Sample Category Title

USD/CAD Weekly Outlook

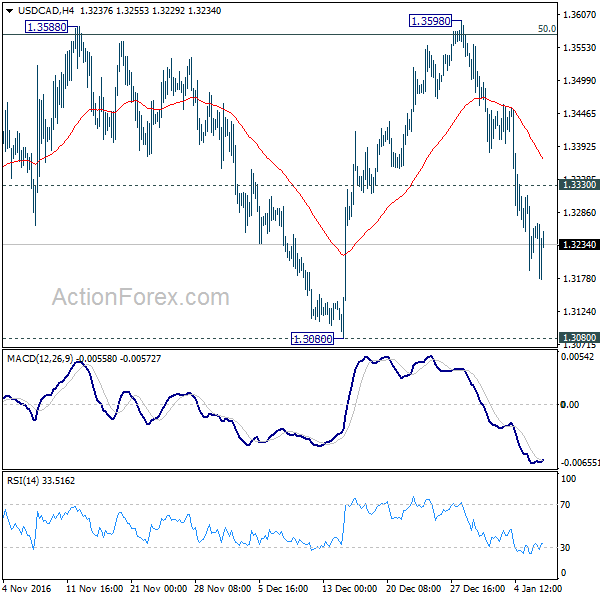

USD/CAD's fall from 1.3598 extended to as low as 1.3176 last week. Initial bias stays on the downside this week for 1.3080 support next. As noted before, price actions from 1.2460 are viewed as a corrective move. Decisive break of 1.3080 will indicate that it's completed and turn outlook bearish for retesting 1.2460 low. On the upside, above 1.3330 minor resistance will turn bias neutral again with focus back on 1.3588/98 resistance zone.

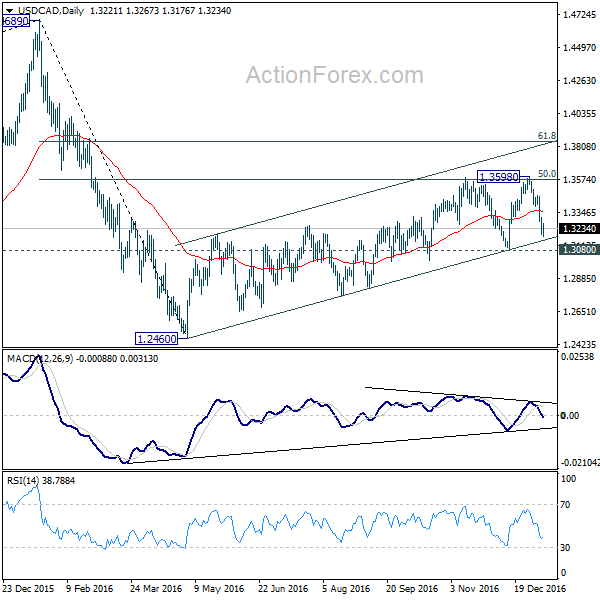

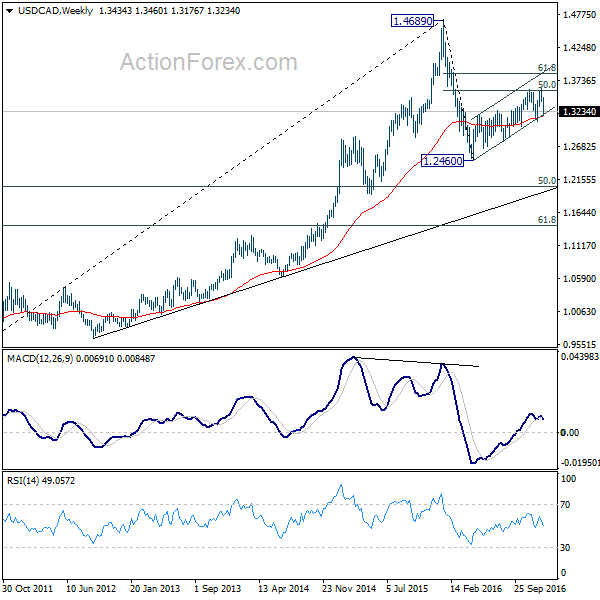

In the bigger picture, price actions from 1.4689 medium term top are seen as a correction pattern. The first leg has completed at 1.2460. The second leg is possibly finished at 1.3598 too after hitting 50% retracement of 1.4689 to 1.2460 at 1.3575. Break of 1.3080 would likely resume the fall from 1.4689 through 1.2460 to 50% retracement of 0.9406 to 1.4689 at 1.2048. We'd start to look for reversal signal below 1.2460 to complete the correction. In case of another rise, we'll look for topping sign at 61.8% retracement of 1.4689 to 1.2460 at 1.3838.

