Live Comments

RBA’s Bullock says inflation above 3% “unacceptable,” keeps door open to more hikes

RBA Governor Michele Bullock reinforced the hawkish stance at a Senate estimates hearing today, making clear that further tightening remains on the table. “If we need to go up further because inflation is entrenched, the board will do so,” she said, stressing that returning inflation to target remains the central bank’s primary mandate.

Bullock said inflation running “with a three in front of it” is unacceptable. She noted that, at present, total demand is judged to be exceeding the economy’s capacity to supply, helping to explain ongoing inflation pressures. At the same time, she struck a more balanced tone on growth, pointing to the labour market as a key "positive". While productivity remains weak and limits how fast the economy can expand, employment conditions are holding up. “We’re in this position because the economy is actually doing okay,” Bullock said,.

The RBA raised the cash rate by 25 bps last week to 3.85%, reversing one of last year’s cuts, after underlying inflation accelerated to 3.4% in the latest quarter. With forecasts pointing to inflation reaching 3.7% this year, markets now price roughly a 75% chance of another hike to 4.10% at the May meeting.

BoC minutes stress geopolitical risks, keep policy optionality

The BoC left its benchmark overnight rate at 2.25% in January, and the published summary of deliberations underlined how elevated uncertainty has reshaped policy discussions. Members agreed that maintaining "optionality" in setting monetary policy was critical given the unusually turbulent backdrop.

The minutes highlighted that recent geopolitical events — including tensions in Venezuela, Iran and Greenland — along with perceived threats to the independence of the Fede — have amplified global uncertainty. U.S. trade policy, increasingly seen as driven by geopolitical aims, was identified as a key source of unpredictability that could disrupt global supply chains and impact economic activity.

BoC officials also flagged downside risks associated with the upcoming review of the United States-Mexico-Canada Agreement (USMCA), suggesting that unresolved trade negotiations could weigh on Canadian growth.

Against this backdrop, the minutes reinforce the view that the BoC is likely to stay on hold for now, with flexibility to respond as data evolve.

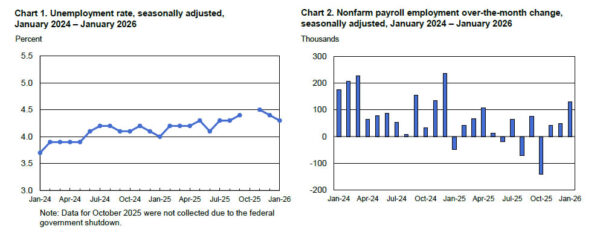

US NFP beats at 130k, unemployment rate dips to 4.3%

US non-farm payrolls surprised to the upside in January, rising 130k against expectations for just 66k. The gain was also well above the 15k average monthly increase seen through 2025.

Unemployment rate edged down from 4.4% to 4.3%, beating forecasts for no change, while the participation rate ticked up 0.1 percentage point to 62.5%. The combination suggests labor supply and demand both strengthened modestly at the start of the year.

Wage pressures also remained firm. Average hourly earnings rose 0.4% month-on-month, above the 0.3% consensus, with annual wage growth holding at 3.7% yoy. For markets, the report challenges expectations of rapid Fed easing and reinforces the narrative of a labor market that remains resilient.