Sample Category Title

USD/CHF Mid-Day Outlook

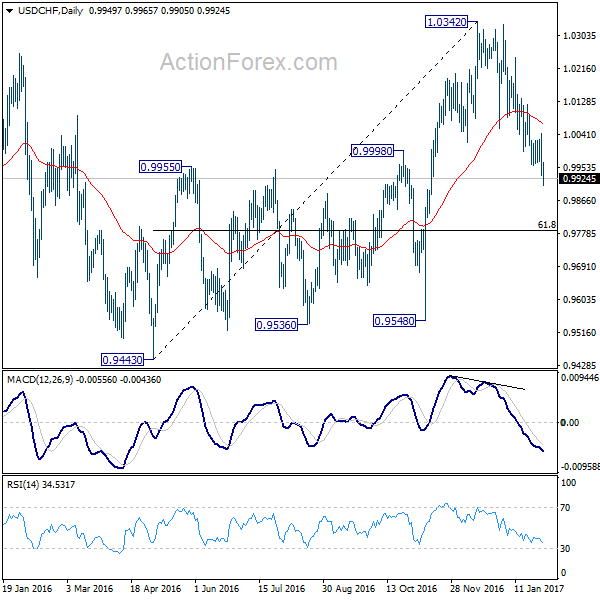

Daily Pivots: (S1) 0.9907; (P) 0.9975; (R1) 1.0018; More.....

USD/CHF's declines continues today and reaches as low as 0.9905 so far. Intraday bias remains on the downside for the moment. Fall from 1.0342 is seen as the third leg of the pattern from 1.0327. Next target will be 61.8% retracement of 0.9443 to 1.0342 at 0.9786 and below. On the upside, however, break of 1.0043 will indicate short term bottoming and turn bias back to the upside.

In the bigger picture, rejection from 1.0327 resistance suggests that consolidation pattern from there is still in progress. Fall from 1.0342 is seen as the third leg and retest of 0.9443/9548 support zone could be seen. But we'd expect strong support from there to contain downside. At this point, we're still expecting the larger rally to resume later to 38.2% retracement of 1.8305 to 0.7065 at 1.1359.

Subscribe to our daily and mid-day newsletter to get this report delivered to your mail box

Canadian Dollar Edges Up Ahead of Canadian GDP

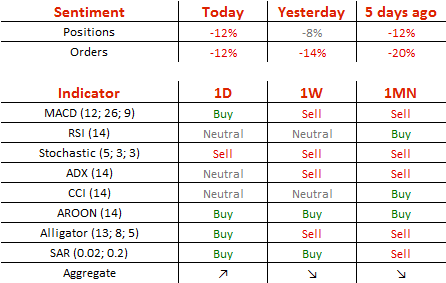

USD/CAD is slightly lower on Tuesday, continuing the downward trend which marked the Monday session. Currently, the pair is trading at 1.3070. On the release front, Canada releases GDP, with the estimate standing at 0.3%. In the US, today's key event is CB Consumer Confidence, with the markets expecting a strong reading of 112.6 points.

All eyes are on Canadian GDP, which will be released later on Tuesday. In October, GDP declined 0.3%, missing the estimate of a 0.1% gain. This marked the first decline since May and has raised concerns that economic growth in the fourth quarter will be weak. If GDP again misses expectations, we could see the Canadian dollar lose ground, and the BoC will be under increased pressure to lower interest rates. Earlier in January, the bank held rates at 0.50% but expressed concerns of economic turbulence due to Donald Trump's protectionist stance, which could have significant repercussions for the Canadian economy.

The markets had predicted that US economic growth would soften in the fourth quarter, and Advance GDP fell short of the estimate. The economy expanded 1.9%, shy of the estimate of 2.1%. Business investment and consumer spending remains solid and should continue into 2017. However, Trump's protectionist rhetoric and action, which saw tensions escalate with Mexico last week, could cloud the bright picture for the US economy.

