Sample Category Title

BoE Dovish Tilt Knocks Sterling; Tech Rout Continues

Sterling weakened sharply after the dovish read-through from the BoE’s rate hold. Although Bank Rate remained at 3.75%, the narrow 5–4 vote surprised markets and brought forward expectations for another cut. The close split highlighted a policy committee on a knife edge. With nearly half the MPC already favoring easing, investors quickly began to price a higher probability of a March move.

That perception was reinforced by Governor Andrew Bailey’s press conference. Bailey framed the outlook as “one of good news,” emphasizing that the disinflation process is firmly on track and progressing faster than the Bank anticipated late last year. Bailey said inflation is expected to average around 3% through the first quarter before dropping close to the 2% target in April and staying there. He stressed that this timeline is roughly a year earlier than the Bank expected in November.

Those comments strengthened the view that, barring negative surprises, doves could hold the upper hand at the March meeting. Markets interpreted the message as lowering the bar for additional easing rather than reaffirming caution.

The broader market backdrop also turned less supportive for risk assets. Risk sentiment soured as US equities opened lower, led by renewed losses in the NASDAQ, extending the ongoing tech rout. Adding to the unease, the Challenger, Gray & Christmas report showed job cuts surged by 108k in January—the highest January total since 2009 and the largest monthly reading since October 2025.

Whether this tech-led weakness bleeds into traditional sectors is now the key watchpoint. For now, markets are cautious rather than panicked, but the labor signal has raised eyebrows. Risk-off sentient is giving Yen and Swiss Franc a lift as markets enter into the US session.

Euro also held modest gains following the ECB’s hold. With policy seen as appropriately set and Euro appreciation already factored into the baseline, the ECB signaled no urgency to move.

On the other hand, sterling is the weakest performer after the BoE’s dovish tilt. Aussie and Kiwi also lag on risk-off sentiment. Yen and Swiss Franc outperform with Euro. Dollar and Loonie trade in the middle.

In Europe, at the time of writing, FTSE is down -0.93%. DAX is down -0.92%. CAC is down -0.55%. UK 10-year yield is up 0.007 at 4.564. Germany 10-year yield is up 0.006 at 2.870. Earlier in Asia, Nikkei fell -0.88%. Hong Kong HSI rose 0.14%. China Shanghai SSE fell -0.64%. Singapore Strait Times rose 0.21%. Japan 10-year JGB yield fell -0.023 to 2.228.

BoE holds at 3.75%, 5-4 vote highlights uneasy balance

The BoE left Bank Rate unchanged at 3.75%, in line with expectations, but the decision masked a much tighter internal debate than markets had anticipated. The 5–4 vote highlighted how finely balanced was the policy considerations as inflation cools but uncertainties persist.

Five members, including Governor Andrew Bailey, backed holding rates steady. Within this group, Megan Greene, Clare Lombardelli and Huw Pill argued that a "more prolonged period of restriction" may still be needed to prevent inflation from settling above target. Bailey and Catherine Mann were more confident that easing inflation would mitigate that risk, but judged that the "evidence was yet sufficient" enough to justify a cut.

On the other side, four members—Sarah Breeden, Swati Dhingra, Dave Ramsden and Alan Taylor—voted for an immediate 25bp reduction. They judged that risks of inflation persistence had "receded materially" and placed greater weight on weaker demand, arguing that policy remains overly restrictive.

Despite the hold, the overall message retained a clear easing bias. The statement reiterated that Bank Rate is "likely to be reduced further", but emphasized that future decisions will be finely judged and data-dependent, leaving the timing and pace of cuts firmly open.

ECB holds at 2.00%, Euro strength already factored in

The ECB left the deposit rate unchanged at 2.00%, in line with expectations. The accompanying statement reaffirmed confidence that inflation should stabilize at the 2% target over the medium term and reiterated a data-dependent, meeting-by-meeting approach to policy decisions.

At the press conference, President Christine Lagarde emphasized that risks are “broadly balanced.” She acknowledged that some risks have increased while others have eased, leaving the Governing Council comfortable with current settings rather than inclined toward near-term action.

Lagarde outlined upside and downside inflation scenarios. On the upside, persistent energy price increases, more fragmented global supply chains, slower moderation in wage growth, and planned boosts in defence and infrastructure spending could lift inflation over the medium term.

On the downside, weaker external demand from tariffs, excess global capacity spilling into euro area imports, tighter financial conditions, and a stronger Euro could all dampen price pressures.

On the exchange rate, Lagarde noted that Euro appreciation could bring inflation down beyond current expectations. However, she added that the Euro’s gains against the dollar since March 2025 are already incorporated into the ECB’s baseline, while stressing that the Bank will continue to monitor pass-through effects closely.

