Sample Category Title

Cliff Notes: Distilling the Trend

Key insights from the week that was.

The December Labour Force Survey was the only major release for Australia this week. After falling 28.7k in November, employment surged +65.2k, well above consensus (+27k) and even surpassing Westpac’s above-market forecast (+40k). We had expected the rebound in employment to occur alongside a bounce-back in labour force participation; but the participation rate only lifted marginally to 66.7%. This combination meant the unemployment rate surprised, falling from 4.3% to 4.1%.

Looking through the monthly volatility, the past few months results suggest the ‘gradual softening’ narrative, which prevailed through much of 2025, may have paused or come to an end. Jobs growth may be near or at its trough now the rapid deceleration in ‘care economy’ hiring has largely played out, and market sector hiring is starting to pick up. We still think the unemployment rate will drift higher over 2026, as labour force growth outpaces employment at the margin. There could also be some seasonal volatility in the mix, as has typically been the case through summer post-COVID. The next few months will be key to confirming the trend.

Given December’s stronger labour market read and evidence of a moderate consumer upswing, next week’s Q4 inflation data will once again be the deciding factor for the RBA’s February decision. We are forecasting trimmed mean inflation to print 0.7%qtr / 3.1%yr which should be enough to warrant the Board remain on hold. In this week’s essay, Chief Economist Luci Ellis discusses the risk of an upside surprise for inflation and the implications for the RBA.

Offshore, China’s Q4 GDP report showed the economy met its 5.0% target in 2025. However, the growth was narrowly based, with investment in high tech manufacturing capacity and consequent strong growth in exports driving the result as the construction sector continued to contract and consumer demand remained weak. December’s partial activity data makes clear that risks to growth are skewed to the downside into 2026, with retail sales growth slowing to 3.7%ytd in December and fixed asset investment contracting 3.8%ytd, driven primarily by weakness in the private sector. With active fiscal support, China can achieve growth circa 4.5% in 2026. But additional stimulus must focus on households, bolstering the outlook for both income and confidence. Decisive support to end construction’s long and deep contraction is also necessary.

In the US, the PCE price index rose 0.2% in November to be 2.8% higher over the year, broadly consistent with outcomes in October and September. Inflation remains above the FOMC’s 2% target and is expected to remain elevated as tariff effects slowly pass through to the consumer. Survey anecdotes suggest businesses are hesitant to pass on higher costs given heightened price sensitivity among consumers. While inflation is unlikely to re-accelerate meaningfully in 2026, it will remain materially above target and warrant modestly restrictive monetary policy. We expect the Committee to hold rates steady next week, followed by one last rate cut in March and an on-hold stance for the rest of the year.

Across the pond, the UK CPI rose 0.4% in December after a 0.2% fall in November. Annual inflation accelerated to 3.4%, supported by a 4.5% rise in services prices. The monthly gain was driven by volatile components, including a 5.5% month-on-month jump in airfares and a 1.0% lift in food prices. Fiscal measures, such as energy bill reductions and a freeze on rail fares, should contribute to disinflation in coming months. The unemployment rate meanwhile held steady at 5.1% in November, while average weekly earnings slowed slightly to 4.7%yr from a revised 4.8%yr. Employment declined, reflecting ongoing softness in hiring across retail and hospitality. We expect the Bank of England to continue easing through Q1 and Q2 to guard against downside risks to growth.

Consumers at a Crossroads

A genuine cyclical upswing in consumer spending is underway. This follows a long period of weakness and should not be assumed to be signalling a runaway inflationary boom.

- A genuine cyclical upswing in consumer spending is underway, and has been for most of the past year. December quarter looks to have been particularly strong, and not just a blip related to shifting patterns of pre-Christmas shopping.

- This upswing should not be interpreted as necessarily signalling a problematic inflationary boom. The weak growth in consumption of recent years would be the wrong basis of comparison for the subsequent recovery. If consumer demand really were straining against supply, the pattern of increases in inflation would be different, and consumption imports and credit growth would be stronger. But that is not what the latest data show.

- There are several possible scenarios for the outlook for consumption, some more benign than others. The key driver will be household income, which has (finally) recovered enough to allow people to spend more.