Donald Trump has barely warmed the president's chair in the Oval House, but has already signed a host of controversial executive orders which have been condemned both domestically and abroad. Trump has withdrawn from the Trans-Pacific Partnership and declared he will reopen the NAFTA trade agreement with Canada and Mexico. He has also ordered work to begin on a wall with Mexico and banned immigrants from seven Moslem countries. Trump's unconventional and disjointed approach to international politics and trade could have major ramifications on global trade and could lead to financial instability in global markets, triggering volatility in the currency markets. Just a few days before being sworn in as president, Trump stated that the US dollar was "too strong", blaming a weak Chinese currency. Predictably, the greenback lost ground after Trump's remarks. It's a safe bet that Trump's offhand tweets and comments will continue to fuel market movement.

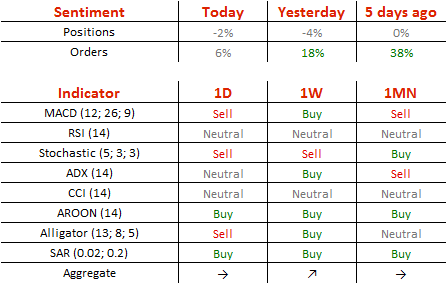

Yen Unchanged as BoJ Stands Pat

USD/JPY is unchanged in the Tuesday session. Currently, the pair is trading at 113.40. On the release front, there were no surprises from the Bank of Japan, which maintained interest rates at -0.10%. Japanese Household Spending declined 0.3%, better than the forecast of -0.8%. In the US, today's key event is CB Consumer Confidence, with the markets expecting a strong reading of 112.8 points. On Thursday, the Federal Reserve will set the benchmark interest rate, which is expected to remain pegged at 0.50%.

On Monday, the BoJ maintained interest rates at -0.10%, where they have been pegged since January 2016. The bank raised its GDP projection for fiscal year 2017 to 1.5 percent, up from 1.3 percent. At the same time, the BoJ highlighted the uncertainty that the economy faces due to the new US administration. President Trump has already taken some protectionist moves, and this could have a negative effect on Japan, which relies heavily on exports. The Japanese yen remains at low levels and the BoJ has previously said that it would consider action if the dollar rose above 120 yen. However, after the rate announcement, BoJ Governor said that the bank does not have a target for the currency.

The markets had predicted that US economic growth would soften in the fourth quarter, and Advance GDP fell short of the estimate. The economy expanded 1.9%, shy of the estimate of 2.1%. Business investment and consumer spending remains solid and should continue into 2017. However, Trump's protectionist rhetoric and action, which saw tensions escalate with Mexico last week, could cloud the bright picture for the US economy.

Donald Trump has just started his new position, but he has already signed a host of controversial executive orders which have been condemned both domestically and abroad. Trump has withdrawn from the Trans-Pacific Partnership and declared he will reopen the NAFTA trade agreement with Canada and Mexico. He has also ordered work to begin on a wall with Mexico and banned immigrants from seven Moslem countries. Trump's unconventional and disjointed approach to international politics and trade could have major ramifications on global trade and could lead to financial instability in global markets, triggering volatility in the currency markets. Just a few days before being sworn in as president, Trump stated that the US dollar was "too strong", blaming a weak Chinese currency. Predictably, the greenback lost ground after Trump's remarks. Still, Trump's shock election win in November has boosted the US dollar, with USD/JPY soaring 8.3% during that time.

Global Market Headlines Continue to be Dominated by US Travel Ban

Although some of the selling momentum experienced yesterday throughout the stock markets has cooled down, the market headlines across the globe continue to be dominated by the executive order from Donald Trump to ban certain nationals from entering the United States. While it has to be taken into account that the record moves seen in the stock markets last week would increase the risks of some investors being tempted to take profits from positions, there is no doubting that this move from Trump has caused outrage across the globe and such actions represent a risk to the market sentiment. There was for example some market movement following the news overnight that Donald Trump fired the acting US attorney general for questioning the legality of his immigration clampdown, contributing towards losses being seen across the trading session in Asia.