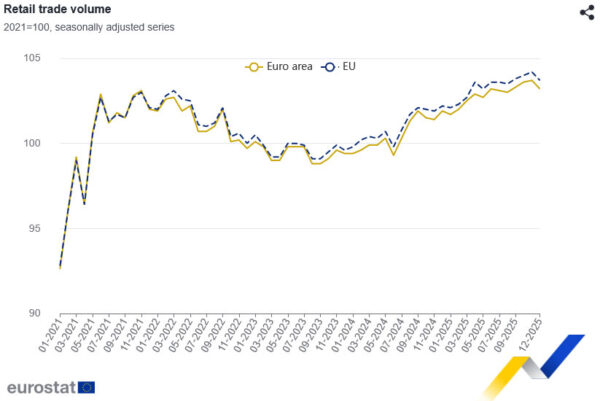

Eurozone retail sales fall -0.5% mom in December as consumer weakness persists

Retail sales across the Eurozone fell -0.5% mom in December, a steeper decline than the expected -0.2% drop.

Detail shows a clear split between essentials and discretionary items. Food-related sales rose slightly by 0.1% mom, but non-food purchases excluding fuel slumped 1.2%, pointing to continued restraint on big-ticket and discretionary spending. Fuel sales were flat, offering little offset to the broader weakness.

The weakness was broad-based across the European Union, where retail sales also fell 0.5% on the month. Among reporting countries, Portugal (-3.1%), Sweden (-1.9%) and Denmark (-1.6%) recorded the largest declines, while Luxembourg (+7.0%), Slovakia (+3.1%) and Croatia (+1.8%) posted solid gains.

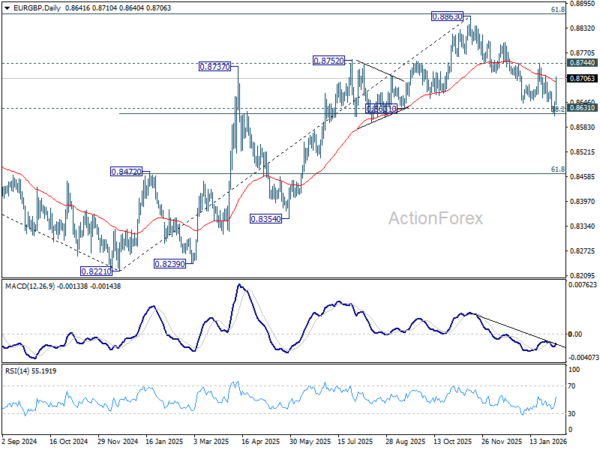

US initial jobless claims surge to 231k vs exp 210k

US initial jobless claims jumped 22k to 231k in the week ending January 31, well above expectation of 210k. Four-week moving average of initial claims rose 6k to 212k.

Continuing claims rose 25k to 1,844k in the week ending January 24. Four-week moving average of continuing claims fell -15k to 1851k, lowest since October 5, 2024.

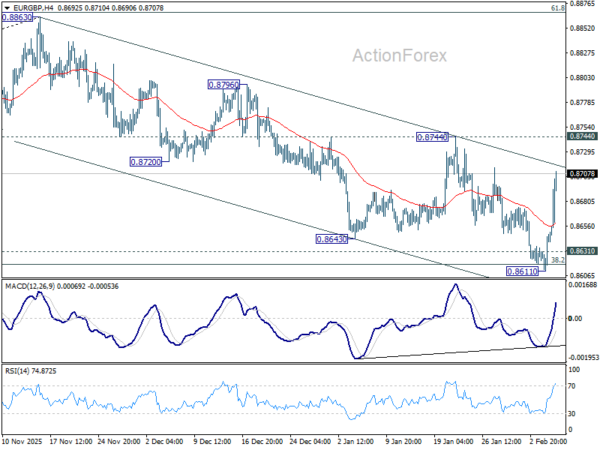

EUR/GBP Mid-Day Outlook

Daily Pivots: (S1) 0.8623; (P) 0.8636; (R1) 0.8660; More…

EUR/GBP's rebound from 0.8611 extended higher today but stays below 0.8744 resistance. Intraday bias stays neutral first. On the upside, firm break of 0.8744 will argue that fall from 0.8863 has completed as a correction. Intraday bias will be back to the upside for retesting 0.8863, with prospect of resuming larger up trend. Nevertheless, on the downside, decisive break of 0.8631 cluster support (38.2% retracement of 0.8221 to 0.8663 at 0.8618) will carry larger bearish implications.

In the bigger picture, rise from 0.8221 medium term bottom (2024 low) is seen as a corrective move. Upside should be limited by 61.8% retracement of 0.9267 to 0.8221 at 0.8867. Sustained trading below 55 W EMA (now at 0.8625) should confirm that this corrective bounce has completed. In this case, deeper fall would be seen back to 0.8201/21 key support zone. However, decisive break of 0.8867 will suggest that EUR/GBP is already reversing whole decline from 0.9267 (2022 high). That should pave the way back to 0.9267.

US initial jobless claims surge to 231k vs exp 210k

US initial jobless claims jumped 22k to 231k in the week ending January 31, well above expectation of 210k. Four-week moving average of initial claims rose 6k to 212k.

