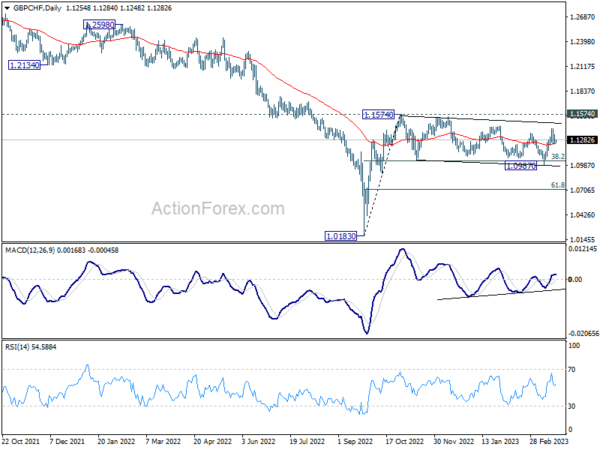

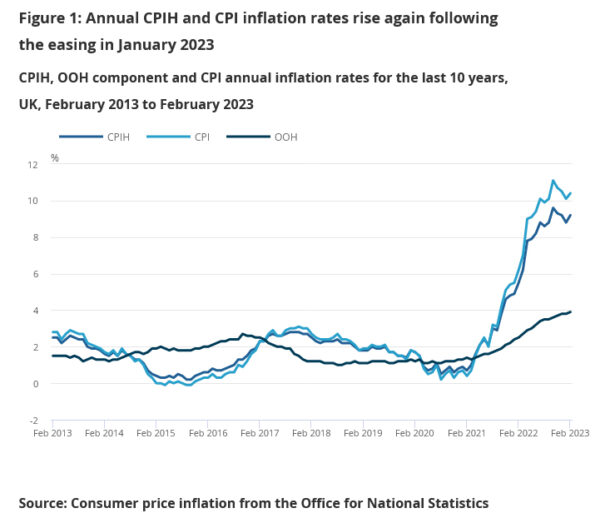

Following BoE’s decision to raise interest rates by 25bps to 4.25%, Governor Andrew Bailey expressed uncertainty about whether this would be the peak for rates.

Talking to broadcasters, Bailey said, “We don’t know whether it’s going to be the peak,” adding that “We’ve seen signs of inflation really peaking now. But of course it’s far too high… We need to see it starting to come down progressively and get back to target.”

In a separate video, Bailey explained the rationale behind the rate hike, stating, “Inflation is still too high, but we continue to expect it to fall sharply from the middle of this year. Raising interest rates is the best way we have of making sure that happens.”

He also emphasized that “low and stable inflation is the foundation of a healthy economy,” and that raising rates is the “best tool” for bringing inflation back under control.

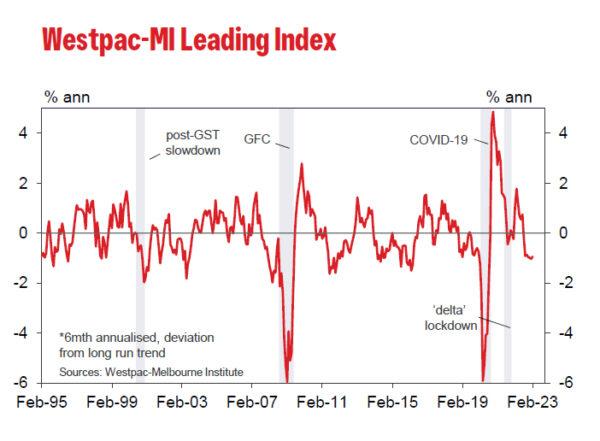

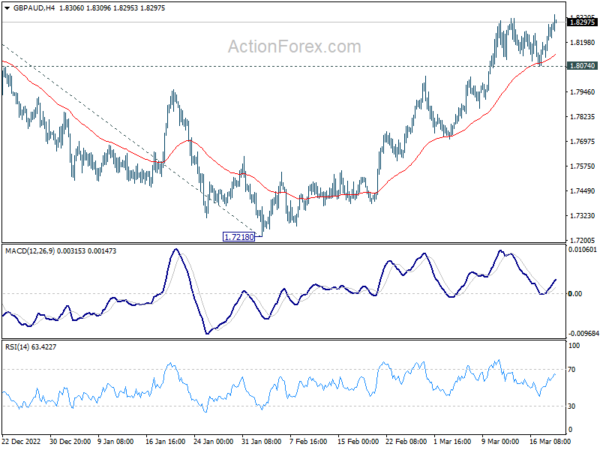

Australia PMI composite dropped to 48.1, renewed contraction

Australia PMI Manufacturing dropped from 50.5 to 48.7 in March, a 34-month low. PMI Services dropped from 50.7 to 48.2, a 3-month low. PMI Composite dropped from 50.6 to 48.1, a 3-month low. All readings indicated renewed contraction in the private sector following improvements in February.

Looking at some details, the results indicate a continued economic slowdown, with composite output and new orders indexes at their lowest since the 2021 Delta lockdowns. Despite easing labor demand, employment indexes suggest businesses are still looking to expand their workforce in 2023. Price indicators have eased but remain elevated, with Australian inflation peaking in late 2022. Service industry input prices are still high, suggesting potential inflationary pressures in 2023 due to labor costs and energy prices.

As the Reserve Bank of Australia (RBA) prepares for its April meeting, it faces a tough decision on whether to pause its tightening cycle amid global financial uncertainty, strong employment numbers, and concerns about inflation levels. Some argue that the RBA should raise the cash rate closer to 4% before pausing to observe the economy’s performance over the next few months.

Warren Hogan, Chief Economic Advisor at Judo Bank noted: “There is no point pausing for a month before hiking again. The RBA Board need to get the cash rate to a level that they think will buy them the time to observe how the economy unfolds for at least three months, if not longer.”

Full Australia PMI release here.