Investors definitely need to be aware that the markets behaved very suddenly towards pricing in heavy premiums following the US election outcome based on fiscal promises, but so far it is the far-right agenda that we have seen the most movement on from the Trump administration. Fiscal stimulus, job growth and infrastructure spending were the contributors towards the milestone levels in the stock markets, although the agenda so far has been more heavily pointed towards protectionism and moving the United States away from globalisation – quite the opposite in comparison to the "partnership and peace" message Trump delivered following his election victory that soothed investors nerves following his election victory.

I do believe that investors need clarity on how the Trump administration will move forward with fiscal stimulus and infrastructure spending rather than blacklisting certain nationals and getting into a war of words with Mexico over the wall, otherwise there is a risk of the stock markets entering a correction. Basically, the previous moves that were seen are not justified without clarity on what investors priced in.

Dollar still slipping against emerging currencies

While the Dollar has edged higher against emerging currencies in Europe such as the Turkish Lira and Russian Ruble, the Greenback has slipped somewhat against Asian currencies like the Malaysian Ringgit, Thai Baht and Indian Rupee. These are marginal losses but likely related to the overwhelming consensus that the Federal Reserve will be leaving US interest rates unchanged tomorrow. The Asian currencies in general are among those most vulnerable to higher US interest rates, especially considering the amount of bonds that are held in these nations from foreign investors.

What needs to be taken into account with the US interest rate decision tomorrow is that the Federal Reserve is likely to highlight the area of uncertainty over the US fiscal direction following the Trump inauguration. This might be seen as a minor issue now but if Trump is not able to deliver on fiscal intentions and instead continues to isolate the United States from globalisation, it does risk the Federal Reserve needing to keep US interest rate policy unchanged for longer.

EURUSD back above 1.07

The EURUSD has managed to move back above 1.07 on Tuesday following the news that consumer prices in January increased by 1.8%. This is a significant annual increase and will once again open the debate over whether ECB President Mario Draghi will need to provide guidance on the ECB stimulus program and whether the current level of stimulus needs to be tailed back following inflation moving back towards the central bank goal of 2%. Expect for Mario Draghi to continue stressing that inflation needs to be consistently around the target level at 2%, before the central bank acts and this would also dissuade investors away from pricing in further recoveries into the Euro.

GBPUSD looks at risk to falling below 1.24

There has been pressure on the British Pound following the reports earlier this morning that Theresa May might be aiming to invoke Article 50 earlier than expected on March 9. It is quite surprising that Theresa May is reportedly aiming to pull the trigger on Article 50 earlier in March rather than later in the month, especially considering the continuous uncertainty over the strategy to exit the European Union. Investors are also likely to be kept on their toes over the next two days as MPs begin a two-day debate on the European Union bill, allowing the government to trigger Article 50.

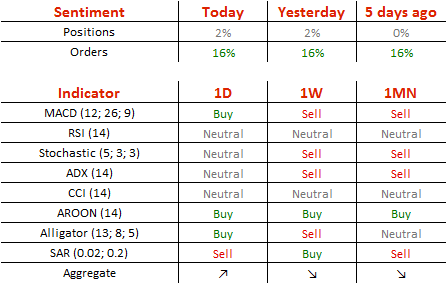

Euro Shrugs Off Strong Eurozone Inflation and GDP Data

EUR/USD is almost unchanged in the Tuesday session. Currently, the pair is trading at the 1.07 line. On the release front, it's a busy day. In the Eurozone, CPI Flash Estimate gained 1.8%, above the estimate of 1.5%. Preliminary Flash GDP improved to 0.5%, edging above the forecast of 0.4%. The unemployment rate dropped to 9.6%, compared to an estimate of 9.8%. The news was not as good from German Retail Sales, which declined 0.9%, nowhere near the forecast of +0.6%. Later in the day, ECB President Mario Draghi delivers remarks at a conference of the ECB and the European Commission. In the US, today's key event is CB Consumer Confidence, with the markets expecting a strong reading of 112.8 points. On Thursday, the Federal Reserve will set the benchmark interest rate, which is expected to remain pegged at 0.50%.