Continuing claims rose 25k to 1,844k in the week ending January 24. Four-week moving average of continuing claims fell -15k to 1851k, lowest since October 5, 2024.

ECB holds at 2.00%, Euro strength already factored in

The ECB left the deposit rate unchanged at 2.00%, in line with expectations. The accompanying statement reaffirmed confidence that inflation should stabilize at the 2% target over the medium term and reiterated a data-dependent, meeting-by-meeting approach to policy decisions.

At the press conference, President Christine Lagarde emphasized that risks are “broadly balanced.” She acknowledged that some risks have increased while others have eased, leaving the Governing Council comfortable with current settings rather than inclined toward near-term action.

Lagarde outlined upside and downside inflation scenarios. On the upside, persistent energy price increases, more fragmented global supply chains, slower moderation in wage growth, and planned boosts in defence and infrastructure spending could lift inflation over the medium term.

On the downside, weaker external demand from tariffs, excess global capacity spilling into euro area imports, tighter financial conditions, and a stronger Euro could all dampen price pressures.

On the exchange rate, Lagarde noted that Euro appreciation could bring inflation down beyond current expectations. However, she added that the Euro’s gains against the dollar since March 2025 are already incorporated into the ECB’s baseline, while stressing that the Bank will continue to monitor pass-through effects closely.

Full ECB statement, Lagarde's press conference speech.

BoE holds at 3.75%, 5-4 vote highlights uneasy balance

The BoE left Bank Rate unchanged at 3.75%, in line with expectations, but the decision masked a much tighter internal debate than markets had anticipated. The 5–4 vote highlighted how finely balanced was the policy considerations as inflation cools but uncertainties persist.

Five members, including Governor Andrew Bailey, backed holding rates steady. Within this group, Megan Greene, Clare Lombardelli and Huw Pill argued that a "more prolonged period of restriction" may still be needed to prevent inflation from settling above target. Bailey and Catherine Mann were more confident that easing inflation would mitigate that risk, but judged that the "evidence was yet sufficient" enough to justify a cut.

On the other side, four members—Sarah Breeden, Swati Dhingra, Dave Ramsden and Alan Taylor—voted for an immediate 25bp reduction. They judged that risks of inflation persistence had "receded materially" and placed greater weight on weaker demand, arguing that policy remains overly restrictive.

Despite the hold, the overall message retained a clear easing bias. The statement reiterated that Bank Rate is "likely to be reduced further", but emphasized that future decisions will be finely judged and data-dependent, leaving the timing and pace of cuts firmly open.

(ECB) Monetary policy decisions

The Governing Council today decided to keep the three key ECB interest rates unchanged. Its updated assessment reconfirms that inflation should stabilise at its 2% target in the medium term. The economy remains resilient in a challenging global environment. Low unemployment, solid private sector balance sheets, the gradual rollout of public spending on defence and infrastructure and the supportive effects of the past interest rate cuts are underpinning growth. At the same time, the outlook is still uncertain, owing particularly to ongoing global trade policy uncertainty and geopolitical tensions.

The Governing Council is determined to ensure that inflation stabilises at its 2% target in the medium term. It will follow a data-dependent and meeting-by-meeting approach to determining the appropriate monetary policy stance. In particular, the Governing Council’s interest rate decisions will be based on its assessment of the inflation outlook and the risks surrounding it, in light of the incoming economic and financial data, as well as the dynamics of underlying inflation and the strength of monetary policy transmission. The Governing Council is not pre-committing to a particular rate path.

Key ECB interest rates

The interest rates on the deposit facility, the main refinancing operations and the marginal lending facility will remain unchanged at 2.00%, 2.15% and 2.40% respectively.

Asset purchase programme (APP) and pandemic emergency purchase programme (PEPP)

The APP and PEPP portfolios are declining at a measured and predictable pace, as the Eurosystem no longer reinvests the principal payments from maturing securities.

***

The Governing Council stands ready to adjust all of its instruments within its mandate to ensure that inflation stabilises at its 2% target in the medium term and to preserve the smooth functioning of monetary policy transmission. Moreover, the Transmission Protection Instrument is available to counter unwarranted, disorderly market dynamics that pose a serious threat to the transmission of monetary policy across all euro area countries, thus allowing the Governing Council to more effectively deliver on its price stability mandate.

The President of the ECB will comment on the considerations underlying these decisions at a press conference starting at 14:45 CET today.

(BOE) Bank Rate maintained at 3.75%

Monetary Policy Summary, February 2026

At its meeting ending on 4 February 2026, the Monetary Policy Committee voted by a majority of 5–4 to maintain Bank Rate at 3.75%. Four members voted to reduce Bank Rate by 0.25 percentage points, to 3.5%.

Although above the 2% target currently, CPI inflation is expected to fall back to around the target from April, owing to developments in energy prices including from Budget 2025. Reflecting the impact of monetary policy, and consistent with evidence of subdued economic growth and building slack in the labour market, pay growth and services price inflation have generally continued to ease. The risk from greater inflation persistence has continued to become less pronounced, while some risks to inflation from weaker demand and a loosening labour market remain.