A genuine cyclical upswing in consumer spending is underway. It has been building since early last year, and the final quarter of 2025 looks to have been particularly strong, if the timely indicators are a guide. The ABS Household Spending Indicator (HSI) increased by 1% in the month of November, and October had been even stronger. While the HSI only covers a subset of total consumption, the timelier Westpac–DataX Card Tracker more closely matches total nominal spending and suggests the strength continued into December. We estimate quarterly growth in consumption to have been 2% in nominal terms, and 1% in real terms, and believe that there is upside risk to these estimates. Over the past 15 years or so, rates of growth of this magnitude have been rare outside post-lockdown bounce-backs.

The question is whether this is a lasting strong trend or a blip related to holiday spending. Seasonal adjustment processes are meant to adjust for pre-Christmas shopping, allowing observers to focus on underlying trends. When those seasonal patterns change, though, as they have been with the increasing popularity of Black Friday sales, this adjustment will not be complete. As in recent years, we therefore cannot be sure that all of the recent strength is true trend rather than a ‘head fake’ from shifting seasonality.

Despite these uncertainties, something genuine does seem to be going on. Real consumption growth has picked up. Even consumption per person is rising, after several years of stagnation. The fundamentals are consistent with this. Incomes are also recovering after languishing at 2018 levels until recently. Real disposable income per person is now back close to the pre-pandemic trend. Lower inflation and the Stage 3 tax cuts reduced the squeeze on real incomes; lower interest rates also helped a little. Wealth effects from higher housing prices would also have been supporting spending over and above these income effects.

Nor is this a ‘K-shaped’ economy story where the recovery is narrowly based on spending by the already well-off. Data from our Westpac–DataX Consumer Panel to December show that the recovery in spending has been broad-based across income groups. Even consumers in the lowest tax bracket, whose spending had previously lagged, are now seeing a turnaround. Nominal spending is growing at a reasonable clip across age groups, too. The pattern seen in 2023, when spending growth lagged and even turned negative for the under-35s while older consumers’ spending remained strong, has long since passed.

We are cautious about interpreting the current upswing as a new, inflationary boom. Context is important: the gains come after several years of weakness. Interpreting that period of weakness as the new trend would be the wrong basis for comparison. The latest outcomes are not necessarily a story of rampant demand straining against stagnant supply. Leave aside our longstanding view that trend growth in supply capacity is a bit faster than the RBA and some others seem to think: the downstream effects that you would expect to see in a weaker-supply scenario are simply not in evidence.

If consumer demand really were outstripping supply, one should expect to see the effect on inflation more or less immediately; the effect of actual spending on prices is not the ‘long and variable lags’ that apply to monetary policy. While inflation did kick up in Q3 2025, the monthly data (such as they are) for Q4 so far have been less clear-cut. If this really were a demand boom, one should also expect to see the pick-up in inflation being more skewed to categories where domestic demand might play a role, like market services and some retail goods, rather than the administered prices (water, council rates) and obvious global supply shocks (meat, coffee) that dominated the list of inflation components with the highest inflation rates in recent months.

Nor do we see much of a pick-up in consumption import volumes, which would be a normal release valve in the face of a sudden upswing in domestic demand. Even overseas travel is lagging the levels it would have reached had pre-pandemic trend growth continued. One might also expect to see stronger household credit growth relative to household incomes than has been the case until recently.

This upswing in spending, though genuine, poses something of a conundrum: consumer sentiment remains pessimistic, even as people spend more. Only outright homeowners – those without mortgages – are net optimistic as a group. Renters and households with mortgages are mostly pessimistic, and increasingly so in recent months as the interest rate outlook has turned.

Is this disconnect a case of false consciousness, with people feeling worse off even though they are spending more? There is evidence to suggest that people react badly to the way past inflation lifts price levels, even after the inflation itself has passed. We also know that it is usual for most people to say that they are not better off than before, but be more optimistic about their future finances.

Or is the disconnect between spending and sentiment telling us something about the recovery, i.e. that it is more fragile than it looks? It is hard to escape the conclusion that consumption has been able to recover only because real incomes have recovered. There is a pathway where solid employment and income growth, and thus consumption, continues to recover. But that is a pathway where overall GDP growth is decent, not one where demand challenges stagnant supply.

Less benign is the scenario that sees spending growth realign with weak sentiment: the one where the recovery in spending starts to fade. For most of 2025, the labour market was easing gradually, as the economy pivoted from growth driven by the jobs-rich ‘care economy’ to the more dynamic, but less employment-intensive, market sector. The December labour data went the other way, putting into question whether that trend will continue. If it does, income growth will moderate by more than we currently expect, especially given wages growth has been relatively benign so far this cycle. And with growth in housing prices already softening in the two largest cities as the outlook for rates shifted, any positive wealth effects in play could also peter out. Suffice to say that this scenario, of a return to sluggish growth in consumer spending, is not our base case or even a major risk, but it is plausible.