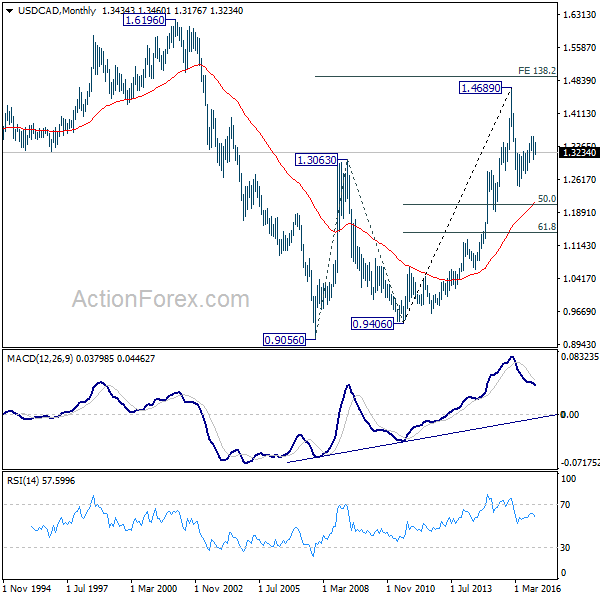

In the longer term picture, rise from 0.9056 (2007 low) is viewed as a long term up trend. It's taking a breath after hitting 1.4689. But such rise expected to resume later to test 1.6196 down the road.

Subscribe to our daily and mid-day newsletter to get this report delivered to your mail box

GBP/JPY Weekly Outlook

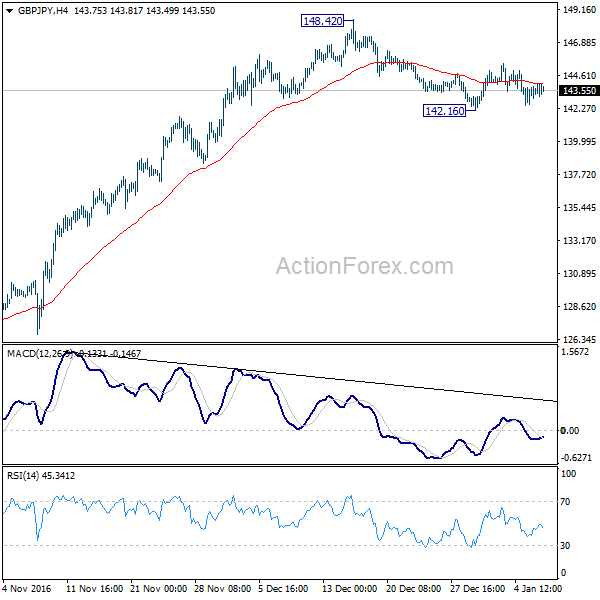

GBP/JPY stayed in right range above 142.16 last week and outlook is unchanged. Initial bias remains neutral this week first. Rise from 122.36 is seen as a corrective move. Below 142.16 will affirm the case that it's completed at 148.42. In that case, intraday bias will be turned to the downside for 55 day EMA (now at 140.43) and below. Break of 148.42 will extend the rise from 122.36. But we'd expect strong resistance from 150.43 long term fibonacci level to limit upside.

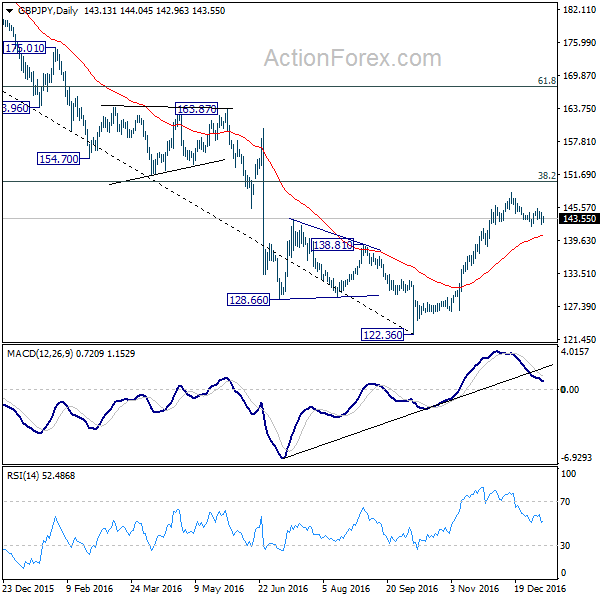

In the bigger picture, the down trend from 195.86 top (2015 high) should have made a medium term bottom at 122.36 after hitting 100% projection of 195.86 to 154.70 from 163.87 at 122.71. Rise from there is now expected to develop into a medium term corrective pattern. Upside should be limited by 38.2% retracement of 195.86 to 122.36 at 150.4 for setting the medium term range.