Monetary policy is being set to ensure that CPI inflation not only reaches 2% but remains sustainably at that level in the medium term, which involves balancing the risks around achieving this. The restrictiveness of policy has fallen as Bank Rate has been reduced by 150 basis points since August 2024. On the basis of the current evidence, Bank Rate is likely to be reduced further. Judgements around further policy easing will become a closer call. The extent and timing of further easing in monetary policy will depend on the evolution of the outlook for inflation.

Minutes of the Monetary Policy Committee meeting ending on 4 February 2026

1: Before turning to its immediate policy decision, the Monetary Policy Committee (MPC) discussed key economic developments and its judgements around them, as well as its views on monetary policy strategy. The latest data and analysis underpinning these topics were set out in the accompanying February 2026 Monetary Policy Report.

The Committee’s discussions

2: The Committee’s policy discussions at this meeting focused on: the near-term outlook for inflation, and its implications for underlying price and wage pressures; the role of slack in the economy in helping to keep inflation at the target in the medium term; and the appropriate response of monetary policy, taking into account these factors as well as broader strategic considerations.

3: CPI inflation had fallen from 3.8% in September last year to 3.4% in December. Reflecting the impact of monetary policy, wage growth and services price inflation had generally continued to ease, albeit remaining above target-consistent levels. CPI inflation was expected to fall back to around the 2% target from April. This mainly reflected developments in energy prices, including the impact of measures announced in Budget 2025. This near-term outlook was notably lower than had been expected in the November Monetary Policy Report, although there had been less news relative to the MPC’s December meeting.

4: UK import prices were also contributing slightly to the projected decline in CPI inflation this year, including as US tariffs and previous energy price falls were weighing on global export price growth. Uncertainty around the global outlook remained.

5: All members of the Committee continued to stress the importance of inflation not only reaching but remaining sustainably at the 2% target in the medium term. Members had different views on the extent to which the near-term reduction in headline inflation, which predominantly reflected one-off factors, would be sufficient to curb remaining risks of persistence in underlying inflationary pressures.

6: For some members, the prospective reduction in headline inflation, particularly in categories such as energy and food that remained salient for households, could feed through quickly to inflation expectations and lead to continued normalisation of wage and price-setting. These members also pointed to pay settlements in the Agents’ pay survey slowing to 3.4% this year, close to target-consistent levels. However, other members were more concerned about still-elevated inflation expectations and a range of future wage indicators, despite disinflation to date. If such inflationary pressures persisted, monetary policy would need to remain more restrictive to avoid inflation settling above the target in the medium term. Most members put some weight on Bank staff analysis that had found little evidence of structural changes in wage bargaining over the recent period.

7: The extent to which remaining excess domestic inflationary pressures would fall would crucially also be influenced by developments in the labour market and the degree to which economic slack acted against these pressures in the coming years. Underlying GDP growth had remained below estimates of potential, and Agents’ intelligence pointed to a subdued outlook for demand. The labour market had continued to loosen, with the unemployment rate having picked up to just over 5% recently. As a result, the February Report central projection incorporated a slightly wider output gap over the forecast period than had been expected in November.

8: Most members judged that there remained some downside risks around this already weaker outlook, which could widen the output gap further and result in an undershoot in inflation, in the absence of looser monetary policy. Households might remain cautious about spending, with a risk that the saving rate would not fall back as expected. Demand could remain weak and unemployment could increase by more than expected.

9: Other members noted signs of a slowing in the pace of labour market loosening as, for example, vacancies had started to tick up. Weak productivity growth could keep unit labour cost growth elevated and contribute to a narrower output gap than otherwise estimated. And growth in bank lending and broad money had both edged higher, suggesting that monetary policy was not overly restrictive.

10: On balance, the Committee judged that the risk from greater inflation persistence had continued to become less pronounced, while some risks to inflation from weaker demand and a loosening labour market remained. In making this assessment, members had generally been influenced more by new Bank staff analysis, including that published in the February Report, than by the most recent data releases.

11: In considering how monetary policy should be set to balance these risks around inflation settling sustainably at the target, the Committee judged that, on the basis of the current evidence, Bank Rate was likely to be reduced further, although there were different views on the timing and extent. Judgements around further policy easing would become a closer call. With uncertainty around how precisely a neutral level of Bank Rate could be estimated, slowing the pace of further easing could provide space to gain assurance about how the risks were evolving.

12: Across possible inflation scenarios, the MPC considered how well different monetary policy paths could insure against adverse economic outcomes.

13: Some members were most concerned that cutting rates too quickly risked inadvertently making policy too accommodative if inflationary pressures did not recede, and that it might be costly to change course in that event. If downside risks were instead to materialise, Bank Rate could still be reduced faster then. Other members were concerned that holding Bank Rate at a restrictive level for too long could require a sharper adjustment in monetary policy later on. Finding clear evidence that structural changes had occurred in the economy would always take a long time to become evident in the data. And waiting too long to change policy in the meantime could come at the cost of a sharper downturn in activity and a significant undershoot in inflation.