Before reaching for a particular narrative to explain an outcome, be sure to guard against getting stuck in the past. It isn’t 2023 anymore. Australia is neither just emerging from a period of disrupted supply chains nor contending with a temporary surge in population growth to catch up from the effects of closed borders. It is also important to triangulate against multiple data sources, to ask, “if this were true, what else would we expect to see?”, and “what would we need to see to change our minds?”. And to be fair, it is possible that the current upswing evolves into something more exuberant over the course of this year. That is not what the latest consumption data imply, though. Consumers have been spending more because they (finally) have more income to spend. We expect this to continue – even with some moderation in income growth back towards pre-pandemic averages – and do not necessarily see it as cause for alarm.

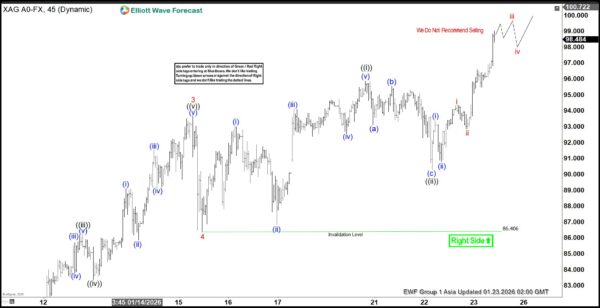

Silver (XAGUSD) Elliott Wave: Strong Impulsive Rally Unfolding

Silver (XAGUSD) continues to demonstrate a powerful impulsive rally, advancing steadily toward new all-time highs. The short-term cycle that began from the January 15, 2026 low is unfolding as a clear impulse five-wave rally. From that date, wave (i) concluded at $93.03, followed by a corrective pullback in wave (ii) that ended at $86.83. Momentum then carried the market higher, with wave (iii) reaching $94.12 before another modest retracement in wave (iv) down to $92.56. The final leg higher, wave (v), extended to $95.86, thereby completing wave ((i)) of a higher degree structure.

After this initial advance, silver entered a corrective phase in wave ((ii)), forming a zigzag pattern. From the peak of wave ((i)), wave (a) declined to $93.09, while wave (b) rallied back to $95.56. The market then resumed its downward move in wave (c), reaching $90.29 and completing wave ((ii)) at the higher degree. With this correction finished, silver has resumed its upward trajectory in wave ((iii)), signaling renewed strength in the impulsive sequence.

The potential upside target for wave ((iii)) is projected using the 100% to 161.8% Fibonacci extension of wave ((i)). This range lies between $99.75 and $105.6, offering a significant zone of interest for traders and investors. In the near term, as long as the pivot at $86.4 remains intact, dips are expected to attract buyers. Market participants should anticipate renewed demand in sequences of three, seven, or eleven swings, reinforcing the bullish outlook and supporting further upside momentum.

Silver (XAGUSD) 45 minute chart

XAGUSD Elliott Wave video:

https://www.youtube.com/watch?v=S99JkLpZ-N4

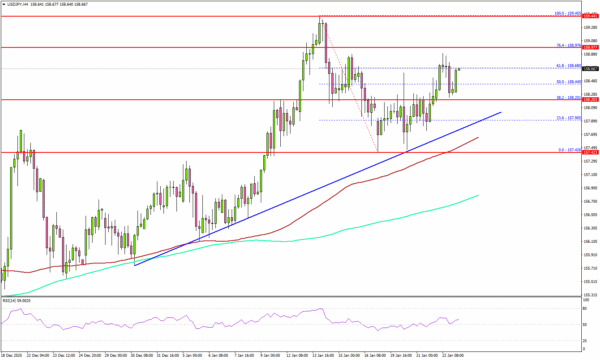

USD/JPY Upside Resumes, Opening Door To Further Gains

Key Highlights

- USD/JPY started another increase from the 157.50 support.

- A major bullish trend line is forming with support at 158.00 on the 4-hour chart.

- AUD/USD and NZD/USD gained bullish momentum and outperformed other majors.

- Gold started a consolidation phase after trading to a new record high above $4,880.