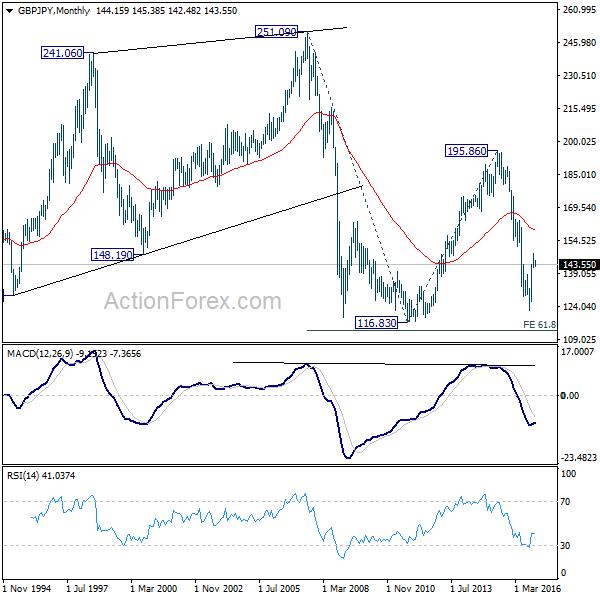

In the longer term picture, while price actions from 122.36 would develop into a medium term correction, fall from 195.86 is still seen as resuming the down trend from 251.09 (2007 high). Hence, after the correction from 122.36 completes we'd expect another fall through 116.83 low.

Subscribe to our daily and mid-day newsletter to get this report delivered to your mail box

