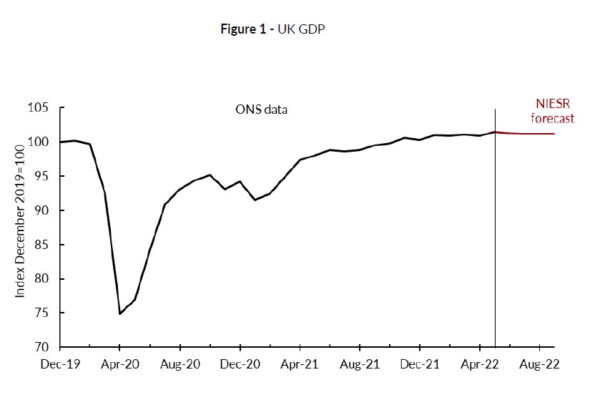

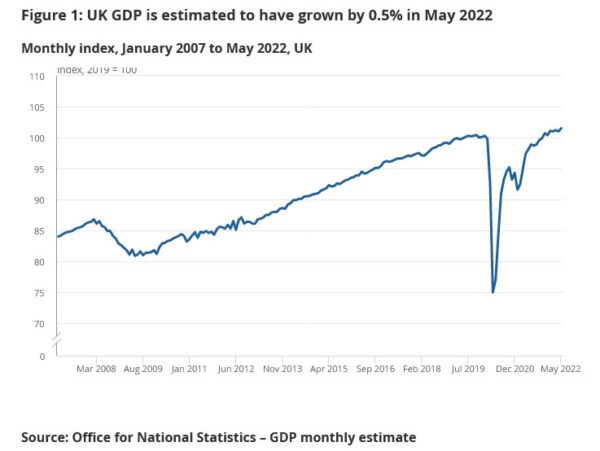

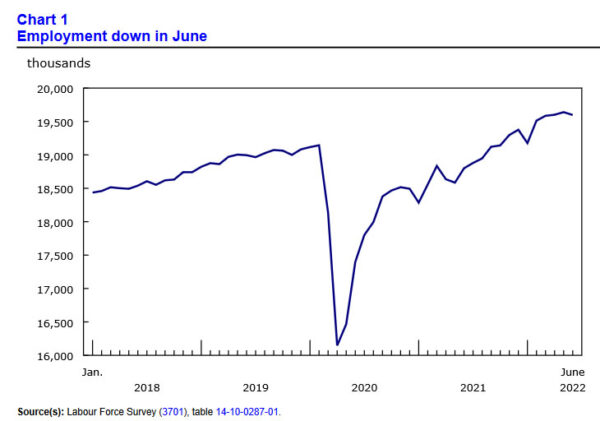

After data showing 0.5% mom GDP growth in UK, NIESR now forecasts 0.2% mom growth in June. For whole of Q2, growth would then be 0.2%. It still forecast a contraction of -0.1% in GDP Q3, with growth likely to slow further as inflation drags on consumer demand.

Rory Macqueen, Principal Economist, NIESR:

“If April activity was more encouraging than the headline figure suggested – with strong consumer-facing services dragged down by the reduction in vaccinations – the opposite may be true of May. Headline growth of 0.5 per cent owed much to rising GP visits, while sectors like hospitality, retail and the arts all contracted, suggesting that rising prices may have eaten into discretionary household consumption.

” More encouragingly, manufacturing had its joint strongest month since November 2020, and construction recorded a seventh consecutive month of expansion. With plenty of room for revisions, it looks like touch and go as to whether the UK economy entered recession in the second quarter.”

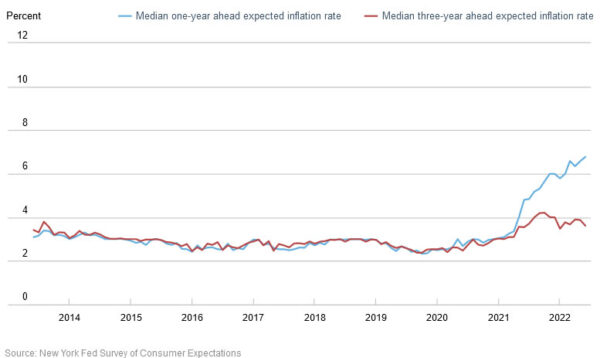

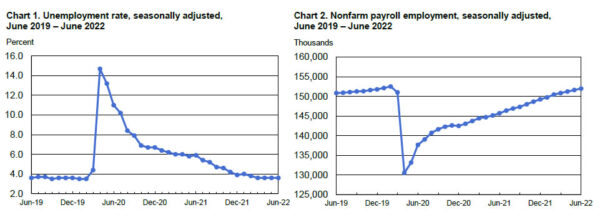

US CPI accelerated again to 9.1% yoy in Jun, energy up 41.6% yoy, food up 10.4% yoy

US CPI rose 1.3% mom in June, above expectation of 1.0% mom. CPI core rose 0.7% mom, also above expectation of 0.5% mom. Energy index rose 7.5% mom, contributed nearly half of the all items increase. Gasoline index rose 11.2% mom. Food index rose 1.0% mom.

For the 12-month period, CPI accelerated from 8.6% yoy to 9.1% yoy, above expectation of 8.7% yoy. That’s the highest level since November 1981. CPI core (all items less food and energy) slowed slightly from 6.0% yoy to 5.9% yoy, above expectation of 5.7% yoy. Energy index rose 41.6% yoy, highest since April 1980. Food index rose 10.4% yoy, highest since February 1981.

Full release here.