USD/JPY Technical Analysis

The US Dollar remained stable near 157.50 against the Japanese Yen. USD/JPY formed a base and started a fresh increase above 158.00.

Looking at the 4-hour chart, the pair climbed above 158.20 and the 50% Fib retracement level of the downward move from the 159.45 swing high to the 157.42 low. The pair is now well above the 200 simple moving average (green, 4-hour) and the 100 simple moving average (red, 4-hour).

Immediate resistance sits near 159.00 and the 76.4% Fib retracement level of the downward move from the 159.45 swing high to the 157.42 low. A close above 159.00 could open the doors for a move toward 159.50. Any more gains could set the pace for a steady increase toward 150.00.

If there is no move above 149.00, there could be a fresh downside correction. On the downside, immediate support is near the 158.20 level. The first major area for the bulls might be near 158.00.

There is also a major bullish trend line forming with support at 158.00. A close below 158.00 might spark heavy bearish moves. The next support could be 157.50 or the 100 simple moving average (red, 4-hour), below which the bears might aim for a move toward the 200 simple moving average (green, 4-hour) at 156.80.

Looking at Gold, the price started a consolidation phase, but the bulls might soon aim for more gains above the $4,880 zone.

Upcoming Key Economic Events:

- US S&P Global Manufacturing PMI for Jan 2026 (Preliminary) – Forecast 52.1, versus 51.8 previous.

- US S&P Global Services PMI for Jan 2026 (Preliminary) – Forecast 52.8, versus 52.5 previous.

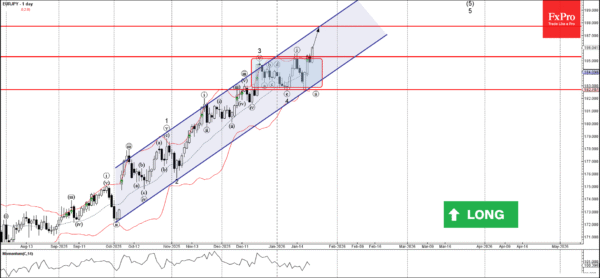

EURJPY Wave Analysis

EURJPY: ⬆️ Buy

- EURJPY broke resistance level 185.30

- Likely to rise to resistance level 188.00

EURJPY currency pair recently broke above the resistance level 185.30 (which is the upper border of the sideways price range inside which the price has been moving from December).

The breakout of this resistance level 185.30 accelerated the active impulse waves 5 and (5).

Given the strong daily uptrend, rising daily Momentum and the strongly bearish yen sentiment see across the FX markets today, EURJPY currency pair can be expected to rise to the next resistance level 188.00.

