitcoin recovery capped at 40k, started third leg of consolidation pattern

Current development, with break of a near term channel, suggests that bitcoin’s recovery from 30635 has completed at 40000 already. Consolidation pattern from 41964 high should have started the third leg. Deeper decline is now in favor back to 30635.

For now, we’d expect strong support around 30k psychological level to contain downside. In case of a deeper than expected correction, bitcoin could dip into support zone between 100% projection of 41964 to 30635 from 40000 at 28671 and 38.2% retracement of 17629 to 41964 at 26924, before making a bottom.