Germany's economy continues to raise concerns, as consumer indicators have looked dismal this week. German Retail Sales, the primary gauge of consumer spending, posted a sharp decline of 0.9%, its fourth decline in five readings. This reading comes on the heels of Preliminary CPI, which declined 0.6%, its first decline in 9 months. However, there was good news from the job front, as unemployment claims dropped by 26 thousand, much better than expected.

Analysts expected the US economy to soften in the fourth quarter, and GDP fell a bit short of the forecast. The economy expanded 1.9%, shy of the estimate of 2.1%. Business investment and consumer spending remains solid and should continue into 2017. However, Trump's protectionist rhetoric and action, which saw tensions escalate with Mexico last week, could cloud the bright picture for the US economy.

Donald Trump continues to stir controversy, after signing a host of executive orders last week which have been condemned both domestically and abroad. Trump has withdrawn from the Trans-Pacific Partnership and declared he will reopen the NAFTA trade agreement with Canada and Mexico. He has also ordered work to begin on a wall with Mexico and banned immigrants from seven Moslem countries. Trump's unconventional and disjointed approach to international politics and trade could have major ramifications on global trade and could lead to financial instability in global markets, triggering volatility in the currency markets. Just a few days before being sworn in as president, Trump stated that the US dollar was "too strong", blaming a weak Chinese currency. Predictably, the greenback lost ground after Trump's remarks. It's a safe bet that Trump's offhand tweets and comments will continue to fuel market volatility.

EUR/US Below 1.07 Mark

'Euro inflation forwards may have rallied too far, too soon in the absence of any sign of a pickup in core price pressures.' – Tanvir Sandhu, Bloomberg

Pair's Outlook

On Tuesday morning the EUR/USD currency exchange rate remained rather flat just below the weekly PP, which is located at 1.0709. However, the course of the rate can be forecasted. Previously, during Monday's trading the pair fell down to 1.0620 mark and rebounded there. As a result a surge began which lasted into Tuesday and reached the weekly PP. Afterwards the rate bounced off of the resistance level and set a course southward. Due to that reason the pair is set to fall down to the weekly S1 at 1.0644. Although, the decline is set to be hindered by the 20-day SMA at 1.0652.

Traders' Sentiment

SWFX traders remain bearish, as 56% of trader open positions are short on Tuesday. In the meantime, 56% of trader set up orders are set up to sell the Euro.

GBP/USD To Climb Back Above 1.25

'Our analytical focus remains on USD. The past week's USD downward correction may be challenged when the Fed releases its statement on Wednesday.' – Morgan Stanley (based on PoundSterlingLive)

Pair's Outlook

The British currency sustained further losses against the US Dollar on Monday, with the immediate demand area around 1.2515 failing to limit the losses. Although the Cable slipped back under 1.25 yesterday, another tough support area is now likely to keep the pair afloat. The support cluster is formed by the monthly PP, the weekly S1, the 20 and the 55-day SMAs, all located around the 1.24 major level. However, the 100-day SMA could also play its part and still trigger a rebound. Technical indicators also suggest the Sterling could edge higher today, but with the 1.26 mark remaining intact, as there is no impetus present for a surge that far up.

Traders' Sentiment

Today 60% of traders are long the Pound (previously 62%). At the same time, the portion of sell orders inched up from 54 to 55%.