Eco Data 1/23/26

| GMT | Ccy | Events | Act | Cons | Prev | Rev |

|---|---|---|---|---|---|---|

| 21:45 | NZD | CPI Q/Q Q4 | 0.60% | 0.50% | 1.00% | |

| 21:45 | NZD | CPI Q/Q Q4 | 3.10% | 3.00% | 3.00% | |

| 22:00 | AUD | Manufacturing PMI Jan P | 52.4 | 51.6 | ||

| 22:00 | AUD | Services PMI Jan P | 56 | 51.1 | ||

| 23:30 | JPY | National CPI Y/Y Dec | 2.10% | 2.90% | ||

| 23:30 | JPY | National CPI Core Y/Y Dec | 2.40% | 2.40% | 3.00% | |

| 23:30 | JPY | National CPI Core-Core Y/Y Dec | 2.90% | 3.00% | ||

| 00:01 | GBP | GfK Consumer Confidence Jan | -16 | -16 | -17 | |

| 00:30 | JPY | Manufacturing PMI Jan P | 51.5 | 50.1 | 50 | |

| 00:30 | JPY | Services PMI Jan P | 53.4 | 51.6 | ||

| 03:07 | JPY | BoJ Interest Rate Decision | 0.75% | 0.75% | 0.75% | |

| 06:30 | JPY | BoJ Press Conference | ||||

| 07:00 | GBP | Retail Sales M/M Dec | 0.40% | 0.00% | -0.10% | |

| 08:15 | EUR | France Manufacturing PMI Jan P | 51 | 50.5 | 50.7 | |

| 08:15 | EUR | France Services PMI Jan P | 47.9 | 50.4 | 50.1 | |

| 08:30 | EUR | Germany Manufacturing PMI Jan P | 48.7 | 47.6 | 47 | |

| 08:30 | EUR | Germany Services PMI Jan P | 53.3 | 52.5 | 52.7 | |

| 09:00 | EUR | Eurozone Manufacturing PMI Jan P | 49.4 | 49.3 | 48.8 | |

| 09:00 | EUR | Eurozone Services PMI Jan P | 51.9 | 52.6 | 52.4 | |

| 09:30 | GBP | Manufacturing PMI Jan P | 51.6 | 50.4 | 50.6 | |

| 09:30 | GBP | Services PMI Jan P | 54.3 | 51.7 | 51.4 | |

| 13:30 | CAD | Retail Sales M/M Nov | 1.30% | 1.20% | -0.20% | -0.30% |

| 13:30 | CAD | Retail Sales ex Autos M/M Nov | 1.70% | 1.10% | -0.60% | |

| 14:45 | USD | Manufacturing PMI Jan P | 51.9 | 52.1 | 51.8 | |

| 14:45 | USD | Services PMI Jan P | 52.5 | 52.8 | 52.5 | |

| 15:00 | USD | UoM Consumer Sentiment Jan F | 56.4 | 54 | 54 | |

| 15:00 | USD | UoM 1-Yr Inflation Expectations Jan F | 4.00% | 4.20% |

| 21:45 | NZD |

| CPI Q/Q Q4 | |

| Actual | 0.60% |

| Consensus | 0.50% |

| Previous | 1.00% |

| 21:45 | NZD |

| CPI Q/Q Q4 | |

| Actual | 3.10% |

| Consensus | 3.00% |

| Previous | 3.00% |

| 22:00 | AUD |

| Manufacturing PMI Jan P | |

| Actual | 52.4 |

| Consensus | |

| Previous | 51.6 |

| 22:00 | AUD |

| Services PMI Jan P | |

| Actual | 56 |

| Consensus | |

| Previous | 51.1 |

| 23:30 | JPY |

| National CPI Y/Y Dec | |

| Actual | 2.10% |

| Consensus | |

| Previous | 2.90% |

| 23:30 | JPY |

| National CPI Core Y/Y Dec | |

| Actual | 2.40% |

| Consensus | 2.40% |

| Previous | 3.00% |

| 23:30 | JPY |

| National CPI Core-Core Y/Y Dec | |

| Actual | 2.90% |

| Consensus | |

| Previous | 3.00% |

| 00:01 | GBP |

| GfK Consumer Confidence Jan | |

| Actual | -16 |

| Consensus | -16 |

| Previous | -17 |

| 00:30 | JPY |

| Manufacturing PMI Jan P | |

| Actual | 51.5 |

| Consensus | 50.1 |

| Previous | 50 |

| 00:30 | JPY |

| Services PMI Jan P | |

| Actual | 53.4 |

| Consensus | |

| Previous | 51.6 |

| 03:07 | JPY |

| BoJ Interest Rate Decision | |

| Actual | 0.75% |

| Consensus | 0.75% |

| Previous | 0.75% |

| 06:30 | JPY |

| BoJ Press Conference | |

| Actual | |

| Consensus | |

| Previous | |

| 07:00 | GBP |

| Retail Sales M/M Dec | |

| Actual | 0.40% |

| Consensus | 0.00% |

| Previous | -0.10% |

| 08:15 | EUR |

| France Manufacturing PMI Jan P | |

| Actual | 51 |

| Consensus | 50.5 |

| Previous | 50.7 |

| 08:15 | EUR |

| France Services PMI Jan P | |

| Actual | 47.9 |

| Consensus | 50.4 |

| Previous | 50.1 |

| 08:30 | EUR |

| Germany Manufacturing PMI Jan P | |

| Actual | 48.7 |

| Consensus | 47.6 |

| Previous | 47 |

| 08:30 | EUR |

| Germany Services PMI Jan P | |

| Actual | 53.3 |

| Consensus | 52.5 |

| Previous | 52.7 |

| 09:00 | EUR |

| Eurozone Manufacturing PMI Jan P | |

| Actual | 49.4 |

| Consensus | 49.3 |

| Previous | 48.8 |

| 09:00 | EUR |

| Eurozone Services PMI Jan P | |

| Actual | 51.9 |

| Consensus | 52.6 |

| Previous | 52.4 |

| 09:30 | GBP |

| Manufacturing PMI Jan P | |

| Actual | 51.6 |

| Consensus | 50.4 |

| Previous | 50.6 |

| 09:30 | GBP |

| Services PMI Jan P | |

| Actual | 54.3 |

| Consensus | 51.7 |

| Previous | 51.4 |

| 13:30 | CAD |

| Retail Sales M/M Nov | |

| Actual | 1.30% |