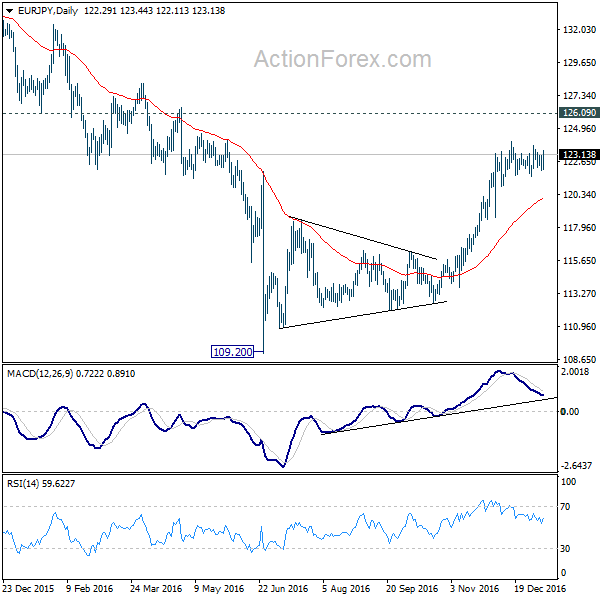

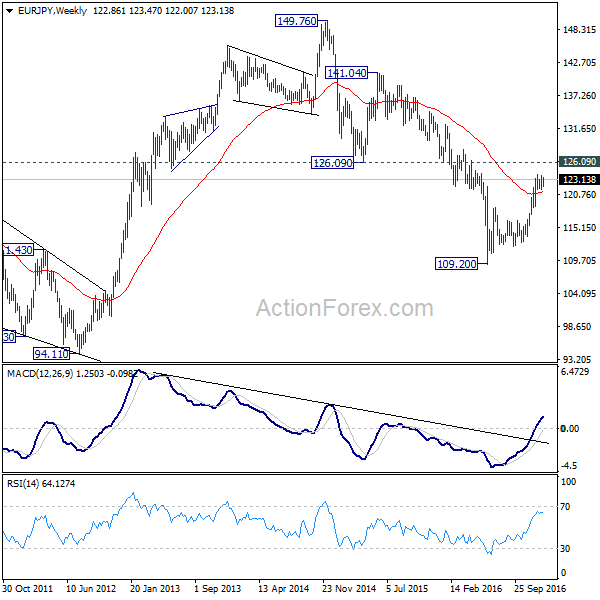

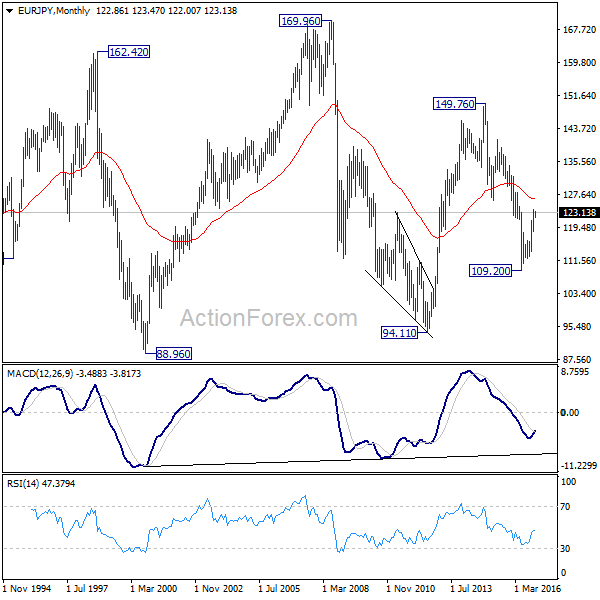

EUR/JPY Weekly Outlook

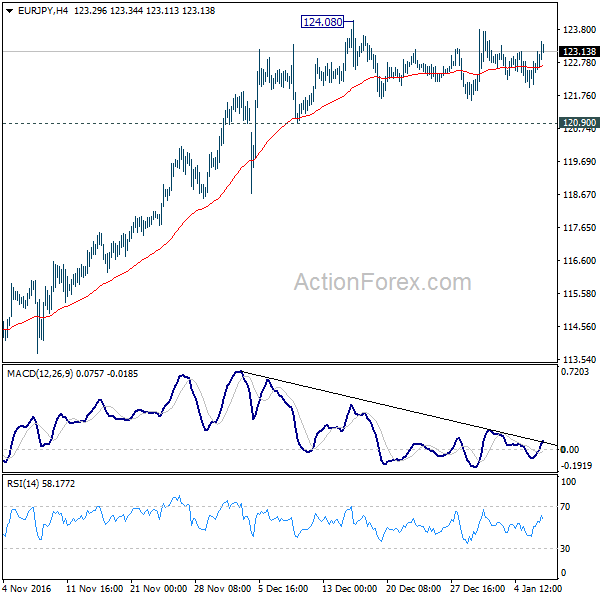

EUR/JPY stayed in the sideway pattern from 124.08 and outlook is unchanged. Initial bias remains neutral this week first. Overall, further rally is in favor as long as 120.90 support holds. Above 124.08 will target 126.09 key resistance next. As rise from 109.20 is still seen as a corrective pattern, we'd be cautious on topping around 126.09. Meanwhile, break of 120.90 will indicate short term topping and turn bias to the downside for 55 days EMA (now at 120.10).

In the bigger picture, price actions from 109.20 medium term bottom are seen as part of a medium term corrective pattern from 149.76. There is prospect of another rise towards 126.09 key resistance level before completion. But even in that case, we'd expect strong resistance between 126.09 and 141.04 to limit upside, at least on first attempt. Sustained trading below 55 day EMA will pave the way to retest 109.20.

In the long term picture, current medium term decline from 149.76 is seen as part of a long term sideway pattern from 88.96. Decisive break of 126.09 will indicate that such decline is completed and EUR/JPY has started another medium term rally already.

Subscribe to our daily and mid-day newsletter to get this report delivered to your mail box

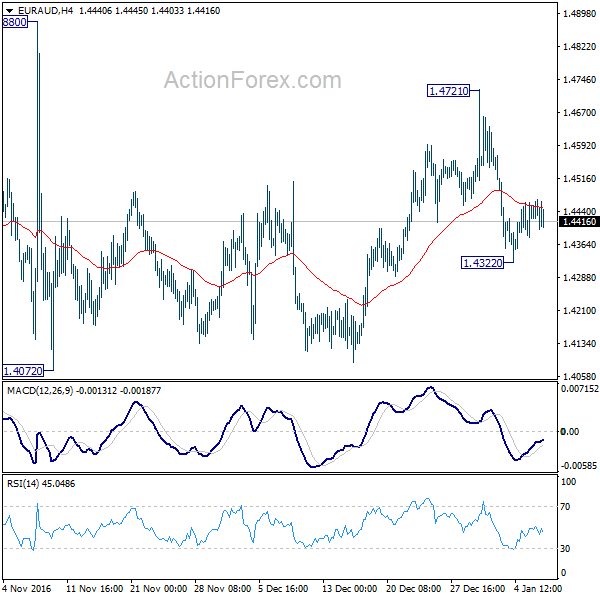

EUR/AUD Weekly Outlook

EUR/AUD's fall form 1.4721 extended to 1.4322 last week but recovered. Initial bias stays neutral this week first. On the downside, below 1.4322 will target 1.4702 low first. Break of 1.4072 will extend the correction from 1.6587 towards next key support level 1.3671. Meanwhile, decisive break of 1.4880 resistance will indicate that such correction from 1.6587 is completed and turn near term outlook bullish for 1.5094 resistance next.

In the bigger picture, price actions from 1.6587 medium term top are viewed as a consolidative pattern. 50% retracement of 1.1602 to 1.6587 at 1.4095 was already met. While further fall cannot be ruled out, we'd expect strong support above 1.3671 to contain downside and bring rebound. Up trend from 1.1602 should not be finished and will resume later. Break of 1.5094 will be the first sign of resumption of up trend from 1.1602 and target retesting of 1.6587 resistance first.

In the longer term picture, the rise from 1.1602 long term bottom isn't over yet. We'll keep monitoring the development but there is prospect of extending the rise to 61.8% retracement of 2.1127 to 1.1602 at 1.7488 and above. However, break of 1.3671 should confirm trend reversal and target 1.1602 long term bottom again.