USD/JPY Risks Sliding Under 113.00

'The market is very much tethered to movement in the broader U.S. dollar. We may be entering some very important times as the markets are digging for clues on the Trump policy front.' – OANDA (based on Reuters)

Pair's Outlook

Risk-aversion kept driving the markets yesterday, causing the US Dollar to lose nearly 100 pips against the Yen. The Buck, however, remains on the back foot, risking to post more losses versus the Japanese currency today. The monthly and the weekly S1s could still provide sufficient support in order to avoid this outcome, but that would imply a close in the green zone, with the 114.00 mark being reclaimed again. Ultimately, a drop towards 112.60 is possible, namely a strong psychological support level, which is expected to cause a U-turn if things get out of hand for the Greenback. Meanwhile, technical studies are unable to confirm any scenario, as they keep giving mixed signals.

Traders' Sentiment

Market sentiment remains relatively neutral, as 51% of all open positions are short and the other 49% are long.

Gold Reaches Above 1,200 On Tuesday

'To go higher, gold needs constant injections from political uncertainty or increases in geopolitical tensions.' – James Steel, HSBC (based on Reuters)

Pair's Outlook

The yellow metal continues to surge, as political uncertainty increases demand for a safe haven investment. However, from a technical perspective, it seems that the 20-day SMA was strong enough to push the yellow metal higher. In addition, during the move the bullion broke through the resistance put up by the weekly PP, which is located at 1,196.86. Due to that reason the commodity price might rise up to the weekly R1 at 1,213.16, as there are no other levels of resistance up to that mark.

Traders' Sentiment

Today 51% of SWFX traders are still bullish. In the meantime, 58% of trader set up orders are set up to buy the yellow metal.

European Market Update: European Inflation And Employment Data Continues Improving Trend

European inflation and employment data continues improving trend

Notes/Observations

US political volatility appears to be on the rise in the aftermath of the recent imposition of immigration controls; Trump fired acting U.S. Attorney General

European inflation continues to improve (France, Spain Euro Zone all beat expectations)

German unemployment hits fresh post-reunification low at 5.9% while Italy Dec reading hits a 18 month high

Overnight:

Asia:

(JP) Bank of Japan (BOJ) left Interest Rate on Excess Reserves (IOER) unchanged at -0.10% and maintains its current policy on both asset purchases and yield control); Reiterated overall assessment that domestic economy to maintain moderate expansion; Appears to signal no taper at this time

(JP) Japan Dec Jobless Rate in-line with expectations (3.1% v 3.1%e) and hold just above multi-decade lows

Japan Fin Min Aso expected weak Yen/strong USD trend to continue in H1; FX policy should be discussed in global context

Europe:

(UK) Parliament begins debate on Article 50; reports that five amendments presented to draft bill (**Note: final vote on Wed, Feb 8th)

(UK) Jan GFK Consumer Confidence hits a 3 month high (-5 v -8e)

Americas:

President Trump fires Acting Attorney General Yates (Obama holdover) who would not enforce immigration orders; names Dana Boente new acting AG

Economic data

(JP) Japan Dec Annualized Housing Starts (miss): 923K v 938Ke; Y/Y: 3.9% v 8.4%e v 6.7% prior

(FR) France Q4 Advance GDP (in-line) Q/Q: 0.4% v 0.4%e; Y/Y: 1.1% v 1.1%e

(DE) Germany Dec Retail Sales (miss) M/M: -0.9% v +0.5%e; Y/Y: -1.1% v 0.5%e

(TR) Turkey Dec Trade Balance: -$5.6B v -$5.6Be

(FR) France Jan Preliminary CPI (beat) M/M: -0.2% v -0.5%e; Y/Y: 1.4% v 1.1%e

(FR) France Jan Preliminary CPI EU Harmonized M/M: -0.2% v -0.5%e; Y/Y: 1.6% v 1.2%e

(FR) France Dec Consumer Spending M/M: -0.8% v +0.2%e; Y/Y: 1.5% v 2.1%e

(FR) France Dec PPI M/M: 0.9% v 0.7% prior; Y/Y: +1.7 v -0.5% prior

(ES) Spain Jan Preliminary CPI (beat) M/M: -0.5% v -1.2%e; Y/Y: 3.0% v 2.3%e

(ES) Spain Jan Preliminary CPI EU Harmonized M/M: -0.9% v -1.6%e; Y/Y: 3.0% v 2.2%e