| Consensus | 1.20% |

| Previous | -0.20% |

| Revised | -0.30% |

| 13:30 | CAD |

| Retail Sales ex Autos M/M Nov | |

| Actual | 1.70% |

| Consensus | 1.10% |

| Previous | -0.60% |

| 14:45 | USD |

| Manufacturing PMI Jan P | |

| Actual | 51.9 |

| Consensus | 52.1 |

| Previous | 51.8 |

| 14:45 | USD |

| Services PMI Jan P | |

| Actual | 52.5 |

| Consensus | 52.8 |

| Previous | 52.5 |

| 15:00 | USD |

| UoM Consumer Sentiment Jan F | |

| Actual | 56.4 |

| Consensus | 54 |

| Previous | 54 |

| 15:00 | USD |

| UoM 1-Yr Inflation Expectations Jan F | |

| Actual | 4.00% |

| Consensus | |

| Previous | 4.20% |

Greenland Tensions Ease, But Forecasts for Gold Still Very Optimistic

- Gold prices steadied near $4 880 an ounce, just below record highs, after tensions over Greenland eased following a diplomatic breakthrough between Donald Trump, Europe, and NATO, temporarily cooling safe-haven demand.

- Geopolitical risk and concerns over U.S. monetary policy independence continue to support gold.

- Goldman Sachs Group Inc. raised its year-end gold price forecast to $5,400 an ounce, citing strong demand from private investors and central banks, while silver and other precious metals also extended gains.

Gold stabilizes after a political storm

Daily timeframe of Gold, source: TradingView

Gold prices steadied near $4 880 an ounce, very close to yesterday's all-time high, after tensions surrounding Greenland eased. For several sessions, the metal had hovered close to record levels, fueled by demand for safe-haven assets amid escalating diplomatic strains.

Important was shift in tone from the White House. Donald Trump withdrew the threat of tariffs against Europe following an agreement with allies on a “framework for a future deal” concerning Greenland.

Greenland, NATO, and financial markets

The understanding announced after talks with NATO Secretary General Mark Rutte includes a strengthened NATO presence, the stationing of U.S. missile systems, and rules governing mining rights—aimed at limiting Chinese influence in the region. The meeting at the World Economic Forum in Davos “took some of the temperature out of U.S.–EU tensions,” although there are still “plenty of dip-buyers” supporting gold prices.

Goldman Sachs raises its forecast

Despite the near-term cooling, the outlook for gold remains robust. Goldman Sachs Group Inc. lifted its year-end gold price forecast to $5 400 an ounce, citing intensifying demand from private investors and central banks. Analysts emphasized that risks are “significantly skewed to the upside” amid lingering global policy uncertainty.

Silver and other metals also advance

Daily Timeframe of Silver, source: TradingView

Silver climbed as much as 2.8% and reach new all-time high at $96 an ounce and reversing earlier losses. Over the past year, prices have tripled, boosted by a historic short squeeze and heavy retail buying. Platinum and palladium also edged higher, while the Bloomberg Dollar Spot Index slipped slightly, offering additional support to precious metals.

What’s next?

Gold underlying fundamentals remain strong. Geopolitics, monetary policy, and structural investment demand continue to keep gold—and precious metals more broadly—firmly in the global market spotlight.

Natural Gas Explodes by 70% in Four Sessions: What’s Next?

- Natural Gas explodes to up 70% since the Friday close

- Supply bottlenecks, geopolitical tensions and oversold prices build a cocktail for price explosion

- Exploring Technical Levels for Natural Gas

Natural Gas, historically highly correlated with WTI Oil, has largely decoupled over the past four sessions.

While the weekly correlation ranged between 0.20 and 1.00 since 2020, it has turned close to negative in late 2025.

Since the Sunday open, US Natural Gas prices have exploded by approximately 60%.

While initially attributed to fears of European supply disruptions amid recent EU-US trade tensions, the reality is more complex.

US output sits at decade lows.

Persistently low prices have disincentivized production following the record output of 2023-2024, creating a supply bottleneck just as the Northern Hemisphere enters its coldest period.