14: The Committee noted that the central projection was conditioned on a market curve that fell slightly in 2026 then sloped upwards thereafter, to around 3¾% in 2029. Instead, the median respondent to the Market Participants Survey expected Bank Rate to fall to 3.25% and stay there. Members recognised that the upward slope in market pricing beyond this year, even if it did not solely reflect market expectations of Bank Rate, was providing restriction via firms’ and households’ financing costs.

The immediate policy decision

15: The MPC sets monetary policy to meet the 2% inflation target, and in a way that helps to sustain growth and employment. The MPC adopts a medium-term and forward-looking approach to determine the monetary stance required to achieve the inflation target sustainably.

16: Five members (Andrew Bailey, Megan Greene, Clare Lombardelli, Catherine L Mann and Huw Pill) preferred to maintain Bank Rate at 3.75% at this meeting. These members recognised that progress in disinflation had continued. While the lower near-term outlook for inflation was welcome, it remained to be seen how this would pass through into wage and price-setting in the economy. For three members in this group (Megan Greene, Clare Lombardelli and Huw Pill), a more prolonged period of policy restriction was likely to be warranted to mitigate the remaining risks that inflation could settle above the target, but they would continue to assess the evidence. The other two members in this group (Andrew Bailey and Catherine L Mann) had greater confidence that this risk would be mitigated by the lower near-term path for inflation and placed greater emphasis on the risks to inflation from weaker activity, but neither member judged that the weight of evidence was yet sufficient to warrant reducing Bank Rate at this meeting.

17: Four members (Sarah Breeden, Swati Dhingra, Dave Ramsden and Alan Taylor) preferred a 0.25 percentage point reduction in Bank Rate at this meeting. These members judged that the risk from greater inflation persistence had receded materially, and thought it likely that inflation expectations would normalise once inflation itself returned to around the target. These members attached a greater weight to the risks to inflation from weaker demand. For these members, monetary policy was still too restrictive, and a further cut in Bank Rate was warranted at this meeting.

18: The Chair invited the Committee to vote on the proposition that:

- Bank Rate should be maintained at 3.75%.

19: Five members (Andrew Bailey, Megan Greene, Clare Lombardelli, Catherine L Mann and Huw Pill) voted in favour of the proposition. Four members (Sarah Breeden, Swati Dhingra, Dave Ramsden and Alan Taylor) voted against this proposition, preferring to reduce Bank Rate by 0.25 percentage points, to 3.5%.

MPC members’ views

20: Members set out the rationale underpinning their individual votes on Bank Rate.

Members are listed alphabetically under each vote grouping. References in parentheses relate to boxes and sections of the February 2026 Monetary Policy Report. References to scenarios relate to those set out in Section 3 of the November 2025 Report, which have been updated in the February Report.

Vote to maintain Bank Rate at 3.75%

Andrew Bailey: My policy decision is based on accumulating evidence. Despite all the uncertainties in the world, we are not currently facing a situation in which monetary policy is being hit by big new shocks. Activity is subdued against a background of inflation returning to the target. I can see the case for the output gap having widened, but by how much is uncertain. Although survey evidence on activity is pointing to a slightly more positive short-term picture, my central outlook is aligned with the staff’s view of weaker demand, leaving the risks more balanced. The supply side story remains uncertain (Box C). I expect to see quite a sharp drop in inflation over coming months. While I am more confident in the overall path of wage disinflation, it is naturally less clear when and how much the expected upcoming drop in inflation will influence wage settlements (Box B). Overall, the risks from inflation persistence appear to have continued to reduce. I therefore see scope for some further easing of policy. This does not mean that I expect to cut Bank Rate at any particular meeting. I will go into the coming meetings asking whether a cut is justified.

Megan Greene: I continue to place more weight on the risk of inflation persistence, preferring to wait for clearer evidence that inflation will settle sustainably at the target before easing policy further. I find it difficult to justify our significant downward revision to slack in this forecast, given year-on-year headline GDP growth surprised to the upside for much of 2025. I also think it unlikely that potential productivity will pick up as assumed (Box C) and put more weight on Bank staff’s smaller output gap sensitivity (Section 3.2). Our central projection requires underlying inflation and wage growth to decline further for inflation to stabilise at the target. I have three primary concerns: forward-looking indicators of wage growth remain above target-consistent rates; firms in the DMP Survey expect little change in their own-price inflation over the next year; and household inflation expectations remain elevated. I would prefer to wait to see that firms and households revise down their inflation expectations in response to lower realised inflation. I continue to think the monetary policy stance is not materially restrictive. Finally, I believe the cost of a policy error is greater if Bank Rate follows the market path and we end up with inflation persistence versus weaker demand.