(ES) Spain Jan Preliminary CPI Core M/M: % v 0.1% prior; Y/Y: % v 1.0%e

(AT) Austria Q4 GDP Q/Q: 0.6% v 0.4% prior; Y/Y: 1.8% v 1.2% prior

(DE) Germany Jan Unemployment Change (beat): -26K v -5Ke; Unemployment Rate: 5.9% v 6.0%e ( (post-reunification record low)

(IT) Italy Dec Preliminary Unemployment Rate (miss): 12.0% v 11.8%e

(PL) Poland Overall 2016 GDP Y/Y: 2.8% v 2.7%e

(UK) Dec Net Consumer Credit: £1.0B v £1.7Be; Net Lending: £3.8B v £3.2Be

(UK) Dec Mortgage Approvals (miss): 67.9K v 69.0Ke

(UK) Dec M4 Money Supply M/M: -0.5% v +0.4% prior; Y/Y: 6.2% v 6.4% prior

(EU) Euro Zone Dec Unemployment Rate (beat): 9.6% v 9.8%e (lowest level since 2009)

(EU) Euro Zone Q4 Advance GDP Q/Q: 0.5% v 0.5%e; Y/Y: 1.8% v 1.7%e

(EU) Euro Zone Jan CPI Estimate (beat) Y/Y: 1.8% v 1.5%e (3 1/2 year high); CPI Core Y/Y: 0.9% v 0.9%e

Fixed Income Issuance:

(ID) Indonesia sold total IDR22.0T in bonds

SPEAKERS/FIXED INCOME/FX/COMMODITIES/ERRATUM

Index snapshot (as of 10:00 GMT)

Indices [Stoxx50 +0.6% at 3,279, FTSE +0.6% at 7,161, DAX +0.3% at 11,721, CAC-40 +0.5% at 4,810, IBEX-35 +0.6% at 9,416, FTSE MIB +1.0% at 18,936, SMI +0.2% at 8,340, S&P 500 Futures -0.1%]

Market Focal Points/Key Themes: European equity indices are trading higher despite the Asian and US sessions ending lower overnight; Rallies in European indices predominantly led by banking stocks; Italian FTSE MIB outperforming with the peripheral lenders trading sharply higher, with automobile manufacturers Fiat ad Ferrari also trading notably higher; FTSE 100 gains led by commodity and mining stocks as copper prices trade higher intraday.

A plethora of upcoming scheduled US earnings (pre-market) include AmerisourceBergen, Aetna, Ally Financial, Anixter, CIT Group, CONSOL Energy, Coach, Danaher, HCA, Harley Davidson, Hubbell, Eli Lilly, MasterCard, Manpowergroup, NASDAQ OMX, NuStar Energy, Nucor, Paccar, Pfizer, Pentair, Sprint Nextel, Stifel Financial, Scotts Miracle-Gro, Simon Property, Taylor Morrison, Thermo Fisher Scientific, Under Armour, UPS, Valero Energy, Exxon Mobil, Xerox, and Zimmer Biomet.

Equities (as of 09:50 GMT)

Consumer Discretionary: [Centrotec CEV.DE +0.2% (prelim FY16 results), GFK GFK.DE +0.1% (prelim FY16 results), Givaudan GIVN.CH -4.2% (FY16 results), Hennes & Mauritz HMB.SE +5.5% (Q4 results), Ocado OCDO.UK +7.5% (FY16 results), Richemont CFR.CH +2.0% (Four execs to depart)]

Energy: [Nostrum Oil & Gas NOG.UK +4.7% (production), Royal Dutch Shell RDSA.UK +1.5% (To sell package of UK North Sea assets to Chrysaor for up to $3.8B), Seadrill SDRL.NO -20.6% (financial restructuring update), Scottish & Southern Energy SSE.UK -0.7% (trading update)]