Subscribe to our daily and mid-day newsletter to get this report delivered to your mail box

EUR/GBP Weekly Outlook

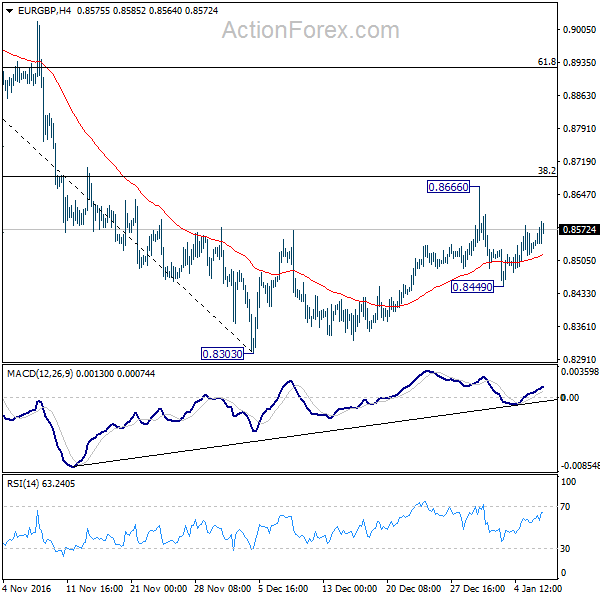

EUR/GBP dipped to 0.8449 last week but recovered since then. Initial bias is neutral this week first. Overall, the cross is bounded in a corrective pattern that started at 0.8303. Below 0.8449 will turn bias to the downside for retesting 0.8303 first. Break there will extend the whole fall from 0.9304. In that case, we'll look for bottoming signal again at around 0.8116. On the upside, sustained break of 38.2% retracement of 0.9304 to 0.8303 at 0.8685 will revive the case of near term reverse and bring further rise to 61.8% retracement at 0.8922 and above.

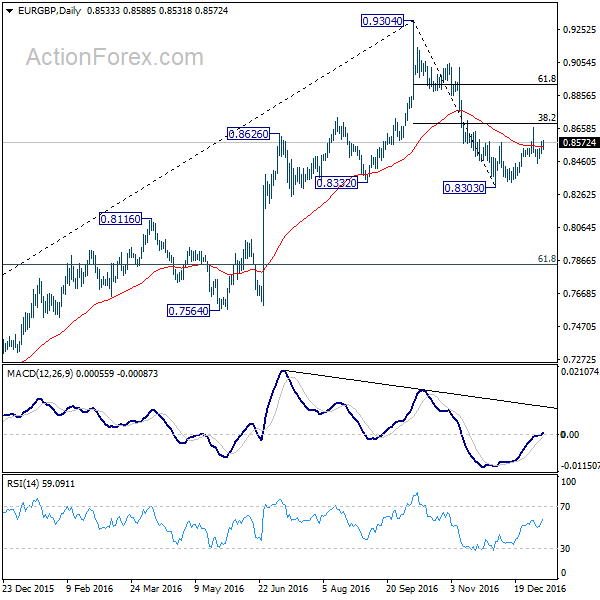

In the bigger picture, price actions from 0.9304 are viewed as a medium term corrective pattern. Deeper fall cannot be ruled out yet. But we'd expect strong support around 55 weeks EMA (now at 0.8243) to contain downside. Overall, the corrective pattern would take some time to complete before long term up trend resumes at a later stage. Break of 0.9304 will pave the way to 0.9799 (2008 high).

