Live Comments

Nikkei celebrates Takaichi landslide, USD/JPY faces post-election reality check

Japan enters the week riding a powerful post-election wave after equities surged to fresh record highs. Nikkei jumped above 57,000 following Prime Minister Sanae Takaichi’s historic election victory. Although the index has since retreated modestly, it is still holding on to the bulk of its gains, up nearly 4.5% on strong domestic risk appetite.

Takaichi’s win was historic in scale. Her Liberal Democratic Party captured 315 seats in the lower house, its strongest showing ever, and together with coalition partner Ishin now controls 351 seats. That gives the ruling bloc a two-thirds supermajority, allowing it to override the upper house and advance legislation with unprecedented ease.

That supermajority significantly strengthens Takaichi’s hand. It opens the door not only to aggressive fiscal measures but also to constitutional changes, while easing the path for defense spending increases amid a more challenging global environment. For equity investors, political uncertainty has collapsed, and policy execution risk has been sharply reduced.

Yen, however, has not followed equities in a straight line. USD/JPY initially jumped at the Asian open but quickly retreated. Traders remain alert to the risk of intervention should the Yen weaken too sharply, limiting follow-through on election-driven selling. This leaves currency markets in wait-and-see mode. With the election result now fully realized, the question is whether Yen selling momentum can re-emerge as focus shifts back to fiscal expansion, or whether the pair has already priced in the bulk of the political shock.

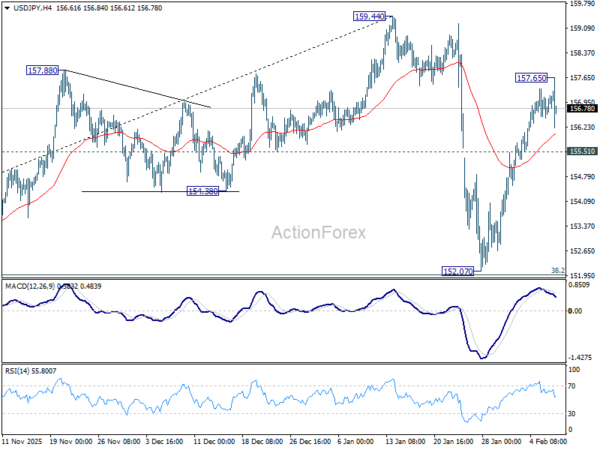

Technically, momentum is already showing signs of fatigue. USD/JPY’s 4H MACD is falling below its signal line, indicating that the rebound from 152.07 is losing steam. That move is viewed as the second leg of a broader corrective pattern from 159.44. While further gains remain possible as long as 155.51 holds, strong resistance is expected near 159.44 high. A clear break below 155.51 would argue that the third leg of the correction is already underway, reopening the path back toward the 152.07 support ahead.

Japan’s nominal pay accelerates to 2.4% in December, but real wages still negative

Japan’s real wages fell -0.1% yoy in December, marking the 12th consecutive monthly decline, though the contraction was the smallest seen in 2025. While the pace of erosion is clearly slowing, the data underline how inflation continues to outpace pay gains for households.

Nominal wages rose 2.4% yoy, extending a 48-month streak of increases, but the outcome fell short of expectations for a 3.0% rise. The acceleration from November’s 1.7% growth points to improving momentum, but not yet at a pace sufficient to deliver sustained real income gains.

Breaking down the components, base salaries rose 2.2% yoy, picking up from November's 1.7% yoy. Overtime pay increased 0.9%, slightly slower than the prior month's 1.2%. Special payments, largely winter bonuses, rose 2.6% up from 1.5%.

Attention now shifts firmly to the upcoming spring wage negotiations. The key questions are whether large firms can again deliver pay hikes above 5% for the third straight years, and whether those gains finally spill over to smaller companies.

BoE’s Pill urges to look past April inflation dip

BoE Chief Economist Huw Pill cautioned against drawing "too much comfort" from the near-term dip in inflation expected later this year. Speaking at an event today, Pill said the downside in short-term inflation dynamics was partly created by "fiscal measures" announced last November and risks obscuring the more persistent forces shaping longer-term price pressures.

Drawing a parallel with 2025, Pill said the Bank of England had previously looked through a temporary inflation spike caused by regulatory changes, and should apply the same logic to the projected drop to 2% in April when lower regulated energy prices take effect.

He stressed that monetary policy must remain focused on addressing persistence in inflationary pressures beyond these temporary effects. Pill was among the narrow 5–4 majority on the MPC who voted to keep Bank Rate unchanged at 3.75% this week.