This winter differs significantly from recent years. Previous warm seasons created storage gluts and led to assumptions that milder winters were the new norm. However, the current reality is harsh (This current winter is a cold one, based in Montreal I can only confirm), challenging those assumptions.

Simultaneously, power generation demand is surging.

The need to power AI data centers and metal smelting operations—sectors currently seeing high demand—is outpacing futures delivery schedules, fueling this price acceleration.

Stress on the system is amplified by the US's role as the world's leading LNG exporter, particularly to Europe following the closure of Russian supply routes.

Consequently, demand spikes or supply troughs in Europe now have immediate impacts on US spot prices.

The market is facing a perfect storm: a severe winter, rising global energy demand, and escalating tensions between key suppliers and constrained consumers.

Add to this the instability in Iran—holder of the second-largest proven gas reserves—and persistent global conflicts, and the result is an explosive mix for prices.

We will now dive into the Natural Gas charts, ranging from daily to intraday timeframes, to identify the trajectory of this squeeze, potential retracement levels, and historical context.

Natural Gas Multi-Timeframe Technical Analysis

Weekly Chart

Natural Gas (ETF) Weekly Chart – January 22, 2026 – Source: TradingView

Natural Gas is posting a gigantic Bullish Marabozu candle (which doesn't show any wicks) indicating high pressure to the current Market.

Now breaking outside of its 2024 Upward Channel, further upside could easily be warranted.

The RSI is quickly moving to overbought levels and the daily action faces a short-term challenge at the 2022 Pivotal Resistance ($5.25 to $5.50).

Current prices remain about 40% to the 20-Week MA highs (which got up to $7.194)!

To trade Natural gas with close precision and further clues on physical supply/demand balances, keep a close eye on the EIA's daily reports – Today In Energy.

Moving averages will be long to catch up to such a squeeze and won't serve as ideal technical indicators on higher timeframes (Weekly, Daily).

One may rather look for support and resistance levels and Fibonacci-retracements for entries and exits.

Daily Chart and Technical Levels

Natural Gas (ETF) Daily Chart – January 22, 2026 – Source: TradingView

The 75% rise since Friday close is a frightening picture – This weekly close will be very key for upcoming action. See why on the intraday timeframe just below.

Levels of interest for Natural Gas trading

Resistance Levels

- $5.30 to $5.50 Immediate Resistance

- $5.68 Session and Weekly Highs

- 2022 Key Pivot (As Resistance) $6.00 to $6.20

- December 2022 Resistance level $6.60 to $6.95

- August 2022 Record $10.15

- ATH in 2005 at $15.51

Support Levels

- $5.00 to $5.20 Break-Retest support

- $5.00 Psychological mini-support

- $4.60 to $4.75 Major Momentum Pivot (61.8% Fib)

- $4.20 Pivotal Support ($4.10 4H MA 50)

- $3.60 Monday Support and 200-Day MA

- $3.00 August 2025 Support

2H Chart

Natural Gas (ETF) 2H Chart – January 22, 2026 – Source: TradingView

Despite the extreme squeeze throughout the past few days, the action is reacting to some overbought levels and marking intermediate tops.

With the current $5.67 Wick being rejected, Nat Gas is reacting well to the $5.30 to $5.50 Resistance Zone, which will act as key barometer for bull/bear strength:

- Breaking above on the Daily hints at a quick test of the $6.00 Resistance

- Remaining here indicates a short-term pullback to the $5.00-$5.20 Break-Retest support – Look at the 2H 20-period MA.

- Correcting then bouncing from there would be the most sustainable bull-path for the commodity

- Breaking the $5.00 Support however should see a calmer price-action, extending the potential correction to $4.60 which will be an interesting Pivotal Support area.

Safe Trades!

US: Consumer Spending Remains Resilient, Outpacing Income

Personal income rose 0.3% month-over-month (m/m) in November, up from 0.1% m/m in October (also released today) and slightly below expectations. On an inflation adjusted basis, personal income was up just 0.1% m/m in November, and down 0.1% in October.

Consumer spending grew by 0.5% month-over-month in nominal terms, matching the pace seen in October and aligning with market expectations. After adjusting for inflation, the real spending rose by 0.3% m/m in both October and November.

Examining the broad categories, spending on both goods and services rose in real terms in both October and November. Spending on goods rose by 0.6% in November, following a 0.4% m/m gain in October. Spending on services increased by 0.3% in November, following a 0.2% gain in the prior month.