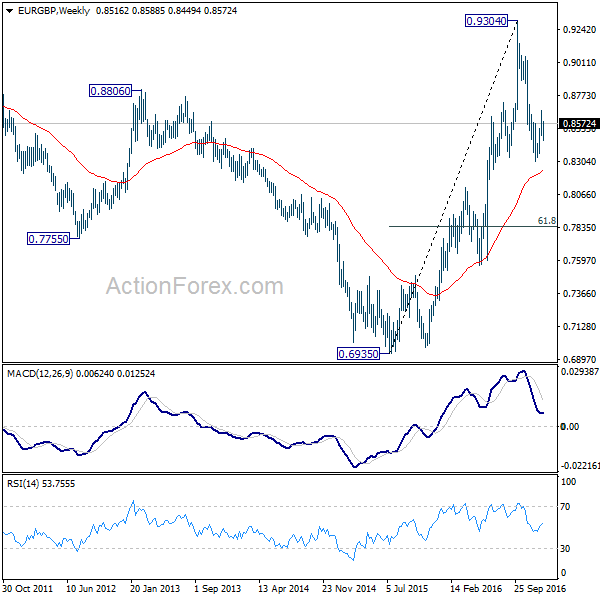

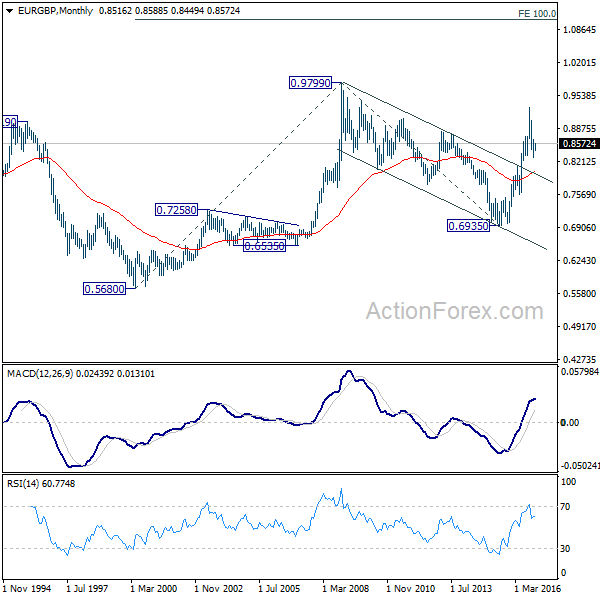

In the long term picture, firstly, price action from 0.9799 is seen as a long term corrective pattern and should have completed at 0.6935. Secondly, rise from 0.6935 is likely resuming up trend from 0.5680 (2000 low). Thirdly, this is supported by the impulsive structure of the rise from 0.6935 to 0.9304. Hence, after the consolidation from 0.9304 completes, we'd expect another medium term up trend to target 0.9799 high and above.

Subscribe to our daily and mid-day newsletter to get this report delivered to your mail box

EUR/CHF Weekly Outlook

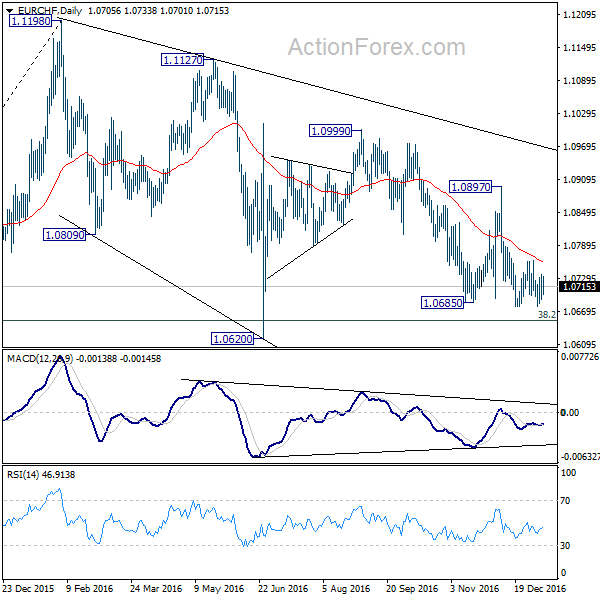

EUR/CHF stayed inside tight range above 1.0677 last week and outlook is unchanged. Initial bias stays neutral this week first. Price actions from 1.1198 are seen a corrective pattern that is still unfolding. Below 1.0677 will target 1.0620 key support level. On the upside, above 1.0762 will turn focus back to 1.0897 resistance. Decisive break there will suggest reversal and turn near term outlook bullish.

In the bigger picture, the decline from 1.1198 is seen as a corrective move. Such correction is still in progress and retest of 38.2% retracement of 0.9771 to 1.1198 at 1.0653 could be seen. Sustained trading below 1.0653 will target 50% retracement at 1.0485. Meanwhile, break of 1.0897 resistance will argue that the larger up trend is finally resuming for above 1.1198.

Subscribe to our daily and mid-day newsletter to get this report delivered to your mail box

EUR/USD Mid-Day Outlook

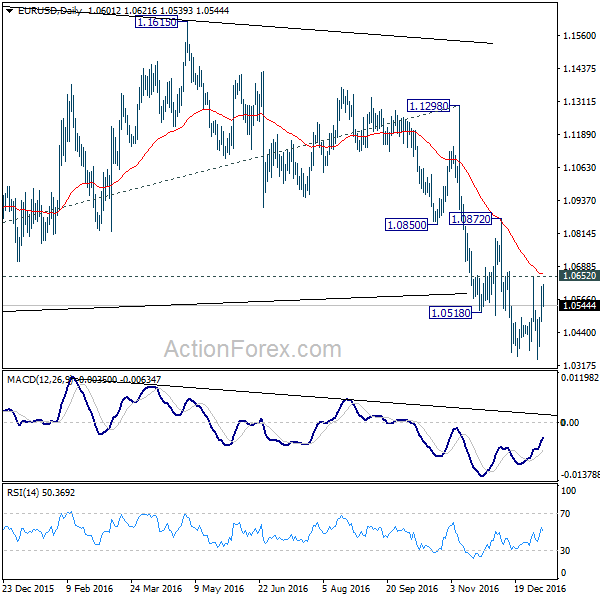

Daily Pivots: (S1) 1.0519; (P) 1.0567 (R1) 1.0654; More.....