Financials: [Sanne Group SNN.UK +3.6% (trading statement)]

Industrials: [Alfa Laval ALFA.SE +8.1% (Q4 results), UPM-Kymmene UPM1V.FI -9.5% (Q4 results, raises LT outlook)]

Telecom: [Com Hem COMH.SE +1.0% (Q4 results)]

Speakers

ECB's Draghi: Financial integration essential for well-functioning single currency

ECB's Villeroy (France) reiterated view that concerns about rising inflation are exaggerated

UK Government might may invoke Article 50 on March 9th at a European summit. Govt told House of Lords on Mon, Jan 30th that it wanted the bill authorizing Brexit to be approved on March 7th

France Fin Min Sapin: 2017 beginning with very good economic conditions

Spain Econ Min de Guindos saw national inflation easing from Q2

German Finance Ministry spokesman reiterated further payments to Greece depend on successful completion of debt review and IMF participation

Turkey Central Bank Quarterly Inflation Report raised its inflation forecasts for both 2017 and 2018 citing thatimport price rise was the main factor. It raised 2017 CPI from 6.5% to 8.0% and 2018 CPI from 5.0% to 6.0%. CBRT noted that in Jan it decided to strengthen policy tightening and could do additional policy tightening if needed and would use all policy tools until inflation was under control. CBRT also noted that 2017 economic recovery could be slower than expected and expected exports to recover

BOJ Gov Kuroda post rate decision press conference reiterates that that economic recovery remained on a moderate trend and the upward revision to GDP forecasts reflected overseas economies. Reiterated that risks to both growth and inflation remained on the downside (Board Members Kiuchi, Sato both believe that inflation to stay below 2% over BOJ forecast horizon). Reiterated to achieve 2% inflation target around FY18 (**Note: Apr 17 thru Mar 2018). To keep close watch on policy direction and impact from new Trump Administration. Kuroda added that the central bank had "no intention to signal future policy stance through bond buying operations. Too early to discuss any exit strategy from policy; only halfway to inflation target; balance sheet and interest rates were important parts of exit strategy but still dependent on economic situation

Currencies

USD remained on the defensive mode in the aftermath of US President Trump's broad-sweeping executive order on immigration curbs from 7 Middle East countries. Safe-haven plays remained in focus with JPY and Gold being eyed as primary benefactors.

The EUR/USD hovered around the 1.07 level and little changed in the session despite continued improvement in European inflation data and record low unemployment in Germany. Dealers noted that several ECB officials, including President Draghi, have recently highlighted the importance of seeing core CPI pick-up as one of the determinants of meeting its price stability mandate

The USD/JPY moved off its worst levels after BOJ showed its firm commitment to managing the yield curve and dismissed speculation of any imminent tapering of policy. USD/JPY trying to make its way back to the 114 area after testing 113.26 overnight

GBP/USD was softer by 0.4% at 1.2435 as UK Parliament begins debate on the Article 50 bill. Several bits of UK data did disappoint in the session highlighted by mortgage approval for Dec

Fixed Income:

Bund futures trade at 161.66 down 40 ticks with on risk aversion flows with strong German job numbers, stronger Eurozone CPI and GDP readings also weighing on futures. Continued downside targets 161.19 followed by 160.80. A reversal higher targets 162.22 yesterday high, 162.49 then 163.01 followed by 163.38.

Gilt futures trade at 123.35 down 30 ticks of an opening high of 123.69 falling with the Euro Indices rising. Support moves to 122.99, 122.60, 122.23 then Dec low at 122.08. Resistance moves to 123.79 followed 124.13 to close the gap. Short Sterling futures trade flat with Jun17Jun18 remaining steady at 28/29bp.

Tuesday's liquidity report showed Monday's excess liquidity fell to €1.260T down €5B from €1.265T prior. Use of the marginal lending facility fell to €15M from €183M prior.

