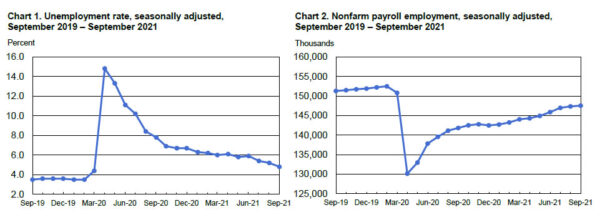

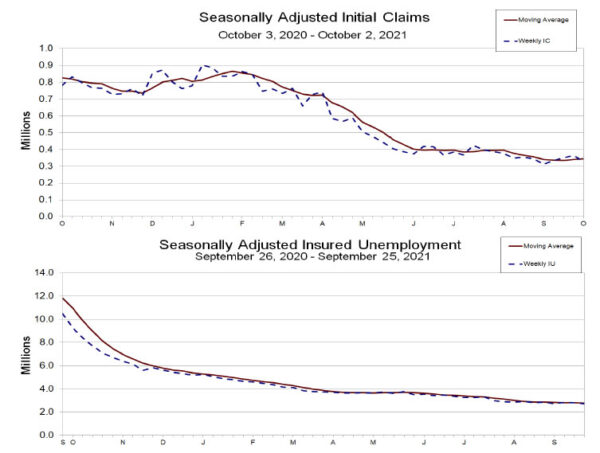

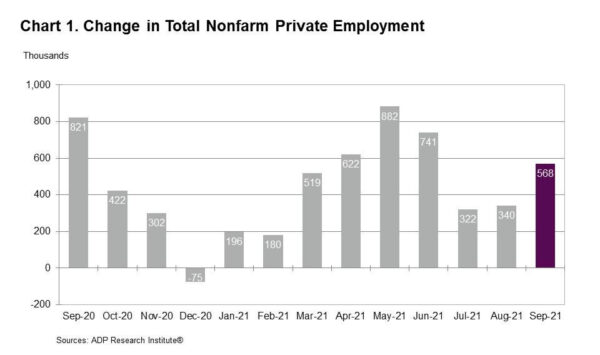

San Francisco Fed President Mary Daly said on Sunday that there will be “ups and downs” in the job market recovery, as “Covid is not behind us”. She admitted that “Delta has taken a toll” but remained upbeat that “it hasn’t yet derailed us”.

“It’s too soon to say it’s stalling, but certainly we’re seeing the pain of COVID and the pain of the Delta variant impact the labor market,” she said.

“I don’t have a different view than I had on it when we first started. It’s going to be hard and as goes Covid, so goes the economy,” she added.

Daly also said, “everyone is feeling the rising prices” for energy, good and basic services. “This is really hard. And it’s also really directly related to Covid. It’s related to the supply bottlenecks, to the disruptions. But I don’t see this as a long-term phenomenon.”

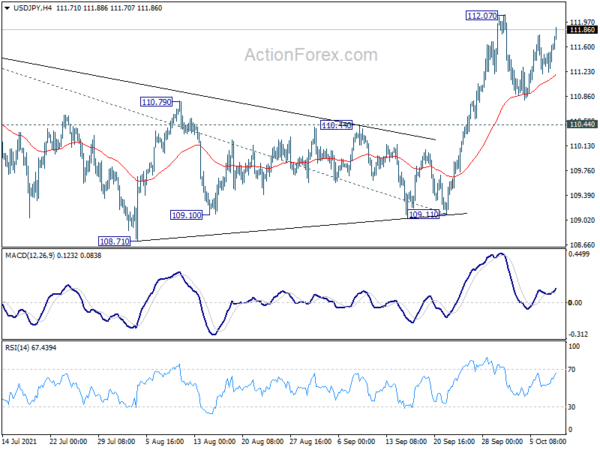

BoE Saunders: Appropriate to price in a significantly earlier path of tightening

BoE hawk Michael Saunders said over the weekend, “markets have priced in over the last few months an earlier rise in Bank Rate than previously and I think that’s appropriate.”

Saunders noted that markets have fully priced in a February hike, and half priced a December hike. “I’m not trying to give a commentary on exactly which one, but I think it is appropriate that the markets have moved to pricing a significantly earlier path of tightening than they did previously,” he said.

Separately, BoE Governor Andrew Bailey warned in an interview that inflation is “going to go higher, I’m afraid”. “We have got some very big and unwanted price changes,” he said, as the pandemic altered consumer behavior.