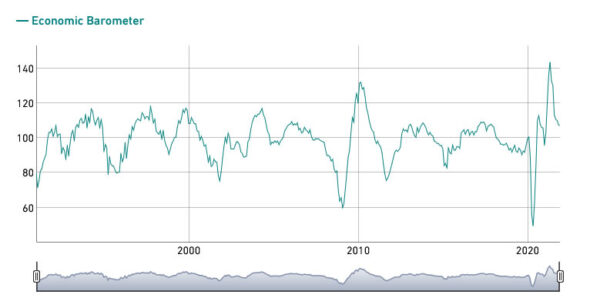

Swiss KOF Economic Barometer dropped slightly from 107.5 to 107.0 in December. “The barometer remains above its long-term average,” KOF said. “The Swiss economy should thus continue to develop positively at the beginning of 2022, if the economic activity is not impaired by the renewed spread of the virus.”

“This month, the barometer is mostly influenced by indicators covering private consumption, which are slightly negative. Another slight negative contribution is sent by bundles of indicators from the finance and insurance sector. In contrast, indicators for foreign demand are contributing positively.”

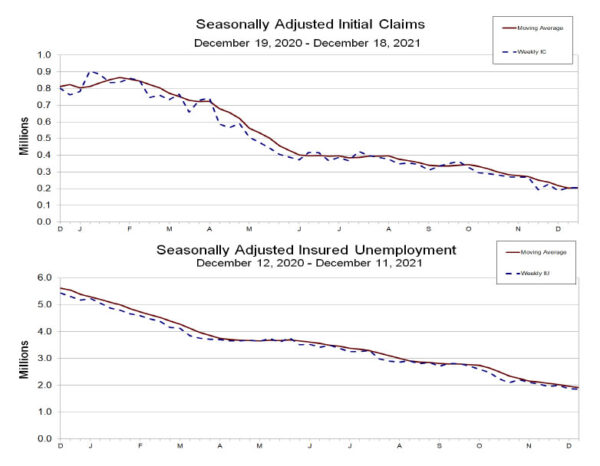

US initial jobless claims dropped to 198k, lowest since 1969

US initial jobless claims dropped -8k to 198k in the week ending December 25, better than expectation of 205k. Four-week moving average of initial claims dropped -7k to 199k, lowest since October 25, 1969.

Continuing claims dropped -140k to 1716k in the week ending December 18, lowest since March 7, 2020. Four-week moving average of continuing claims dropped -60k to 1850k, lowest since March 14, 2020.

Full release here.