With spending outpacing income, the personal saving rate declined to 3.5% in November, down from 3.7% in the prior month and 4.9% a year ago. This marks the first time saving rate dipped below 4% since 2022.

Inflation remains persistently elevated above the Fed's 2% target. Core PCE – the Fed's preferred inflation gauge – rose by 0.2% in both October and November, on par with the pace seen prior to the shutdown. In annual terms, core PCE inflation was up 2.8% year-over-year in November, up slightly from 2.7% pace seen in October.

Key Implications

Personal spending was robust through the first two months of Q4 2025, echoing other indicators, such as retail sales, and suggesting that consumer spending remained more resilient throughout the lengthy government shutdown than expected. In volume terms, consumer spending was up 0.6% from September, putting our estimate of Q4 2025 PCE growth at 3.0% (annualized) – not much slower than the 3.5% pace seen in Q3 but considerably higher than originally projected. It was also notable that spending continued to outpace income, with saving rate falling to levels not seen since late-2022 when core measures of inflation were around their peak. Evidently, households are saving less or dipping into their savings to maintain the spending momentum, particularly during the period where some payments were disrupted by the government shutdown.

We expect consumer spending to remain robust at the start of 2026. Consumers should benefit from past interest rate cuts, some stabilization in the labor market, and ongoing accumulation in wealth. The fiscal boost from higher OBBBA-linked tax refunds—which are expected to arrive between February and April—should also provide another tailwind to household income and spending. This robust spending momentum and steady inflationary backdrop provide the FOMC with reasons to remain patient regarding further rate cuts when its members meet next week.

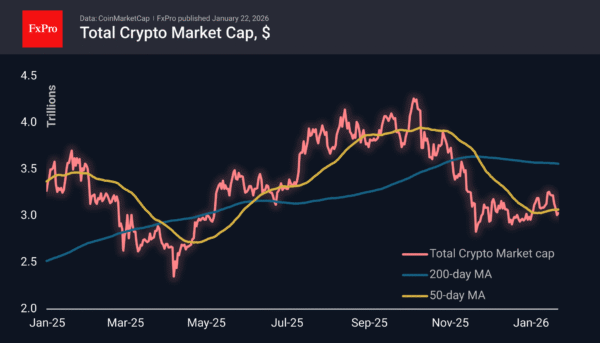

Cryptos Remain Laggards With Weak Rebound

Market Overview

The crypto market cap grew by less than 1% to $3.04 trillion. Since October, it has become the norm for cryptocurrencies to pay particular attention to negative news and react weakly to positive news. This time, the impressive rebound in stock markets only helped stop the sell-off in the crypto market and led to a modest rebound in cryptocurrencies from local lows. The momentum of the rebound was not even enough to overcome the 50-day moving average, underscoring the current dominance of bearish sentiment in the crypto market.

The sentiment index further highlights the extreme fear, losing 41 points over the last seven days of decline. After touching the greed zone last week, profit-taking emerged. While risk sentiment improved following developments in Davos yesterday, it was not strong enough to trigger a sustainable rebound in crypto.

Bitcoin jumped from $87K to above $90K at the end of the day on Wednesday, but has since faced active selling as it approaches the round level, although it has not experienced significant declines due to increased risk appetite. Technically, BTC remains just below its 50-day moving average and below the former support line of the uptrend. Despite yesterday’s retreat from local lows in Bitcoin, the picture remains bearish with a higher chance of a resumption of the decline, at least to $84K, and to $80K with a more extreme downward momentum.

News Background

Markets have gone into ‘defensive mode’ due to economic turmoil in Japan and political tensions, according to QCP Capital. Instead of acting as a hedge, the first cryptocurrency is behaving like a risky asset, sensitive to interest rates and macroeconomics.

For the first time in history, control of the market has shifted from long-term holders to ‘new’ whales who entered the market in the late stages of the cycle, CryptoQuant points out. The average purchase price for this group is around $98K. And until the market absorbs their loss-making supply, sales will prevail in BTC.

In the first half of the year, the crypto market may fall by 15-20%, and its recovery will begin in the fourth quarter, said BitMine CEO Tom Lee. In his opinion, Bitcoin will retain its status as digital gold and could reach $250,000 in the long term.

Ripple President Monica Long said that the coming year will be a turning point for the industry — cryptocurrencies will finally become integrated into the global financial system and will no longer be perceived as an alternative to traditional finance.