Intraday bias in EUR/USD remains neutral for the moment. As long as 1.0652 holds, outlook stays bearish and another decline is expected. Break of 1.0339 will extend the larger down trend to parity next. However, break of 1.0652 will now confirm short term bottoming and turn near term outlook bullish for stronger rebound to 1.0872 resistance first.

In the bigger picture, break of 1.0461 key support indicates that consolidation from there has completed as a triangle at 1.1298. And, the down trend from 1.6039 (2008 high) is resuming. Current downtrend is now expected to target 61.8% projection of 1.3993 to 1.0461 from 1.1298 at 0.9115. On the upside, break of 1.1298 resistance is needed to confirm medium term bottoming. Otherwise, outlook will stay bearish in case of rebound.

Subscribe to our daily and mid-day newsletter to get this report delivered to your mail box

GBP/USD Mid-Day Outlook

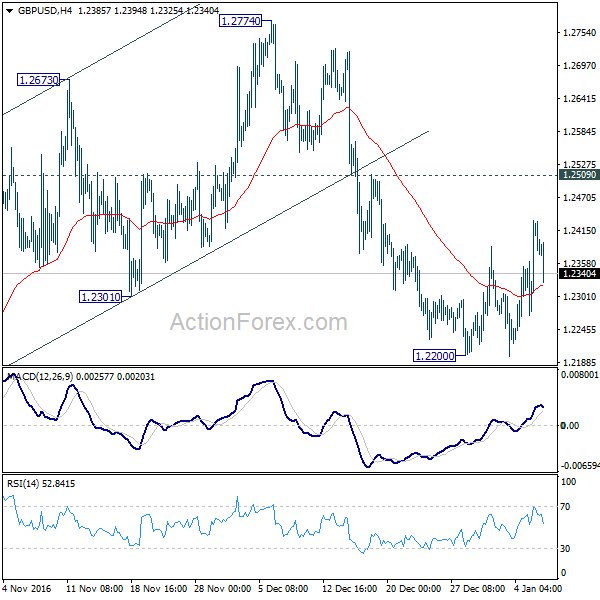

Daily Pivots: (S1) 1.2313; (P) 1.2373; (R1) 1.2475; More...

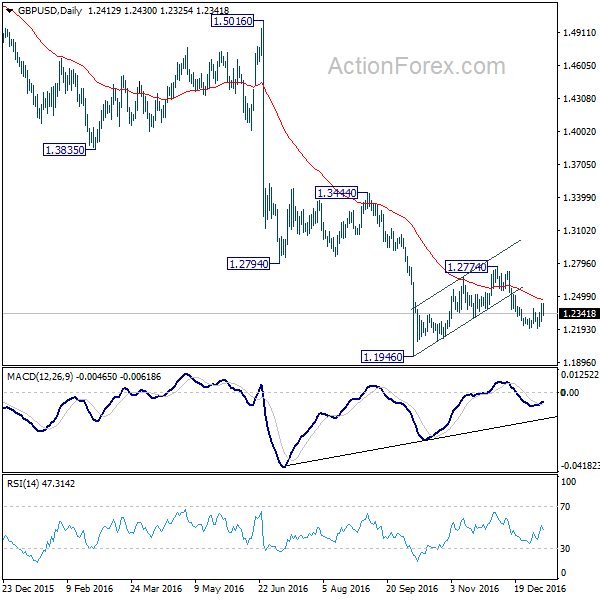

Intraday bias in GBP/USD remains neutral for the moment. With 1.2509 minor resistance intact, outlook remains bearish. We'd still expect upside of consolidation to be limited by 1.2509 resistance and bring fall resumption. Corrective rise from 1.1946 has completed at 1.2774. Below 1.2200 will target a test on 1.1946 low. Decisive break there will confirm larger down trend resumption.

In the bigger picture, fall from 1.7190 is seen as part of the down trend from 2.1161. There is no sign of medium term bottoming yet. Sustained trading below 61.8% projection of 2.1161 to 1.3503 from 1.7190 at 1.2457 will target 100% projection at 0.9532. Overall, break of 1.3444 resistance is needed to confirm medium term bottoming. Otherwise, outlook will remain bearish.

Subscribe to our daily and mid-day newsletter to get this report delivered to your mail box