Corporate issuance saw $17.85B come to market via 3 deals headlines by Microsoft jumbo 7 part $17B issuance upsized from an original $14B with $11.5B being issued in 10, 20, 30 and 40 year bonds.

Looking Ahead

05.30 (UK) Weekly John Lewis LFL sales data

05:30 (EU) ECB allotment in 7-Day Main Refinancing Tender

05:30 (HU) Hungary Debt Agency (AKK) to sell 3-month Bills

05:30 (UK) DMO to sell £2.5B in 1.5% 2026 Gilts

05:30 (BE) Belgium Debt Agency (BDA) to sell €1.0-1.4B in 3-Month and 6-month Bills

06:00 (IE) Ireland Jan Unemployment Rate: No est v 7.2% prior

06:00 (IL) Israel Dec Unemployment Rate: No est v 4.6% prior

06:00 (BR) Brazil Dec National Unemployment Rate: 11.9%e v 11.9% prior

06:00 (BR) Brazil Dec PPI Manufacturing M/M: No est v 0.7% prior; Y/Y: No est v -0.1% prior

06:00 (IN) India Dec Fiscal Deficit (INR):

06:00 (RU) Russia announces weekly OFZ bond auction

06:45 (US) Daily Libor Fixing

07:00 (ZA) South Africa Dec Trade Balance (ZAR): +6.3Be v -1.1B prior

07:00 (IN) India 2016 annual GDP estimate Y/Y: No est v 7.1% prior

07:00 (CL) Chile Dec Unemployment Rate: 6.1%e v 6.2% prior

07:30 (BR) Brazil Dec Nominal Budget Balance (BRL): -113.2Be v -80.4B prior: Primary Budget Balance: -75.1Be v -39.1B prior

07:45 (US) Weekly Goldman Economist Chain Store Sales

08:15 (UK) Baltic Dry Bulk Index

08:30 (US) Q4 Employment Cost Index (ECI): 0.6%e v 0.6% prior

08:30 (CA) Canada Nov GDP M/M: +0.3%e v -0.3% prior; Y/Y: 1.4%e v 1.5% prior

08:30 (CA) Canada Dec Industrial Product Price M/M: 0.6%e v 0.3% prior; Raw Materials Price Index M/M: +2.8%e v -2.0% prior

08:55 (US) Weekly Redbook Sales

09:00 (EU) Weekly ECB Forex Reserves: No est v €280.8B prior

09:00 (US) Nov S&P / Case-Shiller 20-City M/M: 0.70%e v 0.63% prior; Y/Y: 5.00%e v 5.10% prior; House Price Index (HPI): No est v 191.79 prior

09:00 (US) Nov S&P / Case-Shiller (overall) HPI M/M: No est v 0.85% prior, Y/Y: No est v 5.61% prior, House Price Index (HPI): No est v 185.06 prior

09:00 (MX) Mexico Q4 Preliminary GDP Q/Q: 0.6%e v 1.0% prior; Y/Y: 2.2%e v 2.0% prior

09:00 (US) Federal Open Market Committee (FOMC) begins 2-day meeting (Decision on Wed)

09:45 (US) Jan Chicago Purchasing Manager: 55.0e v 53.9 prior (revised from 54.6)

09:50 (UK) Bank of England (BOE) Bond Buying Operation (over 15 years)

10:00 (US) Jan Consumer Confidence: 112.8e v 113.7 prior

10:00 (MX) Mexico Dec Net Outstanding Loans (MXN): No est v 3.61T prior

11:30 (US) Treasury to sell 52-Week Bills

14:00 (AR) Argentina Dec Industrial Production Y/Y: No est v -4.1% prior; Construction Activity Y/Y: No est v -9.4% prior

16:30 (US) Weekly API Oil Inventories

17:20 (CA) Bank of Canada (BOC) Gov Poloz speaks at University of Alberta