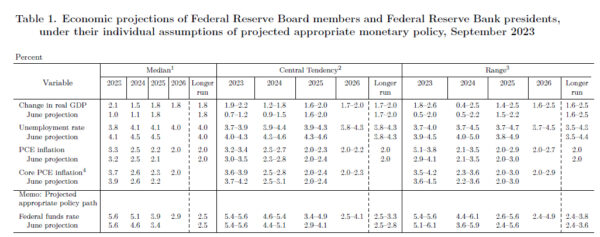

In an unexpected move that diverged from the market’s anticipations, SNB held its policy rate steady at 1.75%, side-stepping the anticipated hike to 2.00%. The conditional inflation projections have undergone downward revision. While inflation could surge above 2% target in upcoming quarters, it’s projected to retract back to 1.9% in 2025 based on current interest rate, without further tightening.

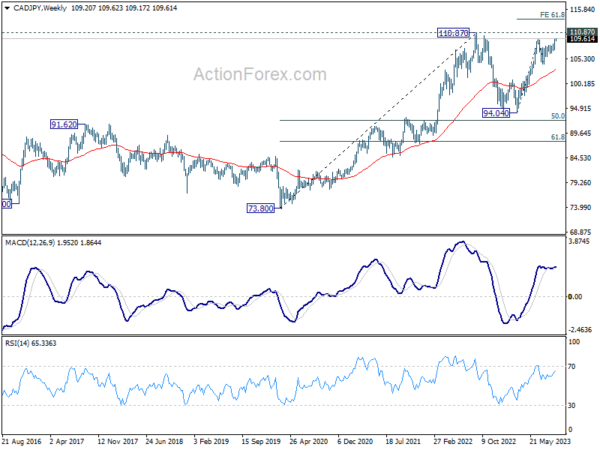

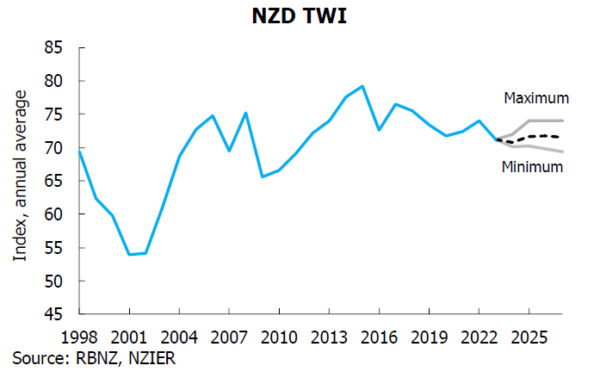

Despite this, SNB did not completely distance itself from a hawkish tone, and maintained the further tightening “may become necessary”. It also reiterated the willingness to intervene in the market with focus on “selling foreign currency

Delving into the specifics of the conditional inflation projections, based on steady 1.75% policy rate, inflation is forecasted to ascend to 2.0% by the end of this year. It will scale up to its apex at 2.2% in the second quarter of 2024, before experiencing a slight dip to 1.9% at the onset of 2025, maintaining that level thereafter.

