Live Comments

Brutal risk shift ahead of US CPI: Yields sink, NASDAQ fails, USD/JPY under threat

US equities staged a sharp reversal overnight, closing decisively lower with NASDAQ leading losses at -2%. DOW fell -1.3%, slipping back below the 50,000 mark after managing to hold it for four sessions only. Treasury markets reinforced the risk-off signal as 10-year yield took another leg lower and is now on the verge of breaking below 4.1% handle.

January CPI is due, but its influence may be limited. The strong non-farm payrolls report has effectively removed urgency for a March Fed move and supports a pause at least through June. Unless inflation delivers a major shock, markets would revert to broader risk dynamics once the event passes.

The catalyst behind the equity selloff is once again AI disruption anxiety. Software stocks, which have been under persistent pressure this year, extended losses sharply. More concerning is that the negative tone is spreading beyond technology. Financials came under pressure amid fears that AI could disrupt wealth management and advisory services. Industrials and logistics stocks also saw heavy selling on concerns that AI-driven efficiency gains in freight and supply chains could erode traditional revenue models. Even real estate came under scrutiny on speculation that higher unemployment or automation could dampen demand for office space.

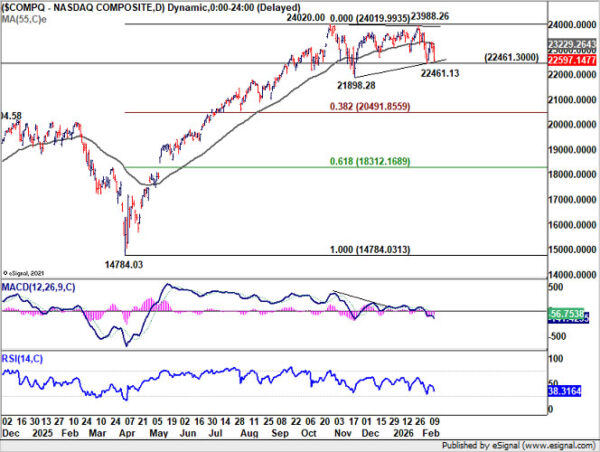

Technically, NASDAQ’s rejection at the 55 D EMA (now at 23,229), is a clear near-term bearish signal. Immediate focus now turns to 22,461 support. Firm break there would open the door through 21,898 support towards 38.2% retracement of 14,784.03 to 24,020.00 at 20,419.85.

Meanwhile, 10-year yield’s close below 4.108 solidifies the view that the rebound from 3.947 3.947 has completed as a corrective move to 4.311. As long as 55 D EMA (now at 4.178) caps upside, downside risk dominates. Sustained trading below 4.100 would send yield further to 4.000 psychological level and potentially retest the October low near 3.947.

USD/JPY remains marginally above 38.2% retracement of 139.87 to 159.44 at 151.96, leaving the pattern from 159.44 technically seen as a consolidation within the broader uptrend from 139.87. As long as this level holds, the structural bias cannot be deemed decisively bearish.

That said, extended weakness in US equities and further decline in Treasury yields would likely intensify downside pressure on USD/JPY. A clear break below 151.96 would mark a significant technical shift towards bearish trend reversal. Deeper fall would then likely be seen to 61.8% retracement at 147.34, and possibly below.

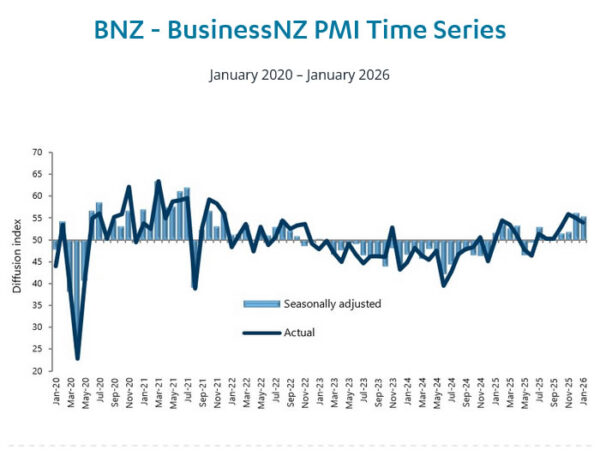

NZ BNZ manufacturing eases to 55.2, but signals continued expansion

New Zealand’s BusinessNZ Performance of Manufacturing Index eased from 56.1 to 55.2 in January, indicating a slight moderation in momentum but remaining firmly in expansion territory. Production slipped from 57.5 to 56.6, employment edged down from 53.7 to 52.9, and new orders cooled from 59.9 to 56.4, pointing to slower yet still solid activity.

Despite the pullback, BNZ described the latest reading as reflecting a “healthy level of expansion.” Senior Economist Doug Steel said the January PMI adds to evidence that the economy has “finally turned the corner,” aligning with forecasts and a broader set of indicators suggesting decent growth.

However, underlying sentiment showed some softening. The proportion of positive comments from respondents fell to 47.7% in January, down from 57.1% in December and 54.4% in November. While the sector remains in growth mode, the decline in optimism hints at a more cautious tone among manufacturers as 2026 begins.

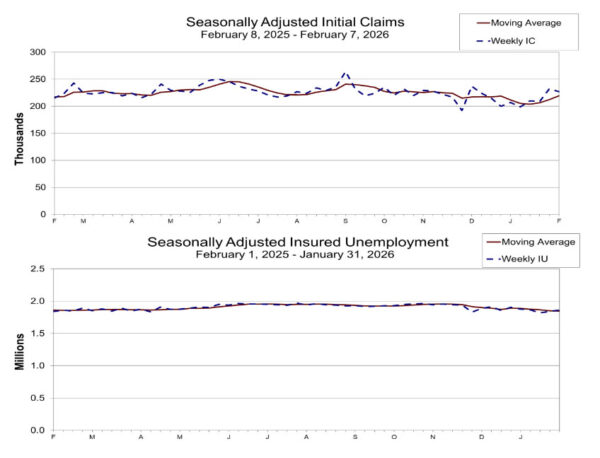

US initial jobless claims fall to 227k, above exp 222k

US initial jobless claims fell -5k to 227k in the week ending February 7, above expectation of 222k. Four-week moving average of initial claims rose 7k to 219.5k.

Continuing claims rose 21k to 1,862, in the week ending January 31. Four-week moving average of continuing claims fell -3k to 1,847k, lowest since October 5, 2024.