Clare Lombardelli: Overall the data continue broadly to show strength in wages and underlying inflation, weak activity and softening employment. While the near-term fall in CPI inflation should reduce second-round effects, it is not assured that wage growth will return to target-consistent rates (Box A). The recent recovery in productivity is likely cyclical. Structural productivity growth, which has been weak since the financial crisis, may not recover to the extent that Bank staff estimate (Box C). I remain concerned about both upside and downside risks to inflation. The labour market has loosened materially, from an extremely tight starting point, but it is unclear how much downward pressure this is putting on inflation. The current degree of restrictiveness is uncertain (Box E), although evidence on credit does not suggest monetary policy is weighing heavily on the economy. Taken together, I prefer to hold Bank Rate at its current level. I am more concerned about the costs of cutting rates too quickly than too slowly, including the risks to credibility from any potential policy reversal that is not in response to a new shock.

Catherine L Mann: New analysis and current developments have moved the appropriate time for a cut in Bank Rate closer. This will partly depend on how various one-off policies (Box D) – which account for half of the projected disinflation between 2025 H2 and 2026 H2 – affect the underlying disinflation process. Wage and price moderation is in train, with one-year ahead expected inflation of income-elastic and discretionary consumer-facing products particularly notable. Some components of CPI inflation have remained above target-consistent rates (Box E), most likely because wage growth is not target-consistent either (Box A). Bank staff analysis on different categories of wage setters suggests that lower inflation should push down on settlements for a significant proportion of private sector workers (Box B). Private sector activity and employment continue to be soft. Consumers have been scarred by high and volatile inflation, which poses a risk to the projected decrease in the saving rate in the central projection. The degree of restrictiveness varies over the time horizon and whether the focus is on real or nominal rates. A cut now would overweight the importance of the near-term mechanical disinflation and risk higher term premia. I look forward to incoming assessments of the constellation of surveys and data ahead of upcoming meetings.

Huw Pill: I do not see a need to reduce Bank Rate further at this meeting. This follows from distinguishing between the underlying disinflation process, which remains intact but incomplete, and the risks around that process, which shift through time but have on balance been in the direction of slower disinflation than expected a year or eighteen months ago. In explaining this slowing, I would emphasise the role of structural changes in wage-bargaining and productivity – notwithstanding the conclusions in Box B, where I draw different implications from the careful and important analysis – and a monetary policy stance that has been overly accommodative since the withdrawal of restriction started in August 2024. While I draw comfort about the medium-term inflation outlook from longer-term market inflation expectations and low-frequency broad money dynamics, I remain concerned that inflationary pressures stemming from an overly rapid withdrawal of policy restriction over the past two years still need to be contained and eliminated. In that light, I continue to favour a cautious withdrawal of policy restriction, guided by longer‑term trends rather than short‑term news.

Vote to reduce Bank rate by 0.25 percentage points, to 3.5%

Sarah Breeden: The significant amount of evidence since December has led to a finely balanced decision. New analysis, rather than new data, has further supported my view that upside risks to inflation have diminished: wage growth is set to end this year at target-consistent levels (Box A); structural change in the labour market now appears less likely to have occurred (Box B); and slack is judged to be a little wider both now and over the forecast. The improved near-term inflation outlook should support a swifter normalisation of wage and price-setting dynamics in an environment of weak demand and labour market slack, as firms and households adjust their expectations towards the target. Upside risks to inflation cannot however be ruled out: inflation expectations may not adjust and potential productivity growth could prove weaker than expected (Box C). But I place greater weight on downside risks, particularly in the near term, including those from an elevated household saving rate and a weakening labour market. I can see a case for taking out some insurance against these downside risks to inflation and think policy should be eased a little faster than implied by the current market path.

Swati Dhingra: My inflation outlook is broadly consistent with the central projection, pointing to continued disinflation. The inflation persistence scenario is less compelling given the prevailing weakness in activity and higher-than-expected unemployment. The return of inflation to near-target this year alleviates previous concerns about threshold effects. I expect inflation expectations to reduce once prices and wages have normalised, with little evidence of structural change to the wage-setting process (Box B), especially now that previous cost-push shocks are at some distance. While my central case has the risks around activity broadly balanced, I still find the downside scenario to be a useful exploration of a weaker demand recovery. The impact of weaker demand on slack could nevertheless be limited if the prolonged demand weakness has also weighed on supply growth (Box C), potentially counteracting the risk of an inflation undershoot. But, overall, I still expect monetary policy to contribute to disinflation over the next year. The market-implied path for Bank Rate looks too tight. The costs of making a policy mistake seem much higher on the downside, especially given weak labour demand. And the reverse strategy of holding Bank Rate then cutting aggressively would be no panacea were there to be a sharp downturn in activity and employment.