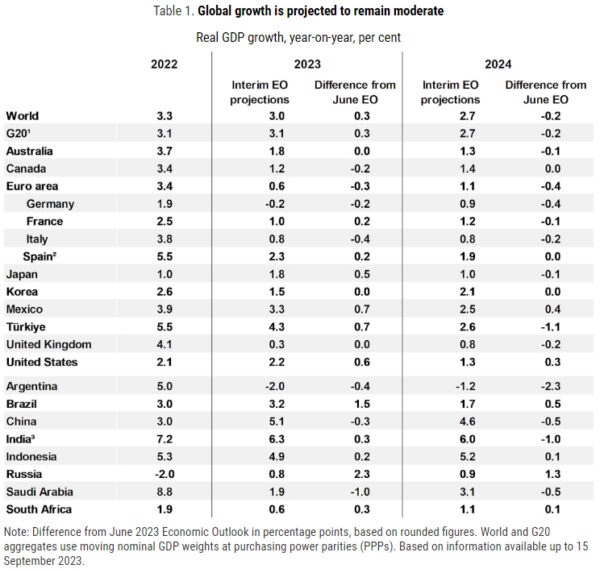

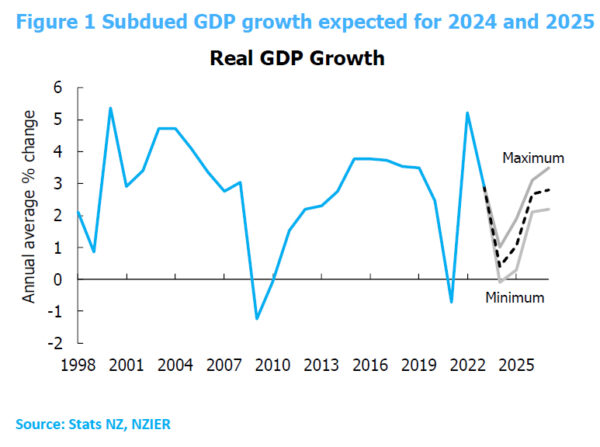

On the economic growth front, SNB’s projections lean towards the cautious side, forecasting tepid growth for the remainder of the year. The annual growth is projected to hover around a modest 1%.

ECB’s Nagel uncertain if rate plateau is reached

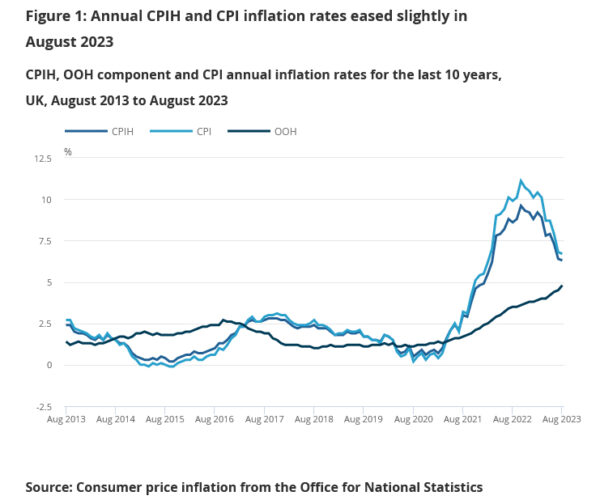

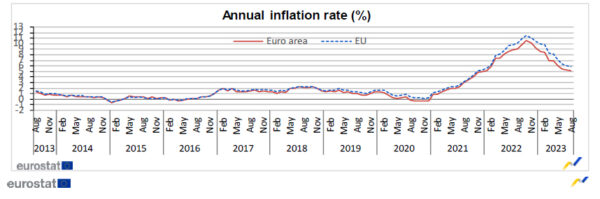

ECB Governing Council, Joachim Nagel, Bundesbank head, posed a crucial question in his speech in Frankfurt, “Have we reached the plateau” on interest rates? He answered by stating that it “cannot yet be clearly predicted”. He continued, elaborating that “the forecasts still only show a slow decline toward the target level of 2%.”

Nagel’s comments hinted at the continuous monitoring of economic indicators, suggesting that while borrowing costs are expected to “remain at a sufficiently high level for a sufficiently long time,” the exact interpretation hinges on the incoming data.

Addressing concerns about Germany’s economic health, he remarked that characterizing Germany as the ‘sick man’ “seems exaggerated.” He attributed the present sluggish growth to specific influences such as the global economic deceleration, Russia’s conflict with Ukraine, and reduced public expenditure. Offering a silver lining, Nagel projected, “Once we get past the worst of these special factors, the weak growth should also ease. We expect the economy to grow again in 2024.”

On the other hand, Latvia’s central bank chief, Martins Kazaks, highlighted the structural nature of recent oil price hikes. He pointed out, “The recent oil price increase in my view is not a temporary or transitory, it’s very much a structural issue.” Such dynamics, according to Kazaks, present heightened inflation risks. Regarding the anticipated rate cuts, he expressed skepticism about their timing, asserting, “I think expecting rate cuts mid next year is somewhat too early.”