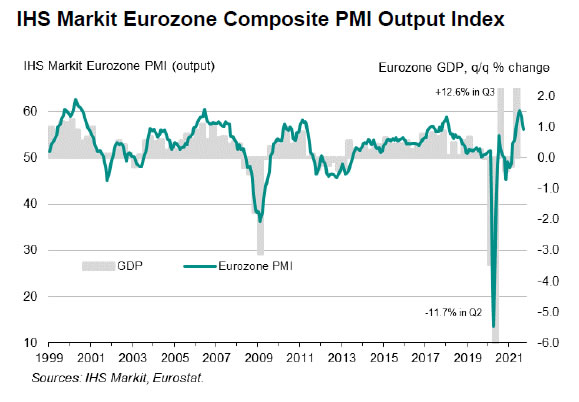

ECB Governing Council member Yannis Stournaras told Bloomberg TV that speculations for a first hike around mid-2023 are “not in accordance with our forward guidance”. He added that the central bank will try to avoid any disruption after the end of the PEPP.

“Asset purchases aim at favorable financing conditions, at smooth transition of monetary policy to prevent any kind of fragmentation in jurisdictions in the euro area,” Stournaras said. “I’m sure that the Governing Council will continue to aim at this.”

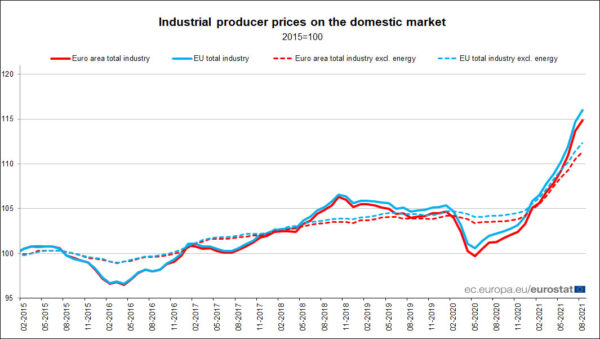

Stournaras also said Eurozone is “not in the same position” as the US on inflation. He said, “the inflation forecasts are lower for the euro zone than in the U.S. and in the U.K. It’s natural that we’re in a different phase of monetary policy.”

Separately, Governing Council member Francois Villeroy de Galhau said he expected inflation to fall back below 2% within a year.

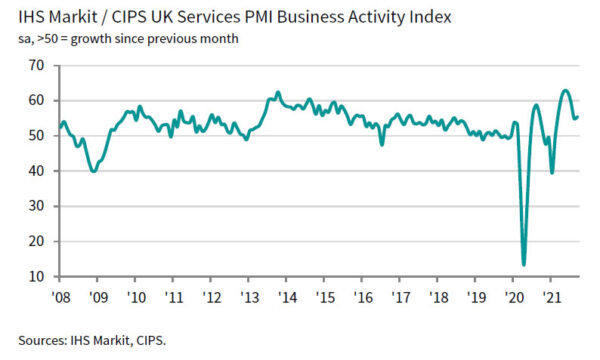

BoE Pill: Risks to economic and inflation outlook becoming two-sided

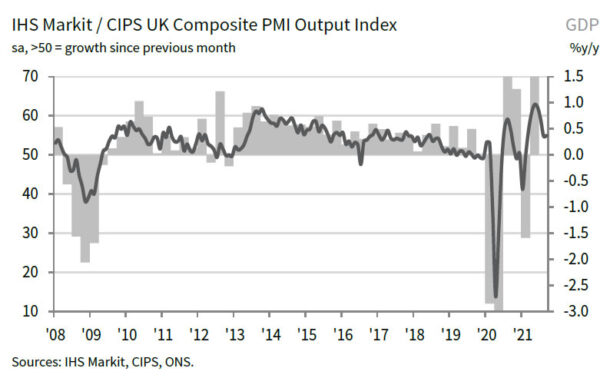

In reply to a questionnaire by the Treasury Select Committee, BoE policymaker Huw Pill said he expected interest rates to “remain at relatively low levels for the coming years, even as the impact of the COVID-19 pandemic recede.”

But he acknowledged that “balance of risks is currently shifting towards great concerns about the inflation outlook.” Also, “current strength of inflation looks set to prove more long lasting than originally anticipated.” He emphasized that “risks to the economic and inflation outlook are again clearly becoming two-sided”.

On BoE’s balance sheet, Pill said, “at a time when financial markets appear to be functioning normally, a gradual and predictable reduction in the stock of asset purchases can be achieved without disrupting markets and/or creating an undesired abrupt tightening of financial and monetary conditions”.

Full answers to TSC questionnaire here.