Dave Ramsden: I see risks to the latest central projection for inflation as now tilted to the downside, reflecting the latest evidence and, in particular, the analysis presented in the February Report. Core disinflation is clearly progressing with cumulative weakening in the labour market and subdued activity, consistent with a slightly larger output gap relative to November. This outlook could be weaker if savings and consumption do not normalise, as a result of recent shocks and geopolitical uncertainty, and if there is greater loosening in the labour market than expected. I am increasingly confident that wage growth will fall to target-consistent rates this year (Box A). Falls in headline inflation (Box D) should help cool inflation expectations and ease wage growth further, with little evidence of structural changes affecting wage-setting (Box B). Additionally, productivity growth may pick up to near its long-run trend (Box C). I do not discount upside risks to inflation nor various ongoing uncertainties. However, with my starting point for an estimate of the neutral rate of around 3%, I judge that policy should be less restrictive in order to meet the 2% target sustainably in the medium term.

Alan Taylor: This is a substantial forecast revision, but the continued drift is more notable. Since February 2025, cumulative revisions for 2026–27 have delivered lower central paths for inflation and greater slack, even as the Bank Rate path on which they were conditioned drifted lower. If the inflation persistence scenario were materialising, the opposite should have happened. This supports my previous outlook, as do other developments. Firstly, inflation is now expected to return to the target this year; some higher-frequency measures suggest we are already close. Secondly, we reach the target much earlier than previously expected (Box D), and falling inflation means that elevated inflation expectations are likely to moderate significantly this year. Thirdly, this is not all due to the one-time shocks dropping out or new fiscal measures kicking in; softer price-wage dynamics and emerging slack also contribute across the forecast period. Together with normalising wages (Boxes A and B), all this reduces or even eliminates the risk of the inflation persistence scenario. I now place even more weight on the central and downside scenarios. If we expect to be at or below the target with significant slack emerging in about six months, a neutral rate of 3% should be in our sights now.

Operational considerations

21: On 4 February, the stock of UK government bonds held for monetary policy purposes was £531 billion.

22: The following members of the Committee were present:

- Andrew Bailey, Chair

- Sarah Breeden

- Swati Dhingra

- Megan Greene

- Clare Lombardelli

- Catherine L Mann

- Huw Pill

- Dave Ramsden

- Alan Taylor

James Bowler was present as the Treasury representative.

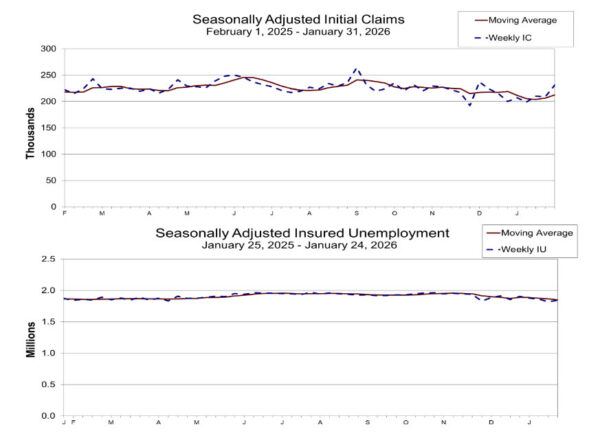

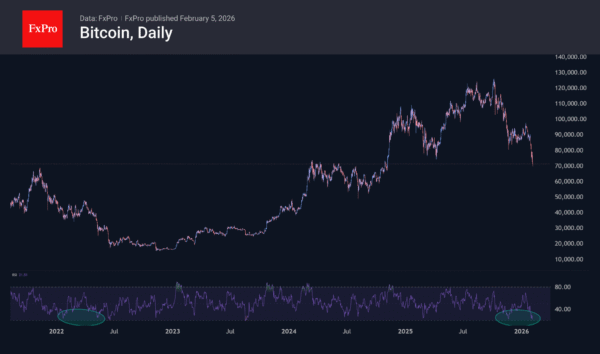

Bitcoin Sell-Off Deepens Despite Oversold Signals

Market Overview

The crypto market cap has fallen by more than 5% to $2.42 trillion. This is a return to last April’s lows, but the bad news is the higher rate of price decline. The cryptocurrency market has become more experienced and saturated with institutional investors, which adds liquidity and suppresses volatility, but does not change the direction. The liquidation of unprofitable cryptocurrency reserves by corporations and funds may exacerbate the downward trend.

Bitcoin was approaching $70K on Thursday morning and now trades at $71K. At current levels, Bitcoin has returned to an area that was a strong resistance from March to October 2024. This explains the current interest of bargain hunters. The RSI on daily timeframes fell to 22, the lowest since August 2023. If we look at a similar phase of the market cycle, a similarly intense sell-off in May 2022 ended with price consolidation around one level for a month, followed by a deeper dive.

News Background

44% of Bitcoin supply is in unrealised loss territory, according to Glassnode. A 30% decline from the recent peak of $108K has reduced the share of profitable coins from 78% to 56%. If the 2022 bear market scenario repeats itself, BTC could fall another 20% to $60K.