USD/CHF Mid-Day Outlook

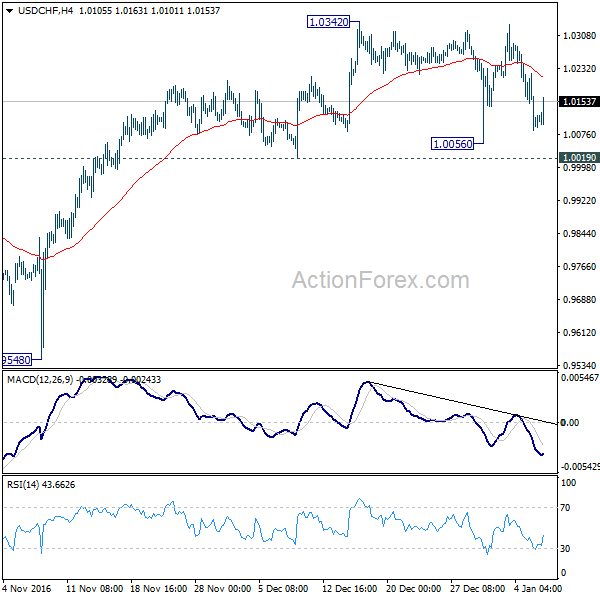

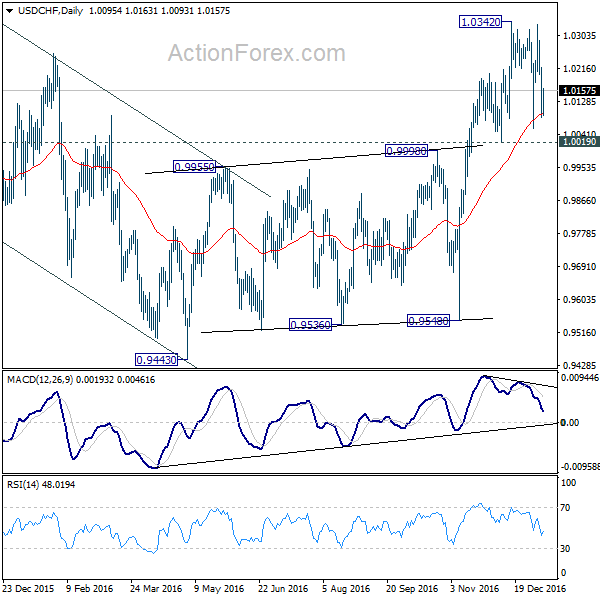

Daily Pivots: (S1) 1.0048; (P) 1.0134; (R1) 1.0182; More.....

USD/CHF is still staying in the consolidation pattern from 1.0342 and intraday bias remains neutral. Deeper fall cannot be ruled out. But we'd expect strong support from 1.0019 to contain downside and bring rally resumption. Firm break of 1.0342 will confirm up trend resumption. However, firm break of 1.0019 will indicate near term reversal and could bring deeper fall bring to 0.9443/9548 support zone.

In the bigger picture, the corrective fall from 1.0327 should have completed at 0.9443 already. Rise from 0.9443 could be resuming the long term rally from 2011 low at 0.7065. But decisive break of 1.0327 is needed to confirm. In that case, next medium term upside target will be 38.2% retracement of 1.8305 to 0.7065 at 1.1359. Rejection from 1.0327 will extend the sideway pattern with another fall back to 0.9443/9548 support zone.

Subscribe to our daily and mid-day newsletter to get this report delivered to your mail box

USD/JPY Mid-Day Outlook

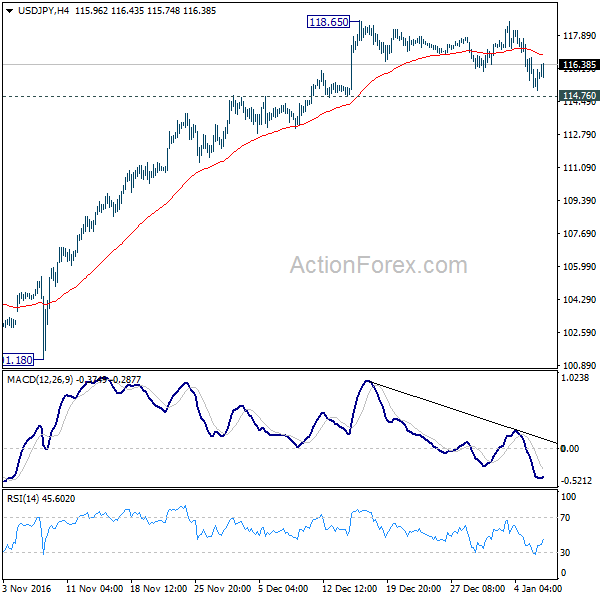

Daily Pivots: (S1) 114.56; (P) 115.99; (R1) 116.77; More...

USD/JPY recovers ahead of 114.76 support but stays in range below 118.65. Intraday bias remains neutral first. Outlook stays bullish with 114.76 intact and further rise is expected. Above 118.65 will extend the whole rise from 98.97 to 125.85 key resistance next. However, sustained break of 114.76 will confirm short term topping and bring deeper pull back to 55 day EMA (now at 112.76) and possibly below.

In the bigger picture, price actions from 125.85 high are seen as a corrective pattern. The impulsive structure of the rise from 98.97 suggests that the corrective is completed and larger up trend is resuming. Decisive break of 125.85 will confirm and target 61.8% projection of 75.56 to 125.85 from 98.97 at 130.04 and then 135.20 long term resistance.

Subscribe to our daily and mid-day newsletter to get this report delivered to your mail box