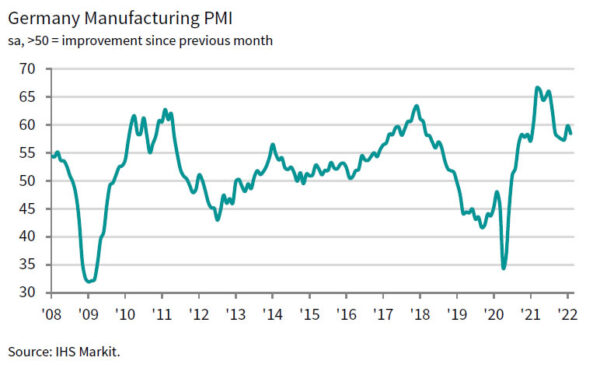

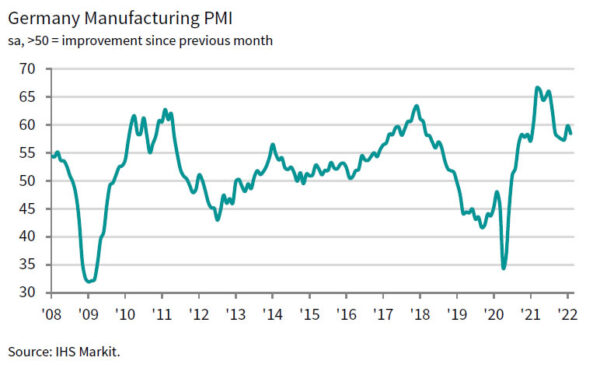

Germany PMI Manufacturing was finalized at 58.4 in February, down from January’s 59.8. Markit said there were sharp rise in backlogs as growth in the new orders outstripped output. Factory cost inflation slipped further from recent highs. Incidence of supply delays was lowest since November 2020.

Phil Smith, Associate Economics Director at IHS Markit, said:

“Underlying demand for German manufactured goods was strong in February, with new order growth accelerating and the survey showing rising sales both domestically and internationally.

“Production continued to rise, but staff absences linked to the Omicron wave of the pandemic were a constraint on output and added to already stretched capacity, thereby contributing to a sharp rise in backlogs of work. However, with COVID cases in the country looking like they might have already peaked, this particular headwind will hopefully be only temporary. Furthermore, the pace of factory job creation remained rapid as manufacturers looked to address capacity shortfalls.

“Supply constraints showed further tentative signs of easing in February, and one of the positives from this was a fall in the rate of input cost inflation to an 11-month low. “When the survey was conducted, firms were hopeful of further progress in the supply situation and were highly optimistic about the outlook. With the escalation of the situation in Ukraine since February’s survey, and the surge in oil and gas prices that’s come with it, downside risks to the sector’s performance in 2022 have increased.”

Full release here.

SNB Zurbruegg: Important to keep rate differential to avoid excessive Franc appreciation

SNB Vice Chairman Fritz Zurbruegg said in a l’agefi interview, “Switzerland has always had lower rates than others since the financial crisis. It is very important for us to keep this differential to avoid an excessive appreciation of the Swiss franc.”

“As soon as the situation requires it, we’ll raise our interest rate,” he said. But, “we’ll keep this ability to intervene in foreign exchange markets if needed to ensure price stability.”

“Experience has shown that having some leeway within the range we associate with price stability has worked well in the past in Switzerland,” he added. “We are a small, open economy with capital flows linked to our safe-haven status. We cannot always achieve a precise target and inflation can fluctuate in the short term because we aim for the medium term.”