Despite the ‘disturbing similarity’ to the selloffs of 2018 and 2022, an 80% collapse of Bitcoin from its highs is unlikely due to institutional adoption, regulated product inflows and interest rate easing, according to K33 Research.

Bitcoin reserves on Binance show no signs of outflows despite market turbulence, CryptoQuant notes.

Ethereum founder Vitalik Buterin said that the original concept of layer 2 (L2) solutions is outdated and proposed a new model for ecosystem development, shifting the focus from simple scaling to unique project features.

Solana could grow to $2,000 by the end of 2030, despite lower near-term targets, according to Standard Chartered. The target level for the end of 2026 has been lowered from $310 to $250. The blockchain will need more time to scale new use cases.

Eurozone retail sales fall -0.5% mom in December as consumer weakness persists

Retail sales across the Eurozone fell -0.5% mom in December, a steeper decline than the expected -0.2% drop.

Detail shows a clear split between essentials and discretionary items. Food-related sales rose slightly by 0.1% mom, but non-food purchases excluding fuel slumped 1.2%, pointing to continued restraint on big-ticket and discretionary spending. Fuel sales were flat, offering little offset to the broader weakness.

The weakness was broad-based across the European Union, where retail sales also fell 0.5% on the month. Among reporting countries, Portugal (-3.1%), Sweden (-1.9%) and Denmark (-1.6%) recorded the largest declines, while Luxembourg (+7.0%), Slovakia (+3.1%) and Croatia (+1.8%) posted solid gains.

GBP/USD Flags More Declines as BoE Rate Decision Awaited

- GBPUSD pulls back from multi-year highs as BoE decision approaches.

- Bears eye a daily close below 1.3600 to extend downside momentum.

GBPUSD has turned weekly gains into losses after a quiet week, slipping toward the 1.3600 level early on Thursday as traders' position ahead of the Bank of England’s rate decision. The central bank is expected to leave rates unchanged, with markets focused on guidance over the duration of the pause and the scope for easing later in the year, despite still-elevated inflation.

The policy decision comes as the pair is testing a key support near 1.3615 after resuming its pullback from the 4½-year high of 1.3868. A break lower could meet the 20-day SMA at 1.3565 and the 38.2% Fibonacci retracement of the November–January rally at 1.3540. Then, all the attention could shift to the crucial floor near 1.3500, where the 50- and 200-day SMAs and the rising trendline from November converge. Failure to pivot there would violate the upward trajectory from 1.3000.

While momentum indicators point lower, the stochastic oscillator is entering oversold territory, suggesting downside momentum may be losing steam. Nevertheless, a bullish reversal would require a close above Wednesday’s resistance at 1.3730, which could open the way towards the 1.3815–1.3840 zone ahead of the 1.3900–1.3950 region.

In summary, GBPUSD may remain subdued in the near term, with bearish momentum likely to resume on a sustained close below 1.3615.

GBP/USD Under Local Pressure: Focus on Bank of England Signals

GBP/USD fell to 1.3627 on Thursday. Investors are awaiting the outcome of today's Bank of England meeting.

UK interest rates are expected to decline throughout the year. However, the regulator is unlikely to provide clear signals about the timing and scale of easing, as it needs to wait for a clearer picture of inflation.

Additional pressure on the US dollar stems from the delay in the publication of key US labour market data due to the partial government shutdown. This increases uncertainty about the Fed's future policy.

By the end of the year, global markets are pricing in around 35 basis points of Bank of England easing – one 25 bp cut and a second cut priced with a probability of around 40%.

Political risks remain in the UK. Investor attention is focused on the by-elections in Gorton and Denton County on 26 February, alongside the May local elections. Pollsters show a rise in support for the Reform UK party. It is ahead of both Prime Minister Keir Starmer's Labour Party and Kemi Badenoch's Conservatives, despite the general election not being scheduled until 2029.

Technical Analysis

On the H4 chart, after a sharp rally in the second half of January and a fresh high in the 1.3850–1.3880 zone, GBP/USD entered a correction phase. The price has turned down from the upper end of the Bollinger Bands and is now testing the 1.3620–1.3650 support area. Upward momentum has weakened, leaving the structure short-term neutral-to-bearish. At the same time, the broader upward context has not yet been breached.

On the lower H1 chart, a descending corrective channel has formed. The price is consistently posting lower lows and remains near the lower Bollinger Bands. Selling pressure persists, with the nearest support at 1.3520–1.3550. To stabilise, the market would need a return above the 1.3660–1.3700 zone.

Conclusion

In summary, GBP/USD is experiencing a tactical pullback driven by pre-BoE caution and delayed US data, which is creating a temporary dollar squeeze. The technical correction appears orderly and is testing key support within a larger bullish structure. The near-term trajectory hinges almost entirely on the Bank of England's tone today: any dovish hints could extend the correction towards 1.3520, while a neutral or hawkish hold could trigger a recovery attempt. Political uncertainty in the UK adds a layer of medium-term risk, but for now, the primary focus remains on monetary policy signals and the defence of the 1.3620 support zone.